A blow to the Nanny State

It's all about the UK government's drive to get us all saving for retirement. A good start, they figured, would be to make employers set up pension schemes, so employees at least had a plan to pay in to. Workplace pensions used to be hugely successful – with the UK boasting more private pension savings than the rest of Europe put together – until Chancellor Gordon Brown killed it with stealth taxes and regulations.

So it seemed like a good idea at the time. Unfortunately, it's based on an outdated concept of 'employment' – a hangover from the mass-production age. People still think of employers as factory owners employing hundreds of people. But today's businesses are smaller, less structured, and less permanent: they are not based on fixed capital, but on mobile talent.

Gone are the days of entering the factory at 16 and retiring from the same place, with a cheap watch, at 65. People shift jobs much more, drift from employment to self-employment to entrepreneurship and back again, and work in different sectors through their lives. For many, their retirement nest egg is not their pension but their home, their investments, their business: forcing them to contribute to an outdated pension concept leaves them less able to invest in these other ways.

And Treasury rule-makers kill any good idea. They are petrified of losing revenue because of the tax breaks on pensions. And they like things neat. So now, even if you are only employing someone part time – and not necessarily as an employee for your business, but as a home help, say, or gardener or indeed nanny – you have to register the fact. And that's true even if the person is part time and you are not paying them enough to oblige you to pay into their pension plan anyway.

Daft, of course: it will make people reluctant to hire others, including part-time home helps and the rest. So less well off people will find it harder to get one of those starter jobs that give them the first step on the jobs ladder.

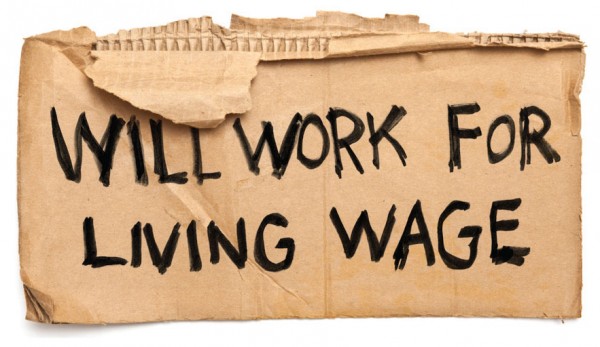

Andy Burnham's very strange £11 minimum wage

Gosh, isn't Andy Burnham showing himself to be a strong leader?

Firms have been warned by Andy Burnham that they could face penalties including higher national insurance payments if they failed to pay a proposed new higher living wage of around £11 an hour. In a fresh push to make up ground on surprise left-wing Labour leadership frontrunner Jeremy Corbyn, the shadow health secretary said he would seek to use a "carrot and stick" approach to force up wages if he led the party to power in 2020. At the start of the final 10 days of campaigning, Mr Burnham will set out his proposals at a campaign event in Pudsey, a Yorkshire constituency that Labour failed to win at May's general election. The national rate - which would rise to over £12 in London - would apply to all age groups and be adjusted for the loss of tax credits and linked to the cost of housing, food and household items.

Such a strong leader that he can simply divine the price of something and 65 million people and the markets that are their interaction will simply buckle under and obey. Sadly for such price fixing games that's not in fact how things work.

More specifically, the level of the minimum wage has an impact upon how many people actually have jobs to earn a wage from. It's entirely true that low minimum wages have little effect on employment: simply because very few people earn very low wages. The higher that minimum is compared to the general wage level the greater the unemployment effect. There's no cut and dried limit here, but the rule of thumb is that a minimum wage higher than 50% of the median will have substantial such unemployment effects.

Currently the median wage is around £13 an hour meaning that the proposed £11 is around 85% of that median.

This isn't going to work out well, is it?

"It will be based on the simple principle that the same hour's work deserves the same hour's pay, regardless of your age. So I will abolish the youth rate minimum wage, apply the higher rate to everyone and give incentives for companies to go even further."

And there is where the real effects will be felt. For those the minimum wage is most binding upon are those who are young and untrained. And if someone fresh off the educational production line must be paid that same £11 an hour as someone with a decade of experience of turning up to work on time and sober then that teenager just isn't going to get employed is she?

