GDP is becoming an ever worse measure of how we're doing

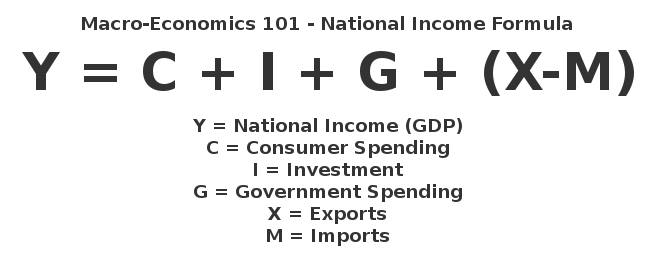

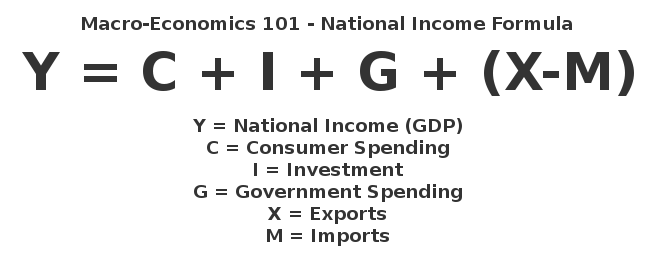

That GDP isn't a very good measure of how we're doing has been known since the concept was first pushed by Simon Kuznets coming on a century ago. It only includes monetised transactions, includes government at what it costs rather than the value it adds, doesn't discuss the distribution of income or consumption, only the gross amount and so on and on. It has its merits, in that it is also reasonably easy to calculate, something that isn't true of all of the potentially better alternatives. The really important thing to understand though is that it is not actually a measure of how well we're doing. It's a proxy for how well we're doing. And unfortunately it is becoming an ever less accurate proxy, as this new paper details:

It is also the case that zero-priced digital goods are – by definition – not counted in GDP. Some of these are advertising funded, rather than subscription funded, so the business model choice affects measured GDP – although the invariance could be restored by taking account of the imputed cost to consumers of the unwanted adverts (Nakamura and Soloveichik 2015). Zero prices and the prices of digital bundles are not accounted for in the consumer price deflators either, leading to an understatement of real growth.

Some zero-priced goods – not only products such as software, blogs, and videos, but also ‘sharing economy’ services such as house swaps or shared meals – could be considered voluntary activities, analogous to reading to children in the local school or volunteering in a charity shop. These volunteer activities are outside the conventional production boundary, just like household services.

The importance here (and the paper discusses many other reasons why GDP is getting less good as a measure) is that we're not in fact interested in production at market prices, nor cconsumption at them, at all. What we're truly interested in is how much people can consume. With physical goods we have a rough rule of thumb: the consumer surplus (that is, the value the consumer gets but which they don't have to pay for) is 100% of GDP. So, if GDP is £1.5 trillion, roughly right for the UK, we're really saying that we think that the value of all consumption, to those doing the actual consumption, is some £3 trillion. But those digital goods skew this horribly.

We measure, for example, Google's addition to GDP as being the advertising they sell here. Which, given that they sell it all from Ireland means no addition to UK GDP at all (well, OK, the wages of their support engineers do count but). But absolutely no one at all thinks that the consumption value to all of us of Google's existence is zero. Thus GDP is getting ever further out of whack with what we really want to measure, which is total consumption.

It's also true that there's no very easy answer to this either. But we should be aware of it. And for two very good reasons. Firstly, economic growth is not as slow as the standard GDP figures show us. And secondly, inequality is rather less than most think. You and I have just as much access to, and at the same price, the services of Facebook, Google and so on as Gerry Grosvenor, something that does indeed reduce the gap between the richest man in the Kingdom and us working stiffs.

We have to announce that all modern physics is rubbish

Well, obviously it's rubbish, eh? Because as Walter Heisenberg pointed out we can't even pin point the location of a particle using physics. So, what's the use of it, eh? We can know where an electron is going, possibly even how fast, but not where it is. So, thus, obviously, we need to take an entirely different approach to the whole subject of trying to understand the physical world around us. At least, this would be so if we were to take Tim Garton Ash on economics seriously:

The Guardian recently asked nine economists whether we’re heading for another global financial crash and they gave many different answers. Yet still we turn to economists as if they were physicists, armed with scientific predictions about the behaviour of the body economic. We consumers of economics, and economists themselves, need to be more realistic about what economics can do. More modesty on both the supply and the demand side of economics will produce better results.

