Sadly, the IFS is wrong here

The IDS has a report out talking about how wealth is unequally distributed in the UK. And it's a good report, ticks all of the procedural boxes and emphasies one very important point. It's also entirely wrong.

The full extent of the wealth gap between Britain’s rich and poor has been laid bare by a thinktank report showing that 9% of households have no assets while 5% are worth in excess of £1.2m.

The study by the Institute for Fiscal Studies shows that the UK is a more unequal country when measured by wealth – the value of assets such as housing, pensions and shares – than it is when measured by income.

Obviously wealth inequality is higher than income: it's possible to have that negative wealth and we don't ever measure negative incomes. And the report (here) does emphasise an important point, that there's a life cycle to wealth. Generally, the young have no wealth, those on the verge of retirement are at the wealthiest they will be and then wealth declines as pensions are drawn down.

Except the report is still wrong. Because it doesn't include any of the things that we do to reduce the effects of wealth inequality. On pensions, for example, a private pension, or a public one earned from a job, is wealth: which it is. But the state pension is not wealth. and yet it's wealth in just the same sense that the other pension rights are.

Similarly, we count housing equity: but a lifetime tenancy at below market rents, like a council house, is also wealth and we don't count it.

The net effect of this is that all such reports (and we must emphasise that all such reports do work this way) measure the gross wealth inequality. It's as if we measured income inequality only by market incomes. And we don't, we measure income inequality after the influence of the tax and benefit systems. We ought to measure wealth inequality the same way but we don't.

After all, what we want to know is, should we be doing more here? And we cannot possibly even think about that until w know the situation after what we do do.

Ten initiatives to help young people: 4. Personal service jobs tax deductible

Let down by the inadequacies of our education system, some young people leave school without any meaningful qualifications, and find it hard to obtain unemployment. Meanwhile, many successful men and women in work find it difficult to balance the needs of a working life with domestic chores such as looking after children, keeping gardens tidy, and doing odd jobs around the house. The domestic commitments make them less focused and less productive. The two could be matched, given appropriate incentives. Young people with scant qualifications could work as nannies, au pairs, handymen, gardeners and, if they were put through their driving test, as chauffeurs. Taking into account minimum wage and National Insurance, however, the cost of employing people in personal service would be beyond the means of many working people.

Given people to help with personal services, successful men and women could have more of their time to do work, and raise their productivity and their contribution to the nation's economy. Government could facilitate this by making it a tax-deductible business expense for people to employ young people under the age of 25 in personal services such as those listed above.

The gains would be immense to both sides. Freed from the hassle of domestic chores, the business people would gain time to concentrate more on their work. The young people would gain employment, and would acquire skills and experience to render them more employable in the future. They would have the habits, experience and discipline of work, and would enhance their CVs with good references. Furthermore, they would have the examples of successful businessmen and women as role models, encouraging them to raise their own sights.

There would be on-the-job training, with their employers coaching them in the requirements for acting as chauffeurs, gardeners, handymen, nannies, household assistants and the like. It could be a requirement for tax deductibility that the employers would agree to train their employees in this manner.

There would, of course, be a tax cost to the Treasury if such employment were made tax-deductible. But it would be offset by huge gains in employment, with fewer young people out of work, and fewer of them entering adult life without marketable skills. Fewer of them would be dependent on state support in future. The gains resulting from this would outweigh the costs.

It's what you believe that ain't so that's the problem

An American writes in The Guardian:

An American writes in The Guardian:

When an American talks about a “welfare state”, they’re talking about scattered programmes such as food stamps, tiny cash benefits and milk and formula vouchers for infants and pregnant women, which together provide a fraction of the benefits a British citizen is entitled to.

This is not in fact so. As that little chart shows. It comes from Lane Kenworthy, one of the better researchers into inequality and poverty in the US. The definition of the chart is:

Figure 6. Tenth-percentile household income Posttransfer-posttax household income. The incomes are adjusted for household size and then rescaled to reflect a three-person household, adjusted for inflation, and converted to US dollars using purchasing power parities. “k” = thousand. “Asl” is Australia; “Aus” is Austria. The lines are loess curves. Data sources: Luxembourg Income Study; OECD.

And his comment upon it:

OUR POOR AREN’T ESPECIALLY WELL-OFF America’s affluence doesn’t trickle down to everyone in a straightforward fashion. As figure 6 shows, the income of US households on the lower part of the income ladder is below that of their counterparts in many comparator nations.

Below that in many countries and as the chart shows, above that here in the UK. The point being that America provides a standard of living to its poor very much the same as those provided by the supposedly much more generous European countries. All are managing something between $10k a year and $30k and the US is slap bang in the middle.

