Help to Save will only harm

First, Help to Buy, now Help to Save. What will be the next headline-grabbing, vote-seeking but yet fiddling, complicated, expensive and ultimately destructive policy from the UK government? Help to Buy helped to buy votes (at taxpayers' expense) by subsidising house purchases. As UK house prices were rising fast, it was almost universally popular. Not in the Adam Smith Institute of course: we explained its damaging consequences on the blog. By adding further to the demand for housing, but doing nothing to increase supply (such as easing the UK's suffocating 1940s planning policies), the scheme simply stoked prices further.

Under Help to Save, around 3.5m people on universal credit or working tax credits who save up to £50 a month will receive a cash bonus of 50% of their savings after two years. Then they can save for another two years, with the same deal.

That amounts to a cash gift of £1200 from taxpayers. Not that many of the 3.5m will get that amount: £50 a month is a huge amount for people on benefits to save – indeed, half of UK adults have less than £500 set aside for emergencies.

Of course, if interest rates were not kept artificially low by the Bank of England (in concert with other people's central banks), saving might be more attractive. And if there were not so much onerous regulation on hiring and firing, more people on benefits would be able to get a job, and move on to a better one. Help to Save looks like a measure to plaster over the cracks opened up by earlier ones.

And think about the administrative complexity of the scheme. The UK's tax code is already nearly the world's longest, and its welfare code is pretty dense too: but here we are, adding another couple of dozen pages. Just think about the rules, and the staff, you need to create and manage even a trifling scheme like this. First, you have to identify those who qualify – and check their bona fides. Which means rules, documents and civil servants. Then you have to check what they are saving, so you need access to their account – or are you setting up a special account for them? Ditto. You need to check that the two-year and then four-year schedule has been met. Ditto. Then you need to pay over the cash, so you need to raise payments, dispatch them, make sure it is all done correctly, deal with mistakes and complaints.... Ditto.

It does not take much reflection to see that this scheme – and countless others like it – will occupy a sizeable civil-service task force, probably in several centres throughout the country, and that the cost of the scheme could well be a significant proportion of the intended benefit. Are there not cheaper and easier ways to help poorer families? Like taking them out of National Insurance entirely?

Irregular Immigration in the EU

The last couple of years have seen a huge amount of migrants come into the EU. They have come for a variety of reasons, but the principal ones have been to flee conflict and secure a better standard of living. Much of the media and public will infer from the second reason that this is to claim extensive welfare benefits that are available for asylum seekers, and if this is true it is of course a problem. But the cost of asylum seekers is of course amplified by the fact they are not allowed to work. This makes them very costly as they are not contributing in taxes, and rightly or wrongly this causes resentment. The macroeconomic benefits of migration however, have long been documented, and two recent papers address the potential economic benefits of the irregular migration that has been seen on the continent.

A paper from the Federal Reserve Bank of Dallas notes that the US used to be the main recipient of irregular immigration, but this has shifted to the European continent for a number of reasons, mostly dependent on proximity. The open borders within the exterior EU border has previously made it easy for migrants to move where they want to go, principally Germany, Austria and Sweden. The standard economic benefits are again discussed, not just for the immigrants themselves, but for recipient countries; they have higher rates of GDP growth, private investment, innovation and entrepreneurial activity. This applies to both informal and formal labour, but with asylum seekers these benefits are not entirely applicable as long as they are restricted in joining the formal labour force, they are possibly going to be working in the formal sector but the fiscal benefit will not be seen by the government as it will not be taxed.

However, in order to protect those benefits over the long term, Orrenius and Zavodny make a case that an effective border control has to be implemented, and if asylum seekers are to be allowed to work then failed asylum seekers have to be removed. This is of course a huge policy challenge with the many entry points onto the European landmass, but will mean that the EU is able to welcome not only asylum seekers but those who wish to work in the EU, balancing the line between the huge fiscal cost of irregular migration and high wages behind a border which is rigorously enforced, sending an incentive for more irregular migration.

