But why is this a better world?

Apparently having more women in power making decisions leads to more decisions being taken which make the world a better place. We’re not so sure.

In fact, we’ve been stuck with at best 30% of the cabinet being women since that threshold was first reached in 2007. Does this matter? Yes, finds recent research into the effects of female representation on policymaking.

With some impressive data collection from that most glamorous of political arenas, Bavarian councils, the study examines the impact of female councillors on what decisions get taken. The results are… striking. One additional woman on a local council resulted in a 40% expansion of public childcare in their district. You can see the same dynamic in the UK. The British state basically ignored childcare before the 1990s, when a larger cohort of female MPs such as Harriet Harman helped put it on the agenda. Childcare spending even went up during the last decade of austerity.

Our point is not about whether paid childcare is a good idea or not. We can see value in moving something from the unpaid, household, labour section of the economy into the paid, market sector of it. It allows greater division and specialisation of labour for example, thus greater efficiency. We can also see that this effect might not be all that great - depends on how many children any one employed person is allowed to look after. There’s also that small point that kids might like being looked after by their Mums. Possibly, even, that mothers like being Mums - we do find a decent portion of the population deciding to just that, after all.

Rather, our point is the assumption there. It is simply assumed that more paid childcare is good. Thus anything that provides more of it is good, like female political management. The argument in favour of equal political rights is not, to our minds, a consequential one. That is, it’s not dependent upon, nor even supported by, the decisions that result.

After all, we don’t use whatever Caroline Lucas is getting wrong this week to argue against female MPs, despite the temptation.

That JPMorgan climatechangeisgonnakillusall report

Much fuss as it appears that JP Morgan has a report stating that climate change is going to wipe out human life upon this lovely planet:

The human race could cease to exist without massive worldwide action to tackle global warming, economists at JP Morgan have warned in a hard-hitting report on the "catastrophic" potential of climate change.

And:

The world’s largest financier of fossil fuels has warned clients that the climate crisis threatens the survival of humanity and that the planet is on an unsustainable trajectory, according to a leaked document.

The actual report is here.

Much of it is entirely reasonable. Discount rates are discussed, it is pointed out that any economic losses are counterfactual:

And fourth, these are counterfactual losses rather than actual losses. Nobody would have an income in 2100 lower than today in absolute terms, but rather lower than it would have been in the absence of climate change.

Sadly, they don’t go on to point out that if policies are adopted which reduce emissions by reducing economic growth then the losses will be larger - something many of the IPCC’s own models make clear.

They also point out, as with Stern, Nordhaus, the IMF etc, that if all of the predictions about emissions, their effect, temperature change are correct then the solution is a carbon tax. Anyone insisting that all the predictions are all correct and not agitating for a carbon tax is not taking the matter seriously - although that’s us, not the report.

However, there’s a gross mistake in the report. The assumption is:

Using their model and the IPCC Representative Concentration Pathway (RCP) scenario 8.5―broadly a business-as-usual emissions outlook …

Everything they say is based upon the idea that we’re following that RCP 8.5 path. Which we’re not. We’re not in current emissions and we’re not in future either. For to do so requires the use of coal in ever greater quantities, something that isn’t being done and isn’t going to be either - technologies that don’t use that ever more coal have already been developed and are being deployed.

In fact, the one thing we are absolutely certain about over climate change is that this emissions pathway isn’t going to be one that happens, it’s a gross over-estimate of the future. Thus any predictions based upon it are false.

There is also a more subtle point:

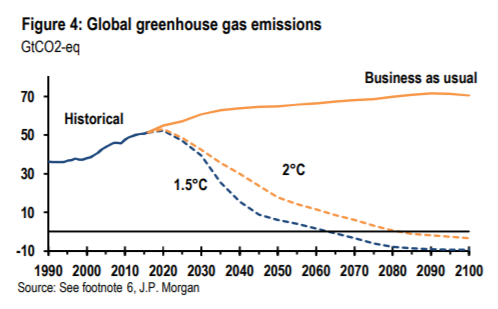

If no new policies are enacted relative to what was legislated as of the end of 2017, emissions would rise to 60GtCO2eq by 2030 and 70GtCO2eq by the end of the century (Figure 4, Business-as-usual (BAU) scenario).

No. This is to assume that technological changes - and thus variances in emissions - only come from legislative fiat. Yet this is not so. The most obvious example being fracking, which has distinctly reduced emissions by making natural gas significantly cheaper than coal for electricity generation in the places that it has been done at scale. You can add whatever effects you wish from those claims that wind, or solar, are price competitive as well.