Which is to entirely miss the point over what economics can tell us about the timing of crashes. The physics tells us that we cannot know both velocity and location of that electron. This is a finding from the science: it's not one of those things open to negotiation nor something that we're going to solve by using a different evidential or logical approach.

And so it is with the timing of a crash in financial or other markets. We do not in fact say "Oh, economics cannot predict that". We say that "It is impossible to predict that, we have proven it". Thus the hunt for a predictive method for a crash is a odd as a hunt for the true location and also velocity of a particle. It's not that we cannot do it with the current state of the science: it's that the science has proven that we cannot do it.

Thus, if economics fails on this point then so does all of modern physics fail on the same point. And the silly thing about saying that is that nuclear bombs still go boom even if we cannot tell which particle caused it in what manner, and economics is still, even the current economics we use is still, hugely useful in describing the larger world we live in, even if not accurate to the level of detail that physics is not.

Yes, let us be realistic about what economics can do. One of the things we know it cannot do is predict a crash.

Yes, we're afraid we are this cynical

That the major concerns in economics - or perhaps we should say that major concerns in political economy - have changed in recent years is true to us. But we're afraid that we are really rather cynical about why they have changed:

I hear frequently that economics needs to change, and it has, at least in the questions we ask. Twenty years go, the dominant conversation in economics was about the wonder of markets. We needed to free the banking system from regulations so it could do its important job of turning saving into productive investment unfettered by government interference. Trade barriers needed to come down to make everyone better off. There was little need to worry about monopoly power, markets are contestable and the problem will take care of itself. Unions simply get in the way of our innovative, dynamic economy and needed to be broken so the market could do its thing and make everyone better off. Inequality was a good thing, it created the right incentives for people to work hard and try to get ahead, and the markets would ensure that everyone, from CEOs on down, would be paid according to their contribution to society. The problem wasn't that the markets somehow distributed goods unfairly, or at least in a way that is at odds with marginal productivity theory, it was that some workers lacked the training to reap higher rewards. We simply needed to prepare people better to compete in modern, global markets, there was nothing fundamentally wrong with markets themselves. The move toward market fundamentalism wasn't limited to Republicans, Democrats joined in too.That view is changing. Inequality has burst onto the economics research scene.

If we are to talk about that political economy then yes, we agree that the change has happened. We do not project this cynicism onto Professor Thoma's views, of course, but we do think we know why the change has occurred.

Because the answers to that first set of questions were correct. Things like the Washington Consensus (essentially, a list of stupid things you shouldn't do to an economy) were correct. Don't do these things, don't mess with markets where they do work and economic growth will happen. The adoption of those simple rules: let markets alone in those areas where they do work, has led to the greatest reduction in absolute poverty in the history of our entire species.

The questions were asked and answered and the answers to those questions were correct.

But of course that's not enough for some people. We too are entirely happy to agree that pure unadorned markets do not work in all circumstances. There are interventions, things that only government can do and which also must be done, that must and should be made. However, it's a very human desire to want to be able to plan the world in one's favoured image and a societal instruction set which says "intervene in these small and limited areas, otherwise leave well alone" just isn't going to be emotionally or professionally satisfying for all too many in the field.

And thus inequality. An excuse to do all sorts of societal management, management and fiddling that the answers to the previous set of questions ("How do we make the poor rich?" "How do we make all richer?") largely preclude, as people who would wish to manage society for emotional reasons would prefer.

As an example we think of the work of Piketty, Saez and Zucman. It's entirely clear in the economics of taxation that transactions taxes, wealth taxes and capital taxes are to be abjured. They make everyone poorer to no good reason. Yet if we start shouting about inequality then we can impose those things which we know to be deleterious. That is, the concentration upon inequality is simply a result of people desiring to do those things that the previous set of answers say not to do. So, obviously, change the subject and quickly.

