Economic Nonsense: 17. The Industrial Revolution brought squalor and impoverished the poor

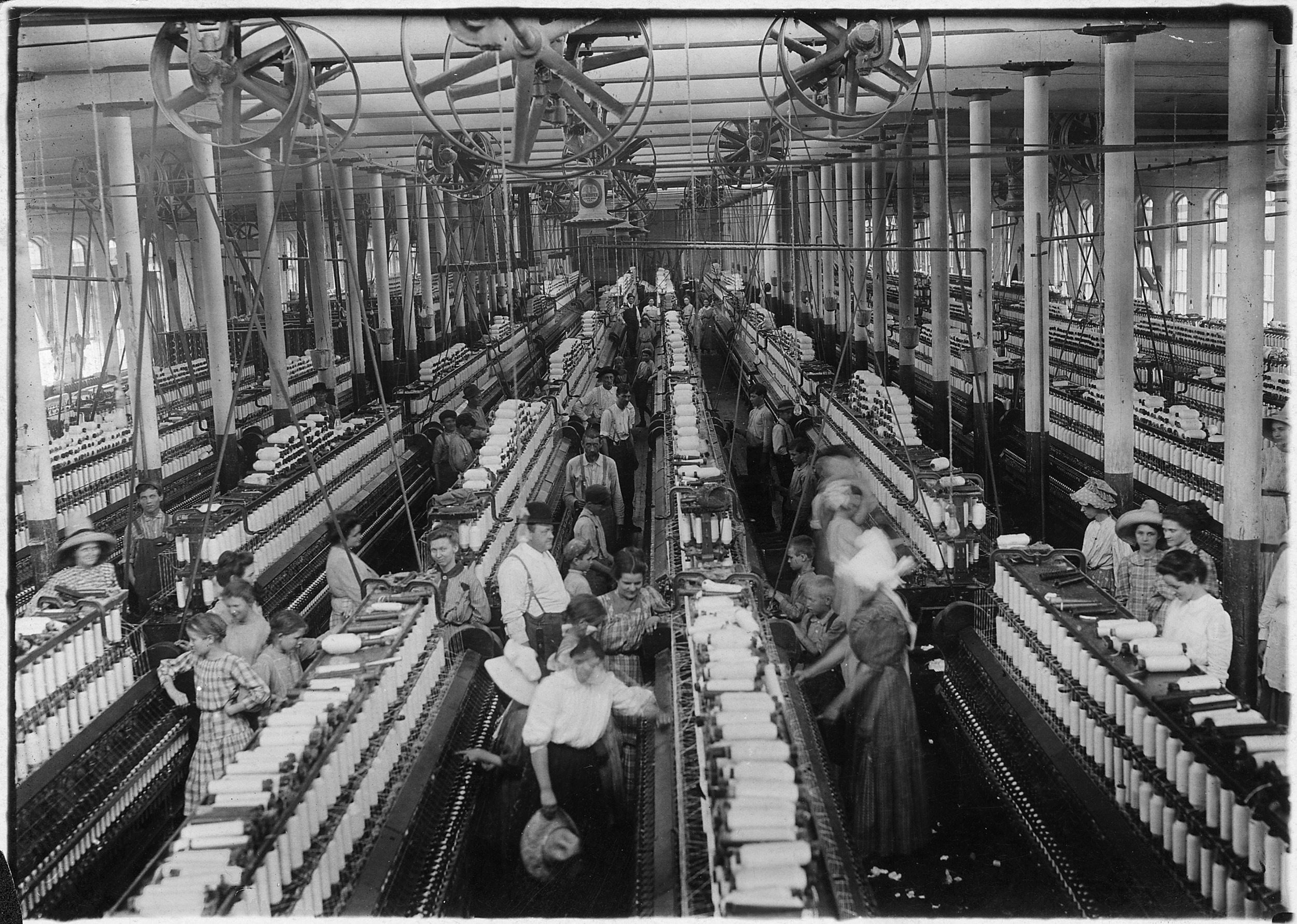

Life for poor people, which meant most people, was pretty miserable before the Industrial Revolution. It was short, full of toil and deprivation. Most worked on the land, rose at dawn, retired at dusk, and did hard physical labour. Starvation was an ever-present threat, and subsistence depended on adequate harvests. A bad year could be fatal. Life expectancy was low, diets were poor and disease was rampant. Movement into the towns and factories spurred by the Industrial Revolution was a step up for the overwhelming majority. They earned wages. They lived in housing that is today thought squalid, but was in fact an improvement on the pitiful country hovels they had lived in previously. Their food was better and life expectancy began to rise. They began to be able to afford luxuries such as pottery, metal utensils and tea.