The actual claim in the report is that something which isn’t going to happen would be dangerous. Which might even be true but it’s not a hugely useful addition to the debate for it’s not going to happen.

But Polly, we were warned this would happen

Polly Toynbee wants us all to know that Brexit is going to mean higher wages for the low paid in our society. Polly thinks this is a bad idea and we’re not quite so sure.

The argument in favour of free migration is that those migrating benefit - they, as we, are God’s special snowflakes and why should they be denied the wealth and glory of our society based upon nothing but accident of birth? Whatever your answer to that it is clear that restricting the free movement of labour will raise local wages.

If there is to be no more cheap foreign labour, he will need to raise pay steeply to attract enough British staff.

Yes, quite so, and the problem with this is? As we pointed out elsewhere last year:

Brexit is about to give us a problem with this, though. Karl Marx was right: wages won’t rise when there’s spare labour available, his “reserve army” of the unemployed. The capitalist doesn’t have to increase pay to gain more workers if there’s a squad of the starving eager to labour for a crust. But if there are no unemployed, labour must be tempted away from other employers, and one’s own workers have to be pampered so they do not leave. When capitalists compete for the labour they profit from, wages rise.

Britain’s reserve army of workers now resides in Wroclaw, Vilnius, Brno, the cities of eastern Europe. The Polish plumbers of lore did flood in and when the work dried up they ebbed away again. The net effect of Brexit will be that British wages rise as the labour force shrinks and employers have to compete for the sweat of hand and brow.

As we were in fact warned before the referendum in 2016:

The wages of low-paid workers would rise if Britain left the EU, the chairman of the campaign to remain in Europe admitted yesterday.

Lord Rose, the former boss of Marks & Spencer, told MPs that ending free movement would mean less competition for Labour, so pay would go up.

British wages for workers in Britain rise. Especially at the low end. Isn’t this what Polly has been campaigning for over the past 5 decades?

Certainly, we can see the downside of it - we are cutting off considerable numbers from the glories of working in Britain. But the actual thing being complained about, that wages will rise. Someone is going to have to tell us what’s so horrible about that.

There's really no excuse for it these days

There is controversy at the World Bank over a paper published by a research team there. When aid to certain countries rises so too do the Swiss bank accounts of those who rule there. “Swiss” here just standing in for private and secret and not in the country being ruled. The controversy being that all know this to be true but such things are not to be said. Rather like commenting upon the gastrointestinal interestingness of the elderly aunt at the tea table - obvious but not mentioned.

To us quite the most interesting part is this:

For countries receiving more than 2 per cent of GDP in aid “the implied average leakage rate is approximately 7.5 per cent”, the report, by three economists, states. “On the other hand, raising the threshold to 3 per cent of GDP (sample of seven countries), we find a higher leakage rate of around 15 per cent. This is consistent with existing findings that the countries attracting the most aid are not only among the least developed but also among the worst governed and that very high levels of aid might foster corruption.”

Poor places are badly governed. We would go further and insist that there’s no excuse left either. Places are poor because they are and have been badly governed. For what the past few decades have shown is that a modicum of capitalism and markets - Adam Smith’s peace, easy taxes and the tolerable administration of justice being much the same thing - can make anyplace rich. Places that were colonies have done it, places that were not. Places with natural resource endowments, places without. Places of every religion and none. There is simply nothing left to blame but that bad governance - something we could and would define as not allowing that modicum of capitalism and free markets.

Another way around to put much the same point. Assume that those who would plan an economy are correct - they’re not, but assume. That does require that those governing are competent and at least vaguely honest. If that government doing said planning and economic direction is a nest of thieves then it’s all most unlikely to work. In fact, the place would do better with the thieves having nothing whatever to do with the economy. That is, if poverty is caused by bad government then riches will be achieved with less of it.

Sometimes making something a right is the wrong way to provide it

There is really nothing new here, it’s just a good exemplar of an old point:

The Consequences of Treating Electricity as a Right

This paper seeks to explain why billions of people in developing countries either have no access to electricity or lack a reliable supply. We present evidence that these shortfalls are a consequence of electricity being treated as a right and that this sets off a vicious four-step circle. In step 1, because a social norm has developed that all deserve power independent of payment, subsidies, theft, and nonpayment are widely tolerated. In step 2, electricity distribution companies lose money with each unit of electricity sold and in total lose large sums of money. In step 3, government-owned distribution companies ration supply to limit losses by restricting access and hours of supply. In step 4, power supply is no longer governed by market forces and the link between payment and supply is severed, thus reducing customers' incentives to pay. The equilibrium outcome is uneven and sporadic access that undermines growth.

