Time to do your duty and tell government what you really think

The government is calling for views on what should be done about ticket scalping:

The Review is focusing on the secondary ticket market for re-sale of tickets for UK sporting, entertainment and cultural events. The Call for Evidence is to enable the Review to look more closely at consumer issues and secondary ticketing.

The Review would particularly welcome responses from event organisers, primary and secondary ticket sellers, online resale market businesses and enforcement bodies. However, anyone can respond, and all responses will be considered.

We suggest that you write to them and tell them what you think. There are those who think that something must indeed be done:

There’s something seriously wrong with the way UK ticket sites and touts operate: tickets for Jeff Lynne’s ELO went on sale at 9am this morning, and by 9.20am there were 4,264 tickets listed for resale on GetMeIn alone.

We of course do not think that there's anything wrong with this at all. And therefore we think that the government should do absolutely nothing in this area. Indeed, we cannot imagine any circumstance in which people should not be allowed to dispose of their legally held property as they see fit. If instead of using a ticket to shimmy down on Monday they decide to throw it into the ocean why not? It is theirs, belongs to them, it is their legal property. Restrictions on what they may do with it simply reduce the essence of it being their property.

It may well be true that acts and or venues aren't pricing tickets so that the market clears. But that's their problem, not something that needs action to ensure that the arbitrage that does clear the market does not take place.

Sorry Jezza, steel plants and banks aren't alike at all

It would appear that Jeremy Corbyn does not realise that one thing is not like another thing: that banks and steel works are not the same.

In a speech to Labour’s Eastern regional conference in Stevenage, Corbyn will say that the prime minister should follow the interventionist route of Gordon Brown during the banking crisis and step in to help workers. “We need Cameron and Osborne to act as decisively in 2015 as Gordon Brown did in 2008, when Labour part-nationalised RBS and Lloyds to prevent economic collapse,” Corbyn will say.

“If the Italian government can take a public stake to maintain their steel industry, so can we. That’s why Labour will be pressing Cameron to use the powers we have to intervene and, if necessary, take a strategic stake in steel – to save jobs and restructure the industry.”

Bailing out the banking system was the right thing to do, bailing out the steel industry would not be. This is not because bankers tend to come from the same background we do while steel workers are northern working class types. Rather, it's essential that a modern economy have a financial system and it's not essential that a modern economy have a domestic blast furnace or two. For it's actually impossible to have anything at all resembling a modern economy without a financial system. But as long as someone, somewhere, has a few blast furnaces then we'll be just fine, we don't actually have to have any, any more than we need to grow our own bananas, coffee or Bourdeaux domestically.

We're not entirely fans of the way that banking was bailed out, that's true enough: rather more shareholders and even banking management might have been led to the chopping block to satisfy our tastes. But that we need to have the system itself is obvious.

There is a further issue as well: imagine that there was indeed a part nationalisation leading to a restructuring of the industry. The outcome of this would be that the very same plants which are now closing would close. Simply because it is still true that a modern economy doesn't need to have so many blast furnaces hanging around. Just as one technical example, the Redcar plant imported all of its raw materials (the original location was because all could be locally resourced but that's long gone). There's little to no economic point in importing such raw materials to transform when we lose money by doing so. Especially as we can have that transformation done for us elsewhere and just import the steel.

Thus nationalisation would, if done properly, change the outcome not one whit. And if it doesn't change the outcome not one whit then the nationalisation wouldn't be being done properly. So, let's save all our money and not do the nationalisation then.

Bureaucracies will grasp at anything, won't they?