Yes, this is cynical: but then we are about the motivations of our fellow humans. Oxfam has spent decades arguing that the only solution for abject poverty is that the rich world transfer more to the poor. Recent decades have shown that the cure for abject poverty is for rich people to buy things made by the abjectly poor in abjectly poor places. But there is still that very strong desire to tax the heck out of the rich: so the same original policy is now proposed it's just using inequality, not poverty, as the excuse. We are being less cynical about Oxfam there than we are about economics in general.

As it happens inequality is a problem which is going to go away of its own accord. Global inequality, as a result of that fall in absolute poverty, is falling. And in country inequality is going to start falling as a result of the change in demographics. The last few decades, as we added those poor to the global economy, have seen a relative rise in the amount of labour compared to he amount of capital. The returns to, the price of, capital have thus risen. The working age population, globally, started falling relative to the supply of capital last year. Thus inequality will decrease for the opposite reason that it increased. It's a self-solving problem: but that won't stop the calls to soak the rich for of course the soaking is the point, the answer whatever the question is.

All we've got to keep an eye out for in the future is the next reason they'll give for the policies they so desire. Who knows, they might even come up with a valid one one day.

The Pink Tax is a myth

Or, rather, it is in much the same way that the gender wage gap is a myth. I’ll provide some context: this article by Anne Perkins is the latest in a wave of pieces expressing latent support for a study released by NYC Consumer Affairs in December. Amongst its findings were that 42% of products available to consumers were targeted at women and more expensive than an equivalent alternative. As a consequence of women deciding to buy these pink products, they are on average $1,351 a year worse off.

Perkins argues that companies price their gender-targeted products differently ‘because they can’ – they are taking advantage of the ‘soft underbelly of exploitation’.

The logic underpinning the campaign seems to involve services and products possessing a sort of objective value – a ‘fair’ price. That companies discriminate between consumer groups in their pricing is evidence that they charge above this price, and therefore exploit their customer base.

Of course, there is no such objective value. The value of a product or service is only what it brings to the consumer, its emotional payout. In this vein, we would expect having a shirt dry cleaned to afford a greater emotional payout to women than to men - this is explained by their willingness to pay for the higher price in the first place. Although in material terms, they are offered identical (or at least very similar) services, the emotional experiences of the groups are different. Madsen provides an excellent account of this theory of value in this Youtube video.

Perkins also neglects to recognise that in return for higher prices on their bottles of shampoo or perfumes, women enjoy a greater range of products to choose from. Supply does tend to equal demand, folks!

The campaign may have some genuinely positive aims: informing consumers that just down the aisle is a near-identical product in different coloured packaging for 30p less can only be a good thing. I myself had no idea that products were priced in this way. Perkins does say that the power to redress the imbalance, should we abhor it as she does, lies in the hands of each and every one of us. I endorse this sentiment.

However, to go a step further than this and use the information as ammunition in the ideological assault on free-markets and to support a demand for government intervention is undoubtedly misled. If we do as Perkins suggests, and outlaw gender price discrimination, then in some cases we will rectify a wrong that could have been solved by easier access to market information. In other cases, we will end up either giving women an especially sweet deal or raising the price to such a level that very few men are willing to pay.

Corporation tax vs. sales tax

I was on the Today programme this morning, at the ungodly hour of 6.15am, making the case for scrapping corporation tax and replacing it with a sales tax. This has come onto the agenda because Lord Lawson, chancellor under Margaret Thatcher, and great shifter of tax from incomes to consumption, suggested the idea. I also made a similar argument in City A.M. last week.

Why might we want to scrap corporation tax? Corporations are legal fictions; the burden of the taxes they pay must come out of the pockets of their stakeholders. In fact, it comes out of their employees' wages and their shareholders' returns. In itself this is not a huge problem, but we have a huge weight of economics research telling us that we must not tax capital.

Why might we want to switch to a sales tax instead? Well, unsurprisingly given where I work, I'd probably prefer no tax hikes at all. But, presuming we have to raise revenue somewhere, then the goal is to minimise the distortions in the system. Taxing corporate profits discourages profits—the most reliable guide a firm is doing its job—and discourages corporates—the backbone of modern capitalism.