Some things are indeed rights and not only should but must righteously be supplied to all. Civil liberty, equality before the law, property rights. Somethings are badly provided if they are rights and therefore should not be such - health care, education, electricity, housing, food and so on. The difference being that old one of negative and positive rights of course.

Do note that even if something is not to be provided as of right there’s still plenty of room for government aid in that provision. It’s just that the how of the aid needs to be carefully thought about. Rather than a food ration perhaps a cash handout to purchase food with and so on. Rather than a housing ration financial support to purchase housing services to those who need it.

Another way to put this being that rights really are different - therefore it’s necessary to be highly selective about what is determined to be that right.

This is casuistry up with which we shall not put

The Institute for Alcohol Studies wants to tell us that while an increase in booze taxation would indeed be regressive it wouldn’t be really. For, if the money raised were spent on the National Health Service then it would be the poor who gain more from the extra spending, even as they pay more because of the extra taxation. This is casuistry and we’ll not allow it:

Raising alcohol taxes does not disproportionately affect poorer households, once the effects of the potential additional funds generated to plough into the NHS are taken into account, according to a study.

Although the research acknowledged increasing duties on alcoholic beverages may hit the most economically deprived proportionately harder than the rich, it claims this is outweighed by how the poorest benefit more from increased healthcare spending.

The report by the Institute of Alcohol Studies (IAS), has prompted calls for the Treasury to increase alcohol duties – known as one of the so-called “sin taxes” alongside sugary drinks and tobacco – in next month’s budget to combat binge drinking. The research challenges long-held concerns that alcohol taxes are regressive.

The research - a far too grand name for this perversion of the language - is here.

Regressive taxation is when the poor pay a greater portion of their income in this tax than richer people do. Raising booze taxation meets this standard of what regressive means. Thus higher alcohol taxes are regressive and that’s that, no twists and turns change it.

Higher NHS spending - assuming that it’s not just on the diseases of the rich - will be progressive, we can agree upon that. So, it is indeed possible to say that taxing the poor more - a regressive move - and spending more, in a more progressive manner than the regression of the receipt of income, is overall progressive policy.

But that still leaves us with the taxation part being regressive. For, obviously enough, it is possible to have some progressive form of taxation to pay for the spending and thus make the overall policy stance rather more progressive.

Note that all of this is entirely independent of whether you think there should be more tax on booze. Or more spending upon the NHS. Or even whether the tax system, the benefits and spending one, should be more progressive, more regressive or anything else.

Taxing alcohol is regressive taxation. That’s just what it is, whatever the casuistry of those urging us to pile imposts upon the modest pleasures of the working man. The IAS can go boil their heads on this one.

Funding Institutional Care

Archie, Bertie and Charlie are all elderly and require full-time institutional care: food and accommodation, supervision and security (they need to be kept in) and visits from family and friends. Archie is the lucky one: he has his own bedroom and his institution is dedicated to making his stay as pleasant as possible. Bertie shares his bedroom with five others who keep him awake at night with snoring and strange noises. The staff try to be kind but it is clear they don’t think he should be there. Charlie shares his bedroom with just one other and they get on well. The staff, on the other hand, are dedicated to making his experience so disagreeable that he will not wish to return once he leaves.

Archie’s stay would cost a paying customer an average of £93 per day without nursing or £130 with full-time nursing. Local authorities can achieve lower prices. Bertie costs £400 and Charlie costs £103. Suppose England has Archies, Berties and Charlies. HM Treasury would save £510M a year by putting all the Berties and Charlies in the same type of institution as Archie and they would be better off there too.

Unfortunately the Bertie and Charlie institutions, namely NHS hospitals and HM Prisons, are nothing like as underfunded as Archie’s, the local authority social care institutions. NHS hospital beds are full of elderly people who should be in residential homes and our prisons likewise could reduce overcrowding with a more imaginative re-location of their older inmates. The government is cutting off its nose to spite its face by the gross underfunding of adult social care.

Looking more closely at the figures:

In 2019, the average number of “bed-blockers”, i.e. NHS hospital patients who should have been discharged, was about 4,500 per day.

The average cost of prison to the state is £37,543 p.a. per prisoner or £103 per day. There are about 1,700 prisoners aged 70 or over in England and Wales, one of them (in January 2019) aged 103. How likely is it that these old folk, locked in secure homes, would escape and ravage the community?

The moral of this story is that government thinking is not joined up, even within HM Treasury. The green paper on adult social care is now overdue by several years, there is no sign yet of the “urgent” cross-party talks on the subject and the budgets are set in isolation with little regard for the best outcomes for individual frail, elderly people.

Tesla shows why China grows quite so quickly

Something we’ve noted more than once before - China is probably the most free market economy in the world at present.

