Housing in London

In The Green Noose, Tom Papworth has argued persuasively for loosening the green belt. Another way to goose up the supply of housing in London would to deregulate the construction aspect of provision. We welcome competition in local government, so let HMG pass legislation encouraging London Boroughs to bid for time-limited privileges. The idea would be that the first (as it might be) eight out of thirty-two London Boroughs would obtain the full extent of incremental rates on new housing arising, if they bid for temporary relief from taxes and regulatory restrictions.

New construction is already exempt from VAT, so the targets would be to suspend officious HMRC registration of subcontractors, so as to reduce labour costs; taxes on capital gains, profits and dividends arising out of qualifying developments, so as to incentivise developers and investors; and suspending stamp duty on associated property transactions, so as to cheapen costs to purchasers.

This is however likely to be less effective than deregulation of land-use and construction practices. As to land-use, we would advocate suspending

- Height restrictions, protected sight-lines, listings, change-of-use consent and the whole paraphernalia of JNCC restrictions;

- The rights of occupants of collectively owned properties to form blocking minorities refusing market compensation (this is with a view to easing the consolidation of building lots); and

- Judicial review of compulsory purchase and planning decisions.

To conclude on this score, we would argue for a presumption of planning approval unless a reasoned refusal is delivered within fourteen days; developers’ access to an appeals tribunal with a presumption of summary reversal; and stricter tests for reasonability and timeliness in the exercise of neighbours’ rights, including local impact, party-walls and natural light.

Finally we turn to construction practices. These are hamstrung by obsolescent and intrusive restrictions by way of building and fire regulations. It’s an open secret that the latter are honoured in the breach, with new residents removing smoke-detectors and door-closers and demolishing corridor and lobby walls as soon as they can. As to building regulations, these are largely a cloak to defend time-expired practises and uncompetitive suppliers. Instead, let developers show that their proposals comply with best practice in the form of building codes elsewhere (eg. Vancouver, Melbourne or Chicago).

To those who argue that this encourages builders to resort to regulatory arbitrage, our answer is “why not?” More competition in local government!

To be serious about inequality for a moment

The Office of National Statistics has just released figures on incomes in the UK. Giving us that interesting little chart above. Do note that that is income of those who are in the tax system. And also that it does not include the impact of the benefits system. So this doesn't include subsidy to housing or anything like that. And then have a look at the global rich list. Where you can plug in an income and the country to which it refers and see where that income in that country puts you on that global rich list. The reason you must add the source country is because they are calculating using PPP adjusted currency rates. That is, they're taking account of how much things cost in each country. So this isn't really a comparison of incomes, it's a comparison of living standards.

And here's the astonishing thing. That bottom 1% lifestyle in the UK is still among the top 20% globally. The UK minimum wage puts you well into the top 10% (almost top 5% in fact). And a little over median wage puts you into the global top 1%.

To repeat, this is not assuming that things are cheaper in other countries. This is after we convert to the prices you're paying at Morrisons.

We've nothing at all against those who would campaign about either poverty or inequality. But we would like to take this little opportunity to remind all that by any historical or global standard we here in the UK, yes even the relatively poor by local standards, are living pretty high on that income scale. And that feeds in to what we think is the important point about what we might want to do about inequality or poverty. Let's concentrate on that global picture, not gaze at our own navels. Encouraging poor country growth wit the aim of abolishing absolute poverty seems to be so much more productive to us than worrying about whatever gap there might be between the top 20%, top 10% and top 1% of the global income distribution.

President Obama: the ultimate poverty hypocrite

Americans are experiencing buyer's remorse. Last summer CNN found that 53% of those polled would choose Mitt Romney to be president today, over the 44% who chose Barack Obama. And with Obama’s approval ratings fixed these days below 50%, I suppose it’s only human to get a bit testy with those you're compared to:

President Obama poked fun at former rival Mitt Romney and leading Republicans on Thursday, saying the GOP’s rhetoric on the economy was “starting to sound pretty Democratic.”At the House Democratic Caucus retreat in Philadelphia, Obama noted that a "former Republican presidential candidate" was “suddenly, deeply concerned about poverty.”

