Young Writer on Liberty 2015 Winners

We're delighted to announce the winners of our 2015 Young Writer on Liberty competition, and will be showcasing some of their work in the coming days. The theme of this year's competition was 'The road not yet travelled: Three paths the next government should take for a freer United Kingdom'. Entrants wrote three, 400-word articles on this theme, each outlining a policy proposal to make the United Kingdom richer, freer and more prosperous.

We received dozens of entries and competition was fierce with incredibly high standards. This year for the first time, entries were spilt into 'Under-18' and '18-21' categories, with a winner and a runner-up in each.

The runner-up of the Under-18 category is Alan Petri, and the winner of the Under-18s is Theo Cox Dodgson. The runner-up of the 18-21 category is Tamay Besiroglu, and the category winner Theo Clifford.

Runners-up will have one of their entries showcased on the ASI blog tomorrow, and category winners will have all three of their pieces posted over the week.

Category winners will also receive £150 prize money, whilst both winners and runners-up will receive boxes filled with liberty-related books.

Check-in next week to read the entries!

What a pity Professor Krugman doesn't explore this logic completely

We have long been making the point that there's two aspects to Paul Krugman. The outstanding economist and excellent essay writer, then there's the New York Times columnist rather in the tank for one specific political view of the world. that second world being where government tells people how to live their lives better. But there's still flashes of the underlying economist around:

Politicians who preside over economic booms often develop delusions of competence. You can see this domestically: Jeb Bush imagines that he knows the secrets of economic growth because he happened to be governor when Florida was experiencing a giant housing bubble, and he had the good luck to leave office just before it burst. We’ve seen it in many countries: I still remember the omniscience and omnipotence ascribed to Japanese bureaucrats in the 1980s, before the long stagnation set in.

We see this in the development economics of Ha Joon Chang and others too. S Korea grew so therefore the policies that we like that they followed must be implemented elsewhere so they can have growth. Our point is that the reality is rather different:

This is the context in which you need to understand the strange goings-on in China’s stock market. In and of itself, the price of Chinese equities shouldn’t matter all that much. But the authorities have chosen to put their credibility on the line by trying to control that market — and are in the process of demonstrating that, China’s remarkable success over the past 25 years notwithstanding, the nation’s rulers have no idea what they’re doing.

We tend to think that no government ever knows what it is doing. This is partly Hayek, pointing out that it can never have enough information to plan things, partly our own observations of how governance actually works in detail. We know lots of the people who do actually run the government. Some of them are even very nice people but we'd not describe any of them as the Wise Solons who know the answer to every, or even any, of the nation's problems.

So what have we just learned? China’s incredible growth wasn’t a mirage, and its economy remains a productive powerhouse. The problems of transition to lower growth are obviously major, but we’ve known that for a while. The big news here isn’t about the Chinese economy; it’s about China’s leaders. Forget everything you’ve heard about their brilliance and foresightedness. Judging by their current flailing, they have no clue what they’re doing.

China's stunning growth since 1978 is not an illusion. The country has gone from being roughly as rich as England in 1600 (as measured by per capita GDP) to about the UK in 1953, 1955 or so. That's pretty good for simply stopping the adherence to Marxist and Maoist idiocies. But that's what it was: the rulers stopped following idiot policies.

And thus why we are minarchists. There are indeed some things that both must be done and must be done by government. But given the paucity of knowledge, of competence, among those who would govern that's all that government should attempt to do. The only further ambition they should have is to not do stupid things. Which, given those who become the governors, means nothing over what must and can only be done by government.

