Economic Nonsense: 18. Capitalism is disreputable because it is based on greed

This is a misinterpretation. Capitalism is based not on greed but on the legitimate aspiration of people to better their lives. Adam Smith spoke of "The uniform, constant, and uninterrupted effort of every man to better his condition," and of course it applies equally to women. It is this desire to better their circumstances that leads people to forego present consumption in order to achieve greater returns in the future. They invest in order to increase their wealth. That investment supplies funds to companies and provides the capital which they turn to advantage for the benefit of their investors. This is not greed; it is one of the most benign things that people have done. Far from showing greed to the detriment of others, it gains its returns by providing the goods and services that people want and need at prices they are prepared to pay. It is based not on selfish greed but on co-operation to mutual advantage. The investors make it possible for consumers to satisfy their wants, and they themselves make gains in the process.

Capitalism is benign because it is based on trade, and every act of trade is an exercise in co-operation in which people exchange what they have for what they prefer. Capitalism has to be social; that is how it works. Greed is selfish, not social.

The desire of people to better their lives is part of what it means to be human. We do not adapt to the environment as other animals do; we adapt the environment, and we do it in ways that are calculated to improve our lot. We seek greater security, greater command of the essentials of a decent and acceptable life. Capitalism is the most efficacious way we have yet found of achieving these objectives.

Logical Fallacies: 15. The red herring

https://www.youtube.com/watch?v=Ochl99nWpuI

The latest in Madsen Pirie's series on Logical Fallacies: 'the red herring'.

You can pre-order the new edition of Dr. Madsen Pirie's How to Win Every Argument here