We thus return to our long stated position. Which is that if we are going to have a minimum wage, something we don't think should exist at all, then whatever that minimum wage is must be the same as the tax free allowance for both income tax and national insurance. For if there is, as is claimed, some moral amount that an hour's work is worth then there can be no justification for the state taking some of that amount to pay Andy Burnham's salary.

Or, if you prefer, if you'd like the working poor to have more money then stop taxing them so damn much.

Time for Time Limits

A new ASI report, Time for Time Limits: Why we should end permanent welfare, finds that a 5-year limit on Jobseekers’ Allowance (JSA) across workers’ lifetimes could save the Treasury £300-350m per year, as well as boosting labour markets and putting a break on self-fulfilling cycles of dependency. The paper, authored by Peter Hill, a lecturer at the University of Roehampton, reviews President Bill Clinton's 'Personal Responsibility and Work Opportunity Reconciliation Act' (PRWORA) which coincided with a massive decline in welfare rolls from 5 million to less than 2 million families by 2006. The act is credited for saving the US government over $50bn between 1996 and 2002.

In some states, there was a decrease in benefits caseloads of 96%, as well as an unprecedented drop in female unemployment and improvement in their financial status even in low paying jobs, and a drop in child poverty. Furthermore, comprehensive econometric analyses suggest that 6-7% of decreases in unemployment counts (and 12–13% of those in female-headed families) are as a result of the introduction of time limits. Although difficult to estimate the exact impact on the UK labour market ex ante, a similar effect on Claimant Count Unemployment could be expected; this translates to an estimated reduction in the benefit bill of £300–350 million based on current spending.

Though Universal Credit is innovative in tackling benefit withdrawal cliffs that make working very unattractive to some households, it does not put any limits on its unemployment insurance provisions. More radical reform like time limits has potential beyond the government's current schemes.

Just as the US ended welfare as an entitlement programme, the paper argues that the UK should also take the radical step of ending JSA being funded from general taxation and instead return to a form of ‘Unemployment Insurance’ funding from NICs. This would mean operating the welfare system as a genuine self-funding insurance scheme managed through the UK Government Actuary’s Department.

Perhaps it's time to abolish statutory holiday pay

We can imagine some getting a little outraged at this suggestion but perhaps it's time to remove one of the great distortions in the labour market: it's time to abolish statutory holiday pay. Currently:

Almost all workers are legally entitled to 5.6 weeks’ paid holiday per year (known as statutory leave entitlement or annual leave). An employer can include bank holidays as part of statutory annual leave.

Self-employed workers aren’t entitled to annual leave.

From the US we hear that these sorts of rules are killing parts of that gig economy:

This is one of the first startup casualties as a result of the worker classification issue that has gripped the tech industry. Many companies in the gig economy, such as Uber, Postmates, Luxe and Sprig, classify their workers as contractors instead of employees. As a result they don’t have to foot payroll taxes, social security benefits, vacation time or other fees. But workers have filed lawsuits over the issue, and it’s now become a heavily debated talking point among the presidential candidates.

Loading the employment of labour with all of these things (and we could add maternity and paternity leave and so on) makes labour cost more to employ. Well, obviously. but insisting that people take a defined bundle of benefits reduces the value of selling our labour. For if we receive instead just the cash we can decide ourselves, according to our own personal utility maximisation calculations, how we are going to allocate the rewards of our labour over children, retirement, leisure and other forms of consumption. what this problem in the gig economy is doing is making those costs plain to all: some people are willing to do things in exactly that all cash manner and do the allocations themselves. Insisting that they take the defined bundle destroys those jobs they're quite happy doing.

Of course, some will say that everyone must therefore be forced into that standard bundle. But we think there's a liberty argument to be made for instead destroying the very idea of that standard bundle being imposed. Let wages be paid in cash, only cash and purely cash and everyone then gets to decide how they're going to structure their leisure, retirement, child rearing and everything else.

Why should the State insist on either a minimum or maximum amount of leisure for us?

Where is David Cameron getting his information from?

It's distinctly uncomfortable to find the country being run by someone who is not well informed. Worrying even. And David Cameron does seem to be remarkably ill informed on the subject of the gender pay gap:

“Today I’m announcing a really big move: we will make every single company with 250 employees or more publish the gap between average female earnings and average male earnings. "That will cast sunlight on the discrepancies and create the pressure we need for change, driving women’s wages up."

