The Good Old Days are right now

You can't make people happy by law. If you said to a bunch of average people two hundred years ago "Would you be happy in a world where medical care is widely available, houses are clean, the world's music and sights and foods can be brought into your home at small cost, travelling even 100 miles is easy, childbirth is generally not fatal to mother or child, you don't have to die of dental abcesses and you don't have to do what the squire tells you" they'd think you were talking about the New Jerusalem and say 'yes'.

Sir Terry Pratchett. 1948-2015.

If you doubt this in the slightest manner then download the historical GDP per capita figures from Angus Maddison. Note that the numbers are in modern currency (well, 1990s currency) and marvel at how poor the past was. The average Englishman in 1600 had perhaps $3 a day of modern money to live on all told. The average Congolese has that today.

The myth of owing future generations

If you’re like me you’ve no doubt heard with great frequency the assertion that we owe it to future generations to make huge sacrifices in the present for the sake of the unborn, and that anyone who fails to accede to this maxim is bordering on moral turpitude. I find the argument that we are somehow indebted to our future generations quite absurd. Yes, of course we ought to be responsible citizens, and always be the least wasteful we can be, but the position that we have a moral duty to live as carefully as we can for their sake strikes me as a strange one to take. I think this view fails to consider one key thing – the enormous riches that the unborn will inherit from us. Look at the blood, sweat, toil, imagination and innovation that came from our ancestors to give us the kind of life we have today. As we keep increasing our skills and our ingenuity we bestow ever-greater riches for future generations.

Suppose I have a baby girl in a year's time, and I still live in the UK. Think what that child will inherit on the day of her birth: she enters a world in which she already has rich pickings of food, drinking water, roads, planes, and the luxury of plenty of leisure time. She also has a stable government, property rights, career opportunities, hospitals, entertainment, and thanks to the Internet, she has access to just about every fact that human beings have ever discovered, and to a vast proportion of other minds who she would otherwise have little chance of meeting.

Most importantly, though, she enters a world in which she'll be wealthier than any generation that has ever lived, a world in which she has the lowest chance of being involved in war, and a world in which the free market, science and technology will give her a quality of life unimaginable 250, 100, or even 50 years ago. All this she has inherited from this current generation and everybody's contributions that preceded them. So before people hastily wed themselves to the viewpoint that we are going to burden future generations with a partially ruined planet and legacies from our own carelessness, let's have a reality check and remember how the rich scientific and economic pageant of our past and present is a pageant from which future generations will benefit. When we express it in those terms, all this talk of our owing future generations is shown to be, at best, an exaggeration, and at worst, a laughable misjudgement.

Notice this irony too. Many on the left are always going on about redistributing wealth from the rich to the poor when considering people who are alive. Why, then, do they adopt the opposite approach to people who are going to be much richer than us? When it comes to wealth, prosperity and well-being, just as being born in 2014 is much more of a blessing than being born in 1914 – being born in 2064 or 2114 will (in all likelihood) be much more of a blessing than being born in 2014. Making sacrifices now for the unborn future generations is to transfer wealth from the presently alive poorer group to the unborn richer group – the very opposite of what those on the left support when the groups in question are alive in the present day.

I talked about what a great life my new daughter would be born into if she lived in my home city. I'm aware, of course, that these luxuries are not enjoyed throughout many parts of the world. If she was born in Ethiopia or Somalia the same couldn’t be said of her blessings. But ironically, the answer to this issue is the answer that shows why we should focus primarily on people suffering in the here and now. Efforts and costs expended for future people not yet born are efforts and costs that are potentially taken away from Ethiopians or Somalis now. Unless you think that Ethiopians and Somalis of a few decades time are going to be worse off then present day Ethiopians and Somalis (and if you do you're probably wrong) then deferring future considerations in favour of present day crises is both the right and most logical thing to do.

