Cryptocurrency is interesting again

For the last few years, the world of blockchains - i.e., the world of Bitcoin and the technologies derived from it - has been firmly divided into two camps. The first of these, which can broadly be termed "Enterprise blockchain," is a group of companies, including Intel, IBM, and my own firm, Monax, which apply and adapt the ideas of distributed computation which Bitcoin pioneered for enterprise use-cases.

The second of these is the world of the "coins" or cryptocurrencies, Bitcoin and its imitators, which are doing the same thing they have always done: providing a means of value storage and transfer which is uncensorable and beyond the reach of state regulations (which is why Bitcoin has long been the darling of many libertarians).

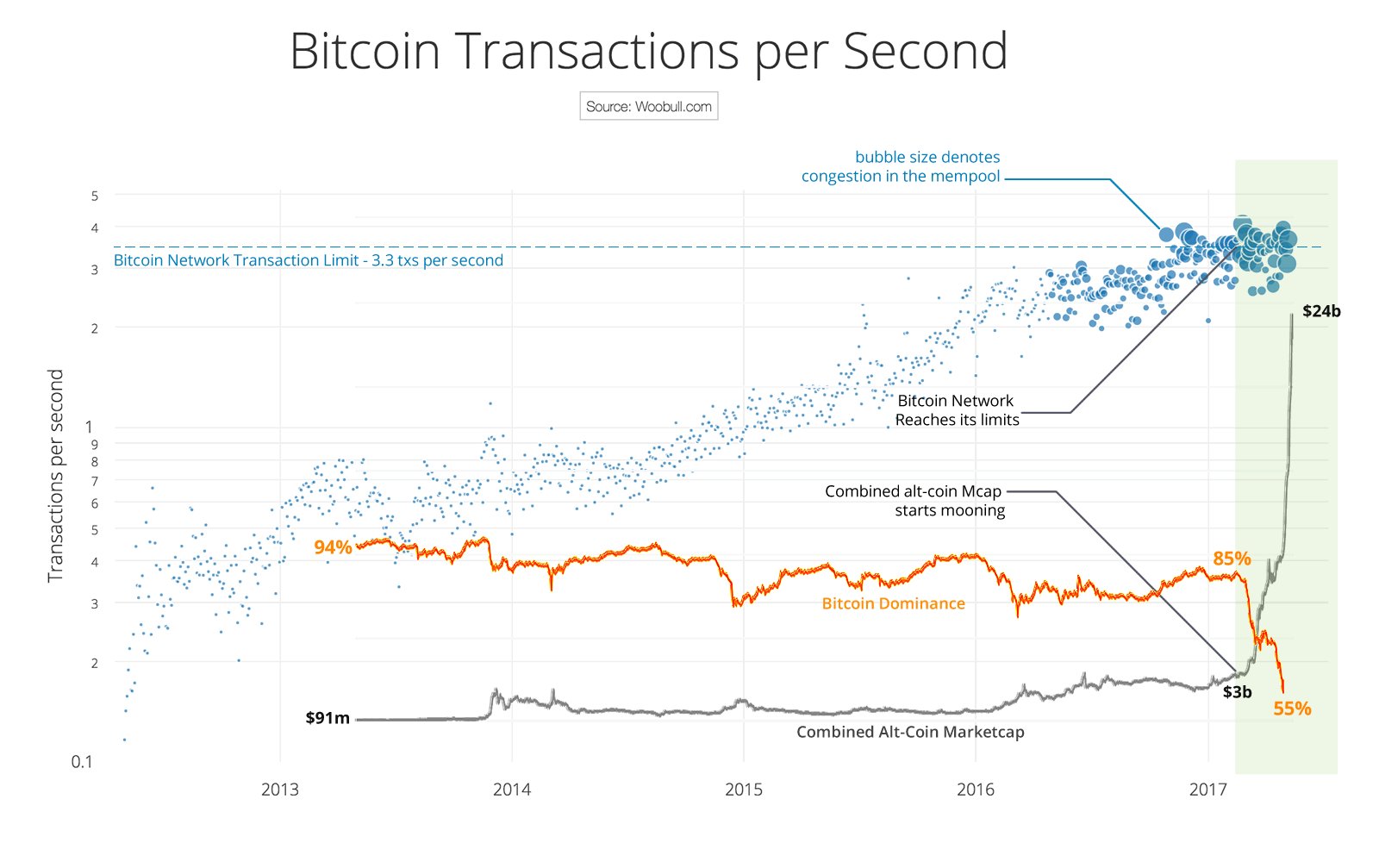

By all indications, Bitcoin is booming, with the price of one coin reaching all-time highs of $1,800 this week. Equally interesting, however, is the fact that the "altcoin" ecosystem - that is, Bitcoin's imitators - have exploded in value as well, to the point where their value equals nearly half of the value of the ecosystem as a whole:

OK. But why?

First, a short primer: any blockchain's application architecture is fundamentally different from what most of us use on a daily basis as we access the web. Applications like Dropbox or work e-mail are run on a server somewhere; administrators of those servers are firmly in control of them and place limits on our access rights to their databases, such as storage limits, to ensure that the system's performance is not degraded from overuse.

Bitcoin, by contrast, is an automatic peer-to-peer system. It runs itself, with the assistance of all of its users, and has no central locus of control. For this reason, a copy of every Bitcoin transaction ever made is stored on every single computer (usually consumer-grade PCs) running the Bitcoin application, and those copies contain all of the rules about who can write to Bitcoin's system - rules which need to be agreed by all the users in advance. The brilliance of Bitcoin's designer(s) is that they wrote the rules in such a way as to obviate the need for human overseers and sophisticated enterprise hardware to run the application.

However, lacking a central enterprise cluster or a human administrator, a paramount architectural concern for Bitcoin is staying usable by preventing the chain from becoming unwieldy in the hands of its (mainly consumer/retail) userbase. This is achieved mainly in two ways; first, only someone holding a Bitcoin is able to write to (transact on) the database. Second, Bitcoin enforces a size limit of one megabyte on the numbers of transactions it will accept in any ten-minute period - a figure that roughly works out to 750 bytes, or 3 transactions, per second.