Sales taxes shift the burden away from successful, desirable economic activity and towards less successful or unsuccessful firms. And note that if firms have a future, investors will plough more and more money into them despite making tiny profits or even losses. This does not change that: start-ups can still spend years making losses before they make it big.

They also go some way to resolving public discord over the corporate tax burden. Since it seems impossible to get over the point that it's pension funds and Google staff who lose out if Google is squeezed (Google might be a bad example because it seems that in this case it's paying the amount required by both the letter and the spirit of the law), maybe this more transparent levy would satisfy popular demands.

Certainly taxing firms on their profit but based on their sales in a territory (rather than where they create value, as in the current system) would create horrendous disincentives—driving many firm subsidiaries out of the UK.

The main objection is the same objection as people give to VAT: sometimes it's unclear whether a sale is made in the UK or not; smaller firms find it costly to keep up with. These are legitimate but dwarfed by the costs of distorting investment under the current system.

The real problem is if a 'sales tax' becomes a revenue tax, and falls on intermediate transactions as well as final sales—this would discourage any subcontracting and push firms to become giant vertically-integrated behemoths. But I am optimistic: with a bit of pushing, sometimes reforming civil servants and politicians will do the right thing.

Watch the Somali pirates and the process of state creation

That's not exactly a terribly flattering picture up above there but it is a typical one of the process of state creation. Yes, this is how polities are born: men with guns enforcing it. as the newspaper says:

Somali pirates who raked in millions of dollars in ship hijackings have developed a lucrative new racket - acting as armed "escorts" to foreign trawlers that steal the country's fish. In a striking case of poacher-turned-gamekeeper, the same armed gangs who once preyed on the trawlermen are now acting as their bodyguards, earning huge "protection fees" in return for letting them poach Somalia's rich fishing stocks.

this is not poacher turned gamekeeper so much as the transition from Mancur Olson's roving bandits to stationary bandits. Olson's point being that it always has been the men with the weapons who decide how things get done and who gets what. But for the general population it's rather better when those men with guns decide to farm the population or a resource on a continual basis, rather than simply steal whatever and everything. For, eventually, it will click that slicing a bit off the top while growing the pie increases the amount that can be stolen. Thus even though the ruling class might be robbers, even robber barons, it is still possible for things to advance.

The way to look at this particular story is that this process is just starting in that part of the world. The other way to look at it is of course that it wasn't all that long ago that it was happening in our part of it. 1066 was most certainly exactly the same and there's various incidents since that we could say very much resemble it. Government isn't therefore just the name for what we do together. It is, rather, what is imposed upon us and the best we can hope for is an enlightened stationary bandit. Or, as we might also put it, one with enough guns to stop others imposing upon us but with not enough other powers for that very government to impose upon us.

We're against regulation because it keeps the poor poor

There's a certain absurdity to the regulatory state around the world. In some US states they insist that you go get a 3 year cosmetology degree in order to be allowed to legally work as a hair braider. We here in Britain shouldn't laugh too loudly: We've told that one of us broke the law by doing a bit of simple electrical work in our own kitchen just recently. That is reserved to those who have the correct chitty from government. But why is it that we are against such regulation of who may enter an industry, who may offer their services? Because, quite simply, it keeps the poor poor:

We examine the relationship between entry regulations and income inequality. Entry regulations increase the cost of legally starting a business relative to the alternatives—working for someone else, entering illegally, or exiting the labor force. We hypothesize that such regulations may cause greater income inequality, because entrepreneurs at the bottom rungs of the income distribution may have relatively greater difficulty surmounting costly barriers to entry. Combining entry regulations data from the World Bank Doing Business Index with various measures of income inequality, including Gini coefficients and income shares, we examine a pooled cross-section of 175 countries and find that countries with more stringent entry regulations tend to experience higher levels of income inequality. An increase by one standard deviation in the number of procedures required to start a new business is associated with a 1.5 percent increase in the Gini coefficient and a 5.6 percent increase in the share of income going to the top 10 percent of earners. Although we cannot eliminate the possibility of reverse causality, we are unaware of any theory that posits that income inequality causes entry regulations.

