The FTSE 100 is entirely useful, as long as you know what you're using it for

It's entirely true that the FTSE100 is not a very good guide to the performance of the UK economy, as The Telegraph points out:

To some degree that might be telling us that the economy is not quite as strong as it might look on the surface. But, more significantly, it is telling us that the FTSE has become completely unfit for purpose. It no longer reflects what is happening in the British economy.

But then again, no one has ever claimed, or no one has ever sensibly claimed, that the FTSE100 is supposed to be a guide to the performance of the British economy. It's a guide to the performance of shares listed in London, not of companies doing business in the UK. As people have known and have been pointing out for many years:

Research by the Capital Group, which manages more than £750 billion of assets, has shown that more of the FTSE 100’s revenues are earned internationally than had previously been believed.

Previous consensus estimates had held that two-thirds of FTSE 100 companies’ turnover was derived from overseas sales.

But the new study has raised this to 77%. According to the Capital Group, 30% of the FTSE 100’s revenues now come from emerging markets, 19% from the US, 17% from Europe excluding the UK, 5% from Japan, 4% from the rest of developed Asia, and 2% from Canada.

Having an economic measure is just lovely. But it does help if one understands what is being measured. In this case, the economic performance of corporations who happen, for legal, historical, or just the general plain flat out honesty of the place, list their shares in The City. As that, it works just fine.

Ten initiatives to help young people: 5. Youth start-up loans

Young people who opt for university education are eligible for loans at preferred rates. They qualify for tuition loans of up to £9,000 per year, and for maintenance loans which could go as high as £8,200 per year for those from low income families. Most students assume this is a good investment that will lead to higher salaries over the course of their working lives, and are cushioned by the fact that only those earning more than £21,000 per year have to start repaying those loans. But young people who do not qualify for university admission, or who decide against it, are not eligible for similar loans. In fact young people starting out in work or seeking work find there and many associated costs. They often have to face deposits for accommodation; they sometimes have to buy new clothes appropriate for their work or their job-seeking. Most have no cushion of saving since few will have yet earned any money.

If young people not at university were given access to loans on terms similar to those available to students, many would find their lives much easier. For some it would help cover the costs of moving into their first independent accommodation. For others it might help pay for a bicycle to travel to work on.

For others, loans such as these would offer the opportunity to start a small business. Paying for driving lessons to pass the test and buying a car would be a real possibility for those who wanted to become professional drivers. Others might find themselves able to rent premises to set up as independent hairdressers. A range of small business possibilities would open up. Far from the world of multi-million software businesses, there are small one-person businesses that operate as gardeners, window-cleaners, street traders, hairdressers, and the like.

To set up a one-person business such as these takes initial capital, capital that young people simply do not have. Some of the lucky ones might borrow from parents. Some might persuade a bank to loan them money, but banks are wary of lending to those without collateral, so for most the possibility is ruled out by lack of available finance. A scheme like that which provides student loans, but which made them available instead to non-university young people would open up countless opportunities for advancement. For some it would help them with their move into the city to find work and accommodation. For others it would open the possibility to start up their own small business. It would reduce unemployment and encourage ambition.

We must regulate Bitcoin because.....?

We can fill in that "...." with whatever we want of course. For Bitcoin enables (despite whatever other fragilities we might think it has) people to transfer money around, do business, trade, without the intervening hand of the State. And that will never do: how can the functionaries of the State make sure they get paid if we just do things without paying them their tithe in tax? And thus:

European Union countries plan a crackdown on virtual currencies and anonymous payments made online and via pre-paid cards in a bid to tackle terrorism financing after the Paris attacks, a draft document seen by Reuters said.

In more detail:

They will urge the European Commission, the EU executive arm, to propose measures to "strengthen controls of non-banking payment methods such as electronic/anonymous payments and virtual currencies and transfers of gold, precious metals, by pre-paid cards," draft conclusions of the meeting said.

