Is VAT to blame for the productivity puzzle?

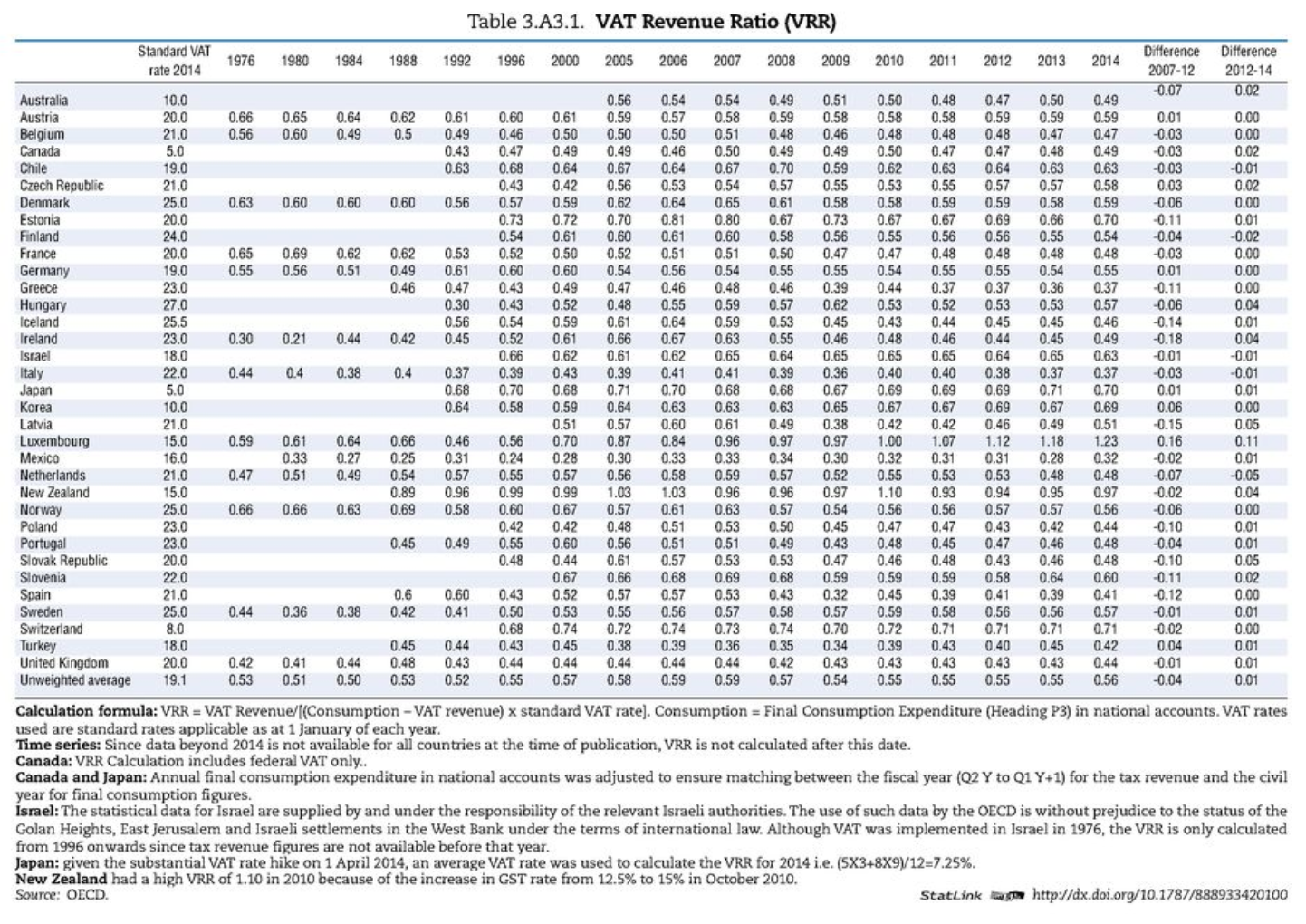

Yesterday the Office for Tax Simplification’s released its long-awaited review of Value Added Taxation. VAT raises about £120bn each year and in general is one of the least economically harmful taxes because it taxes consumption not investment. But the UK’s VAT is one of the world’s least efficient. In fact, in the OECD only Turkey and Greece (!) have less efficient VATs.

Source: OECD, Consumption Tax Trends 2016

I’ve commented before on the stupidity of the lower/zero rating of food and children’s clothes on this blog. Readers are probably aware of the famous Jaffa Cake case, but did you know that while potato crisps are taxed at the full rate, tortilla chips and prawn crackers are zero-rated? Alas, any brave politician determined to fix this distortion, would be mocked for proposing a ‘Doritos Tax’.

But it’s not just zero-rating where Britain falls behind. In an attempt to spare small-business owners the administrative burden of claiming and paying back VAT, we set the threshold for VAT registration rather high. In fact, we set it much higher than our European counterparts. If you report a turnover of £85,000 a year then you must register for VAT, incurring a tax bill of £17,000 minus any VAT reclaimed on inputs. As most businesses near the threshold are sole-proprietorships, where their inputs are low and most value-added comes from their own work, they are unlikely to be able to claim back much.