All of which brings to mind Mark Twain's aphorism, that it's not what you don't know that's the problem, it's what you believe that ain't so that is. The US does have a welfare state and it produces much the same result as those of other countries.

However, there is one major difference. Which is that the US is a much more unequal country, even after the influence of that tax and benefit system. And we, being the pure utilitarians that we are, think that's fine, that's great even. For we do run with the idea that a certain minimum is going to be provided to those who cannot provide for themselves. We might argue about how that is done but we're fine with the basic set up. But once that is achieved we want the greatest good of the greatest number. And that means that once that minimum is in place then we want everyone above it to be able to thrive as much as possible.

Which is exactly what the American system provides of course: and is the explanation for that greater inequality. Because they only worry about providing that minimum, and not the inequality itself, then they tax the rest of society less, allowing it to thrive more. Sounds like a plan to us.

Yes, that's the point

The Daily Mail has got itself all hot and bothered about the price of pharmaceutical drugs. They cost perhaps £100 to manufacture and are then sold to us for possibly £100,000 a treatment. Worse, poorer foreign countries get charged less than we do. As they say:

Indeed, global drug market analysts suggest England's high drug prices are subsidising the supply of cancer drugs elsewhere, with one saying they may be anything up to 90 per cent cheaper in developing countries. 'Even within Europe prices can vary by 50 per cent or more,' says Christian Glennie, head of healthcare research at Edison Investments in London. 'It is impossible to find out what healthcare purchasers are actually paying, but ultimately it is down to what the local market will bear.'

At which point we do rather have to spoil the most enjoyable outrage by pointing out that this is exactly the point.

These drugs all cost some $1 billion to find, create and test. They're administered to a limited number of patients in any one year and they need to make their money back within a decade (the patent lasts for 20 years, but approval usually takes a decade of that time). Thus they're going to be fearsomely expensive for that decade. At which point they transition to generics and they become hugely cheaper.

Further, yes, the rich world gets charged very much more for these drugs: because it's the rich world, see? The existence of these new treatments can be seen as a public good and why shouldn't the rich pay more for something like that than the poor? It's no different than rich people paying higher taxes to fund other public services like the NHS itself than the poor do.

All of the things that the Mail is complaining about are not faults in the system, blips that we need to do something about. They are the very point and purpose of said system, they're why we do what we do.

Finally, we do not set this up so that pharmaceutical companies make profits on the money they have already invested. We are not talking about anything righteous or just here. It is a purely utilitarian calculation: we want people to invest in the next round of curing the diseases that ail us. To do so we've got to allow the people who spent in the last round of such investment make money. Incentives do, after all, matter.

What happens when you ban e-cigarettes

A quick note on what happens when governments ban e-cigs: cigarette smoking rates rise among teenagers.

Regression analyses consider how state bans on e-cigarette sales to minors influence smoking rates among 12 to 17 year olds. Such bans yield a statistically significant 0.9 percentage point increase in recent smoking in this age group, relative to states without such bans. Results are robust to multiple specifications as well as several falsification and placebo checks.

And, from an earlier version of the paper:

Among those with the highest propensity to smoke, ecigarette use increased most while cigarette use declined: a 1.0 percentage point rise in ever use of e-cigarettes yields a 0.65 percentage point drop in this subgroup’s current smoking rate.

The idea that e-cigarettes 'glamourise smoking' has always struck me as being extraordinarily stupid. Turns out I was right. Now, will people who should know better like Public Health England please stop trying to get e-cigs turned into prescription-only medications?

Time to pay for your own innovation mateys

We're approaching that time of the year when the Chancellor hands out the sweeties in the Autumn Statement. And so there's the usual calls for this or that sector to be given more sweeties. It is, as Mancur Olson said democracy degraded into, that time when the special interest groups get to carve up the flesh cut from the bodies of us taxpayers. And so we have industry making the ritual call, as predictably as pigs squealing at the sound of the swill bucket:

Manufacturers are set to unveil more gloom as their champions warn the Chancellor that the UK could be left in the industrial slow lane by cuts in support for innovation and exports.

"Cuts in support" equals less of our money.

Manufacturers are warning George Osborne that Britain risks squandering years of investment in hi-tech research and business support if he cuts support for innovation at the spending review next week.

"Innovation" is such a lovely word, isn't it? For we all like innovation and if government spends money on innovation then obviously we'll get more of it. Lovely! Mariana Mazzucato is right, the state can be entreprenurial.

Except of course that as with most academics at Sussex, she's not right, as Matt Ridley has pointed out:

In 2003, the Organization for Economic Cooperation and Development published a paper on the “sources of economic growth in OECD countries” between 1971 and 1998 and found, to its surprise, that whereas privately funded research and development stimulated economic growth, publicly funded research had no economic impact whatsoever. None. This earthshaking result has never been challenged or debunked. It is so inconvenient to the argument that science needs public funding that it is ignored.