The bodies are not even buried yet, we know absolutely nothing at all about how this attack was financed. And yet everyone knows that cyber-currencies must be more regulated. Because......

Well, just because, because we cannot be allowed to do things beyond the purview of the State and any old excuse is a good enough because to make sure that that is not allowed to happen. The terrorists could have been using their own bank accounts and we'd still be having this clampdown. Because.

Light in the FCA tunnel

The FCA was created to encourage best practice and thereby grow each of the financial services sectors under its oversight. By adopting an adversarial position towards its charges, it has achieved the very opposite of the Chancellor’s intentions, nowhere more so than in the personal financial advice sector. The traditional arrangements for financially advising individuals were turned upside down at the start of 2013 by the FCA’s new rules (in fact a continuation of a policy initiated by its predecessor the Financial Services Authority) known as the “Retail Distribution Review” (RDR) in which Independent Financial Advisors (IFAs) could no longer be reimbursed by the providers of the investments selected, but only by the clients themselves. “Trail commissions”, i.e. the annual fees paid to IFAs by their customers over the lifetime of products such as pensions, with-profits bonds and unit trusts were banned on sales of new investment products from April 2014 and will required to be completely phased out by April 2016. So the client must fund the advisory costs wholly up front instead of being able to spread them over the years of benefit. Is there any regulator, in any sector, anywhere in the world who restricts the way customers pay for services?

The IFAs were presumed by the FCA to be providing advice to maximise their own short-term gain rather than in their clients’ best interests. If the FCA regulated independent shoe retailers, where different shoes also have different styles, features and benefits, the customer would have to hand over £30 before the assistant could advise on shoes. The new rules showed that the FCA has no idea of how competitive markets, or IFAs, work. There are thousands of IFAs, all of whom were already required to make full commission disclosure, and investors can, and should, shop around.

An IFA is trained explain their calculations and show the “present value”, using simple enough techniques such as discounted cash flow and factoring risk. It is not quantum physics and if the investor does not understand every detail, it matters not. Present values of investment proposals are no more difficult to compare than house prices.

Sometimes IFAs split commission with their clients to be more competitive. IFAs businesses are built on long client relationships which would be destroyed by diddling their customers.

The clients of IFAs and shoe shops alike resent having suddenly to pay for what had always seemed free and, furthermore, to pay for advice before they had the benefit from it. It is a bit like expecting consumers to pay for groceries in one month and receive them the next. Needless to say, to the extent that IFAs and their advisees were consulted, their opinions were ignored. The FCA knew best.

The FCA torpedoed the market it was supposed to be nurturing. According to Heath Report II which uses the FCA’s own figures, by March 2015 two thirds of the individuals previously seeking financial advice no longer did so: 23 million had dropped to 7 million causing 13,500 IFAs, and about the same number of administrators to lose their jobs. The FCA claimed, with very dubious arithmetic, that the old system cost clients £233 million but their remedy is costing £344 million. And all these losses are before Trail commission is fully phased out.

It is truly extraordinary that HM Treasury should hand older people unlimited access to their pension pots precisely at a time when the FCA has removed the market’s capability to advise them.

But there is light ahead. The head of the FCA has been replaced and, jointly chaired by his successor and a senior HMT civil servant, a new review started work last month which “will consider the current regulatory and legal framework governing the provision of financial advice and guidance to consumers and its effectiveness in ensuring that all consumers have access to the information, advice and guidance necessary to empower them to make effective decisions about their finances.”

Would it not be wonderful if sense prevailed?

So, what's the difference between Modern Monetary Theory and tax and spend then?