“That's great! Let's go do something about it!” Obama added in a not-so-veiled jab at Romney.

What’s not particularly smart, however, is to frivolously attack someone’s track record on poverty when your own record looks abysmal:

A few ugly facts about the Obama Presidency:

- Median household income has slumped from $53,285 in 2009 to $51,017 in 2012 just up to $51,939 in 2013.

- In comparison to his three previous successors, this fall in median income looks even worse:

- Real median household income was 8.0% lower in 2013 than in 2007.

- Nearly 5.5 million more Americans have fallen into poverty since Obama took office.

- Obama oversaw the first time the poverty rate remained at or above 15% three years running since 1965.

- Home ownership fell from 67.3% in Q1 2009 to 64.8% in Q1 2014; black home ownership dropped from 46.1% to 43.3%.

- Labour force participation rate fell from 65.7% in January 2009 to 62.7% in December 2014.

- The federal debt owed to the public has more than doubled under Obama, rising by 103 percent.

- 13 million Americans have been added to the food stamp roll since Obama took office.

Obama has been very successful in painting a picture of himself and the Democrats as the 'Party of the Poor', and did an even more sensational job convincing 2012 voters that Romney's riches and successes put him out of touch with the middle-class America. But in reality, the president's policies have pushed millions more people into financial stress and poverty.

And he's still causing damage; even his latest State of the Union address called to raise taxes on university savings accounts and still cited fake unemployment numbers, as if this somehow helps the double-digit workers who have given up looking for jobs.

Perhaps the president really thinks his increased federal spending will pay off for the poor. Maybe he really believes that multi-millions more on food stamps is a saving grace instead of a tragedy. But regardless of intention, the facts speak for themselves.

Obama's talk on poverty is cheap. And his mockery of Romney cheaper.

A new ASI project: book reviews

One can never read too little of bad, or too much of good, books: bad books are intellectual poison; they destroy the mind.

~ Arthur Schopenhauer

The Adam Smith Institute is on the look out for young liberal thinkers to review political, philosophical and economic books! If you are a student and would like to review an important new book-length contribution to the humanities, get in touch.

After we've sent you the book, express your critique in 1000 words and submit it to sophie@old.adamsmith.org to be a part of a new ASI reviews publication we are launching.

We welcome reviews on recent works tackling everything from private schools for the poor to the causes of social mobility, to be edited and compiled together by the ASI research team.

Here are some books we think would be good choices—we are very open to any other suggestions:

- Superintelligence by Nick Bostrom

- Zero to One by Peter Thiel

- The Son also Rises: Surnames and the History of Social Mobility by Gregory Clark

- British Economic Growth, 1270 - 1870 by Stephen Broadberry, Bruce Campbell, Alexander Klein, Maark Overton and Bas van

- The Frackers: The Outrageous Inside Story of the New Energy Revolution by Gregory Zuckerman

- The English and Their History by Robert Tombs

- Who’s Afraid of the Big Bad Dragon by Yong Zhao

- The Iron Cage of Liberalism by Daniel Ritter

- When the Facts Change: Essays 1995 - 2010 by Tony Judt

- Europe: The Struggle for Supremacy, 1453 to the Present: A History of the Continent Since 1500 by Brendan Simms

- Going Clear: Scientology, Hollywood and the Prison of Belief by Lawrence Wright

- If A then B: How the World Discovered Logic by Michael Shenefelt

- The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies by Erik Brynjolfsson and Andrew Mcafee

- Troublesome Inheritance: Genes, Race, and Human History by Nicholas Wade

- A World Restored: Matternich, Castlereagh and the Problems of Peace, 1812-22 by Henry a. Kissinger

- The Tyranny of Experts: Economists, Dictators and the Forgotten Rights of the Poor by William Easterly

Logical Fallacies: 5. Equivocation

https://www.youtube.com/watch?v=x_8xKrKw19M

Madsen Pirie's series on logical fallacies continues with a look at equivocation.