The myth that the Industrial Revolution brought squalor and deprivation was propagated by Friedrich Engels amongst others, who failed to compare conditions in industrial towns with the conditions they replaced. It was a commonplace error until T S Ashton published "The Industrial Revolution" in 1949, showing how it brought social and economic progress, and lifted the living standards and life chances of millions.

It was the Industrial Revolution that generated the wealth that paid for advances in public health and sanitation. It led to the conquest not only of extreme poverty, but of curable and preventable diseases. Far from bringing poverty and misery to the masses, it did the opposite, lifting their material conditions at a rate and to a level never before witnessed in human history. It was one of the most benign events that people have brought about, and it set the world on an upward course which still benefits millions of people today.

Maybe there is no zero lower bound on interest rates

Tim Worstall has a fantastic piece on Forbes which neatly lays out a lot of the monetary policy views I have been making the case for here on the blog. In it he:

- Shows that many securities can hit yields below zero (such as, most recently, European governments' bonds), implying that the Keynesian 'Zero Lower Bound' argument that monetary policy is impotent when rates hit zero is false or irrelevant

- Argues that we should favour monetary stabilisation of boom-bust because it allows us to have a small state, which we have other good reasons for favouring

- We have a nice natural experiment showing that monetary policy works—and fiscal policy is unnecessary—the Eurozone vs. the UK and USA. The former has not done QE and it has slumped continually; the latter have done QE and had moderate recoveries

A standard part of the standard Keynesian economics of our day is that fiscal policy becomes necessary at the zero lower bound. However, this standard part of the standard theory rather falls apart if we find that there is in fact no zero lower bound to interest rates. The case for fiscal policy, for stimulus, may therefore be rather weaker than its proponents suggest. And the thing is, we do seem to have evidence that there is no zero lower bound. This comes in two different forms: one that unconventional monetary policy can take the place of fiscal even at that lower bound, the other that, well, zero doesn’t seem to be the lower bound.

I hope you don't mind a bit more of Tim, given that he already writes for us daily!

For growth we want good institutions—democracy is irrelevant

It is eternally surprising to me that people keep doing studies of whether democracy affects growth using the same cross-country data but their regular findings—that institutions and the rule of law matter but democracy doesn't—are less of a surprise. The latest, "Democracy and Growth: A Dynamic Panel Data Study" (pdf) is from Jeffry Jacob, of Bethel University and Thomas Osang of Southern Methodist University:

In this paper we investigate the idea whether democracy can have a direct effect on economic growth. We use a system GMM framework that allows us to model the dynamic aspects of the growth process and control for the endogenous nature of many explanatory variables. In contrast to the growth effects of institutions, regime stability, openness and macro-economic policy variables, we find that measures of democracy matter little, if at all, for the economic growth process.

They look at a full 160 countries over 50 years, building on a large existing literature, which includes (my own picks, not theirs):

- Acemoglu et al. (2008) found that once you control for 'country fixed effects' (i.e. systematic and apparently intractable differences between countries) there is no link between the level of democracy in a country and its income. This is because democracies tend to (not necessarily coincidentally) have other good characteristics.

- Cervellati et al. (2004) found that never-colonies benefited from democracy whereas countries that had once been colonies did worse if they were democratic.

- Barro (1996) found that democracy was slightly negative for growth once you account for variables like the rule of law, small governments, free markets and human capital (i.e. skills, education and cognitive ability)

- Lehmann-Hasemeyer et al. (2014) found that democratising Saxony between 1896 and 1909 destroyed lots of stock market wealth in anticipation of worse laws

- Mulligan et al (2004) found that democracies and non-democracies choose very similar policies

That the evidence suggests democracies and non-democracies perform about the same might be surprising given the state of public ignorance. In Sam's words "the public is ignorant about politics and lacks even the basic facts that it would need to make sound judgments about political issues."

But at the same time, as people get more knowledgeable they get more dogmatic. Experts know a lot, but they gather evidence that fits their existing ideology; ideologies both help us understand the world and blinker us in some ways.