Modern Monetary Theory is all the rage these days. Slightly unfortunately it's usually referred to as MMT which can and does also stand for Magic Money Tree. And that's what the proponents think they have found. This Peoples' Quantitative Easing that is talked about is only a variation of the basic idea. Which is, simply, government just prints all the money that it wants to spend and goes and spends it. Don't worry about taxation, that's not important. But, wait! say the monetarists. Won't this cause inflation? To which the answer is:

Kelton disagrees with Romer and Mankiw on economic theory. In fact, she disagrees with just about every economist Bush or Obama ever hired about economic theory. Kelton is among the most influential advocates of Modern Monetary Theory (MMT), a heterodox left-leaning movement within economics that rejects New Keynesianism and other mainstream macroeconomic theories.

MMT emphasizes the fact that countries that print their own money can never really “run out of money.” They can just print more. The reason we have taxes, then, is not to pay for stuff, but to keep people using the government’s preferred currency rather than, say, Bitcoin. In some rare cases, consumer demand gets too high, so sellers raise prices and inflation ensues. Then, you need to raise taxes to cool the economy down. But the theory holds that this eventuality is pretty rare. James Galbraith, another MMT-influenced economist, once told me that the last time it happened was in World War I. The main takeaway from this is that you really don’t need to balance the budget over any time horizon, and attempts to do so will hurt the economy.

So, in order to reduce the inflation brought about by government spending the newly printed money with gay abandon all you've got to do is raise taxes.

At which point it's very difficult to see what's so new about the idea really. We can raise government spending by raising the tax level without the magic money tree. And if we do use the magic money tree then we're going to have to raise taxes once the politicians apply MMT (of either kind) to their pet projects. So, what's the difference? An expansion of government spending is accompanied by an increase in the tax level.

So, what's new about this?

Presumably what's different is that it's a different argument to raise taxes and have more government spending. But perhaps a difference without much meaning and certainly one that we shouldn't be stupid enough to swallow.

Recapitulation

As the not new saying goes, there's not much new in this world:

This week the firm disclosed "questionable practices" by its management, which had been overhauled last month, and which meant it had to freeze remaining capital.

It said: "the company has used lenders' capital without their permission", leaving a £3.5m deficit between the amount owed to lenders and the capital available to repay them.

The platform, which promised 12pc returns, has currently lent out £23m but said £2.9m of this had not been assigned to legitimate borrowers.

This is about a peer to peer lending firm called Trustbuddy. But there's nothing very new about what has allegedly happened. Absolutely every form of banking that anyone has ever devised has suffered, at one time or another, from the same problem. And that's of course something that we should all remember: absolutely every form of banking will suffer from exactly the same mistakes and scams as every other form of banking.

We watched with rather a lot of amusement as every such scam, mistake and confusion that banking has been prone to since the first goldsmiths started lending out their stock happened at warp speed in Bitcoin over the past few years. And we've no doubt at all that exactly the same will happen in peer to peer lending and any other form of banking that anyone tries.

This isn't to say that peer to peer, or any of the other possible arrangements, are bad ideas. Indeed we're absolutely delighted to see people at least attempting the disintermediation of banking. Civilisation cannot march on to ever greater wealth unless people are willing to try out the available technological space. But some of those being inventive will end up recapitulating past errors and crimes and for us one of the best guides to this brave new world will be a study of the history of how people have used banking to steal from us.

In this field at least, the past is going to be a very good guide to the future.

Sobering thoughts on the Bank of England

I can't say I really trust central bankers. The incentives on them are to over-expand, and create rising prosperity which reflects on them and their political masters. Often they do not even realise they are doing it. But the trouble is that it takes increasing doses to maintain the high, and when you ease off you get a hangover - and real people lose real wealth. Never mind dashing away the punch bowl - don't serve booze in the first place. Keep the economy sober so people can make rational investment decisions.

When you do eventually crash after the previous excesses, I agree that you need to boost the money supply fast - because just as the banks create money in the upturn, they destroy it equally fast in the downturn, and you have to replace at least part of that to bridge the way from the downbeat to the upbeat without, hopefully, hitting the bottom.