The second paper, from the IMF again repeats the message of the first “Rapid labor market integration is also key to reducing the net fiscal cost associated with the current inflow of asylum seekers. Indeed, the sooner the refugees gain employment, the more they will help the public finances by paying income tax and social security contributions. Their successful labor market integration will also counter some of the adverse fiscal effects of population aging.”

We know that the general effects on wages at the lowest level are mostly temporary and limited, so this shouldn’t stop policy makers from loosening restrictions on asylum seekers to mitigate the potentially huge fiscal and political impacts of having many hundreds of thousand of new dependents on the state.

The bad consequences of Brexit

We already know that if the UK votes to leave, then no British firm will be able to sell goods to Europe, British visitors will be barred from there, we'll all lose our holiday homes there, and no UK football club will be able to sign European players; but even worse consequences might follow. Almost certainly, without the protection of EU environmental regulation, British rivers will turn to blood, and a multitude of frogs will emerge from them. With no winds blowing across the Channel the dust here will probably turn into lice, and swarms of flies will descend.

With no Common Agricultural Policy, our livestock will all become diseased, and this will cause boils to break out in people. Without the ability to send our weather across to Europe, thunder and hail will stay in Britain, and swarms of locusts will feed on the flattened crops.

If the UK leaves, the light will be gone from our lives and a thick darkness will envelop the land. It is highly likely that the firstborn of every family will die. While people might be ambivalent about this happening to the Queen, it would be a tragedy for everyone else.

We have to get the message across that the only way to avert these disasters is to remain within the EU.

Why are people so illogical about vaping?

There're certain subjects that seem to turn people into drooling idiots. Those subjects often involve people enjoying themselves so we can at least construct some clues as to why the idiocy. Vaping seems to be one of those subjects. The basic point is really easy enough for anyone to understand: human beings rather like the effects of nicotine and vaping is about 5% as dangerous or less as a manner of ingesting nicotine as the other popular method, smoking tobacco. Being able to abolish 95% of the damage done to health by a product seems like a pretty good idea to us but there are those out there who disagree:

Legislators across the country are bringing bills to statehouses to raise the vaping age in line with the smoking age to a new high of 21 in some states. Politicians and public health activists argue e-cigarettes could hook kids on nicotine and lead to them to transition to tobacco and, therefore, need to be more tightly regulated.

It's obviously true that that is possible: but what we need to know is whether it is true. Is vaping a substitute or a complement to cigarette smoking?

“We should regulate tobacco products proportionate to their risks, and e-cigarette evidence suggests they’re less risky products,” said the Cornell study’s lead author Dr. Michael F. Pesko. “While there’s some risk, it would be a mistake to regulate them the same way we regulate cigarettes.”

The study backs up research published in 2015 showing the drive to ban the under 18s from buying and using e-cigarettes had the exact opposite effect that policy makers intended.

Smoking rates among 12-17-year-olds actually rose in states that banned e-cigarette sales to minors, according to the study by Abigail Friedman of the Yale School of Public Health, published in the Journal of Health Economics found.

“Such bans yield a statistically significant 0.9 percentage point increase in recent smoking in this age group, relative to states without such bans,” Friedman said. The study controlled for smoking rates within states and statewide cigarettes.

It's a substitute so far from making it more difficult, or taxing it more, if we're seriously concerned about human health we should be subsidising it.

In other news the European Union has started discussions on raising the taxation level on vaping to equal that on cigarettes. As we note, there's something about some subjects that just turn people into drooling idiots.

As Charlie Bean says, we're richer than we thought

Or as Sir Charles Bean points out in his new report, we're richer than we thought and getting ever richer faster too:

Improving analysis of the digital economy could show that Britain’s economy is growing faster and consumers are better off, according to former Bank of England deputy governor Charlie Bean. Bean, who published his government-commissioned review of official economic statistics on Friday, said the U.K.’s growth rate could be between one-third and two-thirds of a percent higher with improvements to data collection.

“Measuring the economy has never been harder than it is today,” Bean told reporters at the Data Science Institute at Imperial College London. While digital activity is clearly adding to the economy, it’s not necessarily being picked up by the current methodologies, he said.