You can pre-order the new edition of Dr. Madsen Pirie's How to Win Every Argument here

Reading Owen Jones at the moment is really rather amusing

His basic contention seems to be that Syriza's election victory in Greece is a rerun of the fight against the Nazis and this time the left must win. Very slightly overblown that comparison.

Syriza’s posters declared: “Hope is coming”. Its election must represent that everywhere, including in Britain, where YouGov polling reveals huge popularity for a stance against austerity and the power of big business. A game of high stakes indeed: one that, if lost, will mean countless more years of economic nightmare.This rerun of the 1930s can be ended – this time by the democratic left, rather than by the fascist and the genocidal right. The era of Merkel and the machine men can be ended – but it is up to all of us to act, and to act quickly.

Quite what style he would use to discuss anything actually important is difficult to imagine.

He has, of course, also got the economics of this entirely wrong. Greece's problems do not really stem from "austerity". They stem from membership of the euro. The harrowing internal deflation the country has been undergoing are the result of their not being able to conduct a devaluation of the currency. And far from it being us "neoliberals" arguing that such deflation is necessary we've all been shouting that the devaluation would have been a better idea. Indeed, the absolutely standard IMF (for which read, in Jones' language, neoliberal, Washington Consensus, right wing etc etc) solution to Greece's problems would have been a loan package, some modest budget constraints and a devaluation.

It's not going to work out well, of course it isn't. Partly because it's difficult to see who is going to win that argument over the debt and partly because the actual domestic economic policies of Syriza are so barkingly mad. But before Britain's leftists start cheering this victory over the forces of reaction they'd do well to understand exactly what we all have been saying these years. If the standard, orthodox, economic policies had been followed the Greek situation would never have arisen in the first place. Sure, they borrowed too much, that happens quite a lot. But the deflation would have been replaced by that devaluation and it would all just be a dim memory by now.