In 2007, the economist Leo Sveikauskas of the U.S. Bureau of Labor Statistics concluded that returns from many forms of publicly financed R&D are near zero and that “many elements of university and government research have very low returns, overwhelmingly contribute to economic growth only indirectly, if at all.”

This is just Uncle Milton's four ways of spending money. If you're spending someone elses' money on someone else, as government does with innovation funding, not much will come of it. And if you're spending someone elses' money on yourself, as business does spending that tax innovation money, then the results are little better. But if you spend your own money on yourself, then efficiency and efficacy are the two prime targets and outcomes.

So, yes, let's increase the amount of innovation in UK companies. We would even like to increase the efficiency and efficacy of such spending. Which means reducing to zero the ineffective taxpayer funding of it all and telling companies to fund their own research and work themselves.

Ten initiatives to help young people: 3. Redressing the age imbalance

Several analysts have made the point that there is redistribution from relatively poor young people to comparatively affluent older people, and have suggested that this is unfair. Politically, the elderly have more clout because there are twice as many of the over 65s as there are of the under 25s, and they are twice as likely to vote. This means they are four times as effective in voting terms, a fact that politicians have taken account of. Popular perception of the circumstances in which pensioners live is somewhat out of accord with modern reality. The image of a woman with a blanket over her shoulders, huddled over a fire and wondering if she can afford to toss another stick onto the flames does not accord with present day reality for most pensioners. Some 86% of pensioners live in households with assets in excess of £50,000. The average income of over 65s is £15,400. A young person working on current minimum wage for a normal working week earns just under £13,000. Yet the young person is taxed while the older person is guaranteed a triple locked pension that will rise with inflation, or average earnings, or 2%, whichever is the highest. On top of this comes a winter fuel allowance, a Christmas bonus and a free bus pass.

It is doubtful if this can be sustained in the long term. Government will not end the triple lock in this Parliament because they made a manifesto pledge not to, but for the next Parliament they should consider reverting to indexing pensions in line with the consumer price index, as used to be the case. This would enable them to reduce taxes on low-paid young people.

A proportion of pensioners do live in straitened circumstances, and even though their pension would rise to keep abreast of inflation if it were indexed to the CPI, some would need additional help. If the government did abandon the triple lock in favour of rises with price inflation, they might need to establish an Emergency Relief Fund to deal with older people in poverty. Government might choose to contract out to charities the task of locating such people.

The measure would, without doubt, give government the slack it needed to ease the taxation of low-paid young people, giving help where it was most needed.

Time to do your duty and tell government what you really think

The government is calling for views on what should be done about ticket scalping:

The Review is focusing on the secondary ticket market for re-sale of tickets for UK sporting, entertainment and cultural events. The Call for Evidence is to enable the Review to look more closely at consumer issues and secondary ticketing.

The Review would particularly welcome responses from event organisers, primary and secondary ticket sellers, online resale market businesses and enforcement bodies. However, anyone can respond, and all responses will be considered.

We suggest that you write to them and tell them what you think. There are those who think that something must indeed be done:

There’s something seriously wrong with the way UK ticket sites and touts operate: tickets for Jeff Lynne’s ELO went on sale at 9am this morning, and by 9.20am there were 4,264 tickets listed for resale on GetMeIn alone.

We of course do not think that there's anything wrong with this at all. And therefore we think that the government should do absolutely nothing in this area. Indeed, we cannot imagine any circumstance in which people should not be allowed to dispose of their legally held property as they see fit. If instead of using a ticket to shimmy down on Monday they decide to throw it into the ocean why not? It is theirs, belongs to them, it is their legal property. Restrictions on what they may do with it simply reduce the essence of it being their property.

It may well be true that acts and or venues aren't pricing tickets so that the market clears. But that's their problem, not something that needs action to ensure that the arbitrage that does clear the market does not take place.

Sorry Jezza, steel plants and banks aren't alike at all

It would appear that Jeremy Corbyn does not realise that one thing is not like another thing: that banks and steel works are not the same.

In a speech to Labour’s Eastern regional conference in Stevenage, Corbyn will say that the prime minister should follow the interventionist route of Gordon Brown during the banking crisis and step in to help workers. “We need Cameron and Osborne to act as decisively in 2015 as Gordon Brown did in 2008, when Labour part-nationalised RBS and Lloyds to prevent economic collapse,” Corbyn will say.

“If the Italian government can take a public stake to maintain their steel industry, so can we. That’s why Labour will be pressing Cameron to use the powers we have to intervene and, if necessary, take a strategic stake in steel – to save jobs and restructure the industry.”