This is something that one of us has been banging on about for some time now. We know, absolutely, that we're not measuring the economy properly. This is also more than just a small statistical quirk too. For there's plenty who keep telling us that the economy is growing more slowly than it did in the past and thus the government must do something. However, if it's simply that we're not measuring growth properly then there is no need to that larger state. And as we say, we know we are measuring it wrongly, we're just not sure how wrongly.

A favourite example is WhatsApp. We have three methods of measuring GDP, production, incomes and consumption and all of them are measured at market prices. WhatsApp is currently free and carries no advertising. Thus it appears not at all in either the production or consumption variants of GDP. The engineers who make it are indeed paid so there's some, what, $50 million? $100 million? appearing in US GDP by the income method. But there's a billion users of the app and people are getting some to all of their telecoms needs from it. And we really cannot say that those billion are all getting only 10 cents of value from their use at most. Ten cents a year that is.

We really do know that we're measuring this digital economy wrongly: our question is how wrongly, not whether. That in turn means we're richer than we think we are and also that we're getting richer faster too.

Strangely, bequests don't seem to increase wealth inequality

An interesting finding from Denmark, that bequests and inheritances don't appear to increase wealth inequality:

Our work suggests – contrary to the popular belief – that bequests need not increase inequality even if rich parents have rich kids. In fact, in Denmark, the post-bequest distribution is more equal (if measured in relative terms) than the pre-bequest distribution.

And as we have been assured for years concerning income inequality it is that relative measure which matters. It's also worth pointing out that Denmark is significantly (by 10 percentage points or so) more unequal in its wealth distribution than the UK.

This has an interesting effect on taxation policy of course: the prime objective of inheritance taxation is to try to stop fortunes elf-replicating down the generations. It's also an interesting comment on Thomas Piketty's insistence that inheritance will become all in the near future. It just doesn't seem to work out that way.

We can see that there could be a demographic structure which was more problematic. Say, something like China, where there's a whole generation which is likely to be the only descendant of four grandparents. That's likely to concentrate wealth. But a population that is roughly stable is going to have just as much splitting of wealth between children thus bringing down the amount that any one of them gains. But it is interesting, isn't it? If inheritance doesn't increase wealth concentration then why do we tax it with such moral fervour?

Is Ted Cruz a policy wonk's dream come true?

Now that Ted Cruz seems to have a slim chance of winning the Republican Party presidential nomination, a couple of British commentators have said that he seems even worse than Trump. I do not care for his positions on gay marriage or abortion, and his immigration policy is absolutely terrible, but on many other issues he is actually rather good. It’s often the case that there is a bigger difference between policy wonks and politicians than there is within within those professions, even across ideological divides. On a surprising number of issues, Ted Cruz appears to have sided with the wonks:

- He opposes ethanol subsidies, and still won Iowa, where corn is king. In doing so he may have broken a path for future presidential candidates to drop their support for this piece of corporate welfare.

- He (correctly) blames tight money for the Great Recession, not greedy bankers or loans to poor people. He once flirted with a gold standard, but it looks like he's gotten over that, fortunately. (Update: Perhaps not. Darn.)

- He wants a broad-based VAT to replace payroll and capital taxes, which according to the Tax Foundation would lead to a 13.9 percent higher GDP over the long term, a 43.9 percent larger capital stock, 12.2 percent higher wages, and 4.8 million more full-time equivalent jobs. VATs are relatively efficient taxes, and shifting taxation to them from capital taxes is agreed by most economists to be a good idea.

- He wants to expand the Earned Income Tax Credit, a cash transfer to the working poor, by 20 percent.

- He has introduced a bill in the US Senate that would allow for drugs and medical instruments approved by other developed countries to be used in the US, bypassing the expensive and time-consuming FDA approvals process.

- He supports states’ rights to legalise marijuana.

- He attacked other Republicans who demanded more mass surveillance of American citizens after the San Bernardinho massacre.

Like all politicians he is a mixed bag, but many of these are truly smart policies that most politicians wouldn't touch with a ten-foot bargepole. My opinion is of course irrelevant, but if he would soften his crazy immigration restrictionism I think he would be the outstanding candidate to policy wonks.

