Stop trying to use monetary policy for your ideological whims

A topic that occasionally creeps up in the political discussion of central banks is the will to use monetary policy for special interests. A prime example would be the hydra whose latest head is making the rounds on both sides of the Atlantic: MMT, “Modern Monetary Theory”. This old idea, repackaged in a new shape, states that: governments issuing their own currencies cannot go bankrupt – and so worrying about the deficit or government spending is unnecessary. Unleash the spending!

Naturally, a false conclusion mistakenly interpreted from the (true) statement that British government debt is denominated in a currency it controls and issues, is being taken as reason enough to expand government spending to all kinds of utopian schemes – from Green New Deals or Investment Banks, to job guarantees and free healthcare for all. “Old wine in new bottles” says Professor Anthony Mueller, the author of the Adam Smith Institute’s recent report The Magic Money Tree: The Case Against Modern Monetary Theory.

MMT’s proponents, clearly, wish to use the monetary power vested in the Bank of England for certain politically perverse projects, the kinds of spending schemes only politicians with next-to-limitless funding may conjure up. The economic tradition of MMT is hardly novel (it reaches back at least a century, as Professor Mueller shows), but neither is the attempt to hijack monetary policy into service for some particular end. A concrete example is Janet Yellen, the former chair of the Federal Reserve, who a few years ago, drew heavy criticism from various left-wing organisations after she had sensibly pointed out that a central bank really isn't equipped to address racial differences in employment outcomes.

Rethinking Economics, the British not-for-profit that promotes critical discussions and a “better economics” education, recently jumped on the bandwagon initiated by an even more radical organisation: Positive Money. The latter’s agenda has always been more narrowly focused on advocating for “a fair, democratic and sustainable economy” – predominantly through the use of monetary reform along MMT lines. In the surge of Bank of England’s Quantitative Easing policy after the financial crisis, the organisation called for “People’s QE” – fully endorsed and embraced by Jeremy Corbyn and his followers.

Unsurprisingly, in light of recent month’s climate protests, “Extinction Rebellions“ and other outbursts of quasi-religious nature, Positive Money’s newest approach shouldn’t come as a surprise. By petitioning Mark Carney, the Bank of England’s governor, to “Unleash Green Investment”, the appeal looks a lot like the MMT-inspired American Green New Deal – just without the irksome political process. Instead of going through established democratic channels – most of which are too busy ‘Brexiting’ anyway – the idea is to appeal directly to the Bank’s governor and the MPC, the body responsible for monetary policy. They write:

“A change to the mandate – which is set by the government – could unlock the Bank’s powerful monetary policy operations to channel billions into green investment. And it could empower the Bank to introduce tougher regulation to shift UK bank lending away from fossil fuel companies and towards a low-carbon economy.”

The problem with the Bank’s monetary policies, advocates from Positive Money argue, is not its huge credit footprint (it now owns almost a quarter of outstanding British government debt) or the risks that their unconventional monetary policies may create in financial markets. Instead, its various QE facilities have been “providing an implicit subsidy to fossil fuel companies”.

Yes, you read that correctly.

And since we’re all dead in a decade or so unless we “avert the devastating impacts of climate change, central banks can, and must, go further.” The Bank’s power to create money ought not - the argument goes, to be reserved for its traditional macroeconomic tasks on account of pesky financial stability reasons, but rather to turbocharge the green transition by – I suppose – directly funding all kinds of Green New Deal-style of initiatives. And “actively penalise high-carbon lending” as well as use its regulatory powers to “compel others to do the same.” The activists’ MMT-inspired message is clear: use monetary policy for our favoured ends. Never mind that the tools available to the Bank of England are much-too-blunt for fine-tuning technological changes like that.

While I much enjoy this trend of piling onto monetary authorities all kinds of issues they are absurdly unequipped to address, I was curious about the factual background to this point. So let’s dive into it, head-first.

How could the Bank of England’s QE policies, aimed at reducing long-term interest rates and triggering portfolio reallocations, have been a “subsidy to fossil fuel companies”? Could some of their alphabet soup of new liquidity frameworks have (accidentally?) supported the fossil fuel industry?

