The NGDP Targeting Reader

You might have seen our new paper Monetary Policy After The Crash: Lessons learned? call for the Bank of England’s 2% CPI Inflation mandate to be scrapped and replaced with a Nominal GDP target.

The report’s author Prof Anthony J. Evans persuasively sets out the problems with the Bank of England’s current mandate and explains why we need to adopt a new target and reform the Bank’s Open Market Operations.

It’s an idea with a strong intellectual pedigree. The Bank’s current Governor Mark Carney has flirted with the idea. Michael Woodford, considered by many to be the world’s leading monetary economist, also backs the proposal. Christina Romer, who served as Obama’s Chief Economic Adviser endorsed it. And Greg Mankiw, Dubya’s Chief Economic Adviser and author of the best selling economics textbook, has shown that Nominal GDP targeting performs well compared to other monetary policy rules. Other supporters include Nobel Laureate Bob Lucas, Cato’s George Selgin and perhaps even F.A Hayek.

Rather than explain the idea here (I’ve done that in CapX today). I thought I’d share what I thought were the best introductions to the idea out there.

Scott Sumner’s excellent blog The Money Illusion is probably the best place to start. We’ve published two papers by him The real problem was nominal and The Case for Nominal GDP Targeting. They’re both great papers but for my money, the former is a better introduction to the ideas of market monetarism, while the latter is better at highlighting the specific advantages of Nominal GDP over inflation targeting.

Our former Executive Director Sam Bowman’s Nominal GDP Targeting for Dummies is the best explanation of the ‘musical chairs’ model of why recessions happen.

And our former Head of Research Ben Southwood did an excellent job at skewering common misconceptions around monetary policy, including:

It’s bad if QE increases asset prices. And for that matter that QE only increased asset prices.

That raising interest rates will make house prices affordable

It’s also worth reading Anthony’s other Adam Smith Institute report Sound Money: An Austrian proposal for free banking, NGDP targets, and OMO reforms.

Enjoy!

To introduce Oliver Kamm to the concept of markets

The point of a market - any market, in anything - is to swap one thing for another. The desirability of doing so can stem from all sorts of sources. Could be just that someone is better at something than another. Could be that government action is making such so. Could be a different method of organisation, natural endowments, prodnoses banning something, but the secret to the market part is the swap and nothing else.

Mr Johnson’s big idea is that Remain and Leave voters should unite to ensure that Britain takes advantage of regulatory divergence from the EU and creates a prosperous future. It’s a preposterous notion. Mr Johnson appears unaware that regulation in tradable goods and services exists for reasons entirely unrelated to bureaucratic meddling by Brussels. Standards in food safety, product safety and financial services are there to protect consumers.

British commerce is currently able to sell to EU countries unhindered by tariffs or non-tariff barriers. The EU is not just a free trade area but a single market. If you make a virtue of not adhering to common standards with Britain’s closest trading partners, you’d better have a good idea of what will replace that relationship.

We've regularly pointed out around here that markets in forms of organisation are just as important as any other. We're entirely fine with the idea that cooperatives, or other forms of communal, even socialist, organisation will outperform, in certain circumstances or sectors, more capitalist forms. Even that the State does some things better than non-state actors. Our point always being that we've got to have a market in such things so that we can see which is doing it better.

Exactly and entirely the same is true of regulation and standards. Once we get past the basics already there in common law - don't poison the consumers sort of things, possibly harms to third parties - then we positively don't want the one set of rules. We want the competition to see which actually is better, we need the market.

To take just the one example, current EU law states that a vacuum cleaner with an engine (hmm, technical things aren't quite our bag, motor?) over a certain power may not be sold. We'll never know whether people want one such unless they're allowed to express that preference by buying one, will we? That is, without competing regulatory systems, one which allows and another which does not, we'll never know which system works - "work" being, as always, defined as what makes the consumers as rich as it is possible for them to be?

Far from UK regulation diverging from EU being a problem with Brexit it's actually one of the major points and purposes of the process.