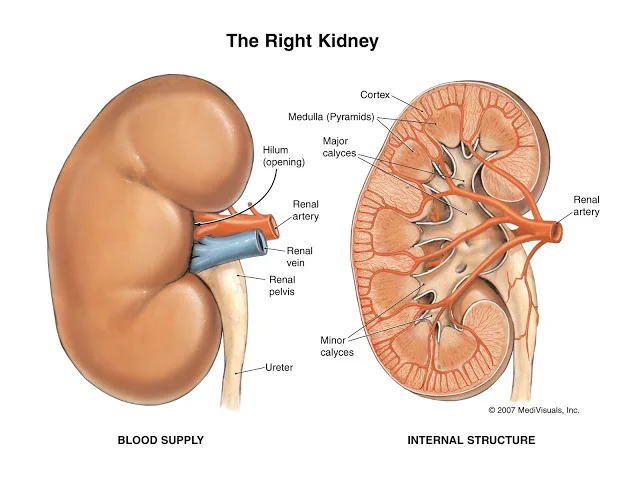

Yes, we really do need to start paying kidney donors

We have long been pointing out that the solution to the shortage of kidneys available for transplant is to offer to pay those donors who might be willing to donate one. Adter all, it's not exactly a new insight that increasing prices brings forth more supply. And the sort of levels of payment necessary are in fact cheaper than the cost to the NHS of dialysis. The New York Times has a nice piece on how this works elsewhere:

Iran’s system has many deficiencies — not least that the very idea clashes with ethical norms observed in many other countries — and the program varies greatly from region to region. But its chief advantage is this: People who need kidneys get them rapidly, rather than die on the waiting list.In the vast majority of cases, donors know in advance what they will be paid and receive appropriate screening and good medical care before and during the operation. And by getting patients new kidneys instead of keeping them on dialysis, the society saves a lot of money and avoids much misery.

Whatever anyone's doubts about whether people ought to be paid for organ donation there's no doubt that it does actually work.

“We should ask ourselves why some people find accepting money to donate a kidney and save a life repugnant, but accepting money for being a policeman or miner or soldier — all of which are statistically riskier than donating a kidney — is O.K.,” said Mohammad Akbarpour, a research fellow in the Becker-Friedman Institute of the University of Chicago. “Is there a fundamental difference?”

It could be that people simply don't understand how low that relative risk is.

Commercializing kidneys calls up images of a filthy, makeshift clinic, a rich traveler with a wad of cash, a desperately poor donor tricked into selling an organ, and a broker who keeps 90 percent of the money. India, Pakistan, the Philippines, South Africa and Indonesia, among other countries, are known for this type of trafficking in organs, and wealthy Americans, Israelis and Europeans are known for buying them.

But in Iran, the legal market pre-empts these abuses. To prevent kidney tourism, recipients in Iran have to share the nationality of their donors, and Iran recently banned kidneys for all foreigners except refugees in Iran from Afghanistan. “The rate of people who die in surgery is much, much lower in Iran than in other developing countries — all the transplants are under supervision,” said Farshad Fatemi, an assistant professor of economics at Sharif University of Technology in Tehran, who studies the kidney market. “If this regulated market weren’t in place, we might have organ trafficking here. We might be more like India or China and have illegal clinics, a black market where nobody looks after patients and donors.”

And there we have something that we have again been saying repeatedly. Markets are going to exist where human desire is great enough. It happens with sex, it happens with drugs, it is happening with organ transplants. In all three we argue that said market will be safer, will work better, if the activity itself is legal so that regulation, if that's necessary, is possible. Insisting that these things are illegal is part of what makes them so dangerous.

So, given that we've got the example of the one and only place in the world where people do not die waiting for a transplant, when are we going to institute our own paid market in them? For it really is true that people die, in great pain, each and every year simply because of some squeamishness about introducing filthy lucre into the proceedings.

As ever, there really are some thing so important that we must have markets in them.

Milton Friedman – a birthday tribute

Milton Friedman was born on July 31st 1912. He was one of the two most influential economists of the 20th Century, the other being John Maynard Keynes, and he promoted monetarism as an alternative to Keynesian orthodoxy. His economic scholarship was unimpeachable, and won him the award of the Nobel Memorial Prize in Economics in 1976.

He was no less influential in promoting free market economics as an alternative to the once fashionable mixed economy consensus that prevailed in the post-war era. He did this at a popular, as well as at a scholarly, level, with a series of articles in Newsweek and other popular journals. He was an excellent communicator, able to explain complex ideas in simple, easily understood language. His "Capitalism and Freedom" remains a classic to this day, still relevant, still persuasive.

His TV series, "Free to Choose," together with the book he co-authored with his wife Rose, were immensely popular, and were hugely influential in gaining popular support for the economics of free enterprise, choice and incentives, and a widespread skepticism of government intervention.