Because future generations are going to be more prosperous than us, and because it is both unethical and unwise to prioritise unborn prosperous people over present day plighted people. The trade-off between focusing on the present life lived by people of today against the future lives lived by people who are going to be our descendants comes down heavily in favour of focusing on the present life lived by people of today, as the prosperity and advancements enjoyed through the free market and through science continues to lay down the foundation of better well-being for those yet to be born.

Flexible work hours may be the key to solving wage gaps

A paper from the American Economic Review thinks it has some more insight into the cause of the gender wage gap. It’s not sexism, employer discrimination, or really even children. It’s the flexibility (or lack there of) of work hours.

The converging roles of men and women are among the grandest advances in society and the economy in the last century. These aspects of the grand gender convergence are figurative chapters in a history of gender roles. But what must the “last” chapter contain for there to be equality in the labor market? The answer may come as a surprise. The solution does not (necessarily) have to involve government intervention and it need not make men more responsible in the home (although that wouldn’t hurt). But it must involve changes in the labor market, especially how jobs are structured and remunerated to enhance temporal flexibility. The gender gap in pay would be considerably reduced and might vanish altogether if firms did not have an incentive to disproportionately reward individuals who labored long hours and worked particular hours. Such change has taken off in various sectors, such as technology, science, and health, but is less apparent in the corporate, financial, and legal worlds. [Emphasis mine.]

The data from this paper is fascinating, and challenges quite a few pre-conceived notions we have about women in the work place. For example, we often think of jobs in the sciences, medicine and maths as being most off-limits to women, but in fact, women make up roughly half of today’s medical graduate enrolments, and actually women lead men in study areas including biological sciences, optometry, and pharmacy.

What’s even more interesting is that the gender pay gap is at its lowest in the tech and science industries. The gap begins to widen when you look at the health industry, and it spikes when you look at the business industry.

The paper, “A Grand Gender Convergence: Its Last Chapter” argues that this is because the tech and science industries are more suited to flexible work hours, presumably because the quality of one's work output is based on results; whereas the business industry demands the constant slog of long work hours and 'face-time' - things which their clients have come to expect, and things that can be much harder for women to do if they are trying to manage both a family and a job at the same time. Claudia Goldin, author of the report, notes "a flexible schedule often comes at a high price, particularly in the corporate, financial, and legal worlds...there will always be 24/7 positions with on-call, all-the-time employees and managers, including many CEOs, trial lawyers, merger-and-acquisition bankers, surgeons, and the US Secretary of State. But, that said, the list of positions that can be changed is considerable."

Workplace culture has been changing for years– jeans, pets, and company-sponsored Red Bull fridges are becoming widely established. A move towards flexible hours is becoming more relevant too, especially in some of the most innovative industries. Perhaps our best bet to solving wage gap issues is to encourage employers to adopt more flexibility (for both men and women) in the many industries that could suit, and even benefit, from it.

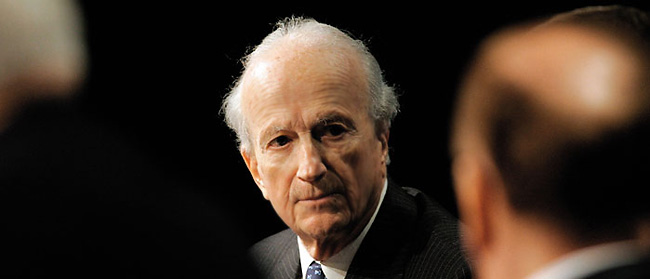

Another little proof that Gary Becker was right

Gary Becker made the point that discrimination (on race, sex etc grounds) was expensive to the person doing the discriminating. If you won't hire people because of their sex or gender, say, then you will be missing out on people of that race or gender who have the talents you're looking for. The implication of this is that then others can profit from picking up that cheap talent. We see a nice example of this in the obituary pages today:

As D J Freeman grew, it pioneered the promotion of women; in the 1980s when only 5 per cent of the partners in many City firms were women, in D J Freeman the figure was 40 per cent. The firm also introduced part-time partnerships and offered maternity leave.