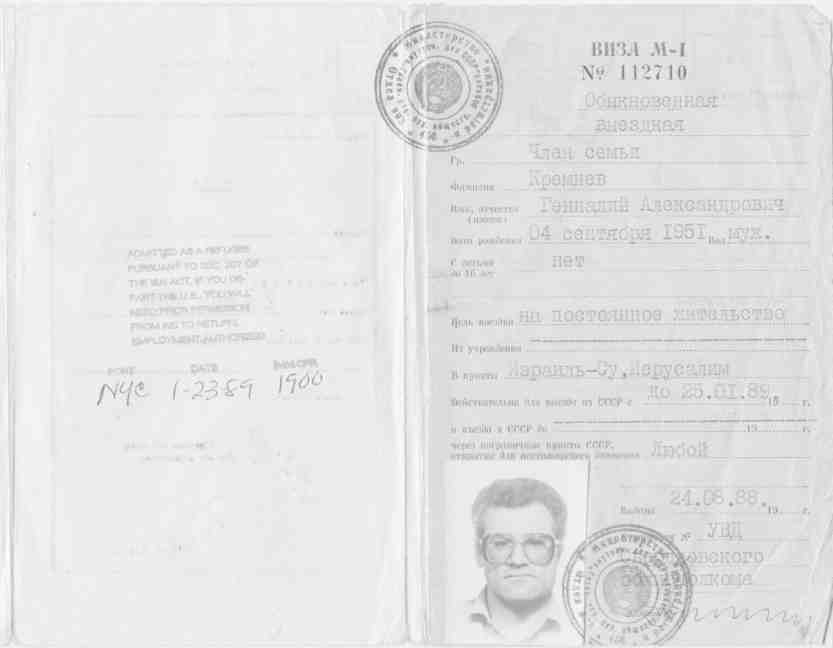

It's undoubtedly true that the political and economic system in Russia has changed, and changed for the better, over the past 50 years. Whatever the downsides of Putinism they're as nothing to the problems with Stalinism. However, the change might not be quite as deep as perhaps we'd all like. Another way of making much the same point is that bureaucracies have their memories too, and they'd often like things to go back to when they had more power:

Russian officials are considering reintroducing Soviet-style exit visas, a senior MP said on Friday, in a move that would severely restrict Russian’s rights to travel abroad for the first time since the fall of the Soviet Union. Vadim Solovyov, the deputy chairman of the constitutional law and state building committee in the State Duma, Russia’s lower house, said the move was one of a number of options being considered in response to the apparent terrorist attack on a Russian airliner in Egypt. “There are a lot of suggestions to introduce exit visas at the moment,” Mr Solevyov said in an interview with a Moscow radio station. “Foreign ministry officials and members of the security services would explain to a citizen what he is risking. And when he has received this official information, confirming that 'yes, I know everything, I understand, and none the less I’m going', he would be granted the ability to leave,” he said.

It's not going to happen of course: the State not having the power to determine whether a Russian may leave Russia is one of the most cherished, as it probably should be, of the rights on offer under the new dispensation. But it's an interesting example of a mindset that still exists, isn't it?

And don't think that it applies only to Russia: there's plenty here at home who long for the past days of greater state power over us all.

It appears that George Osborne doesn't understand the law

This is very puzzling:

Bankers who received taxpayer money during the financial crisis are not unlike shoplifters, Chancellor George Osborne has said.

Speaking at the Bank of England, he said that at the time of the financial crisis, and in the years that followed, there were no laws in place to allow regulators and lawmakers to punish offenders in the financial services sector or bring criminal charges against them.

It's puzzling because it's flat out wrong. In evidence:

Former City trader Tom Hayes has been found guilty at a London court of rigging global Libor interest rates.

He was sentenced to 14 years in prison for conspiracy to defraud.

There's plenty of law to deal with those who have actually committed criminal offences: the proof is rather there in that definition. If it's a criminal offence then there's a law under which it can be prosecuted.

What there isn't is a law, or even a series of them, about bankrupting a bank: that would rather run against the very idea of having limited liability of course. Nor is there a law or series of them about being greedy, misled, ill-informed, over-exuberant or even plain flat out wrong. Fortunately so, for there'd be no one at all left outside chokey if that were true.