Perhaps democratic ignorance and expert narrow-mindedness roughly balance out—or perhaps representative democracies and non-democracies both choose similar sorts of people to rule anyway.

Either way, the evidence seems to suggest that insofar as we can help countries to develop, the key institutions we should be supporting are markets, property rights and the rule of law, and considerably less significance should be accorded to democratisation.

Economic Nonsense: 16. Government should own and run vital industries such as transport and energy

This is laughably untrue. Where governments own and run industries, whether 'vital' or not, they pursue political rather than economic objectives. In the case of things such as transport and energy, they will be tempted to keep prices below economic levels to gain electoral popularity, or at least to avoid unpopularity. Such industries will tend to be under-capitalized, since capital expenditure is less visible to the public than are transfer payments such as pensions and welfare. Governments cannot spend the same money on both, and the former attracts less support than the latter. This under-capitalization threatens future supplies. In the case of transport it means that there will probably not be enough infrastructure built to meet future demand. In the case of energy it poses the threat of future power cuts.

If the state owns and runs transport and energy, those industries will be more prone to strike action. Unions behave more cautiously with private firms because they do not want to risk the firms closing or going bankrupt. This does not happen in the public sector, so the unions have more clout. For the same reason state industries will also tend to be over-manned. This is not mere theory. All of these things actually happened in state-owned industries in Britain, including transport and energy. Train services were unreliable and equipment was shoddy and outdated. In the energy sector there were blackouts.

Although we use the term "public ownership," the public cannot exercise any of the rights of ownership as they do when things are privately owned. Instead it is politicians and bureaucrats who decide priorities, rather than businesses trying to anticipate and cater for public demand. When people talk of the need for the state to run 'vital' industries, we do well to remember that few are more vital than the food industry. One can imagine what it might be like if the state controlled the supplies, determined what should be produced, and only sold through state-owned outlets. We don't have to imagine this. It happened in Soviet Russia and was characterized by shortages, low quality produce, and interminable queues at state shops.

Zero hours contracts, mini-jobs, they're both ways of solving the same problem

Outrage in all the usual quarters as the number of zero hours contracts is reported to have expanded again: Nearly 700,000 people are on zero-hours contracts in their main job - a rise of more than 100,000 on a year ago - according to new official figures.

The rise is likely to trigger renewed debate over the widespread use of contracts that offer no guarantee of hours and only those benefits guaranteed by law, such as holiday pay.

Part of this increase is simply that ONS is getting better at counting these jobs, part is a genuine expansion. But there's a terrible confusion in those same quarters about what this all means:

Let’s not be sour. The bounceback in jobs during the current recovery has been staggering – exceeding all predictions. During the depths of the slump too, although things were dreadful, the UK shed far fewer posts than any of the macroeconomic models suggested. Whereas in the past there had been something close to a one-for-one proportional relation between lost jobs and lost output, for every three percentage points of GDP that disappeared after 2008, only 1% of jobs went up in smoke.

But let’s not be blinkered either. If there is reason to be cheerful in the quantity of jobs in a famously flexible labour market, there is reason to be fearful when it comes to the quality. Underemployment, perma-temping and the recasting of low-grade staffers as “self-employed” hires shorn of all rights were striking features of working life in the recession, and all trends that have been stubbornly slow to reverse in the recovery. That much is reaffirmed every month when the official labour market statistics appear. Nothing, however, sums up the pall of insecurity that has befallen so much of the workforce like zero-hours contracts.

What's missing in there is the word "because". We did not have the usual rise in unemployment as GDP fell "because" we had more people on these zero hour contracts. The same is true of Germany, where they have "mini-jobs". And the opposite is true of places like France where they don't have this sort of labour market flexibility.

It should be obvious that the bottom end of the labour market is going to be pretty insecure and badly paid. That's why it's the bottom end of the labour market. And there's two things we can do about it.

We can ban low pay and job insecurity. Other countries do do that and we could too. The result would be that we have more unemployment, as those places that do ban such things have.

We could simply accept that the bottom end of the labour market is going to be badly paid and insecure and have lower unemployment as a result.

It is, clearly, a choice. But those are the binary options. We cannot insist on better pay and more security and also have those 3 or 4% of the workforce working. That's just not one of the options available to us. Those jobs that are being done simply aren't worth very much. Therefore people won't pay very much to get them done. Whether that cost is in the actual wages or in the overhead of having to provide security. Low paid and insecure employment or unemployment: which will you pick?