This was both a matter of conviction, shaped by Freeman’s formidable wife Iris (née Alberge), a former child psychologist who retrained as an employment law solicitor so that she could work alongside her husband (and later wrote a biography of Lord Denning); but it was also a hard-headed recognition that a medium-sized firm needed to compete for talent, and women represented the largest single pool of untapped talent.

Steve Shirley (Dame Stephanie more formally) did this at about the same time by hiring married women, with children, programmers for her firm FI Group. And more recent research shows that the British football leagues were prone to this before the Bosman ruling in the 1990s.

What we find really interesting about this is the following: if such discrimination exists then it is possible for others to profit from it. Becker is pointing out that this will reduce said discrimination. But we can go one step further. In order to believe that such discrimination exists then you also need to believe that it is possible to profit from it.

So, how many do believe that in the modern UK it is possible to make, super, extra, profits by specifically looking to hire women and or ethnic minorities? If the answer is "no" then that's the same as stating the belief that there's no systematic discriomination, isn't it? If yes, then when are you hiring in order to profit from and then reduce said discrimination?

Economic Nonsense: 25. With free markets the poor are left behind

No. It is the poor who benefit most from free markets. The expensive new products that initially only the rich can afford become cheaper as time passes until they fall within what most people can afford. Colour televisions were initially a luxury product for rich people, but there was money to be made so more producers entered the market. The competition spurred firms to develop cheaper methods of production and improvements in quality. Colour TVs are now something that even poor people in rich countries are expected to own. Many consumer goods follow the same trajectory; most recently smartphones have done so. Far from being left behind, the poor are pulled along by the progress that initially caters for the rich.

Free markets offer a great variety, a variety that includes high fashion items for wealthy buyers, but also serviceable and affordable versions for those not so well off. A Bentley is a very fashionable, high quality car with four wheels that enables its owner to get around. A Vauxhall is less fashionable and less high quality, but it has four wheels and enables its owner to get around. The rich eat caviar, while the poor eat the equally nutritious but less fashionable cod roe. The princess and the movie star can wear the latest couturier designed Paris dress; others can await the High Street department store version inspired by it a few weeks later.

On a global scale, the world's poor have made huge gains because of free markets. Hundreds of millions have been lifted from subsistence and starvation because global free markets have enabled them to produce goods or services that sell to people in richer countries. They have not been left behind because globalization has admitted them into markets and allowed them to advance their living standards.

No, Robots aren't taking our jobs

The impact of mechanization on human employment has been a long-held concern. Long before robodoctors, drones and self-service checkouts the Luddites waged war with technology, smashing and burning the labour-saving machines they considered a threat to their livelihoods. Today, people like Tyler Cowen predict that the rise of intelligent machines will result in a society where the top 15% are fantastically successful and wealthy, but much of the traditional work of the lower and middle-classes is performed by robots and automation. Indeed, a much-cited 2013 study by the Oxford Martin Programme on the Impacts of Future Technology found that 47% of total US employment is at ‘high risk’ of computerization and could be automated within the next few decades. ‘Threatened’ sectors include transport, logistics and office administration, but surprisingly also the service sector, which is currently responsible for many of the new jobs created in developed economies.

Technological progress tends to have two differing effects on employment. At first there is displacement, as workers are substituted for new technology. However, efficiencies gained from automation often reduce prices, increasing real income and the demand for other goods. Companies will move into industries where productivity and demand is high and create new jobs, or use new technology to create new industries. Automation also frees up displaced workers to utilize their skills in other, potentially more fulfilling and creative ways.

