Leveraging Up on Bank Stress (I): the Bank of England’s Leverage Ratio Stress Test

(For the previous posting in this series, see here.) This posting goes through the Bank of England’s stress tests of UK banks’ leverage ratios – roughly speaking, their ratios of capital to leverage exposure. The banks perform poorly according to this test even under the very low 3% pass standard used by the Bank. Moreover, almost all banks fail the test under the higher minimum standards called for under Basel III when it is fully phased-in – and even those pass standards are much lower than they should be. These results confirm that the UK banking system is in very poor shape.

In an earlier posting, I suggested that the leverage ratio – the ratio of bank capital to its leverage exposure – is a better capital adequacy metric than capital ratios that use a denominator expressed in terms of Risk-Weighted Assets (RWAs). This is because the leverage exposure is a more reasonable and much less gameable measure than the RWA measure.

In this posting, I will go through the Bank of England’s second stress test – the test based on the Tier 1 leverage ratio, i.e., the ratio of banks’ Tier 1 capital to their leverage exposures. The definitions of these terms were explained here.

In this test, the Bank sets its minimum pass standard equal to 3%: a bank passes the test if its Tier 1 leverage ratio post the stress scenario is at least 3%, and it fails the stress test otherwise.

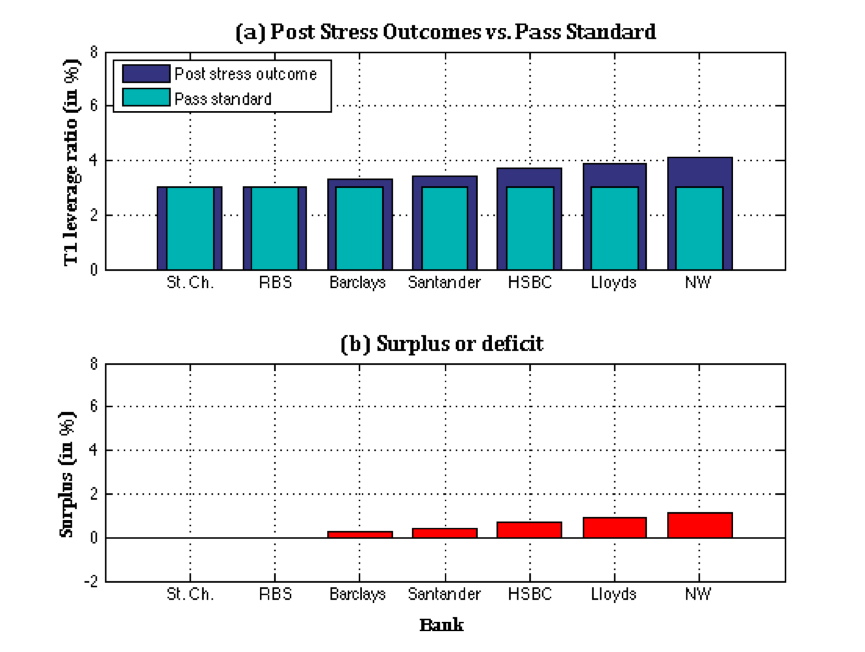

The outcomes for this stress test are given in Chart 1:

Chart 1: Stress Test Outcomes Using the Tier 1 Leverage Ratio with a 3% Pass Standard

Notes:

(a) The pass standard is the bare minimum requirement (3%), expressed in terms of the Tier 1 leverage ratio - the ratio of Tier 1 capital to leverage exposure.

(b) The outcome is the Tier 1 leverage ratio post the stress scenario and post any resulting management actions. These data are obtained from Annex 1 of the Bank's stress test report (Bank of England, December 2015).

By this test, the UK banking system looks to be in pretty poor shape. The average outcome across the banks is 3.5%, making for an average surplus of 0.5%. The best performing institution (Nationwide) has a surplus (i.e., outcome minus pass standard) of only 1.1%, four (Barclays, HSBC, Lloyds and Santander) have surpluses of less than one hundred basis points, and the remaining two don’t have any surpluses.

You should also keep in mind that this 3% pass standard is itself a very low one. Despite its pretensions to impose tough new capital standards, Basel III still allows banks to fund up to 97% of their leverage exposure by borrowing and to have as little as 3% equity to absorb losses. Thus, if a bank has a leverage ratio of 3%, then it only takes only a loss equal to 3% of that leverage exposure to wipe out all its equity capital and render it insolvent.