We're happy enough with the idea that a lorry driver should have some proven ability to drive a lorry before being let loose with a 40 tonne behemoth. But much less certain that we need quite as much restriction on who may do what as we currently have. And why not decide to provide that ladder up out of poverty and inequality by making it easier for people to get those first and entry level jobs?

Or, as we never tire of saying, it's surprising how often the solution to government identified problems, like poverty and inequality, is to stop government doing the damn fool things it already does.

Tax codes tell us what tax rates can't

Changing tax rates is quite hard. It's a big deal. I still remember Gordon Brown's 'twopenny budget' back in 2007, when the then-chancellor cut 2p off the basic rate of income tax and corporation tax (while scrapping the 10p introductory rate of income tax but partly muted that by beefing up tax credits). But changes in tax code technicalities and language are much less salient and widely-noticed, and may well be a more fruitful way of improving tax policy. The job market paper (pdf) from Elliott Ash, a JD/PhD candidate at Columbia university, tackles this question by looking at the text of 1.6m statutes from state legislatures from 1963 until today. He tries to discern the effective tax code "the set of legal phrases in tax law that have the largest impact on revenues, holding major tax rates constant". Essentially his approach allows him to quantify elements of the tax regime that would otherwise be only qualitative—like when people quote the length of the tax code to measure its complexity.

He then associates terms with more or less revenue. For example, the phrase 'buildings and structures' has one of the strongest positive associations with extra revenue from the personal income tax, perhaps because it clarifies what kinds of property can be claimed for deductions. Similarly, 'certain motor vehicles' has a strong negative association with sales tax, presumably because the phrase is generally used to make particular automobiles exempt from sales tax.

His main finding is that Democratic takeovers of state legislatures tend to increase the overall progressivity of the tax system, by switching the language of the state tax code towards effectively raising more from income taxes. By contrast, Republican takeovers shift tax codes towards language associated with more revenue from sales taxes—more efficient but less progressive. This approach is much finer grained than the fairly blunt tool of looking at rates, which are much stickier.

It's not all that surprising, but it's a fascinating approach, and one I expect to be mined for more interesting findings in the future.

Scrapping deposit insurance is a perfectly respectable idea

Our friends the Centre for Policy Studies have a report (pdf) out today, by banker/adviser Andreas Wesemann, which argues for the abolition of deposit insurance. This shocked and appalled some, including All Souls professor Kevin O'Rourke, who asked Twitter if Wesemann and the CPS could possibly be serious.

Yes, they could be serious. Scrapping deposit insurance is an idea with a fairly impressive pedigree. O'Rourke is presumably aware of the hugely-cited 2002 paper "Does deposit insurance increase banking system stability? An empirical investigation", in the prominent Journal of Monetary Economics (the 22nd highest impact econ journal by ideas.repec.org's most sophisticated ranking system). If he wasn't, Garett Jones pointed it out to him on Twitter. It looks at 61 countries between 1980 and 1997 and finds that explicit deposit insurance tends to lead to more banking crises.

This is, of course, precisely what the CPS paper argues. And one of the JME paper authors, with different collaborators, updated the analysis in 2015, looking at data from up to 2013 from across the world, with largely unchanged results (pdf). They point out that insuring deposits may restrain bank runs, but it encourages worse sorts of instability, and drives bank risk-taking. We might add that if debt is a worry, then subsidising deposits but not equity is yet another intervention encouraging debt over other, potentially less worrisome, ways of funding investment.

It's true that not every paper supports the CPS conclusion. Some find that deposit insurance cushions the market in bad times, even if it makes these bad times worse. Others find that the runs that a no-insurance regime allows are a key element of discipline in the system, working toward higher long run stability even as they destabilise in the short run. In the absence of systematic reviews and meta-analyses I can only give my own impression of the literature, which it seems to me sides mostly with the 2002 finding from Demirgüç-Kunt & Detragiache.

But whatever the overall tenor of the research, it's clearly an academically popular position that deposit insurance brings with it clear dangers. So I'd ask O'Rourke and others to tone down the shock and horror—abolishing deposit insurance is a perfectly respectable position. Now how about reconsidering all that Basel III business...