For, as we've explained many a time here we don't really have a gender pay gap. There's a motherhood pay gap, most certainly. And men and women do tend to cluster into specific professions and jobs: pay not being equal between all jobs of course. And that's about it. Once anyone takes a close look we can't find any difference at all (perhaps, maybe, a one or three percentage point residual) between wages of men and women simply on the grounds of their being men and women. The rest of the difference is explained by job choices, hours worked, qualifications, education and so on.

We can even show that it's a motherhood pay gap, not a gender one. For there's a point at which women go from earning more than men to earning less. And that point, that age of life, has been advancing pretty much in lock step over the decades with the average age of primagravidae. And let us be honest about this. In a viviparous mammalian species we're really just not that surprised that there's some gender differentiation in the care and raising of the next generation, are we?

And there's something more worrying too:

However, women on average still earn 19.1 per cent less than men - equivalent to 80p for every pound earned by a man.

That is using mean wages and not median. And Harriet Harman was rapped over the knuckles by the Statistics Commissioner for doing that. Medians are what we should be using here, that use of the mean is grossly misleading.

And, well, you know, surely we can expect a Prime Minister to better than Harriet can't we?

Why does George Osborne hate women and Northerners?

George Osborne is actually boasting about how it will be women and Northerners who lose their jobs as a result of his national living wage:

The chancellor, George Osborne, will respond to claims his budget welfare reforms hit the poor hardest by saying women and those based outside London and the south-east will be the main beneficiaries of the government’s new national living wage.

The point being, in other words, that a rise in the minimum wage can only affect the incomes of those upon whom it is binding. And a rise in the minimum wage is also only going to cost the jobs of some of those upon whom it is binding. Thus the claim that the incomes of specific groups will rise, women and Northerners, is the same as stating that the rise in the minimum wage will cost someone women and Northerners their jobs.

The general rule of thumb is that a minimum wage of over 50% of median wage starts to have significant unemployment effects. And it's not just the general median wage either: it's of the wages of whichever group is under discussion. Wages in the North are rather lower than they are in the SE: thus the jobs losses will hit harder in the North. Female wages are rather lower than male: so more women will lose theior jobs than men. And this £9 an hour idea is actually higher than the median private sector part time hourly pay (from ASHE) which means that one of the glories of the UK labour market, the plethora of part time jobs providing that life/work balance and flexibility, is going to take one darn great big hit.

As we've been saying, instead of raising the wage a vastly better idea would be simply to stop taxing the working poor so damn much. For we've not in fact got low wage poverty in the UK, we've got tax poverty.

Solving one of the most pernicious failures of the UK housing market

It appears that George Osborne intends to solve one of the most pernicious failures of the UK housing market. Which is that once you have, through whatever temporary circumstances, gained access to housing subsidies then you get them for life. This is of course a nonsense: there's a huge difference between receiving a helping hand when needed and gaining permanent access to the wallets of the rest of the population. What he's going to do is:

Measures to force middle-class council house tenants to “pay to stay” in their homes rather than rely on taxpayer hand-outs. Rent subsidies for social housing tenants will be removed from anyone earning more than £30,000 outside London and £40,000 in the capital. They will have to pay full market rents or move out, under the plan.

It has always been absurd that temporary circumstances that lead to being granted subsidised housing then lead to a life tenancy on such subsidised housing.

That we do have a system whereby those who need it gain access to housing they otherwise could not afford is obviously going to be a feature of our society. But the idea that some life event, say, divorce, unemployment, whatever, should then lead to permanent subsidy has been a feature all along. Once you've qualified for council or housing association housing and got it, then that's a permanent tenancy. But circumstances change: and there really never has been any good reason why someone should continue to gain subsidy 20 or 40 years after the just reason for its original grant has faded.

An aside for those who claim that such housing receives no subsidy: opportunity cost. Renting something out at less than market rate is itself a subsidy.

We don't want though, to insist that people have to move out of such housing if they get a pay rise: that would be much too high a marginal tax rate. But people who are earning above the average wage (and £30k is well above it) why shouldn't they pay market rent, not be subsidised by everyone else?

Equality of opportunity or equality of outcome?

