Well, this depends Dr. Chang, this depends

Ha-Joon Chang wants to tell us that the government should permanently be running a budget deficit:

Like individuals, of course, a government can increase its means in the long run by borrowing to invest in things that will make the economy more productive, and thus increase the tax revenue. If a government invests in improving the transport system, it will make the country’s logistics industry more efficient. Or if it invests in healthcare and education, that will make the workers more productive.

We're not entirely certain whether this is either only potentially so or impossible.

For example, we could pay doctors more, an increase in spending upon health care, but not notably an increase in the productivity of either the populace or the general economy. And we could spend more on producing more PhDs in Womens' Studies but this is not synonymous with a more efficient economy. We could spend more on infrastructure: like the Swansea Barrage. But that project has a negative net present value meaning that that spending actually decreases the future wealth of the nation.

So we veer between two different thoughts here. The first being that it is potentially possible that if government spends a deficit on investment in productive projects then yes, perhaps a deficit for investment would be reasonable. Then we look at what British governments do spend "investments" on and decide that as the system cannot identify, nor invest in, productive schemes then the proposition fails.

We do worry though that we are being insufficiently cynical about the ability of government here.

It's remarkable how politics can be driven by simple untruths

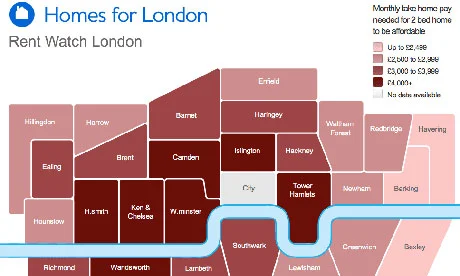

We think we're all onboard with the idea that something dreadful is happening to rents in London? They're vast, much too high, soaring ever higher and becoming increasingly unaffordable? Therefore something needs to be done. Possibly rent controls, maybe throw up a couple of hundred thousand prefabs, possibly crucify buy to let landlords or something?

The problem is that the basic original fact is wrong.

The London Assembly asked the Cambridge Centre for Housing and Planning Research to study the possible effects of various restrictions and new tenancy contracts. Including, obviously, some forms of rent control. Said study pointing out the following:

As can be seen private rents have actually risen below wages or CPI on average during the period 2006-2013. This is true both in London and in England as a whole.

Rents are not rising faster than either inflation or wages.

We do not, therefore, have a problem.

And hands up everyone who thinks that the revelation that we do not have a problem will stop people demanding a solution?

Yes, quite.....

This isn't a joke, it's a criticism

The lady who wrote "Who Cooked Adam Smith's Dinner?" has returned to the pages of The Guardian to tell us more about economics:

Economists sometimes joke that if a man marries his housekeeper, the GDP of the country declines. If, on the other hand, he sends his mother to a care home, it increases again. The joke says a lot about the perception of gender roles among economists, but also shows how work done within the home is not counted as part of GDP, but the same work done outside of it is. This economic assumption may seem harmless, but actually has severe consequences for women and girls.

It's not in fact a joke, it's a criticism. It is what Keynes said about Simon Kuznet's work on trying to define how we do measure GDP. This is not some evidence of the patriarchy controlling economics, it's evidence that the problem has been known about and considered since the very start of the whole idea of trying to measure that economy.

As, amusingly enough, one of us explained in an article published on the same day in a different place.

And we all also know what is the answer to that little conundrum. If GDP is value added at market prices, and there's labour adding value but not at market prices, then how do we value the added value of that labour? The Sarkozy Commission considered this and such as Joe Stiglitz and Amartya Sen told us the answer. At the "undifferentiated labour rate" or, as we might more commonly call it, minimium wage.

It's not just that the original set up of the problem is incorrect it's that she doesn't know it's already been solved.....

There is greater joy in heaven over one sinner that repenteth etc.....

Someone seems to have got the message:

Bono illustrated the shift in thinking that has taken place in his remarks.

“I’m late to realizing that it’s you guys, it’s the private sector, it’s commerce that’s going to take the majority of people out of extreme poverty and, as an activist, I almost found that hard to say,” he said.

As Madsen Pirie of this parish is wont to say, the way to reduce poverty is by buying things made by poor people in poor countries.