Setting aside something like the singularity the economic impact of robots depends on whether they destroy more jobs than they create, and which section of society gains most from the opportunities they bring. At the moment, nobody really has a clue what future economic impact robots will have. Even a survey of nearly 2,000 experts in robotics and AI found that they were split down the middle in terms of techno-optimism (believing that robots will create more jobs than they replace) and techno-pessimism (that the rise of robots will inevitably adversely effect a significant number of blue and white collar workers).

Until now, there’s actually been very little empirical work done on the economic impact of the use of robots. However, a new paper — ‘Robots at Work' —from the Centre of Economic Performance at the LSE makes a welcome contribution to the field.

Using data from industries in 17 developed countries between 1993-2007, the report finds that ‘robot densification’ has no statistically significant effect on total hours worked over the period. This suggests that the use of robots has not (on net) resulted in less work opportunities for humans.

It has, however, had significant, and positive, effects elsewhere. The study found that the contribution robots make to economic growth is substantial, at 0.37 of GDP growth, and accounted for one-tenth of aggregate growth over the period. They also raised annual labour productivity by 0.36 points, comparable to steam technology’s boost to British labour productivity between 1850-1910. They also found that robot densification increased both total factor productivity and wages.

Industrial robots were used in under a third of the economy during the study period, and accounted for only around 2.25 percent of capital stock even within robot-using industries. The authors suggest that the likely contribution of robots to future growth is substantial, particularly when considering their potential impact in developing countries.

There is one note of warning, though — whilst the study found no overall impact of robot densification on hours worked, the use of robots did have a negative and close to significant impact on the hours worked by low-skilled workers, and, to a very small extent, those of middle-skilled workers. Presumably time will tell whether this is trend truly worthy of concern, and whether displaced workers are able to find alternative jobs elsewhere. For now, though, this study suggests that robots are tools which assist with and complement our jobs, as opposed to threaten them.

George Monbiot does rather misunderstand things

The latest bright idea from George Monbiot is that we must, in order to beat climate change, force people to leave fossil fuels in the ground. On the basis that it is necessary to attack supply as well as demand:

Imagine trying to bring slavery to an end not by stopping the transatlantic trade, but by seeking only to discourage people from buying slaves once they had arrived in the Americas.

It's an interesting example of his faulty logic. Because of course the transatlantic trade was at first banned in 1803 and then gradually extended to non-British ships and so on. But slavery lasted in the US until 1865 and into the late 1880s in Brazil, long after that supply was both legally and effectively banned. The solutions were variously more and less bloody but they were actually that people were dissuaded from purchasing slaves rather than that people were dissuaded from supplying them anew from Africa.

So it is, we're sorry to have to say, with fossil fuels and their associated emissions. We are not all victims of the evil capitalists (and, given that governments actually own the vast majority of fossil fuel reserves and resources, it's definitely not the capitalists to blame) who are forcing us to use such fuels. Rather, we the people rather like what we can do with such fuels: travel, heat our homes, heat our food and so on. It is the demand that needs to be changed (assuming that you want to consider climate change to be a problem), not the supply.

After all, banning the production of psychedelic drugs has proved so successful hasn't it? So too the supply of prostitution services where such is illegal. It really is worth recalling that while Say's Law (that supply creates its own demand) might not be entirely true the opposite, that demand calls forth supply is.

The answer to climate change, as above assuming that you think it is a problem and one that needs a solution (we do, even if not as immediate and cataclysmic as Monbiot does), is as it always has been. Either cap and trade or a carbon tax, plus research into non-CO2 emitting forms of energy production, in order to curb demand. Just as Bjorn Lomborg, the Stern Review, William Nordhaus, Richard Tol and everyone else who has actually looked at the economics of the problem has concluded.

Logical Fallacies: 17. The dilemma

https://www.youtube.com/watch?v=3Yy7dDHDlCs

Watch 'the dilemma', the latest in Madsen Pirie's series on logical fallacies.