Anti-slavery laws don't help many sex workers, and may end up harming them

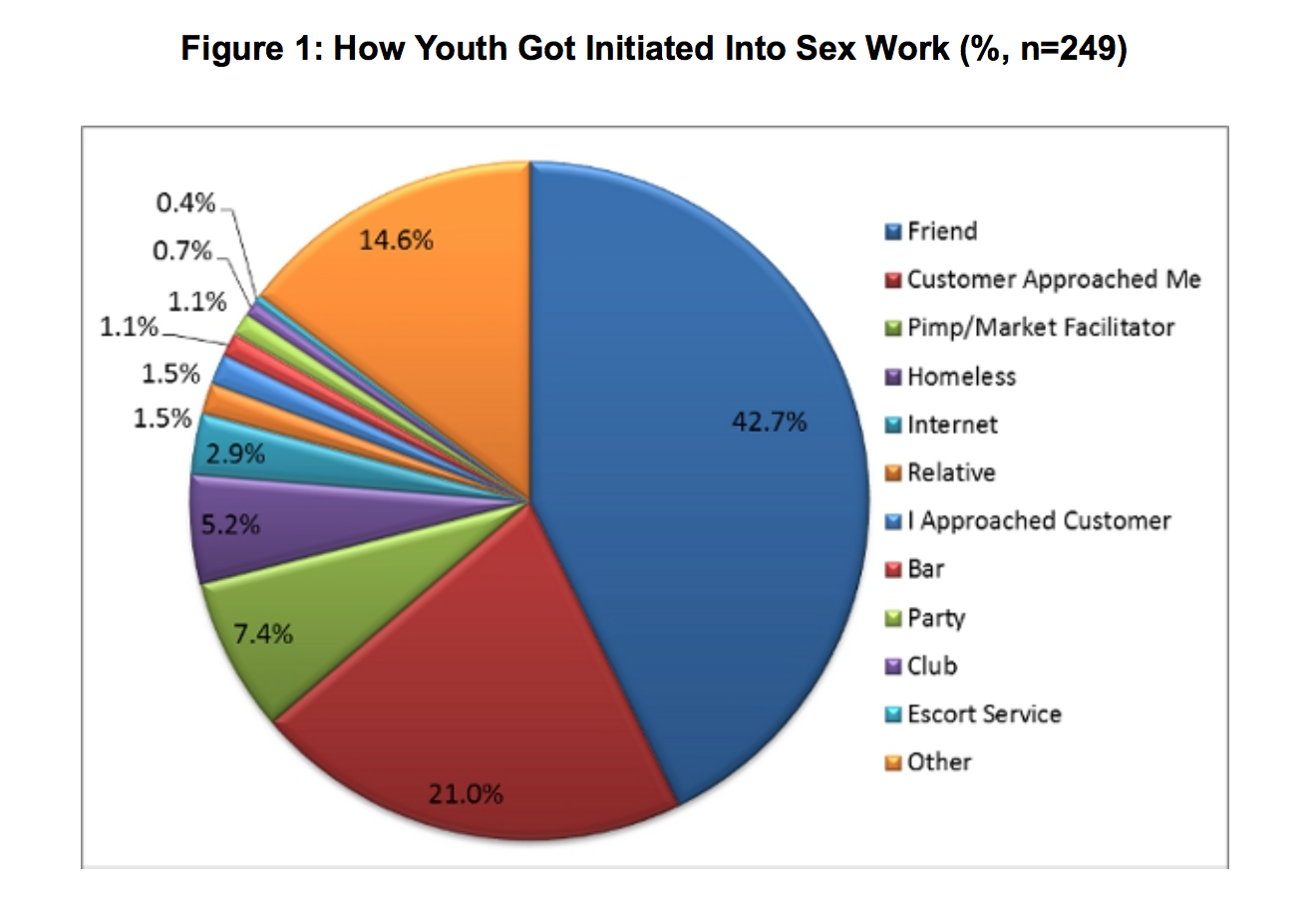

Some people blame sex slavery, or trafficking, driven by pimps for keeping young girls in prostitution. Young girls are drawn in and brutalised by pimps, the conventional wisdom goes, and tackling this is the best way to reduce the number of girls trapped in prostitution. The Modern Slavery Bill in the UK is motivated by this kind of assumption. A new study of underaged sex workers in New York City and Atlantic City seems to suggest that this is actually very rare. Using the largest data set ever gathered in this kind of work in the US, researchers surveyed pimps and sex workers to find out how common pimping was. Figures 1 and 2 below show how few underaged girls are introduced to sex work by pimps and how few actually have pimps on an ongoing basis:

In fact, poverty and lack of access to work, housing or education seem to be what keep girls in prostitution:

None of this tells us that anti-slavery legislation is bad, but it does seem to miss the point somewhat. However, one fact cited by the authors does mean we should think twice about anti-slavery laws: only 2 percent of underaged sex workers said that they would go to a 'service organisation' if they were in trouble, because 'the anti-trafficking discourses and practices they would encounter in these organizations threaten to criminalize their adult support networks, imprison friends and loved ones, prevent them from earning a living, and return them to the dependencies of childhood.'

If only a small number of sex workers count as being trafficked, and anti-trafficking laws alienate others from the services set up to protect them, then anti-slavery legislation may end up having very perverse consequences indeed.

Markets vs. Mandate: the American energy dilemma

New York State’s fracking ban has evoked strong polarising sentiment. Local anti-fracking supporters welcomed the ban as a necessary intervention against corporations pursuing profits at the expense of local safety. The fracking industry on the other hand, saw it as a political move; an example of political interference in the markets at the expense of jobs, energy security and the principles of enterprise and free markets that America stands for. This dynamic is symptomatic of a bigger tension between markets and mandate within the US energy industry; one that that lies at the heart of hotly contested issues like the Keystone pipeline and the proposed TTIP EU-US free trade agreement.

And against the backdrop of a President carving out climate action as a top priority, historic US commitments to reducing emissions, a Republican House majority that views Obama’s Environmental Protection Agency as big-government interventionism, and America’s emergence as a global energy producer, how this tension is resolved affects not just the future of American energy, but has wider global ramifications.