It's not possible to say what will happen after Brexit

We're rather encouraged by this little report into the effects of Britain leaving (or not) the European Union:

British companies could be forced to put up prices to the consumer or even be forced out of business by a ‘Brexit’ from the European Union, according to a report by Oxford academics.

No, not that bit, this bit:

It added that the overall economic impact of Brexit through changes to the country’s immigration policies were “not possible” to predict with certainty ahead of the referendum. The report said “confident predictions about the economic effects of migration after Brexit should be treated with caution”.

Some of us here have very strong views indeed about this Brexit process but we'll not inflict them upon you here. However, that point strikes us as being exactly correct. For it is impossible to state with any certainty what the economic effects of Brexit would be.

For what those effects would be, will be, depend upon the economic policies that are adopted once free of the shackles of Brussels*. If Britain adopts unilateral free trade then, as Patrick Minford has pointed out, the economy will grow. If immigration of low wage workers is curtailed then businesses which employ low wage workers will have a hard time of it, indigenous workers will start to see higher wages. What happens after Brexit depends upon the policies adopted after it, not on the leaving itself.

Thus all reports predicting either disaster or nirvana from the leaving itself should be regarded with the utmost suspicion.

*It could be that you could divine the views of one of us on this subject.

Five questions for scaremongers

Let’s be real. No-one knows what the economic effect of Brexit will be. Anyone who says they do is either kidding themselves or trying to kid you. But we do owe it to ourselves to make intelligent estimates and to set out our assumptions for scrutiny. So here goes. To start with, we break down the UK economy into sectors, using government definitions. No controversy there. Next, we make a couple of estimates.

First, an estimate of the shock for each sector of leaving the EU. This is a big part of what no one knows. This leads us to capture the vulnerability of each sector with the most punishing figures from the record: the collapse in output after the global financial meltdown of 2008 which was worse than any since WW2.

Second, an estimate of the recovery for each sector after five years. Once again we start with the post 2008 recovery after the financial meltdown. This provides a sense of the inherent resilience of each sector. And here is a good place to argue with us: we also include a small factor to reflect the policy response of government and the benefits which experts in international trade have observed from less restrictive trading arrangements. In fact we take only half of the benefit the experts have observed, erring on the side of caution.

Goods

The pie chart shows that the UK’s output of goods is made up of five more-or-less similar-sized elements: the most important ones are finished manufactures, oil and food. Basic materials are not as much in international trade as once they were; and “other” consists of the small sectors of semi-manufactures together with spares & repairs. Our figures are for 2013, but little has changed since.

Chart 1. UK goods

Source: ONS (2013)

Charts two to five below show the position, sector-by-sector, starting with trend growth from over the ten years from 2002 to 2011, that is including the financial crisis. Our estimates for these sectors, together with our estimates for the goods sector as a whole, show an hit from Brexit after one year (save for food etc, whose complement of entrepreneurs make it particularly resilient), with all recovering by the end of five years.

Charts 2 to 5. Outlook for selected UK goods sectors after Brexit

Sources: Authors, ONS (2013), Andriamendjara et al (2013), Berden et al (2007), Erixon and Bauer (2010), Helble et al (2007) and Petri, Plummer and Zhai (2011).

Services

Our pie chart for UK services is simplified by drawing like sectors together. We’ve followed Douglas McWilliams’ recent coinage, the “flat white economy”, bringing together professional services, culture/recreation, communications and technology services. Finance, insurance and real estate are self-explanatory. T&T is transportation and travel. The sectors not involved in international trade are utilities, distribution, healthcare, education and public administration.

Chart 6. UK services

Source: ONS (2013)

Our estimates for the traded sectors - together with our estimates for the services sector as a whole - show smaller initial hits from Brexit (in the case of finance etc, none at all), with all making excellent progress after five years.

Charts 7 to 10. Outlook for selected UK services sectors after Brexit

Sources: As charts 2 to 5.

Boris Johnson spoke of charts like these as “Nike ticks” and putting this all together we get the “Nike tick” for the economy as a whole.