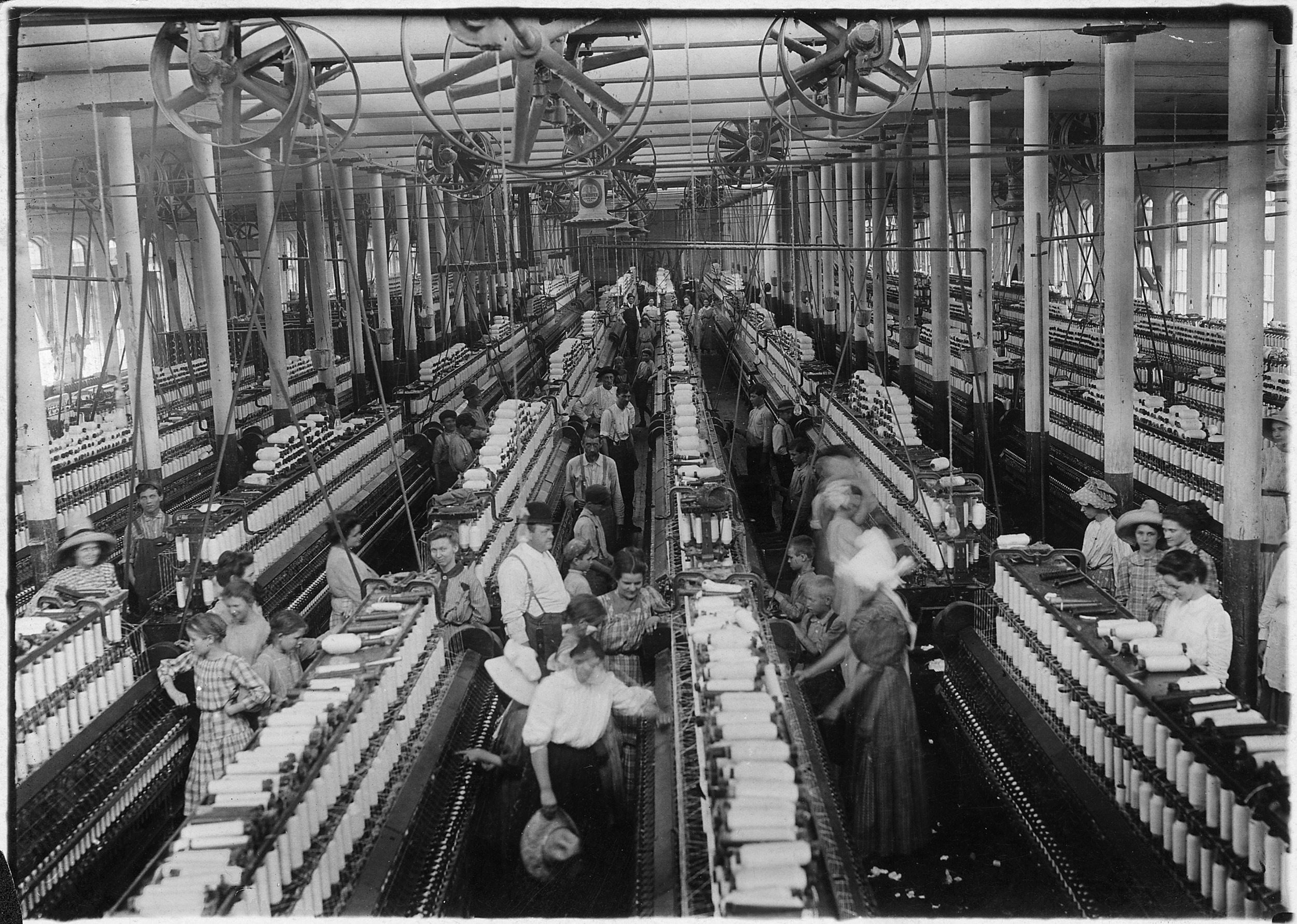

Economic Nonsense: 17. The Industrial Revolution brought squalor and impoverished the poor

Life for poor people, which meant most people, was pretty miserable before the Industrial Revolution. It was short, full of toil and deprivation. Most worked on the land, rose at dawn, retired at dusk, and did hard physical labour. Starvation was an ever-present threat, and subsistence depended on adequate harvests. A bad year could be fatal. Life expectancy was low, diets were poor and disease was rampant. Movement into the towns and factories spurred by the Industrial Revolution was a step up for the overwhelming majority. They earned wages. They lived in housing that is today thought squalid, but was in fact an improvement on the pitiful country hovels they had lived in previously. Their food was better and life expectancy began to rise. They began to be able to afford luxuries such as pottery, metal utensils and tea.

The myth that the Industrial Revolution brought squalor and deprivation was propagated by Friedrich Engels amongst others, who failed to compare conditions in industrial towns with the conditions they replaced. It was a commonplace error until T S Ashton published "The Industrial Revolution" in 1949, showing how it brought social and economic progress, and lifted the living standards and life chances of millions.

It was the Industrial Revolution that generated the wealth that paid for advances in public health and sanitation. It led to the conquest not only of extreme poverty, but of curable and preventable diseases. Far from bringing poverty and misery to the masses, it did the opposite, lifting their material conditions at a rate and to a level never before witnessed in human history. It was one of the most benign events that people have brought about, and it set the world on an upward course which still benefits millions of people today.

Plain packaging: stop the nonsense

The Adam Smith Institute's President, Dr. Madsen Pirie, recently spoke at the "Stop the Nonsense" evening by Forest, Parliament Street & Liberal Vision. You can watch his speech below.

https://www.youtube.com/watch?v=htahYj13x6w

Maybe there is no zero lower bound on interest rates

Tim Worstall has a fantastic piece on Forbes which neatly lays out a lot of the monetary policy views I have been making the case for here on the blog. In it he:

- Shows that many securities can hit yields below zero (such as, most recently, European governments' bonds), implying that the Keynesian 'Zero Lower Bound' argument that monetary policy is impotent when rates hit zero is false or irrelevant

- Argues that we should favour monetary stabilisation of boom-bust because it allows us to have a small state, which we have other good reasons for favouring

- We have a nice natural experiment showing that monetary policy works—and fiscal policy is unnecessary—the Eurozone vs. the UK and USA. The former has not done QE and it has slumped continually; the latter have done QE and had moderate recoveries

A standard part of the standard Keynesian economics of our day is that fiscal policy becomes necessary at the zero lower bound. However, this standard part of the standard theory rather falls apart if we find that there is in fact no zero lower bound to interest rates. The case for fiscal policy, for stimulus, may therefore be rather weaker than its proponents suggest. And the thing is, we do seem to have evidence that there is no zero lower bound. This comes in two different forms: one that unconventional monetary policy can take the place of fiscal even at that lower bound, the other that, well, zero doesn’t seem to be the lower bound.

I hope you don't mind a bit more of Tim, given that he already writes for us daily!

The end of local authority libraries

Local-authority-run public libraries are going the way of launderettes and video stores. Technology has swamped them, and they haven't responded to the changing pattern of demand. We still have 4,145 public libraries in the UK, about fifteen times as many as we had in the 1920s, despite the fact that more and more of us access our reading material (and even our phone books, newspapers, dictionaries and encyclopaedias) in digital form, that over 84% of households have internet access (76% of us access the web every day) and pretty much all schools have and use the internet.