And that is what went wrong: it wasn't that the financial markets were all being run by crooks (although there were obviously some in there, as there are in any field of human endeavour) it was that the people in said markets had some incorrect beliefs about the world. And that just ain't and cannot be made into a criminal offence.

Although we think we could be persuaded on one possible change to the criminal law. Along the lines of Sir Pterry's suggestion about Antipodean Prime Ministers. Simply put them in jail the moment they are elected as everyone finds that this saves time. The possible change that we could be persuaded about being that anyone who is spendthrift to the point of shaming terminally alcoholic mariners should be jailed for life. That should sort out the retirement plans for most Chancellors of our collective lifetimes and if strictly enforced would alleviate that terrible pressure on the Lord's dining facilities. For all previous members of the Commons would find themselves with more pressing duties than taking up the ermine.

We don't exactly suggest that this should be so, rather that the more we think about it the more we think we could be persuaded into it.

Ten initiatives to help young people: 2. US/UK visa swap

Employment is a major concern for many young people, both for those who choose not to undertake university education and for those who have done so. Because of concerns about immigration, especially illegal immigration, the governments of both countries have tightened the rules and made it very difficult for citizens of the one country to seek work in the other. The UK government should negotiate a 'visa swap' with the United States to produce a new kind of visa available to young people below the age of 25. Under the new arrangements, young people in Britain would be able to travel to the US for up to two years, and obtain work there without the need for a work permit. Similarly young US citizens would be able to live and work in Britain for up to two years without the need for a work permit. Neither represent a type of immigration that would concern the other country.

If the two governments agreed to such a visa swap it would greatly extend opportunities to the young people of both countries. There are large numbers of young people in Britain who would jump at the opportunity to live in America for two years and work to support themselves there. In the process they would acquire new skills. In particular they would be exposed to the US approach to consumer satisfaction, and learn the standards of service expected there. They would almost certainly return to the UK with attitudes and skills sought by employers, with their career prospects enhanced.

Similarly, large numbers of young people in the US would welcome the chance to broaden their horizons by visiting Britain for a couple of years and working there. They would have the chance to visit the nearby continent of Europe during holidays or time off, and gain experience of foreign countries other than the UK. Most American youngsters are noted for a can-do attitude and a commitment to the work ethic. Working alongside young people in Britain, they could well provide an example that could spread those attitudes.

In terms of international understanding, the Anglo-American relationship would be enhanced if significant numbers of each country's young people had lived and worked amongst their counterparts in the other country. The cultural exchanges and friendships formed would facilitate each country's understanding and appreciation of the other. An arrangement such as this would be immensely beneficial to the young people of each country, enriching their lives with new experiences and opportunities.

Why is the government even involved in this decision?

Whether, where and if on the subject of new runway capacity in the SE has been an argument rumbling along for the entire lifetime of our latest intern here at the ASI. It's entirely possible that the shouting match will continue to rumble along until his scheduled retirement date if the past is a useful guide to the future. And Jeremy Warner manages to get close to what we think is the correct answer:

This is simply to approve new airport capacity at both Heathrow and Gatwick, and possibly Stansted as well, and let the markets decide which to back. Whatever the outcome, they are more likely to get it right than the politicians and the civil servants.

The only reason we don't say it is the correct and complete answer is because Warner is betraying his less than total and complete belief in markets. Something which we agree we are rather absolutist about, the joys of markets and their outcomes, but then there's no shame in being absolutist when you are in fact correct.

And the point here is not that markets are just more likely to get something right than politicians and bureaucrats. It is that the market outcome is the correct outcome, by definition. The market simply being a reification of the voluntary interactions of the some 65 million people in the country, said voluntary interactions obviously being all of us having our little vote on the outcome we desire. And thus the outcome from those voluntary interactions is the correct outcome, whatever that result is. If it's no new runways, three or more of them (why not expand Basildon to take 737s and A320s?) or any other possible permutation of the numbers, just letting everyone get on with it is in fact the correct answer as, by definition, that's what will produce the correct result.

