It's the disinformation from some that so annoys about climate change

Anyone watching a little TV these days will see the adverts. The starving polar bear, the heartfelt pleas for money to stop this happening. Then the larger insistence that climate change is threatening the very survival of that species.

Which it might even do but it isn’t as yet:

Too many polar bears are roaming the Canadian Arctic, and the growing population is posing an increasing threat to Inuit communities, according to a controversial new government report which has been bitterly contested by environmental scientists.

The bitterly contested is that climate change is changing hunting grounds thus pushing those bears extant closer to humans. The alternative explanation is simply that there are more bears.

This should be easy enough to work out, count the bears as best we can and see whether there are more of them now than there used to be. The answer being yes.

Thus we should view this insistence on the damage climate change is already doing to polar bears as disinformation.

Do note what we generally say about the larger subject around here - let’s have a carbon tax as that’s the solution to the basic problem. What irks in this instance is the claim which turns out not to have substance.

As with the pictures of polar bears swimming far from land - yes, that’s what polar bears do. Similarly the images of starving such. Yes, that’s how apex predators die. Unlike everything else in the food chain they don’t become lunch as soon as the rheumatics kick in, they die sans teeth sans everything. There are no hospice beds, no Liverpool Pathway, to ease the passing. There’s the inability to hunt then starvation.

It’s the demonstrably untrue claims about climate change that annoy. The propaganda. As they should annoy those who desire greater action - if you base your justifications upon things that can be proven wrong then when they are people are going to more than wonder about the underlying claim you’re making, aren’t they?

At last, an accurate description of Gordon Brown's personal income tax policies

Or rather, an accurate critique of it from the Labour side. Clive Lewis tells us of what we consider the most pernicious of Brown’s personal taxation policies. The manner in which he deliberately drove that income tax system ever deeper into the wallets of the poor. For this is indeed what he did, insisted that people ever lower down the income scale must be paying:

He accused Tony Blair and Gordon Brown’s New Labour of “leaning on those further down the income scale”, while leaving “almost untouched” the “huge fortunes of those at the very top” – citing cuts to corporation tax, and fiscal drag, which brings more people into higher tax bands by leaving thresholds unchanged.

Leave aside that taxation of the rich part and concentrate on that of the poor. This is the part of the system - and Brown made it worse - which we’ve long regarded as actually being immoral. Not just inefficient, or not likely to work well, or constrained by reality, but actively immoral.

For we agree with Adam Smith, that the better off should contribute more than in proportion to their income. Which means to us that the poor not contribute at all as a function of their income. If we have taxes upon apples then people who buy apples, whatever their incomes, should be paying the apple tax. But not income taxes upon low incomes.

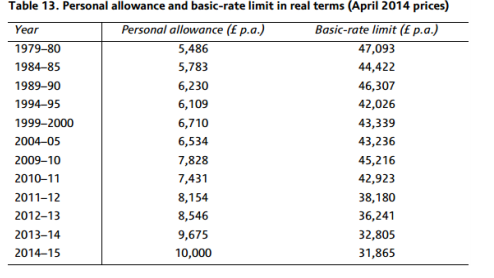

What Brown did was that fiscal drag. Wages tend to rise faster than inflation. So, rises in the personal allowance which are only at the level of inflation drag ever more into that fiscal net - fiscal drag. You can see Brown’s performance on that here. At least once he didn’t raise the personal allowance at all and that at a time of strong wage growth. That’s reaching ever further down into the poor to pay for the British state, not what we think should be done. The effects in real terms - before that background of rising incomes - are here. Incredibly, in those real terms, Brown reduced the value of the personal allowance.

There are many things to criticise over Brown’s tenure as Chancellor. But this is the one we think unforgivable, his deliberate - and obviously complicated and disguised - insistence that the army of Labour voters to be bought by the beneficence of the state be paid for on the backs of the poor. Even if it’s only Clive Lewis who has woken up to this so far that is an advance for the Labour Party, that one understands it. Even if only the one.

A protectionist is someone who argues that you should be poorer so that they can be richer

We’ve made this point before but it’s one that bears repeating. A protectionist is someone who argues that you should be poorer so that they can be richer. Your access to lovely cheap and useful stuff made by foreigners must be restricted so that they can overcharge you for the tat they manufacture.

With that in mind we can now evaluate this suggestion:

Britain must take advantage of Brexit to spur a renaissance in its industrial heartlands by setting tougher standards for renewable energy projects, according to a major Conservative party donor.

Ukraine-born businessman Alexander Temerko has urged Greg Clark, the Business Secretary, to insist that new wind power projects contain at least 60pc British-made components.

Mr Temerko, who was formerly deputy chair of offshore engineering group OGN, warned that the engineering yards of the North East risk losing out to companies in Spain and Germany for lucrative contracts building the parts which will be used to construct giant offshore wind turbines in the early 2020s.

Maybe we do want wind turbines and maybe we don’t want birdchoppers. But if we do we’d like them nice and cheap and made by the most efficient at doing so. If that’s UK onshore producers then good for them, if it ain’t then we don’t want to be buying their tat anyway.