One option is to consider the £450bn or so of government bonds that the Bank bought in order to push down the long end of the term structure of interest rates, primarily by buying up outstanding government debt (which, at the end of 2018 stood at £1,837 billion, equivalent to 90% of GDP – though the OECD says 113%). Certainly, if fossil fuel companies held some of their liquid assets in government bonds, they could definitely have pocketed some capital gains when the prices of those bonds rose – given, of course, that they sold them before maturity. More directly, had they been on the other side of those Bank of England purchases, they could have received cash directly from the Bank.

Now, there are quite a few reasons to doubt this conclusion. First, the Bank’s QE operated on the open market and so neither the Bank nor the fossil fuel companies would have known who they were trading with (this is standard practice).

Secondly, it’s doubtful that fossil fuel companies would hold any government securities at all. Since Positive Money specifically names Shell and BP as beneficiaries to the Bank’s programs, let’s use Shell plc as an example. Surveying its £307bn balance sheet, at most no more than £15 billion (<5%) could even feasibly have included government bonds (“Money market funds, reverse repos and other cash equivalents” is the relevant post). That accounting post could just as well include other cash-like instruments in many other currencies than British pounds.

Thirdly, if fossil fuel companies held government debt, they did so for liquidity reasons, and so any sale would simply have put cash in their accounts, which they could just as easily have to buy other cash-like instruments in the market. Indeed, they probably wanted to: short-term liquid assets are held by non-financial firms to match inflows and outflows of funds, meaning that Shell likely just replenished such a sale with other short-term liquid assets – whose market price also rose after QE, eliminating most of Shell’s imagined benefit.

Thus, even in the unlikely event that fossil fuel companies did hold the kind of bonds that the Bank was purchasing during QE, there’s little reason to believe that this amounted to an industry subsidy of any kind.

Another option is the rather obscure Corporate Bond Purchase Scheme (CBPS) launched in 2016, intended to push down corporate borrowing costs directly. The background was the Brexit vote, and a fear that the general uncertainty concerning Britain and pound-denominated assets would increase lending costs to all British firms, thus having harmful macroeconomic effects. Indeed, the Scheme was limited to £10bn and rolled-over bonds are still on the Bank of England’s balance sheet (accounted for at £12.5bn, probably just changes in market prices). Moreover, CBPS was subject to a strict sector division so as not to favour particular companies and the list for eligible securities is fairly small – mostly containing consumer brands and property companies.

Except for the energy company Scottish and Southern Energy (whose generation mix is about half natural gas/coal, half renewables anyway), one has to be quite imaginative to conclude that CBPS amounts to a subsidy of fossil fuel companies – perhaps the emissions from buses run by First Group ought to be considered?

Research into CBPS seems to suggest that the program reduced the Brexit-induced “excess bond premium” and improved the overall liquidity of corporate Sterling bonds, ultimately causing borrowing costs to be lower than they otherwise would have been. While the Bank’s own assessment show that prices of eligible and ineligible bonds developed identically over the 18-months following the CBPS, it did record a 4 basis points reduction in corporate bonds spreads generally. In other words, this would be a benefit to all debt-issuing companies – of which SSE, for instance, could benefit.

For the sake of it, let’s estimate the monetary gain SSE might have gotten from this 4-basis point reduction in its spread. The only SSE security on the eligibility list is a 23-year, £300m bond, issued in 1999 with a coupon of 5.875%. Indeed, that inopportune moment of issue explains why it is among the company’s most expensive financing; average interest rate for their 8.6bn loan stock is more like 2.5%, resulting in an annual interest bill of £215m. If we were to assume that the 4 basis point reduction is permanent, proportionate and applicable for all the company’s borrowing (a gross exaggeration), the increased liquidity of the Sterling corporate bond market would reduce the company’s lending costs by around three million quid. For a company that makes consistently around a billion a year, that’s quite literally peanuts – not to mention that it’s completely overshadowed by other macro events.

Did the Bank’s liquidity measures somehow benefit some fossil fuel companies, as Positive Money asserts? Since the purpose of the Banks’s unconventional monetary policy was to reduce interest rates across the board, it likely made borrowing costs lower for all companies – including fossil fuel companies. But that hardly amounts to a public subsidy of that industry.