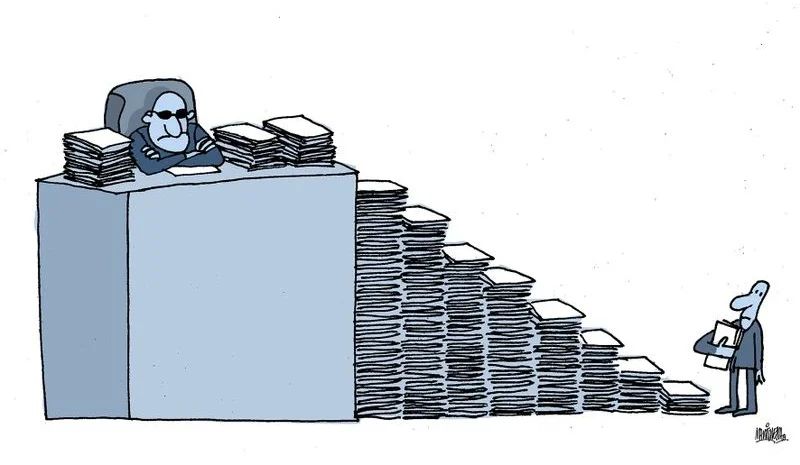

Shareholder 'say on pay' is completely irrelevant

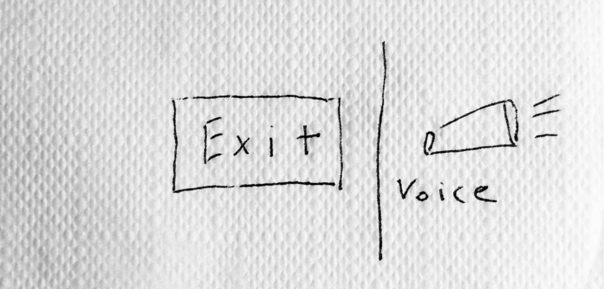

I was on Radio Five Live the other day debating CEO pay. On my side, arguing that high CEO pay is not necessarily bad, was Chris Philp, the Tory MP for Croydon South who sits on the Treasury Select Committee. His arguments echoed those I regularly hear: shareholder capitalism is good generally, but it's bad that non-executive directors on remuneration committees set pay for executives; that these pay awards are rarely voted down; and that few shareholders actually vote. What we need to make sure shareholder capitalism is working, this popular argument runs, is to make sure that shareholders are vocal and closely scrutinising boards.

This is completely false. For the obvious, intuitive reason as to why this is false, ask yourself why all public firms, owned by shareholders, would choose to set pay by remuneration committee if that meant they'd waste millions overpaying their executives.

But wait—isn't this because shareholders don't vote enough on firm decisions and boards get away with murder? No, this explanation is also false. It's false because shareholders have two tools to make sure their money is in good firms: making the firms they have money in better or moving their money to good firms. In practice, doing the former through shareholder action is pointlessly costly, and shareholder capitalism has much better mechanisms, so shareholders overwhelmingly, and effectively, do the latter.

When firms do bad things, shareholders simply move their money out. Since board members and executives tend to be large shareholders in a firm themselves, the departure of other shareholders, driving down the share price, is a huge personal incentive to run it well.

But ignoring this, it's clear how the exit mechanism alone, combined with profit-maximising market institutions like hedge funds, will shift capital towards well-run firms and away from badly-run ones; towards firms whose remuneration committees use shareholder money well and away from those who don't without any need for a single shareholder voting once.

Centuries of capitalism tell us that the market values 'say on pay' very little, and aloof, powerful boards quite a lot. So does the academic literature.

Similarly, to those unfamiliar with the power of 'exit', the fact that shareholders allow remuneration committees to write lucrative 'golden parachutes' into executives' contracts—seemingly rewarding them for failure—is bemusing. But golden parachutes are actually good for firms that award them, as they make bosses less worried about revealing bad info about a firm to non-execs in a timely manner. Regulatory fair disclosure rules, by contrast, don't work.

If say on pay was so necessary to shareholder capitalism's success, why have firms practising it not taken over the market, and the world? That's the question Philp et al. need to answer before they pressure—or worse, force—firms into broader adoption of stockholder votes on pay.