In defence of library fines

A recent article in the i presented the results of a freedom of information request regarding the total overdue book fines collected by university libraries – the article states that 130 university libraries collected fines totalling around £3.5 million in the academic year 2016/2017. The article’s slant towards university libraries charging fines for overdue books being somehow ‘unjust’ is clear – see, for example, the article’s use of Bath and Chichester as universities that have abolished such fines for students, as well as the quoting of the shadow Education Secretary (for some reason) thinking this is related to Vice-Chancellor’s pay.

However, the article fails to take into account the fact that charging fines for overdue books is actually a good thing – specifically, it allows what economists call the ‘(partial) internalisation of an externality’.

An ‘externality’ arises when someone undertakes an activity but does not incur the full societal cost of such an activity. For example, suppose that a pristine hill view is enjoyed by a large group of people, but now a factory has started producing widgets nearby and as a result also releases copious amounts of black smoke that spoils that view. Although the factory would be paying for things such as the energy and raw materials required to produce its widgets, it would not be paying anything to account for the fact that it was spoiling what was once a lovely view. Hence, the factory’s production imposes an externality on those that used to enjoy the view.

In the same way, someone holding an overdue library book imposes an externality on others that want to borrow that book. It is free for a person to borrow the book, and in the absence of fines for keeping it for too long, it is free for the person to keep hold of the book. This means that other people that would want to borrow the book but cannot do so now incur a cost in terms of a delay in when they are able to borrow it.

Returning to the factory example, now suppose that the factory was required to pay a sum to the local council in order to take account of the amount of pollution it creates when it is producing – in this scenario, the factory will realise that the more it produces, the more it pollutes and the more it will have to pay the council. In this way, the factory would now take into account the costs it creates for society as well as the costs it incurs itself – hence, the factory now ‘internalises’ the externality.

Likewise, charging people for keeping books overdue means that they now realise that they take into the cost to society of doing so. In other words, charging for keeping books overdue is an improvement for society as other students can also borrow the books that they need in a timely manner.

Although one could claim that the size of fines charged by university libraries is too high, from what I can recall they are set at a level lower than those charged by ‘normal’ public libraries (it would be interesting to see if there was much variation in the size of fine charged across the type of library, its location etc).

Moreover, there is an argument to be made that university libraries should charge higher fines than those charged by normal libraries. In particular, there are likely to be between 50-150 people on the same university course, with a sizeable proportion of them wanting to read the same book at the same time, whereas a public library is highly unlikely to have such large contemporaneous demands for a specific book. Hence, the size of the externality resulting from an overdue book in a university library is likely to be higher than it is in a public library, meaning that the fine levied by the university library should be higher than that charged by other libraries.

Nevertheless, the thinly-veiled slant of the article that ‘university library fines are another way that universities are out to get money from students unjustly’ is not supported by simple economic theory. Indeed, it is highly likely that students actually benefit from the charging of fines for overdue books.

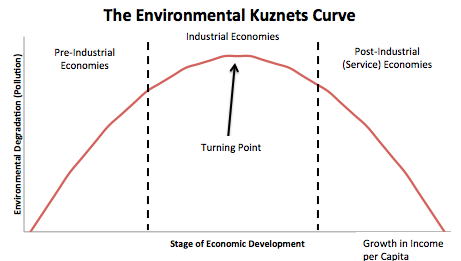

Introducing John Vidal to the environmental Kuznets curve

It's not that people disagree with us, we've been known to disagree with ourselves. And not just among ourselves, but within each. Nor is it that people don't know things - we're ignorant on many a subject. It's that all too often the people who would tell us all what to do believe things which just ain't true. As with John Vidal:

A eureka moment for the planet: we’re finally planting trees again

John Vidal

That the forests are coming back is just fine of course. It's this idea that there's anything new, or even anything that's just happened, which is wrong. Simon Kuznets pointed to an observation, that environmental curve. When the task of life is to do anything to make today's dinner the environment gets the short end of the stick. Once food, clothing, shelter and so on are roughly enough dealt with we devote some portion of our rising incomes to doing things in slightly more expensive ways - ways that don't harm that environment, moving on with yet greater incomes to things which restore its near pristine nature. The Thames has salmon in it again after a several hundred year gap of it containing not much more than sewage.