But there is more to this than just our being correct and Bono now becoming correct. For the UN and the global illuminati are currently congratulating themselves on having met the Millennium Development Goal of halving absolute poverty. And are now designing the next set of goals in order to abolish it in its entirety. Yet absolutely none of the meeting of that MDG came from anything that the UN of those illuminati did. And not even from the eyewatering overseas aid target of 0.7% of GDP, a target which the UK is almost alone in actually meeting. And there's a problem with this.

That problem being that while abolishing absolute poverty is absolutely the thing to be trying to do, none of the mechanisms being suggested by the UN/illuminati to reach that goal actually have anything to do with how we reached the previous one. They're muttering about inclusive development and reducing inequality. When what is needed is yet more globalisation and trade. Or, in simpler terms, just buy the damn stuff made by poor people in poor countries.

We think (and hope) that the true abolition of absolute poverty will happen. But it will be in spite of, not because of, these lovely plans that are being drawn up. Because none of those plans actually ask people to do what we do know actually works: please people, go shopping!

We have something of a problem here

There are those about who would change the world. OK, we might not agree about how they would do so but that's all part of the joy of arguing about it of course. But it is really incumbent upon people who would change this oblate spheroid to understand how it does currently operate before floating plans to change it. And that understanding seems to be rather lacking. Here's one example:

In a speech that may be the most critical of the week to the credibility of the Corbyn project, McDonnell will insist he understands the need to bring the current account deficit under control.

Now, who doesn't understand this, McDonnell or Patrick Wintour who wrote the article, is unknown to us. But the current account deficit isn't something that particularly needs to be dealt with and it's also not something under anything but the vaguest influence of government and politics. What is meant is the budget deficit not the current account one. It it would be useful if people telling us how to make the nation a better place understood the difference.

But, sadly, it gets worse:

McDonnell has promised he will review the role of the Treasury so that it focuses on fiscal policy and revenue collection. He will promise a drive to end corporate tax evasion and, like the party leader, will point to specific firms deemed to be involved in tax evasion.

There is no corporate tax evasion. Evasion is, recall, the illegal kind: and there's no one at all, not even the Dread Murphy, who thinks that there's anything other than the most trivial amount of illegal tax dodging activity in Britain's corporations. There's an awful lot of allegations of tax avoidance, structuring things so that tax is not legally due. There's even more allegations of taxes that aren't even theoretically due not being paid on the grounds that those making the allegations think that the tax system should be changed to make them practically due.

But as far as there is tax evasion it's simply not in the corporate world. It's you and I paying the window cleaner in cash that is the evasion. And again it would help if those who want to change the world understood this difference.

The country being run by people who don't understand these sorts of differences is unlikely to work out well.

McDonnell has now given his conference speech:

Our balance of payments deficit, which is the gap between what we earn from the rest of the world and what we pay to the rest of the world, is at the highest levels it’s been since modern records began.

You can't have a balance of payments deficit. It's a balance, it balances by definition. You can have a trade deficit, which means most likely a capital surplus, and vice versa, but you can't have a balance deficit.

No, not going to work out well.

What is austerity?

It seems like the meaning of the word 'austerity' has transmuted over the past five years, from referring to the balance of fiscal policy, to purely relating to spending issues. For example, Jeremy Corbyn's Labour is widely interpreted as being anti-austerity, both in the popular imagination, and even by Keynesian economists like Simon Wren-Lewis. But his shadow chancellor, John McDonnell, has promised to aim for the same fiscal policy as George Osborne, the man most closely associated with UK austerity! I suspect that the process has gone something like this:

- Osborne proposes a fiscal policy that is genuinely austere in Keynesian terms—i.e. he aimed to close the deficit year-on-year 2010-2020 on whatever measure you like (cyclically-adjusted, current budget, raw deficit)

- This is attacked as fiscal austerity, which is inappropriate, according to New Keynesian economists (i.e. the mainstream of macro), when the central bank's policy interest rates are at the Zero Lower Bound while it is nevertheless undershooting its macro targets (not that it actually was undershooting these targets)

- The popular mind associates 'austerity' with Osborne's economic policy generally, the most concrete and close-to-home example of which is reduced public services spending, rather than the less tangible (supposed) aggregate demand deficiency (supposedly) driven by fiscal austerity

- Thus 'austerity' is associated not with the budget balance (or any adjusted measure thereof) but simply the spending side of the government's balance sheet, and its general approach to public expenditure (e.g. Robert Peston's definition of austerity as "public spending cuts in a recession")

Alternatively, this meaning change might indicate that the right won the battle on fiscal austerity.