Bookshops have responded to these changes, bringing in cafe-style environments and organising events and book clubs that bring people into the shop, where they might just browse around and buy something. Libraries like to say they are doing this sort of thing, but it is half-hearted. Birmingham says its new library will only do events that are self-funding, for example: no concept of using events to bring more people in. That dearth of thinking is why Birmingham has discovered that the £10m-a-year cost of running its £188m spanking-new library (which of course won lots of architecture prizes) is unaffordable, given all the other urgent demands on the city's budget.

It will always be like this. Local authorities have to provide life-saving services, social care, transport, roads, schools, you name it – libraries are always going to be something of a luxury, particularly when 70% of the borrowings are fiction, and much of the rest are about cookery, DIY and cars. Local authorities know this is not a debate about 'public education' but about free entertainment for largely elderly and middle-class users.

LSSI, a company founded by librarians, which works with 78 communities in the US, reckons it can cut the UK libraries budget by 35%, increase opening hours, raise the number of library users, and still spend ten times more on books. Frankly, it is about time we put libraries out to commercial tender. Let us specify what they are actually there for – not something that up to now there has been any public debate about – and the outputs we want, and then invite private, voluntary and charitable groups to make an offer. You can be sure of two things. Firstly, they would not build £188m white elephants, but would create libraries near to shops, schools and other places that people find local and convenient. And secondly, that the entire business would be revolutionised in short order, leading to everything that libraries are supposed to be there for being do cheaper and better.

Pay as you protest?

Libertarians generally subscribe to several maxims. Here are two: 1) That everyone has the right to express their views, providing their expressions are within the law.

2) That it’s a good thing when people feel the effects of the social costs they impose on others.

A recent debate on Radio 2 – about street demonstrators possibly having to pay to protest after police look to refuse to close roads for them to demonstrate – pits these two maxims against each other. However misjudged I find the views of groups like "The Campaign Against Climate Change", "The People’s Assembly Against Austerity", "Global Justice Now", and "Friends of the Earth", there is clearly a case here of the immovable object of people's freedom to protest coming smack bang against the irresistible force of valuable resources being exhausted by the presence of these demonstrators on our streets, in this case in the shape of exhausted police resources, blocked roads, temporary traffic regulations and potential disturbances of the peace.

On the one hand I suggest libertarians wouldn’t want a situation where people’s right and ability to protest was predicated on their ability to pay. But on the other I would prefer protesters to feel the costs of their actions. So while I am all for defending people's prerogative in being able to demonstrate against actions they dislike - when those actions come at a social cost to others, some are arguing that it is not particularly unreasonable that they should pick up the bill for these negative externalities imposed on others.

It may not be unreasonable, but I don't think it should be desired either. The state chooses to have a police presence at a demonstration (it is compulsory to notify the police of any planned demonstration), not the demonstrators. A very risk averse state apparatus operates under the ethos that modern life is safe but expensive. Any restrictions of this kind on the ability of people to protest legally is bound to restrict freedom of expression, and at the same time increase the likelihood of people protesting illegally - and that is not likely to make organised demonstrations any cheaper or safer.

The problem with the bank levy and other Pigou taxes

This is both extremely disappointing and also par for the course:

The Liberal Democrats plan to hit the UK banking industry with an additional £1bn tax bill, which the party says will help eliminate the country’s deficit.

The supplementary charge will be in addition to the existing bank levy, which is on track to raise £8bn in this parliament, said Danny Alexander, the Liberal Democrat chief secretary to the Treasury.

The annual levy on banks, which was introduced in 2010, currently brings in around £2.5bn a year. Mr Alexander’s proposals are expected to take that up to £3.5bn a year.

The point is that the bank levy is a Pigou tax. There's an externality in the market which is not being included in prices. The tax is there to make sure that that externality is included in prices.

The externality is that the "too big to fail" banks receive, as they are too big for the government to allow them to fail, implicit deposit insurance over and above that on offer through the normal regulatory schemes to all deposit taking institutions. This means that they can finance themselves at lower than free market rates and it's the taxpayer that picks up the risk.

The solution, as we noted and praised when the levy was introduced, is to charge an insurance premium on those deposits that are insured in this manner. And that's how it does work: it's only on the deposits of the too big to fail banks, it's only on those deposits which are not insured through other schemes and it takes account of the riskiness of a run in said deposits (thus long term bond finance pays a lower rate than at sight deposits). That's all how it should be.

And the point about Pigou taxes is that it doesn't matter what happens to the revenue. Sure, it's nice to have 'n'all that, but the point is to correct the market, not to raise revenue.

Thus the idea that the rate should be changed in order to increase the revenue raised is nonsense. It's violating the very point and rationale for having the levy in the first place.