As to forests - the low point of US tree cover was in the 1920s. Note that the environmental curve is an observation, not a theoretical construct. So when the peak (or trough) occurs is not something to be calculated but seen. We can also always find specific reasons other than just general wealth. That US reversal largely coming from abandoning the hard scrabble farms of New England and their gradual reversion to forest over the intervening century. Yet we do have a good guide from this and other episodes to give us an idea of the level of economic development at which it happens. A rough sketch being a little before where China is now, a little after where India is today.

Note that nothing was actually done other than not doing anything to the land. Those sweeping vistas of colour so enjoyed in the Fall as the leaves change and fall are modern, the result of simply not farming that land for 100 years.

That is, the environment is a luxury good. No, this is a technical definition, it's something we spend more of our income upon as incomes rise.

Now, we don't expect everyone to know this although it would be nice if they did. But John Vidal was environmental correspondent of The Guardian for many years. He doesn't think this is all true. And surely he should know and understand it?

Introducing the Madsen Moment

One of the core activities of the Institute is to engage and inform. We love to entertain while we explain the world as it is and so we have an exciting new project to let you know about.

We've started recording the Madsen Moment – a weekly video (out every Tuesday) starring President of the Adam Smith Institute, Dr Madsen Pirie. These bitesize explanations are purpose made to be shared via social media and our first three are out now and you can catch up on these on YouTube via the links below:

1) Contingency & why you should have a healthy scepticism over economic forecasts

2) Why Corbyn should look to Deng Xiaoping, and not Mao Zedong, to understand Chinese economic growth

We hope you enjoy them, subscribe to the channel and share them!

Just when does Venezuela need to build a wall?

An interesting little point is that the Berlin Wall has now ceased to exist for longer than it did exist. But we shouldn't forget it nor its lesson. One that Venezuela is going to have to think about:

Venezuela’s neighbours are tightening their borders, alarmed by the exodus of hundreds of thousands of desperate refugees fleeing hunger, hyperinflation and a spiralling political crisis.

Brazil and Colombia are sending extra troops to patrol frontier regions where Venezuelans have arrived in record numbers over recent months.

Colombia, which officially took in more than half a million Venezuelans over the last six months of 2017, also plans to make it harder to cross the frontier or stay illegally in Colombia. Brazil said it will shift refugees from regions near the border where social services are badly strained.

The economic crisis and food shortages which have driven so many from their homes show no signs of easing.

The International Monetary Fund forecasts hyperinflation in Venezuela will hit 13,000% this year, so most salaries are now worth the equivalent of just a few British pounds a month.

So, when do they start to build a wall restricting the number who can flee from the joys and pleasures of socialism?

Note well how such walls and barriers are built - the machine guns face inwards, to stop the people leaving, not outward to prevent invasion.

So, enough with the snide jeering already and to the important point. This is showing that greatest of democratic freedoms, the ability to vote with one's feet. The very thing which hte global imposition of any system denies for in a truly global system of governance there is no where to go to flee from it. Or as we might put it, competition among systems and structures of governance improves matters just as much as similar competition between supermarkets, car suppliers or phone companies improves our experience of those things.

Review: The Captured Economy

The Captured Economy: How the powerful enrich themselves, slow down growth, and increase inequality by Brink Lindsey and Steven M. Teles

There is a tendency on the right to confuse a defence of the status quo with a defence of free market capitalism. Left-wing concerns about a rising share of the national income flowing to the top 1% are typically dismissed. “Equality of opportunity not equality of outcome” is the canned response. The problem is that today’s distribution of wealth is not the sole result of a fair market process, rather regulations restricting competition and construction have redistributed wealth upwards.

In The Captured Economy Brink Lindsey and Steven Teles, scholars at the Niskanen Center, show how the American political system has enabled rent-seeking elites to stifle competition through regulation and subsidy. The traditional trade-off between greater equality and slower growth has broken down. Regressive regulations not only enrich the politically connected, they also contribute to wage stagnation and eliminate economic opportunities for the marginalised.