He pioneered many ideas that eventually gained traction, including an end to military conscription in the US, floating exchange rates, and school choice amongst many others. His monetarist views influenced the Federal Reserve's response to the 2008 financial crisis.

He was a supporter of the Adam Smith Institute and took a keen interest in its work in translating sound economic ideas into viable policy options. He addressed ASI meetings, and regularly chatted with its members at meetings of the Mont Pelerin Society, which he continued to attend until his death in 2006. He went out of his way to help others, to support student groups and to lend his wisdom and advice to free market organizations. He even acted as my referee when I applied to Cambridge, with a hand-written note endorsing me.

He was engaging, personable and likeable, nearly always with a smile on his face and a twinkle in his eye as he corrected economic nonsense from his opponents. Happy birthday, Milton; we miss you.

Well done to Enough Project and Global Witness over conflict minerals

You may or may not be aware of the provisions of the Dodd Frank act over conflict minerals. These were pushed by the Enough Project and Global Witness as a way of reducing the violence associated with the mining of tin, tantalum, tungsten and gold in the Eastern Congo. We were originally told that this would cost some $10 million, one cent on each mobile phone made, and pacify the region. Even the SEC says that this has cost some $4 billion just in its first year of implementation. And it appears that it doesn't in fact work either:

There is widespread belief that violence in poorly governed countries is triggered by international demand for their natural resources. We study the consequences of U.S. legislation grounded in this belief, the “conflict minerals” section of the 2010 Dodd-Frank Act. Targeting the eastern Democratic Republic of the Congo, it cuts funding to warlords by discouraging manufacturers from sourcing tin, tungsten, and tantalum from the region. Building from Mancur Olson’s stationary bandit metaphor, we explain how the legislation could backfire, inciting violence. Using geo-referenced data, we find the legislation increased looting of civilians, and shifted militia battles towards unregulated gold mining territories. These findings are a cautionary tale about the possible unintended consequences of boycotting natural resources from war-torn regions, and the use of international resource governance interventions.

The money quote:

The evidence suggests the legislation significantly increased the incidence of looting and the incidence of violence against civilians by at least 291 and 143 percent respectively.

Lord preserve us from well meaning Social Justice Warriors, eh?

Currently Dodd Frank applies only to listed US companies. Global Witness is among those campaigning to have the same provisions written into European Union law for all companies, even down to the level of sole traders.

Should increase the level of violence they say they want to reduce quite nicely that, eh?

Sweatshops make poor people better off

Sweatshops are awful places to work. But they are often less awful than other jobs sweatshop workers could take. And this is the basic argument in defence of sweatshops. When people argue against them, the question we should ask is: “Compared to what?”. Most evidence suggests that sweatshops pay better than the alternatives. It’s hard to collect reliable data in many poor countries, but Ben Powell and David Skarbek’s 2006 paper “Sweatshops and Third World Living Standards” uses wage data given by anti-sweatshop campaigners to estimate wages for sweatshop workers in ten countries compared to average National Income. This, if anything, should underestimate sweatshop workers’ earnings.

Again, it’s difficult to know how many hours the average sweatshop worker does every week, but most anti-sweatshop campaigners suggest that it is more than 70 hours per week. The results should be taken with a pinch of salt, but Powell and Skarbek found that sweatshop wages exceed average income in between eight and ten out of ten countries surveyed, depending on how many hours were worked.

In nine out of ten countries, “working ten-hour days in the apparel industry lifts employees above (and often far above) the $2 per day threshold.” And “in half of the countries it results in earning more than three times the national average”! (Powell's defence of sweatshops, here, is excellent. His book on the topic is self-recommending.)

Critics of sweatshops point to the 1,000+ people killed and 2,500+ people injured by the collapse of the Rana Plaza sweatshop in Bangladesh in 2013. This was indeed grotesque, and evidence of the poor conditions that many sweatshop workers have to work in.

But what is their next-best alternative? Subsistence farming still dominates many of the countries that sweatshops operate in – in Vietnam, 59% of workers are self-employed in farming; 1.5% work for businesses owned partially or fully by foreign firms. And farming – particularly subsistence farming – is one of the most dangerous occupations in the world.