Six years ago I wrote in the Financial Times about the need for less interference in European energy markets to enhance competitiveness; a perspective I still find myself inclined towards today, and for good reason.

Take energy security for example. Shifting responsibility for energy security from suppliers to government would reduce, not increase, security. A liberalised market provides strong incentives for producers to diversify supply and respond to consumer demand. OPEC’s current oil price war might even eventually strengthen a fracking industry forced to become more technically innovative and cost efficient to survive, despite the shorter-term challenges.

Then there is the danger of vested interests influencing a wide government mandate and effectively using government as a proxy for their own interests as illustrated by recent alleged links between energy company Devon Energy and Oklahoma Attorney General Scott Pruitt.

And of course there is the notion that climate change justifies state intervention to make cleaner renewables more competitive against oil and gas. But while this is a logical argument, its worth noting that government intervention is at least partly to blame for renewables having less market share in the first place. Federal research for US oil and gas as well as tax credits and subsidies totalling $10 billion between 1980 and 2002 dwarfed state support for renewables, ensuring there was never a level playing field to begin with. And modern-day fracking could not have developed without federal research and demonstration efforts in the 1960s and ’70s.

But as valid as all this is, it fails to tell the whole story.

What makes the energy industry unfortunately unique is the speed with which it could environmentally impact our planet; a factor so exceptional it justifies exceptional action in addressing it, including, if need be, some level of market intervention.

The real problem with the US energy debate is its deep ideological polarisation. Energy discourse is too often pulled towards dogmatic extremes; between those who believe strong government intervention is necessary to further centralise and regulate energy markets, sometimes to the point of protectionism, or conversely those who, as economist Paul Krugman put it when describing the GOP, “believe climate change is a hoax concocted by liberal scientists to justify Big Government, who refuse to acknowledge that government intervention to correct market failures can ever be justified”.

A healthy balance is probably somewhere in-between with sound market based interventions that do not plan energy markets or pick winners through polices like the ethanol blending mandate, but instead couple responsibility for environmental damage and carbon emissions with individual companies and consumers. A carbon tax could help achieve this by using market incentives to strengthen cleaner energies and encourage efficient consumption. After all, why should the burden of carbon emissions, which have a cost, not be factored into a transaction?

And just as timely market adjustments within the financial sector could have averted the worst of the 2008 financial crash and subsequent government bailouts, a carbon tax today would prevent a more drastic future government response to disasters that rising CO2 emissions would undoubtedly cause if left unchecked.

Yet with the looming 2016 Presidential elections, the potential for politicised narratives and populist slogans to take priority over any meaningful measured balance in the US energy discourse is all too real and present.

Somewhere between climate deniers, including prominent GOP members, refusing to acknowledge the need for any climate action, and those attempting to address the problem in a vacuum without considering how sweeping interventionist solutions undermine economic competitiveness (an approach that creates an inevitable political, business and electoral backlash), lie more sustainable, effective solutions. It is vital moderates across the political aisle work together to reach them.

Vicente Lopez Ibor Mayor is currently Chairman of one of Europe’s largest solar energy companies – Lightsource Ltd. He is former General Secretary of Spain’s National Energy Commission between 1995-1999 and was previously a member of the Organizing Committee of the World Solar Summit and Special Advisor of the Energy Program of UNESCO (1989-1994).

Unproductive patents

Patents are a state-granted property rights, designed to promote innovation and the transfer of knowledge. They grant the holder a time-limited, exclusive right to make, use and sell the patented work, in exchange for the public disclosure of the invention. This, so the theory goes, allows creators to utilise and commercially exploit their invention, whilst disclosing its technical details allows for the effective public dissemination of knowledge. However, complaints that the patent system is broken and fails to deliver are common.

Patent Assertion Entities (or ‘Patent Trolls’) buy up patents simply to threaten accused infringers with (often dubious) lawsuits, and are estimated to cost American consumers alone $29bn annually. Another scourge are the 'patent thickets' made up of overlapping intellectual property rights which companies must 'hack' through in order to commercialize new technology. These have been found to impede competition and create barriers to entry, particularly in technological sectors.