For the call here is that those who own, those who work in, onshore producers should be protected from foreign competition so that they can overcharge us. The argument is indeed that we should be made poorer so they can be richer. At which point the answer is obvious - go boil yer heads.

The Power of Capitalism

Rainer Zitelmann describes his new book, “The Power of Capitalism,” as “a journey through recent history across five continents.” It’s a very timely contribution, considering the bad rap that capitalism receives these days, especially in academe, together with the flirtation with socialism by those who have no experience of what it has brought about in practice.

That is the point. Capitalism in practice has led to wealth creation and prosperity. It has lifted people out of starvation and subsistence, achieving more for humanity in the past few decades than anything in history before it. Zitelman looks at the practice, with chapters on its record in specific places. He looks at Asia, with China’s new prosperity since it allowed capitalism to flourish. He makes the point that it was allowed to develop from the bottom up, not imposed from the top down. He looks at Africa, at South America, and at Europe and the US. Its record is consistent.

He documents, by contrast, the utter failure of socialism wherever it has been tried, explaining why its failure leads its supporters to claim that it never has been tried. Ah yes, it’s that old theory-versus-practice debate. The facts that emerge point in one way: capitalism works, socialism doesn’t. He has a fascinating chapter on “Why Intellectuals Don’t Like Capitalism,” which does more than revisit Hayek’s earlier insights. Zitelmann points out that intellectuals usually deal in ‘explicit’ knowledge, the sort that can be acquired from books and lectures. Many of them fail to realize that ‘implicit’ knowledge, the kind absorbed often unconsciously from surroundings, can be powerful. A child learns the grammar of language implicitly, working out its rules without being taught them. Zitelmann suggests that because entrepreneurs draw largely on implicit knowledge, intellectuals look down on them.

Although many cry for “more state intervention,” Zitelmann documents how this has failed time after time, whereas “more markets,” “more economic freedom,” has worked to create wealth time after time. It’s a fascinating book and a much-needed one.

We've been saying this for some time, we can't afford the welfare state we've already promised ourselves

This is not an observation we’re making for the first time but then the truth does bear repetition. We cannot afford the welfare state that we’ve already promised ourselves. Or more accurately perhaps, we’ve at least so far been unwilling to pay for that welfare that we have been promising ourselves. This is something that Polly Toynbee complains about near endlessly, that we want Scandinavian coddling but we’re unwilling to pay for it through taxation.

We rather differ as to the conclusion from this but then that’s because we understand the proper definition of “want.

”The middle-aged and over 65s may soon be taxed to cover the cost of their later life care if proposals are given the go ahead.

Matt Hancock, the Health and Social Care Secretary, said he was 'attracted to' a crossparty plan for a compulsory premium deducted from the earnings of over 40s and over 65s.

It has been proposed by two Commons committees, the chair of one has said the premium must be compulsory otherwise 'it wouldn't be done'.

We all have desires of course, we even express preferences about them. We’d like free care in our old age for example. But we can only really be said to want them when we’re also willing to pay for them - revealed preferences that is. Which is where our disagreement with Polly comes in. The British are indeed remarkably unwilling to offer a further 10% of GDP, a further 10% of everything, to government in order to gain that social democratic nirvana.

It’s the not being willing to pay that is the important part too, that’s the revealed as opposed to the expressed. That is, we might well say we’d like to have the most embracing welfare state it’s just that when the embrace comes for our wallets, as with new taxation to pay for social care, it turns out we don’t.

Or as we’ve been known to point out, we aren’t willing to pay for the welfare state we’ve already promised ourselves, let alone anything more or new.

It could be that the tax gap is negative

We’ve varied estimates of the “tax gap” out there. Roughly speaking that gap is the difference between what the law says should be collected in taxation and what actually is collected. HMRC thinks about £35 billion, calls from the wilder shores of loondom say £120 billion. The thing is, we can actually construct an argument that the gap is negative, that HMRC collects more than it ought to.

This is, admittedly, difficult with the HMRC figure, although it’s quite obviously too high as an estimate:

Three of Britain’s biggest supermarket groups have won a legal victory worth up to £500m, following a court battle over business rates on cash machines installed at their shops.

The court of appeal ruled on Friday that cash machines located both inside and outside stores should not be liable for additional business rates, which are a form of property tax on businesses collected by the government.

Several retailers including Tesco, Sainsbury’s and the Co-op had fought in the courts against the tax rules set by the Valuation Office Agency – the arm of HM Revenue and Customs responsible for setting business rates – which had claimed that ATMs should be additionally assessed.

The court verdict means the supermarket chains are in line for a multimillion pound windfall from tax refunds, which the property advisory company Colliers estimates is worth about £500m.

The case dates back to a 2013 decision by the government to charge rates on “hole-in-the-wall” cash machines, which was backdated to 2010.

That is not the negative of tax avoidance, that’s the negative of tax evasion. HMRC has been collecting tax which is not legal to collect - that is the opposite of not paying tax which is legally due, tax evasion. Sadly, our system is asymmetrical, no one will be threatened with jail over this.