We find this all rather sad really:

Britain has too many stay-at-home mothers and must do more to get them into work, the European Union has said. British women are twice as likely as those in the rest of Europe to choose not to work in order to care for their children or elderly relations, EU figures show. The large number of mothers who work part-time or not at all is a “social challenge” that the Government must address by providing more state-funded child care, according to a report issued by the European Council.

The sadness coming from the clear confusion here between equality of opportunity and equality of outcome.

“Despite the positive trends in relation to labour market outcomes, social challenges persist,” it says. “The difference in the share of part-time work between women (42.6 % in 2013) and men (13.2 % in 2013) is one of the highest in the Union. “The percentage of women who are inactive or work part-time due to personal and family responsibilities (12.5 %) was almost twice as high as the EU average (6.3 %) in 2013.”

The aim is not to insist that as many women work full time outside the home as do men. For we are not looking for equality of outcome in gender and work, as we are not in most other areas of life. We're actually looking for equality of opportunity in how people desire to organise their lives. And these same figures that appear to be a problem show that in this respect the UK does very well.

We have an extremely flexible labour market. Some to many women actually desire to raise their own children: also to combine that with some part time work perhaps. It's exactly this choice that the UK does offer. We're the ones getting it right. Those who wish to work full time can indeed do so. Those who wish to work part time, whether male or female, mothers or not, also get to do so. We've a system which offers the maximum freedom for people to organise their lives as they wish. Which is the point and purpose of how we organise society: to maximise choice and opportunity, not to enforce equality of outcome.

What is being identified as a problem here is in fact evidence that the UK has solved this problem.

After all, it's hardly controversial to suggest that there's a certain gender division in desired child care arrangements in a mammalian species, is it? The aim and purpose of public policy should thus be to maximise the expression of that choice: precisely what the UK system does offer.

Ed Miliband is right: in-work poverty is the scourge of our time

Ed Miliband has given his first Commons speech since losing the election, where he's focused on inequality and low pay in Britain. He’s almost entirely wrong on the first of those, in my view, not least because most of the problems he identifies come from perceptions of inequality, which are not driven by reality. But on low pay, he makes an important point. In-work poverty really does appear to be the scourge of our time, and free marketeers ignore it at their peril.

By poverty, I do not mean relative poverty, although that is the definition the government uses to define the word. (A household is defined as in poverty if it earns less than 60 percent of the median wage.) I prefer the approach of the IEA’s Kristian Niemietz and the Joseph Rowntree Foundation, which calculates the cost of a basket of goods that most people would consider essential to living a decent life in modern Britain.

This approach is in the spirit of Adam Smith’s conception of poverty:

A linen shirt … is, strictly speaking, not a necessary of life. The Greeks and Romans lived, I suppose, very comfortably though they had no linen. But in the present times, through the greater part of Europe, a creditable day-labourer would be ashamed to appear in public without a linen shirt, the want of which would be supposed to denote that disgraceful degree of poverty which, it is presumed, nobody can well fall into without extreme bad conduct.

According to the JRF, single working-age people need to earn at least £17,100 before tax to live decently; a couple with two children need to earn £20,200 each (versus £13,900 in 2008), and a lone parent with one child now needs to earn more than £27,100 (versus £12,000 in 2008).

Because real wages have fallen across the board since 2008, and the cost of living has risen, an increasing number of people in full-time jobs are still in poverty. My fear is that this is not simply a product of the financial crisis and Great Recession, but a reflection of a longer-term trend.

Wages usually reflect worker productivity, so simply jacking up the minimum wage is no solution to this. Any worker who is less productive than the minimum wage costs will just not be able to find a job. In general, when minimum wages rise, so does unemployment. So there is no simple way to boost workers’ incomes by forcing wages up.

Changes like automation and offshoring work (to call centres in India, for instance) will raise global living standards overall, and should be welcomed for that reason, but they may hurt the incomes of low-skilled British workers by increasing competition for the jobs they have been doing and leaving only relatively unproductive work left to be done. Some people say low-skilled immigration does the same, but labour market liberalization seems to be a tidy solution to that problem.

