This isn't a surprise

Geoffrey Lean gets all excited over in The Telegraph:

Spread the good news: growth does not have to mean destroying our climate A new report shows Britain achieved the greatest cuts in carbon per unit of GDP ever recorded by any country. There is hope for our planet

Well, yes, anyone who had been paying attention knew this already.

Nevertheless, we may yet look back on 2014 as the turning point, the moment that it became clear – beyond doubt – that economic growth need not endanger the climate. In truth – despite commentators' almost unanimous, if erroneous, assumption – growth does not depend on using more energy. Indeed, he British economy has grown by some 270 per cent since 1965, but at the same time its energy use actually fell - from 196.8 million tonnes of oil equivalent then, to 187.9 million now. Yet, in that half century, the number of cars on our roads has almost doubled, while the array of electric gadgets in our homes has proliferated.

The reason we know this already is because it's an assumption that is made in the models that tell us about climate change.

Just to recap. All of the computer models the scientists are using lie atop an economic model. It is necessary to guess at how many people there will be in the future, how rich they will be and what energy sources they are using to power that civilisation. Only then can any calculation of what emissions will be happen, the results of which can be fed into those computer models. And the originals of those models were the SRES. One the families of possible outcomes assumes this:

The global economy expands at an average annual rate of about 3% to 2100, reaching around US$550 trillion (all dollar amounts herein are expressed in 1990 dollars, unless stated otherwise). This is approximately the same as average global growth since 1850, although the conditions that lead to this global growth in productivity and per capita incomes in the scenario are unparalleled in history. Global average income per capita reaches about US$21,000 by 2050. While the high average level of income per capita contributes to a great improvement in the overall health and social conditions of the majority of people, this world is not necessarily devoid of problems. In particular, many communities could face some of the problems of social exclusion encountered in the wealthiest countries during the 20 th century, and in many places income growth could produce increased pressure on the global commons. Energy and mineral resources are abundant in this scenario family because of rapid technical progress, which both reduces the resources needed to produce a given level of output and increases the economically recoverable reserves. Final energy intensity (energy use per unit of GDP) decreases at an average annual rate of 1.3%.

Decent economic growth combined with a decline in energy intensity. Exactly the process that Lean is getting so excited about. The underlying economic processes in this family of models are that of continued roughly capitalist and roughly free market globalisation. That is, the continuation of the trends of the second half of the 20th century throughout the 21st. And those growth and energy intensity rates are simply straight line projections into the future of what happened in the past: straight line projections being usually the most accurate economic forecasts. Tomorrow will be much like today and so on.

And the projections go further. In this assumed world, if we start to double the portion of energy that we get from coal (an absurd assumption even on the face of it) then we are in A1FI, a world where climate change is a large problem. And if we continue to develop and adopt renewables, at roughly the same speed as we did in the late 20th century (note, it does not need to be as fast as in the past 20 years) then we are in A1T and climate change simply isn't a problem.

That is, we assumed, predicted, calculated even, 25 years ago that globalised capitalism plus a bit of technological advance would mean that climate change was not a problem. Lean is now getting all excited because globalised capitalism plus a bit of technological advance is going to make climate change not much of a problem.

It would have helped if he'd been paying attention from the beginning really.

Do also note the implication of this. This meeting of all the grand Pooh Bahs coming up in Paris doesn't matter a damn. Because the problem is already being solved by globalised capitalism plus a bit of technological advance: as the entire climate change juggernaut actually assumed it would 25 years ago.

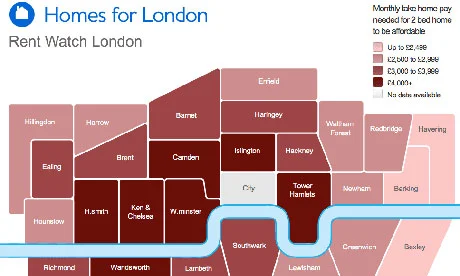

London is hard hit by the housing crisis

The cost of the housing shortage to London's economy is well over £1bn, says this week's report from Fifty Thousand Homes, a new campaign backed by over 100 business leaders and supported by organizations as diverse as London First, CBI London, and Shelter. They publish data compiled by the Centre for Economics and Business Research (CEBR), data that shows the annual wage premium caused by high housing costs is currently £5.4bn annually, and will rise to £6.1bn by 2020 unless action is taken. Furthermore, the unnecessarily high cost of housing is diverting an estimated £2.7bn from annual consumer spending, a sum that could be creating many thousand jobs in the capital. The ASI has repeatedly called for planning changes to make house-building in cities easier, including our most recent paper, "The Green Noose." David Cameron's conference pledge of a national crusade to build 200,000 affordable new homes will be no more than a pious intent unless it is backed by real changes to make new housing possible in and at the edge of cities - the places where people want to live.