I don't think we have a QE system that actually gets cash where it's needed, though. It goes into assets, which is fine for people with assets, but lesser mortals are left high and dry. In the UK, it basically goes into buying up government debt. But like the rest of us, the government can't get out of a fix just by stacking up more debt.

And then you have to be prepared to take all this money out of the system when things start to turn around so you don't get inflationary pressures building. It might be repressed inflation – where the monetary expansion is actually distorting investment decisions, but people are still too nervous to put up prices. But it is still destructive. Again, there is little incentive on a central bank to restrain itself at this point.

I do worry whether the UK's spectacular recovery is in large part due to all the QE we have done (larger, proportionately, than America's). A recovery built on the same thing that brought us the last boom-bust episode. The trouble is, it's hard to know. You could, of course, rely on the market to tell you, as the market probably has a better collective idea than most monetary officials. But that would mean giving up the monopoly control of money. Central bankers aren't going to volunteer for that (though crypto-currency may do it for them).

Europe's monumentally appalling problems are because they have the same boom-bust problems, but a) a bunch of economies that are state-dominated and fat and under-performing, not the best formula for a recovery, and b) countries that should adjust but are locked into the euro so they can't, and c) a complete inability to take on-time monetary decisions anyway because of all the political differences. Sell your shares in the EU!

There's a simple solution to this

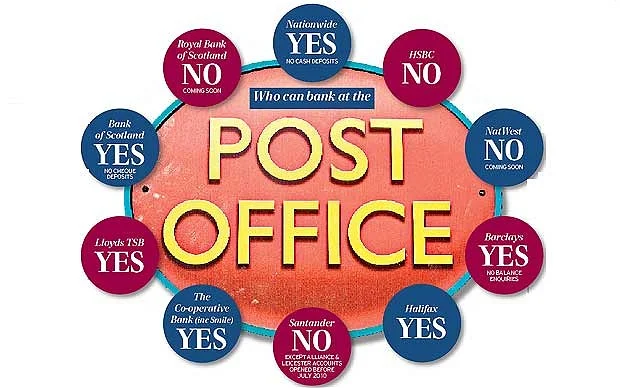

It's entirely possible that the man from the Post Office is right here. That instead of banking when in credit being free, with high charges for not being in credit, it would be better to have a system where all get charged the costs of their activities. Entirely possible that he's right: Free bank accounts are unfair to poor customers and form an unsustainable foundation for the banking system, according to Post Office Money’s chief executive, Nicholas Kennett, who wants to see the industry charge customers regular fees instead.

He believes it is unfair that customers who have to use their overdrafts are charged high fees, which are then used by the bank to offer free accounts to the better-off who rarely pay any fees.

We also have a system to work out whether he is right:

While this may mean that customers who never incur fees and charges are well-served, he argues that charging customers for the services they use would be fairer overall and lead to better service for more account-holders.

In his case, the Post Office offers an account which costs £5 per month and will not let customers rack up unexpected overdraft fees.

Excellent. So, those who think that is the better system will flock to the Post Office to gain access to that better system. Those who do not will not. No one need do anything else. The alternatives exist, all are free to choose between them so choose people will. Which is the best system thus being not something that we can determine a priori, but something emergent from what people do.

You know, this market stuff?

Getting the effect of cash entirely wrong

An amusing proof that it's possible to start from an interesting place and then fall over into complete nonsense. The point at issue being that the amount of cash floating around the British economy has increased in recent years. OK, well, why, and what, if anything, might we want to do about it?

The chief cashier of the Bank of England says that only about a quarter of the cash they put into circulation is used to buy and sell things. The rest of it is either shipped overseas – which we will put to one side for the moment – kept outside of the banking system ie (hoarded), or used to support the shadow economy (iestashed). In other words, not in circulation at all but stuffed under mattresses.If you look at the trend growth of that cash “in circulation” over the last few years, it has accelerated past GDP growth as well as past the amount of money being taken out of ATM machines. And we also know that the use of cash in retailing has continued to fall steadily. That means the “cash gap”, between the small amount of cash that is used to support the needs of commerce and the large amounts of cash that are used for other purposes, has been growing. The interesting question is: why?