Bailing out the banking system was the right thing to do, bailing out the steel industry would not be. This is not because bankers tend to come from the same background we do while steel workers are northern working class types. Rather, it's essential that a modern economy have a financial system and it's not essential that a modern economy have a domestic blast furnace or two. For it's actually impossible to have anything at all resembling a modern economy without a financial system. But as long as someone, somewhere, has a few blast furnaces then we'll be just fine, we don't actually have to have any, any more than we need to grow our own bananas, coffee or Bourdeaux domestically.

We're not entirely fans of the way that banking was bailed out, that's true enough: rather more shareholders and even banking management might have been led to the chopping block to satisfy our tastes. But that we need to have the system itself is obvious.

There is a further issue as well: imagine that there was indeed a part nationalisation leading to a restructuring of the industry. The outcome of this would be that the very same plants which are now closing would close. Simply because it is still true that a modern economy doesn't need to have so many blast furnaces hanging around. Just as one technical example, the Redcar plant imported all of its raw materials (the original location was because all could be locally resourced but that's long gone). There's little to no economic point in importing such raw materials to transform when we lose money by doing so. Especially as we can have that transformation done for us elsewhere and just import the steel.

Thus nationalisation would, if done properly, change the outcome not one whit. And if it doesn't change the outcome not one whit then the nationalisation wouldn't be being done properly. So, let's save all our money and not do the nationalisation then.

Bureaucracies will grasp at anything, won't they?

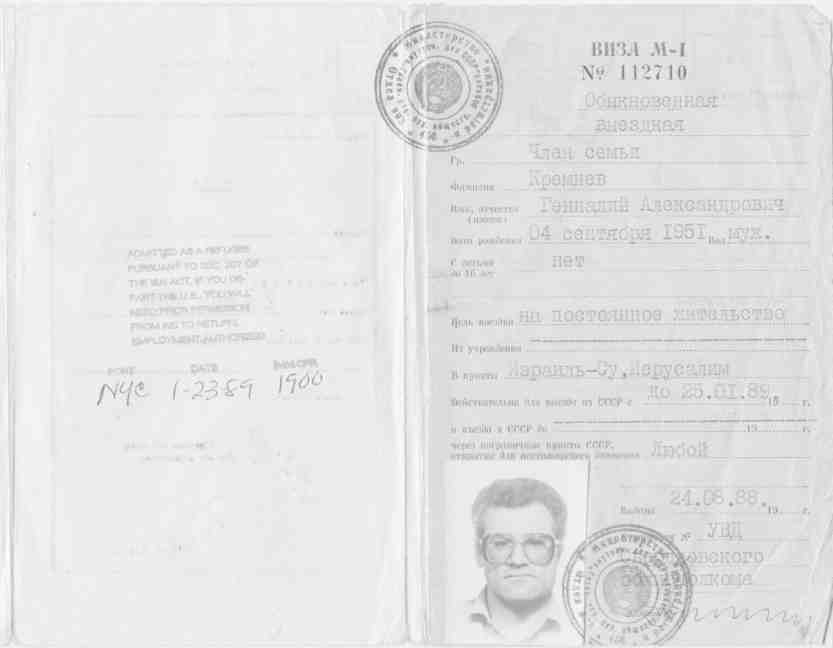

It's undoubtedly true that the political and economic system in Russia has changed, and changed for the better, over the past 50 years. Whatever the downsides of Putinism they're as nothing to the problems with Stalinism. However, the change might not be quite as deep as perhaps we'd all like. Another way of making much the same point is that bureaucracies have their memories too, and they'd often like things to go back to when they had more power:

Russian officials are considering reintroducing Soviet-style exit visas, a senior MP said on Friday, in a move that would severely restrict Russian’s rights to travel abroad for the first time since the fall of the Soviet Union. Vadim Solovyov, the deputy chairman of the constitutional law and state building committee in the State Duma, Russia’s lower house, said the move was one of a number of options being considered in response to the apparent terrorist attack on a Russian airliner in Egypt. “There are a lot of suggestions to introduce exit visas at the moment,” Mr Solevyov said in an interview with a Moscow radio station. “Foreign ministry officials and members of the security services would explain to a citizen what he is risking. And when he has received this official information, confirming that 'yes, I know everything, I understand, and none the less I’m going', he would be granted the ability to leave,” he said.

It's not going to happen of course: the State not having the power to determine whether a Russian may leave Russia is one of the most cherished, as it probably should be, of the rights on offer under the new dispensation. But it's an interesting example of a mindset that still exists, isn't it?

And don't think that it applies only to Russia: there's plenty here at home who long for the past days of greater state power over us all.