As we have said before, significant parts of the green belt are by no means green or environmentally friendly. Building homes on some of this non-verdant land will save many middle and low income workers the long and expensive commute which high housing costs impose upon them.

Now that good economic data has emerged revealing some of the economic costs of poor housing policy, the case for change becomes overwhelming.

TfL’s proposals were filled with nonsense, but what could they do instead?

Madsen, Sam, Charlotte and I have already scrutinised TfL’s recently leaked consultation. The regulations would hammer innovative businesses, reduce competition, raise prices and worsen the quality of transport Londoners receive. The proposals are a conspiracy against the public. Over 130,000 have signed the counter petition. So, what could TfL consult on instead? TfL should be looking for policies that will improve the experience and lower the costs of travel in London. To do this they will need to encourage investment, cut regulation, and harness new technology. Some ideas to get them started include:

Reconsider ‘The Knowledge’ requirement – could drivers who have it certify and prominently advertise this unique selling point? Could others also drive registered hailed cars? Many drivers use mapping apps like Google Maps or Waze, which usually know where to go. These apps can also model a journey based on real-time traffic conditions.

Cut regulations on taxis – reduce the many fees taxi drivers need to pay. Support a more regular dialogue about fares. Allow a greater range of vehicles, which are cheaper and more environmental.

Support car-pooling – rather than hindering innovations, it should be encouraged. Costs are lower for passengers going the same way. It is better for air quality too.

Reconsider tolls and charges – scrap the one-size-fits all barriers of the Congestion Charge. It could be more sophisticated with micro payments based on your actual journey time, location, and number of passengers. Explore privatising major roads and the use of tolls.

Make London the world’s first true driverless car city – a vehicle revolution is coming. Driverless cars will save lives, money and time. We should allow trials on our roads and facilitate the introduction of fully automated vehicles before any other major city.

Push the button on fully automated trains – the Victoria Line pioneered the technology and the DLR operates without a driver at all. Staff could be redirected to supporting passengers.

Fix the basics – trains and the Underground shouldn’t be hurt by faulty signals, bad weather, and a few flakes of snow. When things go wrong, getting a refund could be automatic. In summer, water fountains in stations and air conditioning on trains should keep passengers cool. Barriers on the platform (like in Westminster) should stop people falling or tragically taking their own lives.

Enable drone deliveries – innovators like Amazon are testing drones to deliver packages. Regulations are going to be the biggest hurdle, not technology. Test it out and make it happen first.

Invest in transport by renting prime estate – advertising is not enough. Many transport networks are heavily subsidised by providing space for offices and retail. Hong Kong’s MTR own 13 shopping malls and is filled with underground outlets.

It's remarkable how politics can be driven by simple untruths

We think we're all onboard with the idea that something dreadful is happening to rents in London? They're vast, much too high, soaring ever higher and becoming increasingly unaffordable? Therefore something needs to be done. Possibly rent controls, maybe throw up a couple of hundred thousand prefabs, possibly crucify buy to let landlords or something?

The problem is that the basic original fact is wrong.

The London Assembly asked the Cambridge Centre for Housing and Planning Research to study the possible effects of various restrictions and new tenancy contracts. Including, obviously, some forms of rent control. Said study pointing out the following:

As can be seen private rents have actually risen below wages or CPI on average during the period 2006-2013. This is true both in London and in England as a whole.

Rents are not rising faster than either inflation or wages.

We do not, therefore, have a problem.

And hands up everyone who thinks that the revelation that we do not have a problem will stop people demanding a solution?

Yes, quite.....

This isn't a joke, it's a criticism

The lady who wrote "Who Cooked Adam Smith's Dinner?" has returned to the pages of The Guardian to tell us more about economics:

Economists sometimes joke that if a man marries his housekeeper, the GDP of the country declines. If, on the other hand, he sends his mother to a care home, it increases again. The joke says a lot about the perception of gender roles among economists, but also shows how work done within the home is not counted as part of GDP, but the same work done outside of it is. This economic assumption may seem harmless, but actually has severe consequences for women and girls.

It's not in fact a joke, it's a criticism. It is what Keynes said about Simon Kuznet's work on trying to define how we do measure GDP. This is not some evidence of the patriarchy controlling economics, it's evidence that the problem has been known about and considered since the very start of the whole idea of trying to measure that economy.

As, amusingly enough, one of us explained in an article published on the same day in a different place.

And we all also know what is the answer to that little conundrum. If GDP is value added at market prices, and there's labour adding value but not at market prices, then how do we value the added value of that labour? The Sarkozy Commission considered this and such as Joe Stiglitz and Amartya Sen told us the answer. At the "undifferentiated labour rate" or, as we might more commonly call it, minimium wage.

It's not just that the original set up of the problem is incorrect it's that she doesn't know it's already been solved.....