You can pre-order the new edition of Dr. Madsen Pirie's How to Win Every Argument here

Economic Nonsense: 24. Strong laws are needed to curb the activity of speculators

The villains of the piece change as the economy changes. At one time it was money-lenders, then corn merchants. In modern times speculators are up there with bankers in popular dislike. Speculators are commonly perceived as people who add nothing to a product, and often as people who profit from the hardships endured by others. They are seen to buy cheap in the hope that the price will rise, then sell at a profit without having added to or improved whatever it was they speculated on. In fact speculators often provide a useful service. They can take the burden of risk that others might find difficult to deal with. The speculator who buys a farmer's crop in advance gives the farmer the certainty of a price. Farming is an unpredictable activity, and the market price when the crop I harvested might be higher or lower than that agreed price. The speculator hopes it will be higher and takes the chance, but the farmer prefers the certainty of a known price that enables him to plan his affairs.

When speculators buy or sell commodities hoping to profit from price changes, they dampen some of the fluctuations. If they bet on a future shortage, they will buy now in the hope of selling for a higher price. If enough of them do it, the effect of buying now is to raise the price now, signalling to users to curtail their use, and to producers to bring out more supply. The same happens in reverse if they bet on a future glut by selling.

Businesses that sell to other countries face the uncertainty of not knowing what their goods might fetch in foreign currencies at the time of their delivery. They can smooth this by buying or selling currencies in advance from speculators prepared to take a punt on future changes in exchange rates.

The invisible service that speculation adds to goods is risk management. It is a valuable service, but because people cannot see it, they see it as money for nothing. Always there will be populist politicians prepared to trade on their resentment and propose tough laws to curb an essential service that helps markets to work more efficiently.

Believe it or not, people actually like smoking and eating fatty food

Public information campaigns and nutritional labelling are good at informing people about what’s healthy and what isn’t, but don’t seem to have much impact on what they actually eat. That’s what a comprehensive review of 121 'healthy eating' policies found, and I think it should make us rethink more heavy-handed policies to do with unhealthy food, tobacco and alcohol. There are benefits as well as costs to every activity that public health groups want to discourage. We know there are benefits because people do them freely. But we know there are costs as well, like living a shorter and less healthy life.

The liberal view is that each person’s cost-benefit calculation is different, because they enjoy and dislike things differently. In this view there’s no case for stopping people from doing things unless they don’t actually have the information they need to make a judgement. We should want to make people’s lives better as they themselves understand ‘better’, not according to a single measure we’ve decided on, like lifespan.

So telling people that sugar makes them fatter may be a good policy, if they didn't already know that. And policies that do that do seem to make people more informed. But what’s interesting is the impact they have on people’s diets – usually not much, and sometimes an unexpected one.

For example, a 2008 study found that people who used nutrition labels had big increases in fiber and iron intake, but no change to their total fat, saturated fat or cholesterol intake. The UK’s ‘five a day’ campaign about fruit and veg was very successful at getting people to think about eating more fruit and veg, but increased people’s intake by an average of 0.3 portions a day (which was not viewed as being a very good improvement). 44 studies of similar campaigns in the US and EU have shown about the same size effect.

To some people that might make it look like we need to do more. To me it looks as if people view the costs of changing their diet to something less enjoyable or convenient as being quite important, and are willing to forgo some level of health to avoid that.

Maybe this tells us something about cigarette regulation too – there is some evidence that smokers actually overestimate the risk of smoking and some that they underestimate it. If they do overestimate the risks, we’re ‘informing’ people so much that it’s become misleading.

It would be fair to respond to this that people have no real way of doing a proper cost-benefit analysis about eating sugary foods or smoking, but because the state can’t measure the benefits – that is, the pleasure – it is just as limited.

The fact that people do change their habits about iron and fibre, but not fats, suggests that they aren’t ignorant, they just don’t want to eat less fat! If that’s the case and we’re working to improve people’s lives on their terms, there is no case at all for more heavy-handed policies like taxes, ingredients restrictions and advertising bans.