Clearly, this is using free market in a fairly specialist sense - a communist shading into merely authoritarian government isn’t usually thought of as that. However, it is true, in the sense that is being used. People, organisations, are able to start new economic activity there faster than they are anywhere else. Take the example of Tesla. Their China factory:

How Elon Musk Built a Tesla Factory in China in Less Than a Year

Their German factory:

Tesla has been ordered to stop work on its German factory, in a win for environmental campaigners.

A court ruled that the electric car company must stop clearing forest land near Berlin to prepare for the construction of the facility, its first so-called "gigafactory" in Europe.

Planning permission has not yet been granted on the site, and a complaint has been brought by a local environmental group, the Gruene Liga Brandenburg (Green League of Brandenburg).

The German process started in November, thus has 8 months left to match the Chinese experience. And one third of the time into the process they’ve not cleared the land, not cleared the courts and not cleared the planning process.

Something which rather neatly explains the different speeds of growth. Economic growth is, obviously enough, the outcome of doing new things or old things in new ways. The speed of economic growth is determined by how fast you can do new things, old things in new ways. We in the already rich countries place significant barriers in the way of people doing those new things. Therefore our economic growth is slower than it could be, slower than it might be in other places.

Note what we’re not saying, that there should be no such controls. Well, not here, not now, we’re not. Instead we just want to make, again, the point that everything has costs whatever the benefits that may also flow from the same thing.

Regulation slows economic growth simply because it slows down the rate at which people are able to do new things. This is a cost that has to be kept in mind when considering any proposal for regulation. It might even be true that proper consideration of all those costs, when set against the benefits, will lead us to putting fewer regulatory constraints on our children getting richer.

We'd better get on with abolishing the BBC tax

The Chairman of the BBC tells us that if the licence fee tax is abolished and the institution moved over to a subscription fee arrangement then:

He argued that a move to a subscription model would mean a loss of earnings for the BBC that would lead to popular programmes being axed and that the introduction of Netflix-style payments could result in the loss of public service programming in a race to attract paying viewers.

We are being told two contradictory things. That the BBC would stop producing unpopular things in order to chase ratings and also, at the same time, that the BBC would stop producing popular things which bring in the ratings.

Looks like we’d better get on with the subscription model then. Who wants to leave several billion pounds a year of public money in the charge of someone so terminally confused?

The government's agenda

Commentators have speculated on what might be the ideology that drives Boris Johnson’s government since its December election victory. They ask if it will be pragmatic, free market, or ‘one nation’ Toryism. Most seem convinced that it will strive to consolidate the support of the new Tory voters who ‘lent’ their votes to deliver Brexit, and maybe to reject Jeremy Corbyn and what he stood for, and to help Boris Johnson break through Labour’s ‘red wall’ by doing so.

Even though we are still early into the new government and the new cabinet, there are clear signs that point to the direction it will take. It will be tightly controlled from 10 Downing Street. Not since Peter Mandelson established total control of Labour's output in the 1990s have the actions of individual ministers been subject to such close oversight. The No. 10 machine has objectives it seeks to achieve, and wants to control the levers that must be pulled to successfully bring them about. The PM's top adviser, Dominic Cummings, knows where he wants the country to go, and is putting in place the mechanisms that will enable it to be taken there.

The ideology that can deliver on its election promises and help the government to be re-elected is one calculated to improve the country and the lives of its citizens. It is a problem-solving approach that will attempt to put right as many things that are perceived to be wrong in modern Britain as it can. It will identify the areas in which what happens falls short of what is sought or expected, and introduce measures designed to fix those shortcomings.

Commuter train journeys are in some cases overcrowded, unreliable and expensive, so the government will bring in. measures to improve them. Many young people cannot afford to start on the pathway to home-ownership because there are not enough affordable homes in places where people want to live. The government will take steps to redress this by increasing the supply of housing to address the shortfall. NHS waiting times, whether for GP appointments, A&E treatment, or hospital treatment, are seen to be too long. The government will act to shorten them. Parts of the UK have not shared in the economic success of Southeast England. The government will seek to have them participate in the economic expansion of the nation.

There is a whole series of problems, most of them real, but some perceived rather than real. If the government is to address these systematically and successfully, it needs to avoid virtue-signalling, showy initiatives that sound good and attract media coverage, but which fall well short of what is needed to fix the problem. What are needed are real, practical solutions that work in the real world, ones that enhance choices and opportunities rather than attempt to impose grandiose top-down schemes.

The UK does have problems, and could use a government whose ideology is to fix them. It now falls upon right-thinking people to research policy initiatives that can enable them to do that successfully.