Why the Bank of England should end its stress tests: ‘No Stress’ in a nutshell

In December last year the Bank of England reported the results of its first set of annual stress tests of the capital adequacy of the UK banking system. Its message was reassuring: our banks are safe.

Don’t believe a word of it. The banking system is actually highly vulnerable and the stress tests merely hide that fact. Indeed, they even make the banking system less safe than it already is, by pressuring banks to take hidden risks that the risk models cannot see.

The stress tests are flawed in three distinct ways.

The first is methodological. The tests are based on one scenario and cannot possibly give us confidence the system is safe against all the other possible scenarios they did not consider. They are based on a ‘risk-weighted’ asset metric that is unreliable because it is dependent on gameable risk models that under-estimate banks’ risks – and the system incentivizes banks to game the models to get lower capital requirements and thence higher distributions of false profits. They create systemic instability by pressuring banks to use the same models that are blind to the same risks. They lack credibility because even if the central bank thinks there are major banking problems, it cannot publicly admit to them – to do so would undermine confidence and lead to questions about its own past competence in rebuilding the banking system. The results then have all the credibility of a rigged election.

Even if we ignore these problems, the stress tests are fatally flawed because they use a very low ‘pass’ standard, a 4.5 percent minimum ratio of capital to risk-weighted assets. This minimum is well below those coming through under Basel III. Had the Bank carried out a test using these latter minima, the banking system would have failed the test: same exercise, higher safety standard, opposite result.

The Bank also failed to carry out any tests based on a minimum ratio of capital to leverage – a test that would have been more reliable because it is much less dependent on unreliable risk models. Even the most undemanding such test – one based on a minimum leverage ratio of only 3% - would have revealed that the banking system was very weak. The Bank’s failure to apply this latter test is all the more puzzling because the Bank expects UK banks to meet this minimum standard. Thus, the Bank asks us to believe the banking system is sound, despite the fact that a 3 percent leverage ratio test based on what it currently expects from banks and based on its own stress scenario would have suggested otherwise. One might add that many experts recommend a minimum leverage ratio of 15 percent, five times larger than the leverage test that the Bank did not conduct, or at least report. You can imagine the results.

One can only speculate why the Bank did not report the results of these alternative tests, but one thing is sure: the comforting headlines last December would have been rather different had they done so.

Overseas experience also indicates that stress tests are useless as indicators of bank vulnerability and can go catastrophically awry. Recent stress tests failed to notice the impending collapse, not just of one but of three national banking systems: Iceland in 2008, Ireland in 2010 and Cyprus in 2013, all of which collapsed shortly after being signed off as safe by regulatory stress tests. The European stress tests missed the latter two collapses, but also have a history of being captured by powerful banks and the Euro elite – and of using very unstressful stress scenarios to produce loss projections that turned out to be dramatically short of subsequently realized losses.

The most recent European stress tests would appear to be no exception: the ECB party line was that all was well in the European core despite problems in the fringe countries, but these were dismissed on publication by a variety of experts who pointed out that it was the big French and German banks that were most vulnerable. However, the European stress tests overlooked their vulnerability because they used ‘risk-weighted’ asset measures that were blind to their main risks instead of leverage measures that would have revealed them – the same mistakes that were made by the Bank of England.

Stress tests operate like a radar that cannot see any hazards. We wouldn’t dream of sending out a ship or plane reliant on a radar that didn’t work. We really shouldn’t do that with our banking system either: the Bank of England should abort its stress testing program forthwith.

Kevin Dowd is the author of the Adam Smith Institute's most recent report 'No Stress', which is available here.

Equality of opportunity or equality of outcome?

We find this all rather sad really:

Britain has too many stay-at-home mothers and must do more to get them into work, the European Union has said. British women are twice as likely as those in the rest of Europe to choose not to work in order to care for their children or elderly relations, EU figures show. The large number of mothers who work part-time or not at all is a “social challenge” that the Government must address by providing more state-funded child care, according to a report issued by the European Council.

The sadness coming from the clear confusion here between equality of opportunity and equality of outcome.

“Despite the positive trends in relation to labour market outcomes, social challenges persist,” it says. “The difference in the share of part-time work between women (42.6 % in 2013) and men (13.2 % in 2013) is one of the highest in the Union. “The percentage of women who are inactive or work part-time due to personal and family responsibilities (12.5 %) was almost twice as high as the EU average (6.3 %) in 2013.”

The aim is not to insist that as many women work full time outside the home as do men. For we are not looking for equality of outcome in gender and work, as we are not in most other areas of life. We're actually looking for equality of opportunity in how people desire to organise their lives. And these same figures that appear to be a problem show that in this respect the UK does very well.