Still, including what HMRC does collect but shouldn’t - not something included in anyones’ estimates - will close that tax gap, won’t it?

Once we look at those wilder claims, that £120 billion say, then it’s trivial to show that the gap is negative. For the larger sum includes what the calculator thinks should be taxed but which the law doesn’t. We differ with those calculations, insisting that large number of things which the law says should be taxed should not be. Thus the gap is negative, HMRC collects more revenue than we think just or righteous.

Yes, yes, what fun etc. But it is still true that we have the opposite of tax evasion, the collection of taxes which are not legally due, something that really should be in the figures.

What a delightful complaint about Amazon's new headquarters

An instructive little complaint about where Amazon has decided to put its new HQ building. Or, as it happens, buildings:

This engineered airdrop of tech people threatens to destroy America’s delicate distribution of unwanted wealthy demographic groups. Silicon Valley and Seattle get to deal with the techies. Los Angeles gets the Hollywood people. Washington gets the politics nerds, and New York gets finance types. We have each adapted to our own particular crosses to bear.

The complaint is against people earning good livings, in good jobs. It’s actually against the very process of wealth creation itself. Something which perhaps rather militates against that more general idea of good livings, good jobs, wealth creation for all.

That, to our mind at least, being the point of our having one of these economy things in the first place. The idea that through voluntary cooperation we can and will make the lived experience of each and every human being better. This being something that requires the generation of economic wealth so that economic wealth can be consumed.

There’s also only us people here, that then meaning that it has to be us people generating that wealth that can be consumed. At root, this is simply what an economy is. But here the complaint is that while we’d all just love to be doing the consuming we don’t want any of those producers around us.

It’s as alarming - or confused if you prefer - an idea as that traditional British disdain for those in trade. But then there’s nothing quite so conservative as a modern day lefty, is there? Yea, even progressives from Queens.

Madsen Moment: a boring Budget

Last week’s rather boring Budget, which saw the Chancellor give with one hand but take with the other, caused Dr Pirie to reminisce about when Budgets really delivered change. But it also got him to thinking about how we could get to better and more inspirational times.

Give it a watch now 👇

On the merit of a bacon roll and a cup of coffee

It’s entirely possible for us to observe something out there which we approve of without our then deciding to go and spend more of other peoples’ money on that very thing. That we approve of. Our approval not being sufficient justification for that spending of other peoples’ money, naturally.

Before those resources of our fellow citizens are expended rather more justification needs to be done. Which is where this idea fails:

The Conservatives need to take inspiration from Greggs to beat Labour at the next election, a rising star Tory MP has said.

Tom Tugendhat, tipped as a future leader, hailed the high street bakery for the way its staff were able to share in its profits.

Speaking to the Social Market Foundation think tank, he suggested using public money to reward companies who reward their staff "like Greggs".

Mr Tugendhat said: “I like the way it's run. The employees of that bakery get a share not just in the profit of their own labour but in the output of the firm as a whole.

"After six months they get profit share and a chance to take part in a share save scheme that allows them to buy in at a discounted rate."...

We would hope that those who rise further than our just having heard of them would work through such justifications. That Mr, Tugendhat likes what Greggs does is not a good enough reason for our money to be spent upon it.

It is entirely possible that profit share schemes are a good idea, we certainly rather approve of them. But then the underlying assumption is that such make firms more efficient. The logical consequence of which is that profit sharing firms will outcompete non-such and thus will take over the economy. That is, if the justification usually given holds up then we need to nothing at all to see the practice spread. It’s only if the justification is untrue that privilege need be granted.

That he likes it is not enough that we must pay for it.

However, there is something on which we agree. If any political party were to rise to the level of being able to provide a bacon roll and a cup of coffee, hot and on time, at a price millions wish to pay, this would be an improvement upon all extant political parties so, yes, learn from Greggs by all means.

Maternity leave really does reduce future earnings

There are benefits to many things but there are costs to everything. So it is with maternity leave. Yes, of course, it’s an absolutely great idea that some time is taken off from the daily rat race on the arrival of a new child. We can, of course, argue about quite how much but what we do need to understand is that while this leave does have benefits, might well be positive overall, it does still have costs:

How does paid maternity leave affect children?

Obviously, there are benefits. The baby gets to bond and all those good things. Usually pretty decent child care too. But the costs? The leave itself is such an interruption to a working life that it lowers future wages and thus leaves the child poorer in the future.

While the availability of these benefits sparked a substantial expansion of leave-taking by new mothers, it also came with a cost. The enactment of paid leave led to shifts in labor supply and demand that decreased wages and family income among women of child-bearing age.

Note this is the effect of the maternity leave only, the effects of the existence of the child are already accounted for.

The point being not that we should abolish maternity leave. Only that it’s not an unalloyed good. Further, that making it ever longer might not be in the best interests of mother or child. We’ve already, for example, had the occasional Swedish politician pointing out that that country’s two years has a significant impact upon future employment and promotion prospects. Not positive effects either.