Inflation was well above target despite austerity and the zero lower bound—monetary policy was dominant. Unemployment crashed, employment rose to its highest ever level and highest ever rate as a percentage of the working age population. Slow growth (surely driven by poor productivity) during 2011 and 2012 turned around, and even labour productivity growth might be returning. Wages may now be seeing solid real growth for the first time in years, just as inflation dips into negative territory and GDP grows solidly.

If fiscal austerity is supposed to hurt the economy through reduced aggregate demand and employment then it doesn't feel like such a great argument to hit the Tories with—austerity hasn't seemed to work that way. But if 'austerity' is used as a nebulous term for a general agenda, like 'neoliberal', then it might have legs. Its credibility is helped by the ambiguity it's given when mainstream macroeconomists use it to describe ostensibly similar (but actually quite different) things.

This leads to an interesting symmetry. Wren-Lewis and others have attacked the government for using deficit reduction as an excuse to cut social programmes that he believes they actually want to do for other (ideological) reasons. It seems to me that we're also seeing the converse: those opposing spending cuts for their own ideological reasons use the language of macroeconomics, like 'austerity', to give themselves their own political cover.

Then again, never attribute to malice that which is adequately explained by ignorance.

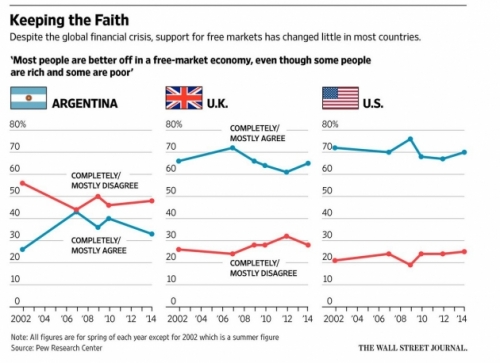

Excellent news: only 30% of the population is knuckle draggingly ignorant

Or, we suppose, we could see this as deeply depressing news, that near 30% of the population is still knuckle draggingly ignorant. Because this question isn't about which variant of a free market economy makes people better off. Even we, arch marketeers that we are, will agree that all markets, nowt but markets and only markets isn't the correct operating system for a socio-economic polity. And Pew isn't asking about whether health care should be government supplied, government financed, insurance so or whatever. They're asking about the basic underlying principle, are we to have an economy that is roughly market based or one that has no markets?

And it really shouldn't be difficult for people to get the right answer to that question. Are roughly market based societies the ones that make the populace richer than not market based ones? Even at the possible expense of inequality?

The answer to this is probably the best researched one we have in all of economics. Because the largest ever controlled experiment was carried out into this very question: we generally call it the 20th century.

Hundreds of millions, then billions, were walled off into non-market economies at various times, from 1917 to 1945 and 1948, to return in 1978 and 1989. With some sad remnants in Cuba and North Korea still stuck in the abject penury of non-market economies. And we know the answer very well indeed. No non-market economy has managed decent economic growth (no, the Soviet Union managed, according to Paul Krugman, not one iota of total factor productivity growth over its entire span) while everywhere that has been a market economy for more than a couple of decades is opulently wealthy by any historical or global standard.

It really shouldn't be difficult for people to get the answer to this question right.

Still, to be cheerful about this, at least we have a decent estimation now of the upper possible bound of the Jezzbollah vote.

Yogi Berra the economist

It's for those who follow American rounders to tell us how important he was to that game, and of course Yogi Berra was famous for his sayings:

He was particularly noted for his fractured relationship with the English language, and Yogi Berraisms were eagerly sought after by collectors. Famous examples included: “It ain’t over till it’s over”; “This is like déjà vu all over again”; “When you come to a fork in the road, take it”; “Baseball is 90 per cent mental, the other half is physical”; and “Always go to other people’s funerals, otherwise they won’t go to yours”.

We, however, would like to point to his skill as an economist. Contained here in this phrase:

Nobody goes there anymore. It's too crowded.

It can, of course, be read just as it is. And yet the second possible reading manages to describe such large amounts of the world. Hipsters, Veblen Goods, conspicuous consumption, why trendy restaurants and nightclubs have their moment in the Sun then die, even why popular beat combos have cycles of popularity.

Nobody important (or "famous", or "cool", or "fashionable") goes there any more. It's too crowded.

To distill pretty much the entire post-subsistence human economy into one short phrase. Now there's an achievement to aspire to, eh?