The International Labour Organisation estimates that agricultural workers suffer 250 million accidents every year, and say that in some countries the fatal accident rate is twice as common in agriculture as in other industries. “Out of a total of 335,000 fatal workplace accidents worldwide,” say the ILO, “there are some 170,000 deaths among agricultural workers.” As horrendous as the Rana Plaza incident was, anti-sweatshop campaigners have not shown that sweatshops are more dangerous than sweatshop workers’ next-best alternative.

Sweatshops seem to have good impacts on women in particular. A study by researchers at the Universities of Washington and Yalethat I blogged about last year looked at different villages in Bangladesh – some close to sweatshops, some not.

In the villages close to sweatshops, girls were substantially less likely to get pregnant or be married off (28% and 29% respectively, and this effect was strongest among 12-18 year olds) and girls’ school enrolment rates were 38.6% higher. The authors say that these effects were likely due to a combination of wealth effects (richer families need to marry off their daughters less early, and can afford to send their daughters to school for longer) and the fact that garment factory jobs reward skills, increasing the value of education.

And what do workers themselves think of sweatshops, given not just wages but other non-monetary compensation as well? Using field interviews with thirty-one sweatshop workers in El Salvador, David, Emily, Brian and Erin Skarbek found that “workers perceive factory employment to provide more desirable compensation along several margins.”

This is not to condemn all work done ‘against’ sweatshops. Using data from Indonesia, the World Bank's Ann Harrison and Jason Scorse found that 1990s campaigns to improve conditions for sweatshop workers in the developing world seem to have led to real wage increases without significant unemployment effects, though some smaller factories did close.

The lesson here may be that work that focuses on improving wages and conditions for sweatshop workers, not closing down sweatshops and trying to wash our hands altogether, may be the best approach. Persuading consumers to continue buying things from sweatshops, but to pay a higher price to give those workers a better wage, might be a decent way of essentially 'bundling' a charitable donation into a normal purchase. Unfortunately, most campaigns in Britain seem to be straightforwardly anti-sweatshop.

And even the most noble-seeming campaigns can backfire. UNICEF argues that early 1990s campaigns to reduce child labour in Bangladesh’s formal economy led to children looking for income in much worse places: stone-crushing, street hustling, and prostitution.

It is understandable that anti-poverty campaigners find sweatshops appalling, and work done to improve conditions in sweatshops might be valuable, but too often people forget that blunt campaigns against sweatshops probably end up hurting people. Instead, people should use the awfulness of sweatshops – and even greater awfulness of other jobs – as proof that we need to do more, much more, to give better options to poor people in other countries.

One option might be guest worker programmes, targeted at people from the poorest countries in the world, to allow them to come and work in the developed world so that they can send more money back home for investment. And lower trade barriers to goods from poor countries would help them grow, too.

Sweatshops are particularly horrifying because they make us feel complicit in the suffering of the poor. They are not a good option, but they are the least bad option currently available to many people. Washing our hands of the situation and just closing the sweatshops would make their workers worse off, potentially much worse off. If we want to help people, we should give them new options, not take away existing ones.

A difficult problem but we'd really better try and find a solution

Disturbing news about social mobility in the UK. To he point that something really must be done:

Well-off parents create a “glass floor” for their less academically inclined children ensuring they “hoard the best opportunities” over poorer peers, a study has suggested.

Children from wealthier families but with less academic ability are 35% more likely to become high earners than their more gifted counterparts from poor families, according to findings from the Social Mobility and Child Poverty Commission.

Clearly something just must be done. The report itself is here and commenting upon it we get:

Study author Dr Abigail McKnight from the London School of Economics said: “The fact that middle class families are successful in hoarding the best opportunities in the education system and in the labour market is a real barrier to the upward social mobility of less advantaged children.”

“Children from less advantaged families who show high potential at age five are struggling to convert this potential into later labour market success.”

“Schools could do much more to help children from less advantaged families build on high early potential.”

Difficult to know what to do really. Perhaps some system could be devised whereby we identified those bright but poor children and then gave them the academic, specialist, education which would enable them to make the best use of those talents? Would it be too, too, odd to suggest that they might even be sent to separate schools?