Growth stays positive throughout, despite falling in the first year. The premium after five years should be seen as a spike on the benefits of deregulation and new markets.

Chart 11. Outlook for UK GDP after Brexit

Sources: As charts 2 to 5

Conclusion

Is it wrong to find these estimates encouraging? We make no apology for doing so, while fully admitting that ultimately all such estimates can only be a quantitative and graphical expression of assumptions. So are they dead right? Of course not. Are they a misleading basis for discussion? We don’t think so. Scaremongers who wish to dismiss them from consideration need to answer five questions:

- Why would the shock of Brexit be worse than the shock of the financial crisis?

- Why would UK firms be less resilient in bouncing back after Brexit than they have been since the 2008 turmoil?

- Take a look at our companion paper “Five questions for stayers”; why wouldn’t the UK and its trading partners benefit from relief from what the WTO shows as the world’s most complicated tariff regime, what the World Bank reports as a system of nontariff barriers second only to Russia, and priorities which put trade with the rest of the world at the back of the queue?

- Why would the UK government sit on its hands for five years after Brexit rather than develop new trading relations?

- Why would the benefit of those relations be less than the figures we are using, one half of the benefits from less restrictive trading environments attested by experts in the field?

To our way of thinking, our figures illustrate that the scare stories about Brexit are just that - scare stories. Do they prove it? No more and no less than the scare stories themselves!