There are two pretty simple alternatives. If the amount of cash that is being hoarded has been growing, that would suggest people have lost confidence in formal financial services. Or, that they have so little knowledge of basic arithmetic that they are happy to have inflation eat away their store of value while forgoing the safety and security of bank deposits, no matter what value of the interest paid.

Well, no, not really, a bit of elementary economics would tell us that when interest rates are on the floor, as they have been "over the last few years", and inflation has been notable by its absence, then people will be more willing to hold cash, even just inert cash, than when they could have stuck it in the bank and got some interest to over the losses from inflation. So, actually, an increase in cash in circulation is just what we would have expected in recent years. And we've not even any evidence that this produces an increase in the financing of the grey or black economies: after all, our general analysis of monetary conditions currently is that the velocity of circulation has fallen. Meaning that we need more cash to finance the same amount of activity: just as we need more base money to finance the rest of the economy which is why QE.

So, the terrors are unproven. But what really boggles is this:

Charles and Jonathan estimate that the grey economy in the UK could have expanded by about 3% of UK GDP since the beginning of the current financial crisis. That means there are an awful lot of people not paying tax, and simple calculations will show that the tax lost that can be attributed to cash is vastly greater than the seigniorage earned by the Bank of England – the money the bank earns from issuing notes. Cash makes the government considerably worse off – and that means us.

It's that last phrase. We are not the government and the government is not us. It's not necessary to come over all entirely Mancur Olson to note this. If the government has insufficient money to defend the nation that might indeed impact us in a negative manner, if it's not got enough to finance Ed Miliband's pension then that's of less impact upon the rest of us.

And, clearly, if government is sucking less money out from our own economic activities to finance those of Ed Miliband then we are better off (even if Ed and Justine are not).

Another way of putting this is that it is not true that everything belongs to the government and we only get what is left after its exactions. Even if the grey and or black markets are expanding this does not make us worse off: it is, after all, difficult to see how an expansion of economic activity does make us worse off.

There is a deeper point behind all of this which is that there are those entirely seriously suggesting that in the near future the country should simply stop using cash. In order, so it is said, to crack down on the horrors that is tax evasion. Which is silly in one manner, because cash is simply a method of keeping score of who owes what to whom, as is all money. And if people are denied one method of doing so then another will be invented. But the part that horrifies us is this idea that the erasure of tax evasion would be worth the the erosion of the simple freedom to truck and barter as one wishes. Where all transactions, even the most minor, would be open to both the examination of the State and the payment of its tithe.

Yes, we really are saying that some level of tax evasion is the only outcome consistent with the maintenance of the general liberty. And we'd rather have that general liberty than we would the payment of the supposedly proper tithes, thank you very much.

Why these crash programmes to build houses won't work

There's any number of plans out there to create massive housebuilding programmes. There's even that lovely Corbynite idea that the Bank of England should just print lots more money to pay for them: along with an insistence that this simply won't be inflationary. Nope, not at all. Because there's slack in the economy, you see? And yes, there is most certainly slack in the economy. But spraying money around and the inflationary effects of doing so does rather depend upon whether there's slack in that part of the economy that you're spraying money at:

Two-thirds of British building companies have had to turn down work because they do not have enough skilled tradesmen, according to a survey by the Federation of Master Builders. The trade body for construction firms said that 66pc of its members have had to refuse new business because of a lack of resources while almost half have been forced to outsource work. The bosses of some of Britain’s biggest housebuilding companies have spoken out this week about the shortage.

Thus the problem in housebuilding is more of a structural one than a short term financing one. Meaning that just spraying money at the sector will only raise wages of those in short supply to do the work. And that is, erm, inflationary, isn't it?

So perhaps it isn't a very bright idea to simply print more money to firehose into this sector then?