It's also entirely par for the course. No politician can see a potential revenue source without wanting to bathe in it. And that, sadly, is the problem with Pigou taxes. They're economically efficient, rational and make the world a better place. Until we come to the politicians who implement them when, over time, they will inevitably lose their original justification and simply become another method of gouging someone or other so as to bribe the electorate.

What's economically efficient, rational and making the world a better place when a Minister's seat is at risk at a looming election, eh?

For growth we want good institutions—democracy is irrelevant

It is eternally surprising to me that people keep doing studies of whether democracy affects growth using the same cross-country data but their regular findings—that institutions and the rule of law matter but democracy doesn't—are less of a surprise. The latest, "Democracy and Growth: A Dynamic Panel Data Study" (pdf) is from Jeffry Jacob, of Bethel University and Thomas Osang of Southern Methodist University:

In this paper we investigate the idea whether democracy can have a direct effect on economic growth. We use a system GMM framework that allows us to model the dynamic aspects of the growth process and control for the endogenous nature of many explanatory variables. In contrast to the growth effects of institutions, regime stability, openness and macro-economic policy variables, we find that measures of democracy matter little, if at all, for the economic growth process.

They look at a full 160 countries over 50 years, building on a large existing literature, which includes (my own picks, not theirs):

- Acemoglu et al. (2008) found that once you control for 'country fixed effects' (i.e. systematic and apparently intractable differences between countries) there is no link between the level of democracy in a country and its income. This is because democracies tend to (not necessarily coincidentally) have other good characteristics.

- Cervellati et al. (2004) found that never-colonies benefited from democracy whereas countries that had once been colonies did worse if they were democratic.

- Barro (1996) found that democracy was slightly negative for growth once you account for variables like the rule of law, small governments, free markets and human capital (i.e. skills, education and cognitive ability)

- Lehmann-Hasemeyer et al. (2014) found that democratising Saxony between 1896 and 1909 destroyed lots of stock market wealth in anticipation of worse laws

- Mulligan et al (2004) found that democracies and non-democracies choose very similar policies

That the evidence suggests democracies and non-democracies perform about the same might be surprising given the state of public ignorance. In Sam's words "the public is ignorant about politics and lacks even the basic facts that it would need to make sound judgments about political issues."

But at the same time, as people get more knowledgeable they get more dogmatic. Experts know a lot, but they gather evidence that fits their existing ideology; ideologies both help us understand the world and blinker us in some ways.

Perhaps democratic ignorance and expert narrow-mindedness roughly balance out—or perhaps representative democracies and non-democracies both choose similar sorts of people to rule anyway.

Either way, the evidence seems to suggest that insofar as we can help countries to develop, the key institutions we should be supporting are markets, property rights and the rule of law, and considerably less significance should be accorded to democratisation.

Ending the BBC licence fee

Why should households pay a levy to support broadcasters, even if they have no television? Or even if they have a television but rarely use it? It's a broadcasting poll tax, which will impose the biggest burden on the poorest households, like the one-parent families who, already, account for the bulk of the prosecutions for non-payment.

And what's the logic of it anyway? That we need broadcasters, and the licence fee is no longer a realistic way to pay for them? Firstly, you can question the extent to which we need broadcasters. Many of us live quite happily without needing daily doses of Call the Midwife, Death in Paradise, Casualty or for that matter Premier League football: why should we subsidise those who can't? Politicians might reckon that Question Time and Newsnight are essential 'public service broadcasting', but precious few of the rest of us would mourn their passing.

Broadcasters are by no means the only people to argue that they are producing a product essential to our lives or culture, but for which it is hard to get people to pay. Newspapers are saying exactly the same: they feed us news, analysis and opinion, but we are buying fewer and fewer of their dead-tree products, picking it all up free online instead. Should we have a levy on households so that Rupert Murdoch can continue to serve us up his vital product? No, definitely not. It is up to those industries to find market ways to charge for what they produce – through advertising, for example, or through subscription mechanisms.

The BBC should do the same. Technology is pretty nifty these days, in ways it wasn't when the BBC was created in the 1930s. For folk who pride themselves on their creativity, developing a subscription service, from which non-payers can be excluded, should not be too far beyond their wit. Or even using advertising and sponsorship, as so many other perfectly reputable broadcasters do.

If the BBC did not exist, we certainly would not invent it. Today it looks rather like a bloated fixed-line network monopoly in an age of mobile phones. A lumbering dinosaur in an age of fleet-footed niche producers. So why force households to keep subsidising this sad throwback?