We have an extremely flexible labour market. Some to many women actually desire to raise their own children: also to combine that with some part time work perhaps. It's exactly this choice that the UK does offer. We're the ones getting it right. Those who wish to work full time can indeed do so. Those who wish to work part time, whether male or female, mothers or not, also get to do so. We've a system which offers the maximum freedom for people to organise their lives as they wish. Which is the point and purpose of how we organise society: to maximise choice and opportunity, not to enforce equality of outcome.

What is being identified as a problem here is in fact evidence that the UK has solved this problem.

After all, it's hardly controversial to suggest that there's a certain gender division in desired child care arrangements in a mammalian species, is it? The aim and purpose of public policy should thus be to maximise the expression of that choice: precisely what the UK system does offer.

Time for a 40% top rate

Lord Lawson has called for George Osborne to lower the top rate of income tax to 40% in his July budget. It is a timely call that echoes former times. When Nigel Lawson, as he then was, was preparing his 1988 budget, the ASI published research showing that if he lowered the top rate from 60% to 40%, the Treasury would soon gain revenue, even though the government share would be smaller in relative terms, and the burden on business would be lighter.

Chancellor Lawson did just that, lowering the top rate to 40% and the starting rate from 29% down to 25%. This was his trademark tax simplification. From a myriad of rates and thresholds he now had reduced income tax to only two rates.

Not only did Treasury revenue increase as predicted, but the richest 10% ended up paying a higher share of the total. From just over a third, their share rose to just under half of the total. Again, this was what research had forecast would happen. By contrast, when Labour reneged on its election promise and raised to top rate to 50%, official figures show that it raised nothing like the £2.9bn glibly forecast by Alistair Darling. And when the coalition lowered it back to 45%, the tax loss was estimated at only £100m.

To cover the political charge of lowering tax for top-rate payers while cutting the welfare bill, Mr Osborne might try a new tactic. He should lower the top rate from 45% to 40% on a two-year trial basis. If after that time two results had not been achieved, he should promise to revisit it.

The two results required would be:

1. That the revenue raised from income tax was now higher than it was from a top rate of 45%, or about to become so, and

2. That the proportion of income tax paid by the top 1%, the top 5% and the top 10% of earners was now higher, or about to become so, than it had been under a top rate of 45%.

Lord Lawson is completely right. Lowering the top rate to 40% would make Britain a more attractive place to do business. It would attract talent and investment to boost our economy. It would achieve growth at no cost to the Exchequer, and it would create jobs. More to the point, it would send a signal to the world that the UK was once again achievement oriented. Mr Osborne should be brave.

But why is private property not allowed to leave the country, even if it is a Cezanne?

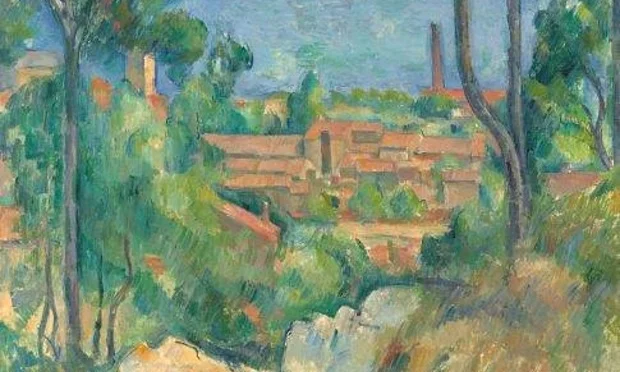

We find this all most odd: An important Cézanne landscape view of the Mediterranean, which has been on public view in Cambridge for nearly 30 years, is in danger of leaving the UK unless more than £13.5m can be raised.

The British government on Monday placed a temporary export bar on Cézanne’s Vue sur L’Estaque et le Château d’If.

Purchased by the industrialist Samuel Courtauld in 1936 and passed down through his family, it was on long-term loan to the Fitzwilliam Museum from 1985 until last year when a decision was taken to sell it.

What justification is there for whoever owns this painting now not being allowed to take their private property where they wish?