Often regressive regulations have seemingly reasonable justifications. Intellectual property incentivises creative endeavours. Occupational licensing protects consumers from quacks. Subsidies for mortgage interest promote home ownership. Green belts stop urban sprawl. But in each case, regressive regulations have been expanded in size and scope by politicians ill-equipped to resist the pleading of special interests.

There is no better example of upward redistribution than planning. Lindsey and Teles document how restrictive zoning laws have raised house prices by preventing the construction of new homes where they’re most desirable. As low-income workers spend more of their pay packets on rent, well-off homeowners benefit from ever rising house prices. Thomas Piketty found fame highlighting a dramatic increase in wealth inequality yet rather than being a natural result of market forces, Northwestern University’s Matthew Rognlie found that the rise was driven almost entirely by housing.

Not only do high housing costs eat into wages, they also create barriers to mobility. In today’s information economy workers are most productive when they’re packed together in big cities. The average worker in London can expect to earn £250 a week more than a worker in the North-East. In the past such regional inequalities would lead workers to ‘get on their bike’, but rents are so high that workers in London only end up marginally better off. Zoning locks workers out from where they are most productive: economists Enrico Moretti and Chang-Tai Hsieh reckon this effect reduced aggregate GDP by 13.5% in the US. The situation is almost certainly worse in the UK, where planning restrictions are even stricter.

The Captured Economy is not a laundry list of policy recommendations. In most cases the necessary reforms are clear. The problem is that rent-seeking elites will fight them and that unless you rent-proof politics, they will win. There is a mismatch of incentives. Take occupational licensing: you need a licence to work as a florist in Alabama. Florists earn more when they are insulated from competition, but consumers pay the price and would-be florists are stuck in worse jobs. Alabama’s florists have a massive incentive to campaign for stricter restrictions, but consumers will only gain marginally from cheaper flower arrangements. As a result, such laws remain unreformed.

Rent seeking will need to be tackled from multiple angles. We will need to end the kludgeocracy that prefers off-balance sheet regulatory solutions to transparent cash payments (see Help to Buy). We should move decision-making to more favourable terrain – city mayors have less of an incentive than local planning committees to reject new development.

Lindsey and Teles’ hope for a liberaltarian movement uniting free-marketeers and social democrats seems unlikely in the UK where Corbyn’s Labour rules out the hope of any pro-market consensus. But The Captured Economy is necessary reading for the Conservatives. Recent attempts at Tory renewal implicitly concede Corbyn is right that free market capitalism isn’t working, proposing toned down versions of Corbynism. To counter Corbyn’s anti-capitalism, the Tories need to tackle the regulations that redistribute upwards. It won’t be easy, but it is necessary.

Polly Toynbee confuses accounting and economics

That councils are facing budget pressures is entirely true. Polly Toynbee doesn't quite tell us why though:

The shires do claim, with some justification, that their finances are more inflexible, paying for care for children and the elderly, with no housing income to balance their budgets.

We should not let people forget that the widely cheered announcement of a national minimum wage - largely binding upon those who provide such care - was not matched by an increase in grants to pay for that pay rise. However, Polly's error, rather than omission, is here:

Let councils borrow unlimited capital to invest in housing, which yields profits.

That is to confuse accounting and economics, a terrible sin. Council housing makes an economic loss, not profit. For unless we consider opportunity costs we are not doing economics at all.

Council rents are lower than market rents, that's rather the point. Said council housing could be let at market rent - we know this very well from the existence of subletting. That difference between what is charged and what could be is the loss.

Thus Polly's call is that we should be making ourselves poorer, increasing the societal loss, by having more council housing. Really, not a good economic idea at all.

The delusions of Oxfam

Buried in Oxfam's latest report about how disastrously unequal the world is we've got an assumption which is so breathtakingly foolish as to kill off any belief in the sense or sensibility of the organisation's mindset. They're trying to insist that the minimum wage in a place should be very much higher than GDP per capita in that same place. Something which simply cannot be done.