Maybe Cuban refugees did hurt unskilled Miamians after all

How do refugees affect the wages of natives in the places they settle? I’ve written on the (few) studies of this effect that I’ve seen, but a new paper contradicts one of them. David Card’s 1990 study of the Mariel Boatlift, where 125,000 Cubans fled the Castro regime to settle mostly in Miami, found that there was no negative effect for unskilled natives. Card’s results suggested that the city’s existing garment and agricultural industries absorbed the extra workers and the influx did not cause downward pressure on the wages of unskilled workers already in Miami.

But a new working paper by Harvard’s George Borjas seems to undermine Card’s conclusions. Borjas looks at a particular sub-section of Miami’s unskilled workforce, high school dropouts, and compares Miami to a different set of cities to Card which, says Borjas, were more like Miami in terms of employment growth before the Boatlift took place.

When you do that, the Boatlift seems to have affected high school dropouts’ earnings very badly: they fell by between 10 and 30 percent, relative to the wages of high school graduates and college graduates. The gap between white and black workers’ wages grew substantially too – black workers’ wages fell by 20 percentage points.

The chart below shows the percentage difference in high school dropouts’ wages relative to college graduates’ wages during this period – the different ‘placebos’ show how dropouts’ wages performed in other samples of cities over the same period.

Borjas concludes that the Boatlift put significant downward pressure on the wages of natives with skills similar to those of the migrants, which may also be the case with other similar influxes of immigrants.

It’s an important paper for anybody interested in the immigration debate. But there are also some important things that should make us cautious about extrapolating too much from this.

Most notably, the relative wages of high school dropouts recover entirely by 1990 – the effect Borjas has found only holds in the short-run. And Borjas's study shows that the impact was negative for people at the bottom, but Card's conclusions about the impact on native workers more generally still seem reasonably solid.

The Mariel immigrants were ‘exogenous’ to Miami’s economy – they did not come primarily to get jobs, but to escape Cuba. So the effect might not apply at all to economic migrants from other EU countries who are coming to the UK to work. But for refugees fleeing war, Borjas’s findings might well be repeated.

David Card may reply with some objections that throw doubt on some of Borjas’s choices, and as some people have pointed out a very influential paper by Borjas from 2003 was later undermined itself by replication and slight changes to assumptions. This doesn’t mean we should be skeptical of Borjas in particular, but it is a reminder to avoid drawing firm conclusions from just a couple of studies. Whatever their findings, more research like this can only be a good thing.

Should Britain emulate Venezuela’s economic policies?

Some of the new Opposition leadership have been inspired by Latin America. They believe Venezuela provides a shining example of economic progress. Jeremy Corbyn has previously lauded Venezuela as “an example of what social justice can achieve”. Shadow Health Minister Dianne Abbott says Venezuela provides proof that “a better way is possible.” She’s a Patron of the Venezuela Solidarity Campaign, which aims “to defend the achievements of the Bolivarian Revolution”.

Without dwelling on the politics of Chavez and Maduro, or the accusations of tyranny, how has the economy performed? Should Britain emulate these policies? The short answer is no. Venezuela is one of the world’s worst managed economies. The policies have had tragic results.

Venezuela is poorer than its neighbours despite a wealth of oil, on which it is now extremely dependent. Chile, Argentina, Uruguay, and Panama all have higher per capita income.

It is in the midst of a deep recession. Inflation rates are amongst the world’s highest at over 100%. It holds the top spot globally for the Misery Index.

Venezuela is ranked 176th for Economic Freedom, just behind Zimbabwe and second last in the region. Ease of doing business is poor, property rights are insecureand investments are risky - entrepreneurs receive the lowest rates of return despite their efforts.

The Bolivar has massively devalued despite their currency restrictions. Price controls have resulted in severe shortages, long queues, and a black market for basic goods from toilet paper to milk, flour and medical supplies. Healthcare is in disarray, with crumbling hospitals and patients forced to search for drugs on the streets – hardly a model for our NHS either.

Even just focusing on equality, the case for Venezuelan polices is weak. Its Gini Coefficient, the traditional measure of wealth distribution, is less equal than that of the UK.

Venezuela’s performance has fluctuated over the years. It has done better when the market for oil is strong, and the profits have been partly directed towards social justice causes. Yet the overall picture is damning for this socialist paradise, regardless of the measure. The policies have failed with great cost. We should be very afraid of any proposals that wish to emulate their folly.