After all, consider the peregrinations of the painting so far:

Provenance Ambroise Vollard, Paris, by whom acquired directly from the artist. Baron Denys Cochin, Paris, by 1904. Galerie Durand-Ruel, Paris, by whom acquired on 12 May 1905. Paul Cassirer, Berlin, by whom acquired on 21 September 1905. Galerie Bernheim-Jeune, Paris, and Jos Hessel, Paris, by whom acquired on 2 April 1909. Jos Hessel, Paris, by whom acquired on 12 July 1910. Galerie Bernheim-Jeune, Paris, by whom acquired on 12 October 1912. Walther Halvorsen, Oslo, by whom acquired on 21 April 1915. Erich Goeritz, Luxembourg, by 1936. Galerie Thannhauser, Lucerne, by whom acquired from the above on 9 July 1936. Wildenstein Galleries, Paris & London, by whom acquired from the above on 11 July 1936. Samuel Courtauld, London, by whom acquired from the above in November 1936, and thence by succession to the current owners.

What is there in all that which justifies the full majesty of the law being applied to keeping it in the UK?

Our general reading of such export bans is that they are a scam perpetrated upon the general public. Some small number of influential people rather like looking at the occasional French painting. But they'd prefer not to have to pay for their pleasures. Thus they manipulate the law so as to insist that their desires are catered to.

It's time for us to change this system: ban export bans now!

School choice for Scotland

Nevada has become the first state in the US to enact a law making school choice universal. This is a groundbreaking example for other countries mildly experimenting with school choice. Adopting something similar in the UK context is an especially interesting idea. It works through an education savings account (ESA) in which the state deposits what it would averagely expend educating a child under the state system. Parents can use this fund for everything from school fees to private tuition – the choice offered in educational services being as wide-ranging and high-quality as individuals demand. And the catchment allocation of pupils to schools they don’t want to attend is a thing of the past.

Notably, families can roll over unused funds from year to year, a feature that makes this approach particularly attractive. It is the only choice model to date that puts downward pressure on prices. Parents consider not only the quality of education service they receive, but the cost, since they can save unused funds for future education expenses.

Scotland, with roughly double the population size of Nevada and a completely devolved education system, could technically do something similar. Not least because it's an idea that people of all political ideologies seem to be supportive of (see my previous post), but there is no freedom of movement in the education system – something that is neither fair on those trapped in the postcode of poorer schools nor an efficient way of driving up standards.

Remarkably many UK private schools at the cheaper end of the spectrum are running at a lower cost than state schools. Take a look at a 2011 paper (pdf) by James Croft that breaks down the cost of state and private sector schools, controlling for expenditures particular to each. Given that profit-making schools can achieve better outcomes for less money, the state handing back the cost of a child's 'free' education would enable people to attend a private school who previously couldn't afford it.

41% operate on fee levels less than, or on a par with, the national average per pupil funding in the state-maintained sector. On average, fees are approximately £7,500 annually. Fees at the more accessible end of the spectrum attract a high proportion of first-time buyers of independent education.

The best education policy currently on offer in Scotland is detailed in the Scottish Conservatives' 2016 Holyrood election manifesto (pdf) which promises school vouchers. But realistically, 60% of Scottish people voting next year are planning to support the SNP. There's just no avoiding for now that Scottish politicians will churn out yet more legislation from our unicameral conveyor belt to undermine independent schools’ autonomy and unintentionally halt our education system's advancement.

Take the Education (Scotland) Bill 2015 (pdf), which I have highlighted in a recent post for an unreasoned section that attempts to outlaw inequality in state schools – if it's successfully implemented teachers not registered with Scotland's General Teaching Council will be barred from teaching.This will massively limit what expert teaching Scottish pupils are exposed to. Meanwhile looms the threat that charitable status, and therefore up to 80% tax relief, will be removed from private schools, affecting hundreds of bursaries for disadvantaged children.

Interference with the better-performing independent schools and misdirected moves in state sector has created an environment in which it is impossible for an education market with school choice and low-cost private schools to emerge. Until we take steps in the right direction, the transience of politics will prove to be either a blessing or a curse.

So student loans seem to be working as a policy then

Some will no doubt decry this finding as evidence of the increasing commercialisation of society, the death of all that is good and holy. We would respond that this is actually the point of having student loans:

The first students to graduate since the imposition of £9,000 annual tuition fees are more focused on securing a well-paid job than their predecessors to pay off their higher levels of debt, according to a major survey of post-university employment.

The survey of 18,000 final year students at 30 universities reported a record proportion had started researching career paths as early as their first year of studies, and more of them undertook work experience to improve their chances of getting a good job after graduation.

The survey found the average level of debt by this summer’s graduates had ballooned to £30,000, compared with averages of £20,000 in 2014 and 2013.

The truth being that university is both enjoyable and highly enriching. To the point that, assuming one has taken the right sort of course, lifetime earnings are some hundreds of thousands of pounds higher for those who have a degree than for those who do not. Thus the major beneficiaries of a university education are those who get one: so why shouldn't they be the ones paying for one?