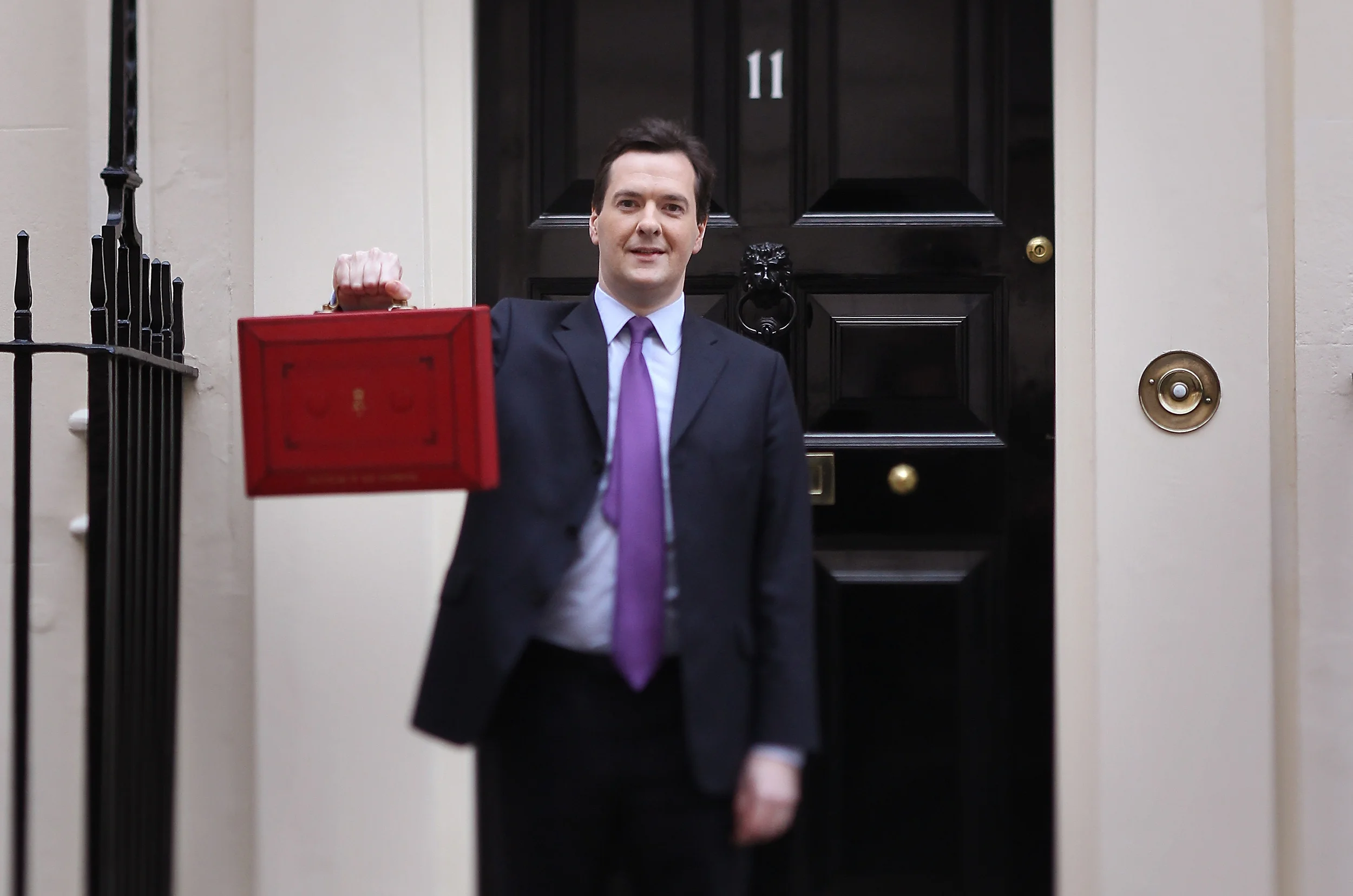

The ASI's 2016 Budget Wishlist

Ahead of the Budget next week, here are the key reforms and tax cuts we hope to see the Chancellor announce: Scrap stamp duty on shares to boost investment

Stamp duty on shares may be one of the most harmful taxes we have despite raising relatively little money (£2.9bn in 2014-15). By making it costly for people to sell their shares, stamp duty interferes with price signals and raises the costs of investing overall. That hurts both savers and businesses’ access to investment financing. Scrapping it would be a cheap way of making stock markets direct money where it will be used best, give a boost to businesses in need of investment – and cement the City’s status as the world’s financial capital.

Pensions tax relief should be left alone

Abolishing the upper rate of pensions tax relief sounds like an easy way to save money, but it would be a huge mistake. Upper rate relief exists to help people smooth their incomes if they will only be in the upper tax bracket for a small part of their lives. Because people are taxed on pension withdrawals, abolishing upper rate relief would introduce double taxation to the system: people in the upper tax rate would be taxed for putting money in to a pension and again when they take money out of it. This would discourage some people from saving for their retirement and unfairly penalize the ones that do.

Alcohol duties should be merged into a simple alcohol tax

The alcohol duty system is amazingly complicated and confused, with entirely different rates per unit of alcohol for wine, beer, spirits, cider and sparkling wine, and strange kinks in the system that, for example, favour strong wines and ciders over weaker ones. This whole system should be replaced with a simple, flat per-unit tax on alcohol (as currently applies to spirits). That would stop the preferential treatment for selected drinks, like cider, and end the preferential treatment for stronger drinks. It might also make life a bit easier for Britain’s growing craft alcohol industry.

Phase out Housing Benefit altogether

Housing benefit should be phased out and eventually scrapped. In a property market where supply is tightly constrained, increases in housing benefit go mainly into higher rents. The empirical evidence suggests that about 70p of every £1 of the £26bn system goes into the pockets of landlords in the form of higher rents. Much of this benefit comes from renters who don’t even get the benefit, who are competed out. What’s more, the system encourages people with less means to move to the most expensive areas, since the level of payment is tied to prevailing rents, which means that the bill is artificially inflated. The government should use the money to supplement low incomes, by raising the employee NIC threshold and making the Universal Credit withdrawal rate less steep, so work pays more for UC recipients.

Stop business rates from taxing capital

Because business rates tax property values, they effectively tax both the land a property is built on, and the value of the bricks, mortar and some machinery on top of that land. Taxing land values is a relatively good way of raising revenue, because it does not discourage production. But taxing property discourages construction, improvements and investments in new machinery. The government should not exempt new machinery from business rates, as it is rumoured to be considering. This would add even more complexity to the system and increase compliance costs. And why should machinery, but not other improvements such as redecoration or refitting, be exempt? Instead, it should reform business rates so that they are based only on the unimproved value of the land the property sits on – and there is no reason not to improve the property itself.