The value of remittances

When it comes to doing development properly, the role of remittances in helping the poorest in other nations plays a pivotal role and yet is considered by many to be a cost to the UK economy - a resource that would otherwise have been spent in the UK, being diverted elsewhere. The efficacy of remittances is also questioned: developing countries have been receiving remittances for years, and what do they have to show for it? These are all false questions and positions.

First, the net cost of remittances to the UK is negligible. In 2013, remittances from people in the UK to people outside of it totalled $2.2bn (outflows). Inflows (remittances into the UK from people outside of the UK) totalled $1.7bn. The net impact on the UK from remittances is $510m, which represents 0.0195% of the UK’s nominal GDP in the same year. Hence, the impact of belonging to a world where remittances are possible, and belonging to one where remittances are condemned, is “negligible” by my reading.

Bearing in mind it is low-cost to us, the only other plausible objection is that it doesn’t do any good. One example of how this criticism is levelled is when it is argued that all remittances do is increase consumption amongst recipients, and is not invested in such a way as to create long-term opportunities for growth.

It’s not clear to me that this is a proper criticism. For one, increasing the amount of resource that is available to an otherwise poor family may result in more consumption, and potentially better consumption. Imagine if the consumption takes the form of food stuffs: although the immediate effect of remittances is on non-investment purposes, these can be seen as an investment in the individuals’ long-term health. And, ultimately, a world in which people eat until they are full rather than going to bed hungry is a better world to live in. But lots of other types of consumption are also effective at improving people’s quality of life - for example, if a family has more resources with which to buy more sources of light, they may be able to work longer in the day and avoid health risks associated with working in more dangerous (i.e. unlit) conditions. Even if there are no such gains, increased consumption is associated with increased welfare - which is in itself good, particularly since the welfare gain is enjoyed by people on the lower end of the income spectrum. It’s not evident a priori that spending remittances on consumption is a bad thing.

But the evidence indicates that remittances have significant supply-side effects, and aren't solely consumption-affecting. A study in Ghana found that remittances were spent in the same way as any other income - split between investment and consumption, rather than focused on consumption. In Mexico, households without healthcare insurance spend on average 10% of remittances on healthcare. Remittances substantially lower the likelihood that children in El Salvador do not enroll into school at all, or leave before the 6th grade. A study of 11 Latin American nations showed that in households with relatively low levels of schooling and healthcare, households receiving remittances had higher health outcomes and were more likely to keep their children in schools.

When it comes to poverty reduction, current studies may, in fact, overplay the impact. The study of Latin American nations argues that many research papers assume a higher impact on poverty than is really plausible, because they do not factor in the fact that the emigrant who is sending their remittances back to the home country would likely have been working had they not left. Nevertheless, even when controlling for this, they find a modest positive effect of remittances on poverty reduction.

The fact that remittances cost the UK relatively little in net terms, combined with the improvements in lifestyle metrics in recipient nations, is a convincing case for them. If we want to do good for those in need, on a global level, we must be committed to permitting remittances and avoid the rhetoric that posits them as being ‘bad’ for the UK. They enable us, as the source nation, to benefit from the skills of the migrants coming to the UK to work, whilst providing welfare and investment opportunities elsewhere. Remittances earn developing nations three times as much as they are sent in aid - rather than forcing transfers via tax, they enable workers to make their own spending decisions with their own earnings from their own labour.

What an excellent argument against the BBC licence fee this is

Not that Ms. Reynolds means it this way of course, she thinks she is producing the concluding argument for the retention of the BBC's licence fee:

Anne McElvoy makes several sound points (“‘The Beeb is not facing involuntary euthanasia’”, Comment). Her easy assumption, however, that BBC radio operates with an unfair advantage – “a serious radio competitor, for example, has never got off the ground…” – must not pass unchallenged. Commercial radio in the UK competes seriously and successfully wherever there is a mass audience to be attracted. It does not, however, compete in “serious radio” because the audience it would attract (for features, documentaries, drama, comedy, etc) is not sufficient to justify the higher costs entailed. What “serious radio” commercial competitor would, for instance, underwrite her regular Radio 3 arts review, Free Thinking, or her Radio 4 series on Charlemagne and his legacy, or even the show where she has now also become a regular, Radio 4’s Moral Maze? Meanwhile, as a frequent visitor to New Broadcasting House, it cannot have escaped her eagle eye that further cuts to BBC radio budgets will seriously threaten the continued existence of any kind of “serious radio”.