Garett Jones vs. Bryan Caplan on immigration

Garett Jones, one of my favourite economists, has a new book out, Hive Mind, about how the IQ of your compatriots is more important in determining your life outcomes than your own IQ. Since the IQs of people in the developing world is recorded as lower than the IQs of people in the developed world, this means that mass immigration could worsen our lives by lowering average IQ, since this feeds through to lower social trust and worse institutions.

This would reduce the value of open borders as a policy regime. But Bryan Caplan, famous libertarian advocate of more liberalised migration laws, disagrees, and they debate this issue here, in what I think is a very high quality and interesting tussle.

UKTI can deliver an easy quarter billion pounds

There are two schools of thought about United Kingdom Trade and Industry (UKTI), the quango intended to help UK exporters and investors inward to the UK. Supporters say it repays its £529 million annual cost in added value for UK GDP many times over. Critics say it is top-loaded with fat cats, ineffective and a dead weight. It has been in operation for 30 years or so but the coalition government took such a positive view that they seriously up-scaled its budget in the light of its 2010 target to double exports to £1 trillion by the end of the decade. At that point export growth was trundling along at 3.5% p.a. With the up-scaled UKTI what can we now expect? You guessed it: 3.5%. (Office for Budget Responsibility forecast). Exports are likely to increase 33% over the 10 years to £630 billion – a far cry from the £1 trillion target.

I am submitting detailed evidence to the Parliamentary Select Committee that is now looking at UKTI, but the bottom line is that the Chancellor should face reality and halve the UKTI budget to £265 million.

The main recommendations are:

- UKTI is top heavy: it needs more field workers doing what SMEs want and fewer HQ time-wasters. Cutting the HQ from 500 to around 50 is a necessary move, not because it is ultimately the right answer but because it is the only path to discovering how big an HQ is really necessary.

- UKTI has now become a stand-alone executive agency, but UK field (advisory) staff should be integrated with Chambers of Commerce in a similar way to overseas staff within FCO posts.

- Inward investment is largely be a matter for overseas posts and should be driven from there. The UK benefit from inward investment should be assessed on long term net value added, not the immediate effect on jobs and cash flow.

- Potential UK exporters should be put in charge. They should be asked what help, and especially contacts, they want, not be told how to do their business. This should be communicated directly to overseas posts. Overseas posts should then communicate back directly to the originators showing what action has been taken or why it has not.

- UK-based trade advisers should work with potential exporters to improve the quality and clarity of their requests, but they should only be copied in – not be separate, and fallible, links in the chain.

- OMIS and other statistical reports and surveys should be charged at much higher rates with potential users advised of the fallibility of this approach. Successful exporting and inward investment are a matter of overseas personal contacts, not paperwork.

- Measuring UKTI performance by the number of UK contacts allegedly made and/or the number of exporters assisted should also be abandoned. The metric that matters is the value added by UKTI, not the achievements of the exporters themselves or other factors such as the Olympic Games.

- The IT system should be refined to the simplest possible to allow exporters, those in overseas posts and advisors directly to access the status of their own projects – though such a project must start very small, given the government’s dismal track record in IT projects. UKTI can use this information to determine how many staff are needed in overseas posts and the UK and dynamically adjust resources accordingly.

To read the full select committee evidence, read below.

[gview file="http://www.old.adamsmith.org/wp-content/uploads/2015/11/Submission-to-BIS-Select-Committee_2.pdf"]

How do we get the adults into government?

We are ever so slightly worried by this announcement:

The government is proposing a national minimum bedroom size as part of a drive to stop landlords carving up houses into ever smaller rooms to maximise rental income.

Bedrooms in houses of multiple occupation would have to be a minimum of 6.5 sq m (70 sq ft), and landords letting rooms smaller than that would be guilty of a criminal offence.