The techno-pessimist view that machines may simply replace workers in some jobs, without creating new ones for them to move into, is not impossible or even particularly unlikely. Even if it is wrong, improvements in automation or competition from abroad may make low-skilled workers’ marginal productivity too low to earn a decent amount. Their productivity might just not be enough to earn as much as we would like them to.

As I see it, there are three possible ways we could reduce in-work poverty:

- Reduce the cost of living. Instead of trying to raise workers’ take-home pay, we could reduce the cost of things they want to buy. Housing and childcare are two of the most expensive things in most people’s budgets. Housing could be made much cheaper if the supply of housing was increased by liberalising planning. Britain has the tightest staff:child ratio requirements in Europe, and in a labour-intensive industry like childcare that has driven costs extremely high. Allowing as many children per staff member as they do in, say, Denmark would let costs fall considerably. However, both of these reforms, as well as most other supply-side deregulations, face considerable political opposition.

- Cut taxes on low-income earners. The government has already pledged to raise the income tax threshold to be close to the minimum wage level. But National Insurance payments kick in at a much lower level – £155 a week, or 23 hours of minimum wage work. Raising this threshold, ideally to kick in after forty hours of minimum wage work, should be a major priority. But the higher the threshold goes, the fewer of the poorest people it helps, because they are already earning less than the threshold amount.

- Just give money to poor people. Whether we do it through something like a Negative Income Tax, a Basic Income, or a significantly simplified and reformed tax credits system, direct cash transfers seem to be a good way of boosting the incomes of the poor without messing markets up in other ways. If they are only conditional on income, they can be designed to avoid severely perverted incentives that exist in the current welfare system. But paying for this would mean major changes to existing benefits system, which the Universal Credit reforms have shown are a minefield. There is also a danger that this kind of system would be implemented as a costly addition to existing welfare payments, rather than a revenue-neutral replacement.

In practice, some combination of the three is probably our best bet. There is no single political grouping that favours all three of these policies; indeed the false solution of massive minimum wage hikes is popular across the political spectrum.

This is worrying, but there is so much evidence against it that it will surely fail, and accepting that we have a problem may be the first step to solving it. So, in highlighting low pay as one of the central problems of the 21st Century, allow me to say something rarely heard on this blog: Ed Miliband is right.

Another sign of the looming apocalypse

That Guardian opinion columns will have only a marginal relationship to economics, maths or even reality is well known. But it is possible to find signs of the looming apocalypse even there, knowing that point.

Are you paid what you are worth? What is the relationship between the actual work you do and the remuneration you receive?The revelation that London dog walkers are paid considerably higher (£32,356) than the national wage average (£22,044) tells us much about how employment functions today. Not only are dog walkers paid more, but they work only half the hours of the average employee.

It is clear that the relationship between jobs and pay is now governed by a new principle. The old days in which your pay was linked to the number of hours you clocked up, the skill required and the societal worth of the job are long over.

There's never been a time when pay was determined by societal worth. Cleaning toilets is highly valuable societally: as the absence of piles of bodies killed off by effluent carried diseases shows. It's also always been a badly paid job. Because wages are not and never have been determined by societal worth. Rather, by the number of people willing and able to do a job at what price versus the demand for people to do said job at that price. You know, this oddity we call a market.

That a Guardian opinion column might opine that jobs should pay their social worth is one thing, to claim that the world used to work that way is an error of a different and larger kind.

We are surrounded by examples of this increasing disparity between jobs and pay. For example, average wages in western countries have stagnated since the 1980s,

And there's the maths error. For that's not true either. Yes, as we know, wages have been falling in recent years but according to both Danny Blanchflower and the ONS real wages are still, after that fall, 30% or so higher than in the 80s (median wages). 30% over three decades isn't great but it's also not to be sniffed at: and it's also not stagnation.

But we expect such errors from the innumerates who fight for social justice or whatever they're calling it this week. At which point we come to the signs of the apocalypse:

Peter Fleming is Professor of Business and Society at City University, London.

Actually, he's in the Business School:

Peter Fleming Professor of Business and Society

That long march through the institutions has left us with professors at business schools believing, and presumably teaching, things that are simply manifestly untrue.

Woes, society to the dogs, apres moi la deluge etc.

It's not a happy thought that this sort of stuff is being taught these days, rather than just scribbled in The Guardian, is it?