Gillian Reynolds

Radio critic, Daily Telegraph

London W2

The point being that there really are things that must be done and can only be done by government and the power to tax. Radio not being one of those of course. There's also a weaker argument that there's things it would be nice to have and where it's worth taxing the masses to produce a benefit to said masses. But what there isn't is a space for the argument that the proles must be taxed in order to provide something of only minority interest. For if something does not justify the costs then we should not be doing it. If producing "serious" radio costs more than can be gained from doing so then this is an activity which makes us all poorer.

The BBC licence fee is a tax of course. And we're really sorry to have to point this out but the point of mass taxation is not so as to provide sweeties for some small section of the metropolitan intelligentsia.

That not many people are interested in "serious" radio is an argument against the tax funding of it: that it doesn't, as claimed, cover the costs of its production is an argument against doing it at all, not in favour of taxing those who are uninterested in it.

Subverting the urge to regulate

Two golf clubs on the Costa Geriatrica north of London play by different rules. Club A pours out regulations and spreads little instructional notices around the course. The new health and safety leaflet is only picked up because it looks like a score card. No one ever reads it. The club even specifies the socks gentlemen are allowed to wear. Club B has none of that. If their Captain suggests a new rule, he is quietly taken to one side and urged to lie down in a dark room until the urge passes. No prizes for guessing which club is the more harmonious. Brussels and Whitehall both trumpet the need for deregulation and then do the opposite. Last week’s Research Note “EUtopian Regulation” discusses whether total regulation could be reduced by competition between the three factories, global, EU, and member states, and concludes that competition might decrease or increase total regulation. It is not the mechanism that matters, i.e. who regulates, but the will to deregulate. We need to take a hard look at the fundamental causes of the urge to regulate and then consider how the vice can be cured.

Yes, it is a vice. For example, complaints about the NHS have grown proportionately to the increase in its “management”, while malpractice in the City has grown in proportion to the number of regulators. I’m not suggesting that correlation is causality, merely that rule-making has improved satisfaction neither in the NHS nor in the banks, nor in golf clubs.

The drivers of regulation are at least threefold:

Cause One is the rise of the lobby group. Unions, NGOs and save-the-worlders all claim to represent ordinary people in pressing for additional regulations. Alongside all those telling government how to spend other people’s money, are those telling government to stop us doing whatever we happen to be doing. In a democracy, we should be free to express our opinions but that is not the same as getting the law changed to remove our freedoms. We should be governed by those we elect, not by those who think they know better. They should be taxed, for a start, on their gross income in order to compensate society for the amount of governmental time they waste.

Cause Two is the excessive number of levels of law-making and law-makers at each level. Every single one of them, like the Captain of a golf club, wants to leave his or her mark on society, to be famous for some Anti-X Act. We even hand out CBEs to these controllistas. Much better would be to reserve medals and pensions for those civil servants who can show that they have simplified and improved our lives. Performance should be measured by outcomes, not activity, i.e. the net reduction of regulation they have achieved.

Cause Three is the excessive number of supposedly independent regulators who have become arms of government. Margaret Thatcher introduced regulators to provide proxy-markets where competition did not exist, e.g. telecoms. The idea was to benefit consumers. Some still push prices down from time to time but too many are now working against consumers, e.g. imposing “compliance” costs, in order to carry out the wishes of government. As government in other colours, we should insist that regulators are funded not by levies on the private sector, but transparently by the government they represent. The squeeze on public expenditure to balance the books would then help bring sanity to regulation.

How can we subvert the urge to regulate? These three solutions should help but we need a much bigger change in the establishment mindset than that. It happened when nationalisation was found to fail and it will happen one day when we recognise the dangers to innovation, entrepreneurship and competition created by these factories of regulation. Bring it on.