Basel III’s minimum capital requirement is also way below the capital standards maintained by non-financial corporates, which only rarely have capital ratios below 30%.

In any case, the Basel 3% minimum requirement would not have helped had it been in place before the financial crisis: by 2007, UK banks’ average capital to asset ratios had fallen to just under 4% - still above the Basel III minimum, but not enough to prevent the collapse of the UK banking system.[1] There is, therefore, no reason to expect that such a minimum capital ratio would protect the system in the face of a recurrence of the recent crisis.

Going back to our stress test, you have an easy exam with a very low pass standard, and yet the UK banking system barely scrapes through, if even that.

It is also curious that the two weakest banks hit the pass standard right on the nose: had the stress been even a smidgeon more severe, they would have failed the test. It is almost ‘as if’ the stress test had been deliberately engineered to ensure that the adverse scenario was as adverse as it could possibly be without actually pushing any bank over the edge.

To be clear: I am not suggesting that the good folks at the Bank would even dream of fixing their stress test to produce such an outcome. But I am saying is that it is quite a coincidence to get not just one but two banks whose post-stress outcomes just happen to come out to be exactly equal to the pass standard.

Be all this as it may, the Bank’s assessment was much more upbeat than any Jeremiad of mine. Regarding the five best-performing banks (i.e., the ones that actually got a surplus) it reported that the PRA Board had judged that the “stress test did not reveal capital inadequacies” for these banks and saw no need to mention that their surpluses were rather on the small side – 0.3% for Barclays, 0.4% for Santander, 0.7% for HSBC, 0.9% for Lloyds, and only 1.1% for the star of the class, the Nationwide.

As for the two dunces that got surpluses of exactly zero in the leverage ratio test, the PRA Board carefully noted that their capital positions remain above the threshold CET1 ratio of 4.5% and meet the leverage ratio of 3%”. Nice choice of words.

Despite their capital inadequacies, these two then got off with of a slap on the wrist from the PRA and their capital plans were approved.

The Bank’s overall assessment was then this:

The stress-test results suggested that the banking system was capitalised to support the real economy in a global stress scenario which adversely impacts the United Kingdom, such as that incorporated in the 2015 stress scenario.[2]

Personally, I would have slightly re-edited this statement to read as follows:

The stress-test results suggested that the banking system only just managed not to fail the test under the 2015 stress scenario and obviously we cannot draw any conclusions about whether the banking system would have passed the stress test under any other stress scenarios that we did not consider.

It might also have pointed out that the banking system would have failed the stress test if the stress scenario had been more adverse or if the hurdle had been even a little higher.

There is another problem as well. The 3% pass standard assumed in this test took no account of the additional leverage ratio requirements that will be phased-in under Basel III: these are the additional leverage ratio requirements corresponding to the Counter-Cyclical Capital Buffer and Globally Systemically Important Institutions Buffer. If we include these to their maximum possible extent under fully phased-in Basel III, then we get the outcomes shown in Chart 2:

Chart 2: Stress Test Outcomes Using the Tier 1 Leverage Ratio with the Potential Maximum Basel III Pass Standard

Notes:

(a) Author’s calculations based on information provided by the Bank of England’s ‘The Financial Policy Committee’s review of the leverage ratio” (October 2014) based on the assumption that the pass standard is the potential maximum required minimum leverage ratios under fully-implemented Basel III.

(b) The outcome is expressed in terms of the Tier 1 leverage ratio - the ratio of Tier 1 capital to leverage exposure - post the stress scenario and post any resulting management actions. These data are obtained from Annex 1 of the Bank's stress test report (Bank of England, December 2015).

If the earlier outcomes reported in Chart 1 were bad, these are disastrous: the overall average shortfall is 0.85%,[3] only one bank (Nationwide) scrapes through the test with a surplus of under 0.1% and the other six banks fail.

It gets worse, too: it turns out that even these outcomes are still overly optimistic.

More on this in the next posting.

Footnotes:

[1] See P. Alessandri and A. G. Haldane, “Banking on the state,” November 6, 2009, chart 2, p. 24.

[2] Quotes from Bank of England, “Stress testing the UK banking system: 2015 results,” pp. 9-10.

[3] And if we applied those other adjustments too, then we would get an even higher average shortfall, i.e., 0.85% + 3.5% – 1.89% = 2.46%. Ouch!