But while that is true that's not really the point of student loans rather than grants. The real point being that a university education is an expensive thing to provide. We'd rather thus encourage people to go and make use of that expensive asset that they've just acquired. Thus recent graduates looking for well paid jobs isn't a fault of the system, it's the major darn point.

That is, that recent graduates are looking for those better paid jobs as a result of having student debt shows that the system of financing degrees by debt is working.

Is the single market possible in a 2-speed EU?

This week unites two crises: Greece and the UK’s proposals for EU treaty change. The EU will get through both with a lot of fudging. Greece will stay in the Eurozone for now and Prime Minister Cameron will keep talking. The former is eventually bound to lead to tougher rules for the Eurozone whether Greece remains in or leaves it. That in turn will lead to stronger UK demands for non-Eurozone members to opt in or out, thus creating a 2-speed EU with progressive integration for the former and demands for the EU to be merely a single economic market by the latter. The fact that the latter is also the overwhelming preference of EU voters carries little weight in Brussels or, indeed, in the other countries where Treaty changes require referenda.

The difficulty of isolating economic from social and political issues is where the EEC came in and why the continentals never envisaged a purely economic single market. This issue was downplayed when the UK joined.

The UK’s position remains that social and political issues should be a matter for the British parliament. David Cameron would doubtless accept John Major’s Maastricht opt out if that were possible. Indeed the UK should reverse all Tony Blair’s EU give-aways and be grateful to Gordon Brown for keeping us out of the Euro.

But all that is history and the question now is whether the single market we desire is at all possible with a 2-speed EU. At the beginning of the year, FT columnist Janan Ganesh proposed that the UK be allowed a veto over proposed EU financial regulations it disliked in much the same way that France has a veto on changes to the Common Agricultural Policy. The argument would be that financial services are as crucial for the UK as agriculture is for France. With the possibility of all the other 27 member states demanding vetoes for their chosen “crucial” areas, German support would be unlikely.

One way to sweeten the pill would be to renounce all UK regulations additional to the EU ones. In combination they must annoy foreign financial companies operating in the City just as much as they aggravate British ones. That would help establish the principle that we need clarity on “competences”, i.e. for each area the EU, or the member state, should legislate but not both. Both doing so drags the whole EU down competitively.

But Eurozone integration threatens that. Distinguishing competences between EU and member states is hard enough but a three way split between Eurozone, other EU and then member states may escape Brussels’ rather limited imagination.

Inequality: some people know what they want to find

One wonders how many times Guardian economics columnists have revealed the shocking discovery that: 'trickle-down economics' doesn't work, equality isn't only desirable for fairness reasons but also for growth and stability; some important group with heretofore sound neoliberal credentials agrees; and that shadowy international organisations and selfish elites are to blame for this fairly clear truth not being tackled through policy. Messrs Elliott, Chakrabortty and Inman, responsible for most of the august paper's economics comment, and all apparently endowed with eternal reserves of surprise, regularly inform us of these groundbreaking findings, that shatter economists' ideological complacent laissez faire free market neoclassical neoliberal capitalist consensus.

The latest has a title that might well have been automatically generated: "So much for trickle down: only bold reforms will tackle inequality" with an equally excellent standfirst, "Even the IMF recognises the vicious circle in which inequality breeds instability, which causes recession and spending cuts that make inequality worse". Between them they really hit up all of the bases, and the piece is no different.

IMF research released last week (pdf) shows that there are economic downsides to inequality. Raising the income share of the poorest 20% of the population increases growth by as much as 0.38 percentage points over five years. By contrast, increasing the income share of the richest 20% by 1% decreases it by 0.08 percentage points. So much for trickle down.

She added that these disparities were becoming baked in, with social mobility on the decrease. To get on in life, you had to live on the right side of the tracks, and according to Lagarde, that “didn’t sound fair”.

At this point, readers might be wondering whether this IMF has anything to do with the other IMF, the one that tells countries seeking financial help that they need to liberalise labour markets by cutting minimum wages and reducing the scope of collective bargaining; the one that demands cuts in public spending and insists that state assets should be privatised at every opportunity.

They are indeed one and the same. The IMF that warns of the perils of inequality is the IMF that is demanding measures of Greece that will add to poverty and make inequality worse. One half of the fund – the economics team that comes up with the big-picture analysis – says one thing. It supports investment in education, an enhanced role for trade unions and higher taxes on the rich. The other half – the part that draws up the structural adjustment programmes – says something entirely different.