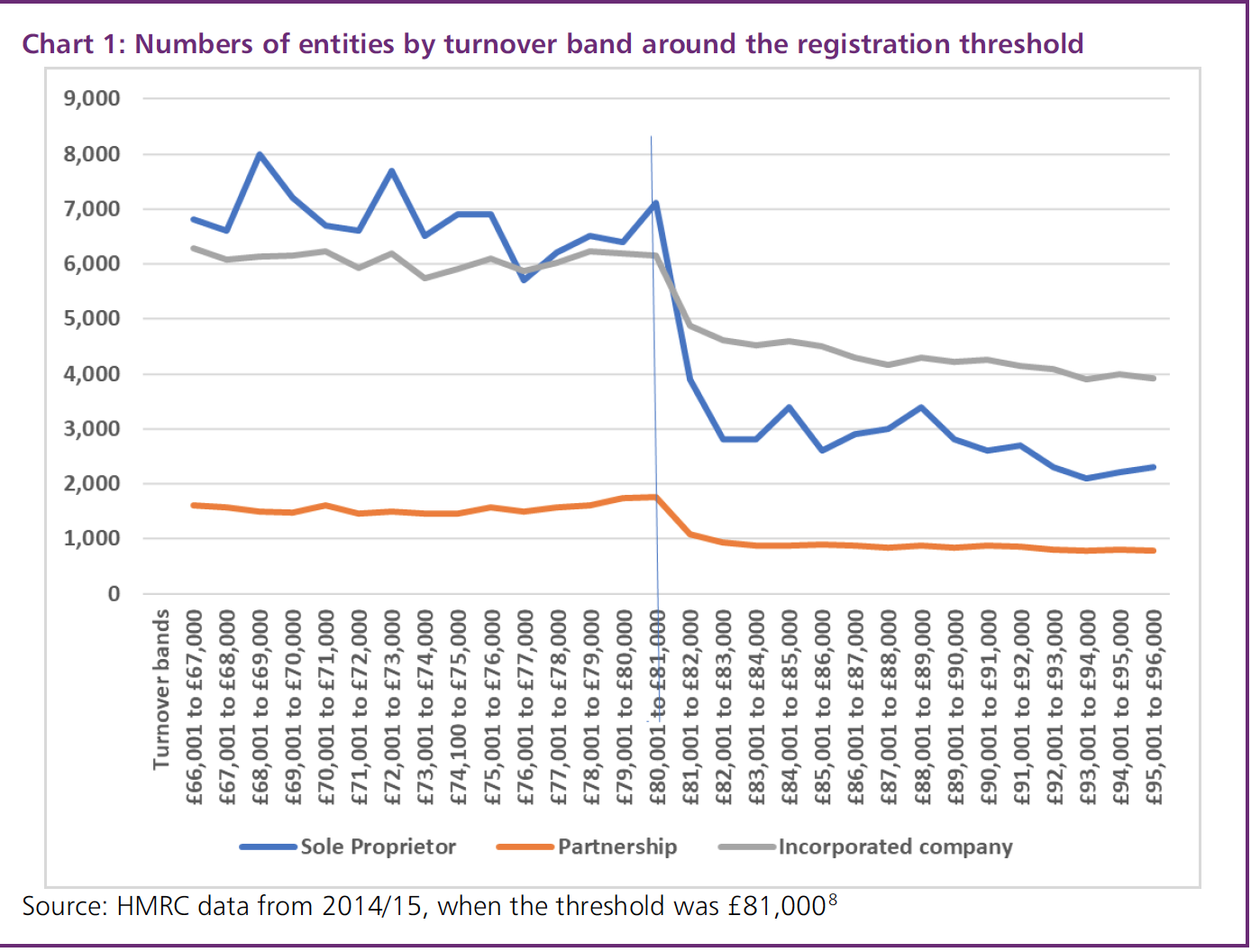

The result is a situation not too dissimilar to the problems caused under the slab system for Stamp Duty. Earning one extra pound can lead to a massive tax bill. As a result there is an overwhelming incentive for firms approaching the threshold to refuse work, under-report turnover or even take extra long holidays . This is seen in the data with firms massively bunching around the threshold.

Source: OTS, Review of Value Added Taxation

Paul Morton, tax director of the Office for Tax Simplification jokes “We hear that cruise ships are full of people staying below the VAT threshold.” We often worry about the effects of marginal tax rates approaching 50% sapping an entrepreneur's incentive to produce, imagine what a marginal tax rate of 1,700,000% on the next pound you earn does!

This is a serious problem. When we worry about a complex tax system, we are not worrying about the need for HMRC and KPMG having to hire extra accountants, rather we are concerned that it is leading people to behave in ways that will destroy productive economic activity.

This bunching effect is significant enough that it may help explain why Britain’s productivity levels are so stubbornly low. It probably isn’t the main factor, but it’s increasingly becoming clear that low productivity levels are not down to simply one thing. It’s not just people in the North being unable to move to productive work in the South because of eye-watering rents or underinvestment in productive machinery because of inadequate capital allowances. It’s all of those things combined.

There’s a further problem. Companies below the threshold often compete with firms registered for VAT. For instance, most Uber drivers turnover under £85,000 which means your average Uber ride is almost VAT-free (you pay VAT on Uber’s cut). If a competitor that employed its drivers directly entered the market, it would be forced to pay VAT in full on each journey. So, the VAT registration threshold might not simply discourage productive activity, it may also lead to inefficient corporate structures.

So what to do? I think the case for reducing the VAT registration threshold is overwhelming. If we brought level closer to the EU minimum threshold of €10,000, it would solve the bunching problem and raise around £2bn for the Treasury in the process. It would mean that more small businesses will have to bear the admin of registering for and paying VAT, but the harms can be mitigated. First, most will use the VAT Flat Rate Scheme which eliminates the need to claim and register every purchase and instead estimates a flat rate on your total turnover based on the industry you are in. So for instance a corner shop owner with lots of input costs will pay a flat 4% rate, while an IT consultant with few input costs will pay 14.5%. Second, we could use the additional £2bn in revenue to cushion the effect of the tax rise by raising the national insurance thresholds.

VAT is one of the least-bad ways to raise revenue. In theory. In practice the UK's VAT falls far short of the ideal. Fixing VAT would boost productivity, efficiency and give us the revenue to cut other more harmful taxes.