The Tianenmen Square massacre of pro-democracy protesters

Thirty years ago, late in the evening on June 3rd, 1989, Chinese troops began opening fire on students and other protesters who for several weeks had occupied Tianenmen Square in central Beijing. The protests had begun following the death in April of Hu Yaobang, a moderate and reformist high-ranking official of the Communist Party. Students gathered in large numbers, staging a hunger strike at one stage. They were demanding democracy, accountability, freedom of the press, and free speech. They were intelligent, educated and civilized, and conducted their protest with some humour and decorum. They erected their own makeshift version of the Statue of Liberty, calling it their "Goddess of Democracy," and pointing out that she needed two hands to hold up her torch in China.

The authorities were divided on how to handle events. Some, like Zhao Ziyang, the Party General Secretary, urged conciliation, but hardliners such as Premier Li Peng wanted the demonstrations to be broken up and suppressed. The tide turned in favour of the hardliners with a People's Daily editorial on April 26th, one that branded the students as anti-party and anti-government. Although intended to scare them into disbanding, in fact it stiffened their determination.

The problem was that China has liberalized its economy under the Paramount Leader Deng Xiaoping, abandoning collective farms and allowing private businesses to flourish. But the ruling Communist Party, even though it had effectively abandoned Communism, was not prepared to loosen its grip on power. The student demands would have diluted and threatened that power.

I have seen documents about that time that show that the party elite was nervous of what was happening in Russia. They thought Russia's mistake had been to implement glasnost before perestroika, liberalizing free speech and criticism before economic reforms had taken place. They were determined not to make the same mistake, and risk being swept away by events that undermined their hold on power.

The troops were sent in with tanks, under orders to "use any measures" to suppress the protest. This was taken to justify lethal force, so the soldiers fired directly on the unarmed students as they advanced into the occupied square. The numbers killed are disputed, since the authorities banned all reporting of their action. It was certainly hundreds killed, and some reports suggest that over a thousand died in the massacre. The square was cleared, but next day came the most iconic photo of the event, when a lone protester confronted a line of tanks, barring their advance for half an hour. He climbed up onto the front one and addressed the soldiers. His subsequent fate is unknown.

In the aftermath, rigorous censorship was reasserted, and the Party's monopoly of power was strengthened. The economic reforms continued, however, and people in Chine are free today to do many things, but not to criticize the Party or the government. Since the Party no longer practises Communism, it holds power for its own sake, as a self-perpetuating ruling elite backed by military force. What Deng called "Socialism with Chinese characteristics" is not socialism at all, which is just as well, because even though they are denied freedom of thought, freedom of speech and freedom of religion, they are allowed to prosper, which is more than Communism's captives elsewhere were allowed to do.

To disprove the inequality argument once again

The Spirit Level, Sir Michael Marmot, the general wisdom of our times, all say, insist, that it is inequality that kills us all. A more unequal society has people living shorter, more foetid, lives. Thus we should reduce inequality in order to boost the health of the nation.

Well, it’s a plan, certainly, what we want to know is whether it’s a useful one. At which point we have this report from IPPR:

Austerity to blame for 130,000 ‘preventable’ UK deaths – report

Dearie us.

What has happened?More than 130,000 deaths in the UK since 2012 could have been prevented if improvements in public health policy had not stalled as a direct result of austerity cuts, according to a hard-hitting analysis to be published this week.

The study by the Institute for Public Policy Research (IPPR) thinktank finds that, after two decades in which preventable diseases were reduced as a result of spending on better education and prevention, there has been a seven-year “perfect storm” in which state provision has been pared back because of budget cuts, while harmful behaviours among people of all ages have increased.

Had progress been maintained at pre-2013 rates, around 131,000 lives could have been saved, the IPPR concludes.

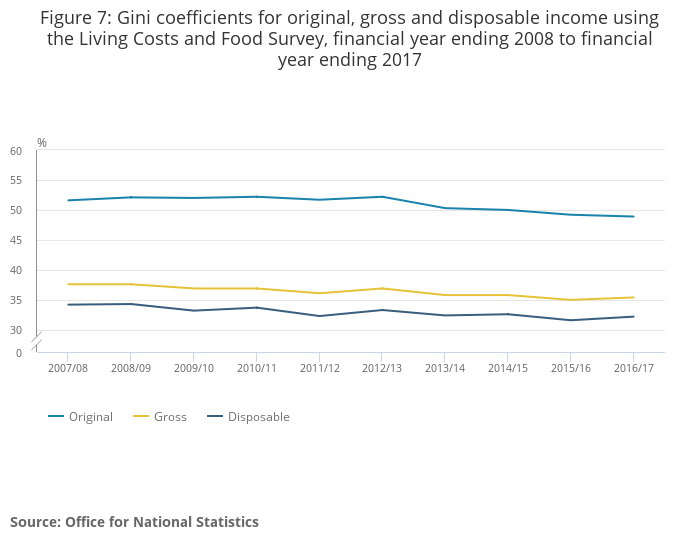

But here’s the problem. Over this very same time span inequality has been falling in the UK.