And we should note something else as well. When given the choice for themselves hundreds of thousands do choose those zero hours contracts, those mini-jobs, instead of unemployment. Meaning, to the people who are doing them, that they prefer that option. And we really shouldn't go around banning something that people are, by the choice they themselves make, preferring, should we?

Economic Nonsense: 15. Protection of domestic industries will safeguard jobs

Sometimes when jobs are threatened by cheap imports there are calls for government to step in and safeguard those jobs by subsidies, tariffs or import quotas. The aim is to make the domestic goods artificially cheaper by subsidy, or to make the imported goods more expensive by taxing them. Some domestic jobs can be retained, at least temporarily, by this tactic. But the more expensive domestic goods will not be able to compete on world markets outside the country. They will find their foreign market share diminishes as people opt for the cheaper ones. Where subsidies are used, domestic taxpayers are made poorer; where tariffs are used domestic customers lose access to cheaper goods. In both cases they are paying to support the industry concerned.

Some years ago in the UK the Lancashire textile industry was protected in this way. It might have prolonged its decline, but it did not stop it. Mass-produced low-cost textiles were being made more cheaply by foreign competitors. Eventually the UK textile industry moved to high added value luxury and designer products that sold at a premium in both domestic and foreign markets. Some UK textile products have become world-beaters, without the need for subsidies or tariffs to protect the jobs they sustain.

The advent of the World Trade Organisation (WTO), which succeeded the General Agreement on Tariffs and Trade (GATT), outlaws most of this kind of protection by multilateral agreement. This means that calls to protect domestic jobs by such means now fall upon deaf ears. The government has signed pledges not to engage in such practices, in return for the agreement of its trading partners to refrain similarly.

There are still grey areas, though, with Boeing and Airbus each alleging that the other receives indirect government support. It is generally true that when governments all try to protect domestic jobs at the expense of foreign ones, everybody loses. The world found this to its cost in the era of the Great Depression.

Why we shouldn't clamp down on zero-hour contracts

The Office for National Statistics has revealed that 697,000 people (about 2.26% of employees) are on zero-hours contracts in their main job, up more than 100,000 on a year ago. Such contracts make life uncertain for the employees concerned, who may not know from week to week, or even from day to day, whether they have paying work. Some 33% of those on zero-hours contracts say they would like to work more. So should we be clamping down on zero-hours contracts? No, we should not.

First, it is absolutely correct that zero-hours contracts have become far more common in the last two or three years. They hovered at about 0.5% for most of the period since 2000. They rose in use quite slowly between 2005 and 2012, then shot up to just under 2% in 2013 and to that 2.26% figure in 2014.

However, the unemployment rate has also come down in the last two or three years as well. In 2011 it stood at over 8%. Now it is less than 6%, and seemingly headed steadily down. Even though zero-hours contracts represent only a very small part of the labour force, it seems reasonable to argue that the two trends are related. The economic outlook is brighter, but is still uncertain; businesses remain unsure about the future, unsure about their markets, unsure of how much they should invest, unsure of how many workers they can justify taking on. A bust-up in the eurozone, for example, or a general election that delivers an unfavourable or unworkable government. might change the outlook completely for many UK businesses. So the only way that they can rationally expand their production, and be ready if things really do boom, it so cut their employment risk. Hence zero-hours contracts.

Remember too that even though the ONS talks about people's 'main' job, they might not be the only income earners in a household. The same is true of those on the minimum wage: many of them will be secondary earners. In fact, 34% of those on zero-hours contracts are aged 16-24 and half of those are in full time education. To them, a minimum wage job or a zero-hours contract, while frustrating, is not a disaster, and the extra income, however low or intermittent, is welcome.

Critics – you know who – say that the government has allowed a 'low-pay culture' to go 'unchecked'. So what would be their solution? Ban zero-hours contracts? Raise the minimum wage yet further? The inevitable result would be that employers would no longer be willing to take the risk of employing so many people. And first to go would be young people, with fewer skills and less understanding of workplace culture than more experienced employees, and secondary earners, often women. There would be fewer 'starter' jobs through which young and unskilled people could gain experience, more young people trapped in benefits, and a rise in unemployment more generally.