What's weird is that while it would be nice to believe in a mendacious Larry Elliott, realistically it's more reasonable to assume this is all in earnest. Indeed, does it really make any less sense than my worldview?

I can point to evidence suggesting that inequality doesn't perpetuate through educational differences. I can point to evidence that people don't actually care about real world inequality, which they wildly mis-estimate; they only care about their perceptions of inequality, which changing inequality doesn't necessarily change. I can show that inequality doesn't unduly affect politics, that it doesn't undercut morality or community, and that the Spirit Level is nonsense.

But then you have people like the IMF, surely among the most credible bodies in the world, regularly releasing papers saying we should care. Who would you believe? As ever, it's very hard to decide what to do when one's meta-rationality goes awry.

I can say that the methodology of the IMF work is shoddy and that you should look at credible meta-analyses—but why should Elliott et al. trust me when I'm going against far more credible people. And surely we cannot expect everyone to dissect the details of every paper when they make a judgement on the area.

So while I might criticise the rather silly framing of this new 'revelation' I can hardly give full-throated criticism of the Guardian economics section line in general—interpreting evidence is just too hard.

Sensible regulation

Regulation involves compliance costs that large businesses can afford more readily than can small firms. Indeed, big business sometimes colludes with government and bureaucracy to have regulations that make market entry difficult for start-up and small competitors.

Regulation should be cost-effective, doing as little economic damage as possible, limiting competition or increasing prices as little as it can while achieving its objectives. Above every regulator's desk should be inscribed the words: "Competition is the best regulator," for it is the ability of the customer to go elsewhere that compels firms to keep their quality high and their prices low.

Above all, regulation should be sensible. Those who have no experience of business are unlikely to produce sensible regulations unless they consult with those who have. Part of the problem is that things change. New products and processes render old regulations irrelevant or inappropriate, and legislators struggle to add extra pages of detail to keep up with events. The pile of regulatory requirements grows higher.

One possible solution might be to draw on the tradition of English Common Law, relying on precedent rather than on closely-written requirements. For example, many pages of detail set out what toilet facilities employers have to provide for employees. A general requirement that employers should have to provide 'decent toilet facilities' immediately begs the question of "What counts as decent?" It could be determined by a series of decisions by juries and tribunals, so that an understanding of what was expected would soon emerge.

The advantage of this method is that it would incorporate the common sense of those sitting in judgement, and could adapt in response to changing times, just as Common Law does.

This is not the Continental tradition of statute law. Law there tends to be made by legislators and bureaucrats rather than by juries. The rules are written down in advance and in detail, rather than emerging from a series of decisions dealing with circumstances. EU regulations are made in this way, and there is little prospect of them changing.

Mr Cameron might make part of his EU negotiating stance that the 95% of UK firms which do not export to the EU should not be subject to EU regulations. A common law system of regulation could then be applied to them, making regulation more sympathetic and more flexible, lowering compliance costs and making it easier for new firms to start up. It would give a significant boost to the economy.

The seriously fascinating opening to a European Union report

We find ourselves near helpless with laughter at this opening to the latest European Union report. It's the one about how the eurozone should be deeper, have a common treasury and so on. And it opens with this:

The euro is a successful and stable currency. It is shared by 19 EU Member States and more than 330 million citizens. It has provided its members with price stability and shielded them against external instability. Despite the recent crisis, it remains the second most important currency in the world, with a share of almost a quarter of global foreign exchange reserves, and with almost sixty countries and territories around the world either directly or indirectly pegging their currency to it.

Europe is emerging from the worst financial and economic crisis in seven decades.

At least one of us around here is known to be deeply eurosceptic, but even given that isn't this just the most delightful piece of political prose?

For there's not a single economist who wouldn't add a "therefore" to the beginning of that second paragraph. Yes, the recession was not caused by the euro itself, but the existence of the euro most certainly made it worse than it would otherwise have been. As that same single currency made the boom beforehand even more frenzied. And then the actual monetary policies followed made matters even worse: the ECB was still raising interest rates when unemployment was soaring past 20% and more in some countries.

We can't help thinking that, well, observe the following:

This report has been prepared by the President of the European Commission, in close cooperation with the President of the Euro Summit, the President of the Eurogroup, the President of the European Central Bank, and the President of the European Parliament.

.... This report reflects the personal deliberations and discussions of the five Presidents.

Five presidents might be four or more too many for an organisation but leave that aside. But do we really desire the governance of an entire continent to be in the hands of those who could violate Poe's Law so grievously?