Even thickets and trolls aside, using the patent system can carry high transaction costs and legal risks. Litan and Singer argue that this prevents many small and medium businesses from utilizing the system, with over 95% of current US patents unlicensed and failing to be put to productive use. This represents a huge amount of potentially useful 'dead' capital, which is effectively locked up until a patent's expiry.

There are plenty of ways we can tinker with the patent system to make it more robust and less expensive. However, they all assume that patents do actually foster innovation, and are societally beneficial tool.

A number argue that even on a theoretical level this is false; the control rights a patent grant actually hamper innovation instead of promoting it. Patents create an artificial monopoly, which results, as with other monopolies, in higher prices, the misallocation of resources, and welfare loss. Economists Boldrin and Levine advocate the abolition of patents entirely on grounds the that there is no empirical evidence that they increase innovation and productivity, and in fact have negative effects on innovation and growth.

A new paper by Laboratoire d'Economie Appliquee de Grenoble, authored by Brueggemann, Crosetto, Meub and Bizer backs this claim, by offering experimental evidence that patents harm follow-on innovation.

Test subjects were given a Scrabble-like word creation task. Players could either make three-letter words from tiles they had purchased, or extend existing words one letter at the time. Those who extended a word were rewarded with the full 'value' of that word, creating a higher payoff to sequential innovation. In ‘no-IP’ (Intellectual Property) game groups, words created were available to all at no cost. In the IP game groups, players could charge others a license fee for access to their words.

The results are striking:

We find intellectual property to have an adverse effect on welfare as innovations become less frequent and less sophisticated…Introducing intellectual property results in more basic innovations and subjects fail to exploit the most valuable sequential innovation paths. Subjects act more self-reliant and non-optimally in order to avoid paying license fees. Our results suggest that granting intellectual property rights hinders innovations, especially for sectors characterized by a strong sequentiality in innovation processes.

In fact, the presence of a license fee within the game reduced total welfare by 20-30%, as a result of less sophisticated innovation. Players in these games used shorter, less valuable words, and in order to avoid paying license fees would miss innovation opportunities which were seized upon in no-IP games.

The authors suggest that patents could be harmful in all highly sequential industries. These range from bioengineering to software, where the use of patents has been strongly criticized, through to pharmaceuticals, where the use of patents is much more widely accepted. If patents really do restrict follow-on innovation even remotely near as much as suggested, the implications could be huge.

Of course, the study is only experimental and far less complex than real life, but it’s a useful contribution to the claim that patents do more to hinder than to help.

You should be very careful what you wish for

An interesting little observation from Ed Lazear:

There are basically two ways that the average economywide wage can fall. There might be a shift in employment away from high-paying to lower-paying industries; in other words, the economy is producing more “bad jobs.” The other way is that the overall composition of work might be the same, but wages for the typical job in most sectors have fallen.

Normally, economywide wage changes reflect what happens to the wage of the typical job. But between 2010 and 2014 there were also significant declines in the proportion of the workforce employed in two high-paying industries. Those declines contributed to overall wage declines—and they may have been caused by policy mistakes.

The share of the private workforce employed in the BLS-defined industries “financial activities” and “hospitals” decreased by about 5% between 2010 and 2014. Jobs in these industries pay 29% and 24%, respectively, above the economy mean. Because a smaller share of labor is working those high-wage industries, the typical job in the economy is now lower-paying than in 2010.

What has been happening here in the UK?

Well, our highest paying industry by a long way is wholesale finance, The City. And for several years that industry was shrinking. And average wages were declining. The City is now expanding again and average wages are rising. It would not do to insist that all of both the rise and fall depends upon the hiring practices of The City. But certainly some of it does.

Which leaves us in a state of some amusement. For of course it is those who have been whingeing most about the domination of the financial markets who have been complaining loudest about the fall in wages. Be careful what you wish for for you might well get it.