What will do in zero-hours contracts, of course, is continuing economic growth. As unemployment falls, businesses will find it harder to attract employees, and workers and potential workers can become more choosy about the jobs they take. Zero-hours contracts will once again become a very small part of the employment market. Growth, employment, greater security. Job done, and not a politician in sight.

Economic Nonsense: 14. Government can create jobs by spending

Government can certainly create the appearance of new jobs by spending. The minister can be televised proudly cutting the tape to open a government-funded business employing 100 people. The problem is that government has to take that money from the private sector in order to do so. It can do so by taxation, inflation or borrowing, and the effect is to give the private sector less money to spend. That, in turn, means lower demand for its goods and services, less economic activity and fewer transactions. The net result is that jobs are lost in the private sector as a result. Part of the political problem is that the government-funded jobs can be seen, with ministers taking credit. The private job losses take place quietly, without people realizing that they are the result of government activity.

There has been much discussion in academic circles as to whether the publicly-funded jobs gained are more or fewer than the private sector jobs lost, but there is a respectable literature to suggest that they are fewer, and that 100 jobs created with public money will result in more than 100 jobs disappearing or not happening in the private sector.

Another part of the problem is that government-funded jobs are created in accord with political rather than economic priorities. The projects sanctioned are those that find favour with ministers, rather than those created to meet demand. They can be done to court electoral popularity rather than to satisfy economic needs. Jobs funded by public money often need public money to sustain them afterwards, and risk disappearing if public subsidy is withdrawn at some stage in the future. Governments are notoriously bad at "picking winners" to support with public funds; it is not their own money they are putting at risk, so they are less likely to do cautious and full accounting. Private investors tend to be more hard-headed since they stand to incur any losses that come about.

Economic Nonsense: 13. Development and growth harm the environment and cause pollution

This is misleading. The early stages of economic development can certainly adversely affect the environment and cause pollution. When a nation is lifting itself out of abject poverty and subsistence-level life for its citizens, it values the wealth being generated more than it minds the environmental degradation that accompanies it. The early stages of Britain's Industrial Revolution saw factories going up, chimneys belching smoke, and land degraded by mining. For people at the time these factors were less important than the improved standard of living it brought, a standard that lifted most of them out of precarious subsistence and the ever-present threat of starvation.

When Britain grew rich enough, they were able to afford a cleaner environment. Money was available to spend on adequate sanitation and sewage treatment, on cleaning up land damaged by development, and by controlling emissions with legislation such as the Clear Air Act. Other developing economies went through similar stages. Today it is the rich countries that can afford to produce more cleanly.

Newly developing countries pollute more because clean production is more expensive. Wood burning and coal burning pollute heavily; gas burning and electricity production can be done more cleanly. Today China, which depends heavily on coal as an energy source, faces major air pollution problems in its cities and contamination of its rivers. But development has lifted most Chinese out of malnourishment, and now they are at the stage where they have enough wealth to start redressing their environmental problems.

Development and growth need not cause pollution and environmental damage once countries become wealthy enough to use cleaner technology. Wealth and technological progress can solve this problem; living more simply cannot.

Economic Nonsense: 12. Minimum wage rates raise living standards for the low paid

When minimum wage rates per hour are set by law, it can raise the wages of those already in jobs and who manage to stay in those jobs. It has a negative effect on those who lose their jobs because firms no longer find them worth employing at the new rates. It has negative effects, too, on those trying to enter the labour market who do not yet have enough skills to be worth the minimum wage to potential employers. Firms employ people because they are worth more to the firm than the wages they cost it. For low-skilled people their value to the firm might be quite low. Very often it is by starting on low wages and acquiring on-the-job skills that people move up the employment ladder. Someone who has worked has learned the importance of good time-keeping and following instructions. They have learned how the firm likes to do things, and are more valuable than an unknown potential employee. If the minimum wage is set at a level above that of their value to the firm, they find it difficult to secure those starter jobs.

In many countries those with low skills tend to be young people and sometimes those from ethnic minorities, especially if they have not had an adequate education. When minimum wage rates are increased, there often tends to be increased unemployment among these categories.

When minimum wages were introduced in the UK, the level was initially set sufficiently low that it had a minimal impact on employment. Subsequent increases are believed to have increased its impact, leading some economists to suggest that a better way of raising the take-home pay of low earners is to stop taking tax off them. Raising thresholds for income tax and National Insurance increases their wage without it costing employers money and pricing their services out of the market.