Sobering thoughts on the Bank of England

I can't say I really trust central bankers. The incentives on them are to over-expand, and create rising prosperity which reflects on them and their political masters. Often they do not even realise they are doing it. But the trouble is that it takes increasing doses to maintain the high, and when you ease off you get a hangover - and real people lose real wealth. Never mind dashing away the punch bowl - don't serve booze in the first place. Keep the economy sober so people can make rational investment decisions.

When you do eventually crash after the previous excesses, I agree that you need to boost the money supply fast - because just as the banks create money in the upturn, they destroy it equally fast in the downturn, and you have to replace at least part of that to bridge the way from the downbeat to the upbeat without, hopefully, hitting the bottom.

I don't think we have a QE system that actually gets cash where it's needed, though. It goes into assets, which is fine for people with assets, but lesser mortals are left high and dry. In the UK, it basically goes into buying up government debt. But like the rest of us, the government can't get out of a fix just by stacking up more debt.

And then you have to be prepared to take all this money out of the system when things start to turn around so you don't get inflationary pressures building. It might be repressed inflation – where the monetary expansion is actually distorting investment decisions, but people are still too nervous to put up prices. But it is still destructive. Again, there is little incentive on a central bank to restrain itself at this point.

I do worry whether the UK's spectacular recovery is in large part due to all the QE we have done (larger, proportionately, than America's). A recovery built on the same thing that brought us the last boom-bust episode. The trouble is, it's hard to know. You could, of course, rely on the market to tell you, as the market probably has a better collective idea than most monetary officials. But that would mean giving up the monopoly control of money. Central bankers aren't going to volunteer for that (though crypto-currency may do it for them).

Europe's monumentally appalling problems are because they have the same boom-bust problems, but a) a bunch of economies that are state-dominated and fat and under-performing, not the best formula for a recovery, and b) countries that should adjust but are locked into the euro so they can't, and c) a complete inability to take on-time monetary decisions anyway because of all the political differences. Sell your shares in the EU!

Some subsidies are not like other subsidies

Austin Healey is arguing that the solar feed in tariff should stay at some gloriously elevated level because:

Mr Healey visited 10 Downing Street to argue the case for a U-turn of the proposed changes last week. The Government currently spends £26bn a year subsidising the fossil fuel industry and £3.5bn on solar: “We think the drop in the tariff is draconian,” said Mr Healey.

The Telegraph helpfully linking that statement to this excellent piece by our own Sam Bowman.

When you read the report, it becomes clear pretty quickly that the IMF’s definition of a subsidy is a little different from everyone else’s. Usually, subsidies describe the government paying money to a firm or industry to encourage production, ostensibly to reduce prices for consumers. Think of the EU’s Common Agricultural Policy, or the cash given to the British steel industry during the Sixties and Seventies. These are unpopular with economists. Subsidies end up making firms bloated, inefficient, and more interested in satisfying government bureaucrats than their customers. And those customers still end up paying for those subsidies with their taxes. But the IMF’s idea of “subsidies” to fossil fuels refers to something completely different. They have taken the indirect costs to society of using energy – air pollution, traffic congestion, climate change – and, if governments haven’t imposed special taxes on one, called it a “subsidy”.

That is, Healey's statement is not actually true, not within the normally accepted meaning of the word "subsidy".

But there's more to it than that. The government does not in fact spend £3.5 billion a year subsidising solar. Rather, it insists that solar should be able to overcharge us for their production. And what is being decided now is that that insistence on the consumer being gouged is to end, or at least decrease.

Yes, it's very definitely a subsidy, a subsidy arising as a result of government action, but it's not government spending upon such subsidy. It's government market rigging to provide it. And the equivalent sum over on the fossil fuel side is, in the best gloss one can put on it, an absence of government rigging the market to account for externalities.

Not all subsidies are the same.

There's a simple solution to this

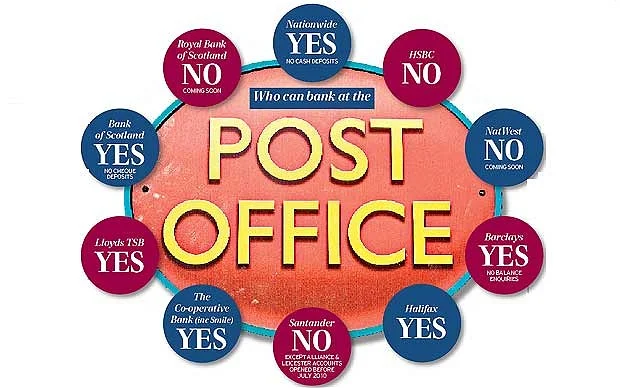

It's entirely possible that the man from the Post Office is right here. That instead of banking when in credit being free, with high charges for not being in credit, it would be better to have a system where all get charged the costs of their activities. Entirely possible that he's right: Free bank accounts are unfair to poor customers and form an unsustainable foundation for the banking system, according to Post Office Money’s chief executive, Nicholas Kennett, who wants to see the industry charge customers regular fees instead.