Bitcoin has hit this limit. As a result, users are now forced to pay increasingly high fees to use the Bitcoin network (paying transaction processors additional Bitcoins to prioritise their transactions among the many thousands that are queued in a backlog, termed the "mempool," and shown on the chart above).

There are two emerging solutions to this - one technical, one market-driven. There is little consensus about how to approach a technical solution, even among the small group of elite developers who are Bitcoin's most respected maintainers.

What *is* more or less agreed is that simply increasing transactional throughput is not an option: Bitcoin's transaction history is currently well over 100 *gigabytes* in size, and doubling transactional capacity means it would grow twice as quickly, meaning that re-centralisation a la Dropbox would occur - Bitcoin would grow so large that it could only be run on enterprise infrastructure.

The other option is the market solution, which the chart above appears to show. The cryptocurrency market as a whole is interesting from an economic perspective in that it provides a perfectly transparent sandbox to see what happens when perfectly substitutable goods (Bitcoin clones) that accomplish the exact same thing (unregulated value transfer) in a fully automatic way (distributed state machines which require no human oversight) are placed in a position to compete. As far as an end-user of cryptocurrency software is concerned, whether a c-currency is $3000 in Dogecoin or $3000 in Bitcoin is immaterial; the shop 'round the corner prices its goods in USD/GBP/EUR, so as long as one coin or the other has sufficient liquidity to cash out, this means competition can occur on the basis of speed and transaction fees.

Which gives the other coins, in their role as fast-followers with smaller size, newer designs and greater community flexibility and incentive to win market share, comparative advantages.

Summing up, what this means is that cryptocurrency is getting interesting again. Not as an investment product (too risky for my taste) or because the technology is sufficiently magical and brilliant that it will eliminate banking (it won’t), but because it shows that even Bitcoin - a machine, which runs itself, and is not operated by any one firm or person - is, reassuringly, forced to cope with the oldest problem in capitalism.

Chiefly, adapt to the perennial gale of creative destruction, or lose market share and die.