The proposal was sparked by an outcry over “rabbit hutch properties”, many costing as much as £1,000 a month, as landlords cash in on the booming housing market, particularly in London.

Lots of people wish to live in parts of the country where there are not many bedrooms. Therefore people are living in small bedrooms rather than large ones: that's just what happens. If there's a shortage of food then people eat smaller meals, if the pub runs out of beer then everyone drinks shorts. Shortages lead to smaller measures.

Government would not ban the consumption of gin if beer were to go short, government would not ban smaller plates if food were to be short, so quite why government thinks that the banning of small bedrooms is going to increase the supply of bedrooms is unknown to us.

All we're really left with is wondering how we might manage to get adults into government. You know, the people capable of doing that mature, joined up, thinking stuff?

Sadly, we're not even sure where you'd send the postcard if you did have an idea about it.

Light in the FCA tunnel

The FCA was created to encourage best practice and thereby grow each of the financial services sectors under its oversight. By adopting an adversarial position towards its charges, it has achieved the very opposite of the Chancellor’s intentions, nowhere more so than in the personal financial advice sector. The traditional arrangements for financially advising individuals were turned upside down at the start of 2013 by the FCA’s new rules (in fact a continuation of a policy initiated by its predecessor the Financial Services Authority) known as the “Retail Distribution Review” (RDR) in which Independent Financial Advisors (IFAs) could no longer be reimbursed by the providers of the investments selected, but only by the clients themselves. “Trail commissions”, i.e. the annual fees paid to IFAs by their customers over the lifetime of products such as pensions, with-profits bonds and unit trusts were banned on sales of new investment products from April 2014 and will required to be completely phased out by April 2016. So the client must fund the advisory costs wholly up front instead of being able to spread them over the years of benefit. Is there any regulator, in any sector, anywhere in the world who restricts the way customers pay for services?

The IFAs were presumed by the FCA to be providing advice to maximise their own short-term gain rather than in their clients’ best interests. If the FCA regulated independent shoe retailers, where different shoes also have different styles, features and benefits, the customer would have to hand over £30 before the assistant could advise on shoes. The new rules showed that the FCA has no idea of how competitive markets, or IFAs, work. There are thousands of IFAs, all of whom were already required to make full commission disclosure, and investors can, and should, shop around.

An IFA is trained explain their calculations and show the “present value”, using simple enough techniques such as discounted cash flow and factoring risk. It is not quantum physics and if the investor does not understand every detail, it matters not. Present values of investment proposals are no more difficult to compare than house prices.

Sometimes IFAs split commission with their clients to be more competitive. IFAs businesses are built on long client relationships which would be destroyed by diddling their customers.

The clients of IFAs and shoe shops alike resent having suddenly to pay for what had always seemed free and, furthermore, to pay for advice before they had the benefit from it. It is a bit like expecting consumers to pay for groceries in one month and receive them the next. Needless to say, to the extent that IFAs and their advisees were consulted, their opinions were ignored. The FCA knew best.

The FCA torpedoed the market it was supposed to be nurturing. According to Heath Report II which uses the FCA’s own figures, by March 2015 two thirds of the individuals previously seeking financial advice no longer did so: 23 million had dropped to 7 million causing 13,500 IFAs, and about the same number of administrators to lose their jobs. The FCA claimed, with very dubious arithmetic, that the old system cost clients £233 million but their remedy is costing £344 million. And all these losses are before Trail commission is fully phased out.

It is truly extraordinary that HM Treasury should hand older people unlimited access to their pension pots precisely at a time when the FCA has removed the market’s capability to advise them.

But there is light ahead. The head of the FCA has been replaced and, jointly chaired by his successor and a senior HMT civil servant, a new review started work last month which “will consider the current regulatory and legal framework governing the provision of financial advice and guidance to consumers and its effectiveness in ensuring that all consumers have access to the information, advice and guidance necessary to empower them to make effective decisions about their finances.”

Would it not be wonderful if sense prevailed?