Oxfam has shown that minimum wages in countries like Morocco, Kenya, Indonesia and Vietnam are not enough for people to escape poverty.246 The Asia Floor Wage Alliance has found that legal minimum wages in the garment sectors in various Asian countries fall far short of providing a living wage (see Figure 8).

That's on page 39 of that report, figure 8 is on page 40. An introduction to the report is here.

The specific part that we know about from personal experience is the garment trade in Bangladesh. This produces some 80% of exports, is the major reason for the country's growth and employs some 4 million people. The minimum wage there is, close enough, 5,000 taka a month, or £50.

That's the minimum wage in the garment factories, not for the economy as a whole. That, the more general one, is whatever can be scraped together by doing whatever, a rather lower sum. That garment trade minimum is also straight in off the fields, no training, no experience, before any benefits (which do indeed exist) and before overtime or anything else.

Yes, a low sum and most assuredly we'd all like it to be much higher. But Oxfam's claim is that this should be a living wage of more like £250 a month (perhaps $250). Something which simply cannot happen.

GDP per capita in Bangladesh is some $1,500 a year or so. We cannot have a minimum wage twice that. This would be the same claim as insisting that the UK minimum wage should be $80,000 a year (say, £60,000). Worse, that this should only apply in one industry.

Imagine the dislocation if, to make up a British comparison, the minimum wage in sandwich making was £60k, all other wages staying as they are today? This would do what to the supply of doctors (maybe not so much) nurses and teachers (quite a lot) and so on?

It's a demand based upon the most aggressively stupid misunderstanding of what ails Bangladesh, isn't it? The actual problem being that the place is too poor to be providing the incomes we'd all be delighted for everyone there to enjoy.

You know, that poverty which is being alleviated by this very neoliberal globalisation, that growth of the garment trade, which has seen the place growing at 6% and more for a couple of decades now.

Bangladesh's problem is not global inequality, the thing Oxfam is whining about, it's Bangladesh's poverty. That the recipients of hundreds of millions of our tax money manage to get this so wrong seriously calls into doubt Oxfam's right to anything more than a contemptuous sneer. The cure for poverty is economic growth, the very thing which has reduced that global absolute poverty from 40% of all humans to under 10% in just these past three decades of that very neoliberal globalisation.

This is just the one example from that report, we could pick out many more. Sorry folks, but Oxfam is deluded here.

Mirror takes over Express - some people will be very disappointed

It's a standard part of the British political discourse that media ownership is too concentrated. This is codespeak for "don't let Murdoch buy any more." There is always an amusement that the concerns of concentration never include the BBC's share.

The underlying intuition here being that newspapers, TV stations and so on direct the opinions of their consumers. Thus if there's some horrible foreigner, with right wing opinions even, then he shouldn't be allowed to teach people to be horribly, foreign influenced, right wing. We can guess which sector of the political compass such complaints come from.

At which point Trinity Mirror takes over the Express newspapers. This should cause great rejoicing in such quarters. Ownership of avowedly populist and rightie papers move over to the people who publish the great left wing tabloid of the country. Huzzah! Victory and all that. The people will be guided to GoodThink!

Except it doesn't work that way:

In comments to BBC Radio 4's Today programme, Mr Fox insisted that "the Daily Express is not going to become left wing, the Daily Mirror is not going to become right wing".

Media outlets do not create the prejudices of their consumers, they chase them. Fox News, for example, does not laud guns and God because it, or its owners, desire to so laud. Rather, they've spotted that many millions of Americans will watch advertisements inserted into news shows which laud God and guns*

Which rather puts the kibosh on the argument about the views of which proprietors should be allowed to own media outlets, doesn't it?

This should not be a surprise, however much it is to those who just don't grasp the basics of the system. Capitalists in general aren't designing society, they're chasing it. Profits come from giving people what they already want, after all. It's the things we don't want that have to be subsidised....

*We might not be describing the channel's output all that subtly here..