He believes it is unfair that customers who have to use their overdrafts are charged high fees, which are then used by the bank to offer free accounts to the better-off who rarely pay any fees.

We also have a system to work out whether he is right:

While this may mean that customers who never incur fees and charges are well-served, he argues that charging customers for the services they use would be fairer overall and lead to better service for more account-holders.

In his case, the Post Office offers an account which costs £5 per month and will not let customers rack up unexpected overdraft fees.

Excellent. So, those who think that is the better system will flock to the Post Office to gain access to that better system. Those who do not will not. No one need do anything else. The alternatives exist, all are free to choose between them so choose people will. Which is the best system thus being not something that we can determine a priori, but something emergent from what people do.

You know, this market stuff?

Panem et circenses

We think it's very nice of the Guardian's subeditors to offer us this opportunity to point to and giggle at Polly Toynbee:

Only the BBC could give us Bake Off and Strictly. We must protect it

Polly Toynbee

Because someone, somewhere, was always going to attach that headline above to it.

Yet there's more to this than just a giggle. For it betrays Polly's very patrician idea of what the State is for. It is to provide the entertainments, the diversions, which stop us plebs from rising up and throttling said patricians. Rather than our view of what said State is for, which is to do those few things which both must be done and can only be done by government.

And what really grates is that at least the Romans insisted that it was the patricians that paid for the bread and circuses, Polly's insistent that we must be charged for what she insists we must have:

If the BBC is to be truly independent, it should have written into its charter a permanent guarantee that it will always get a licence fee uprating to cover inflation – so as to keep off the interfering hands of governments, and all the threats and snarls that besiege it from Westminster.

In 100 pages, the BBC defends in detail its need to do the things heavily targeted by its enemies as ripe for selling off. But no commercial channel approaches Radio 1’s 65% new and live music, or the breadth of Radio 2’s specialist niche music. Radio 3 has depth and range but only 10% repeats, compared with unadventurous Classic FM’s 40%.

Read this document when it goes online at midday today and be amazed at what our public broadcaster does for so little cost. It’s a fine reminder of what you get for £12.13 a month,compared with Sky’s average bundle at £61 a month.

If we want it then we'll buy it, thank you so very much, Lady Bountiful.

Why Theresa May be wrong

Theresa May’s Conference speech on Tuesday made some… strong claims about the harms of immigration, and attracted an array of excellent critiques in the media. I want to highlight one flaw that these reactions didn’t discuss in detail. Her argument relied on a constant blurring of the difference between the volume of immigration and the size of net migration flows. The problems she highlighted with immigration fall into two categories – problems with net migration, which generalise to population growth of any kind, and problems with the level of immigration - an influx of foreigners into our society.

She talked about immigrants putting pressure on government finances and education systems. Conspicuously absent was any mention of the fact that (unlike those of us who are scroungers born-and-bred), the majority of immigrants are actually net contributors to the state. Nor did she extend her logic to the hordes of babies and children in the UK who are net burdens on government services – perhaps because, like the children of immigrants, those children will grow up and pay taxes in the future.

The main thrust of the speech, though, focused on the social impact of immigration – the difficulty of creating a ‘cohesive society’ in the face of the 641000-strong huddled masses that came to the UK in 2014. May’s treatment of empirical research on the social consequences of immigration also leaves something to be desired. (For a more nuanced review of the literature, you might be interested in James Dobson’s ASI paper The Ties That Bind).

Approximately 330000 people moved to London in 2013 (including newcomers from elsewhere in Britain, as well as abroad). This is much higher as a percentage of the population than the 485000 outsiders that came to the country as a whole, and a much larger rate of social churn than in, say, the average town in the North-East of England. And yet the collapse of the social fabric has spectacularly failed to materialise. Indeed, London’s schools are better than elsewhere in the country and improving more rapidly, and there is substantial reason to believe that immigrants have a positive influence on this trend.

No one ever seems to worry about a tide of Scots flooding in and diluting our culture, destroying our values. But are they really like us in some fundamental way that French, Spanish and Polish graduates aren’t? Is there something in the water that hardworking Nigerian cleaners have failed to absorb?

The other assumption that went unexamined in May’s speech was that immigration is ‘high.’ There is some level of immigration at which the costs begin to outweigh the benefits. But with every wave of immigration, such claims have been made. In the 1930s: “Thousands of Huguenots were assimilated, but that was over the course of decades – there’s no way the country can cope with tens of thousands of Jewish refugees!” Each time, British society has proved its resilience and tolerance. Why would there be a sudden tipping point when immigration reaches about 1% of total population? There aren’t any compelling reasons to suspect that this time will be different – which might go some way to explaining May’s failure to provide any.