If it is inequality that murders us all in our beds then a fall in inequality must lead to a reduction in our corpses being found in the morning. If we do reduce inequality and yet the death rate increases then it’s not the inequality nor the increase in it causing the deaths, is it?

That is, reality is telling us that the Spirit Level, the general belief of our times, must be wrong. Falling inequality and a rising death rate just aren’t compatible with the claim that inequality causes the deaths. Beautiful theories and ugly facts again, eh?

Alan Greenspan’s term

Alan Greenspan was nominated by President Reagan to be Chairman of the Federal Reserve Board on June 2nd, 1987. He was reappointed by George H Bush, Bill Clinton (twice) and George W Bush, before finally demitting office on January 31st, 2006. His manner was restrained and subdued, and he gave no broadcast interviews. Even when asked how he was, he jocularly remarked that he couldn’t answer that lest it affect the markets. He said that what he’d learned at the Fed was Fed-speak, “the ability to mumble with great incoherence.”

Revered in his day as the man who had saved the world economy several times, history has been more critical of him following the Great Recession of 2007/08 that followed his term. After the stock market crash of 1987, called “Black Friday” in the US, and “Black Monday” in the UK, he announced his intention to provide liquidity to support the economic and financial system. Money and credit became easier and the economy survived and recovered.

Greenspan organized the U.S. bailout of Mexico during the 1994–95 Mexican peso crisis, another event that threatened dire consequences, but was addressed successfully. He was basically a monetarist who eased credit and interest rates when stimulus was thought needed, and tightened them afterwards to stall asset bubbles. Critics have suggested that Greenspan’s “easy money” was a cause of the Dotcom Bubble, and that his several interest rate rises in 2000 were behind its bursting.

Greenspan reacted to the 2001 September 11th attacks, and several subsequent financial scandals, with a series of interest rate cuts that steadied the markets, bringing the Federal Funds rate down to 1% in 2004. Again, he was hailed as a savior, but the easy money was building pressures into the system, leading people to over-extend themselves. His reputation has diminished following the Great Crisis that came soon after his retirement. His series of rises that took interest rates to 5.25% is reckoned to have been a factor in the 2007 subprime mortgage financial crisis.

In retrospective support of more appropriate regulation, he remarked, "It is not that humans have become any more greedy than in generations past. It is that the avenues to express greed had grown so enormously."

Surprisingly he was an Objectivist, a friend and follower of Ayn Rand, who stood beside him in 1974 when he was sworn in as Chairman of the Council of Economic Advisers. He wrote essays in her “Capitalism: The Unknown Ideal” (1966). These included one in favour of the gold standard.

A lesson to be learned from Greenspan’s spell at the Fed is that you cannot smooth the market indefinitely. Gordon Brown claimed to have abolished “boom and bust,” but it snapped back at him. You can pour money into the economy when it stalls, and you can squeeze money out when asset bubbles form in response. The problem is that by doing so you are preventing the economy from correcting itself by temporary downturns that flush out businesses that cannot cope, and allow capital to be redeployed to newer ones that can. The pressures build up so that the economy corrects itself in one big collapse instead of a series on manageable downturns. When you catch a tiger by the tail, it has a habit of turning back on you.

Chavista support for terrorism

Earlier this year the ELN (National Liberation Army of Colombia), a far-left Colombian terrorist group, killed 29 innocent people and wounded 68 more in a vehicle bomb suicide attack on the Police Academy in Bogota, Colombia’s capital. The ELN is a vicious organisation dedicated to perpetuating armed conflict in Colombia, and it is alleged to be backed by Venezuela as part of the Maduro regime’s efforts to use state-sponsored terrorism as a political tool.

The ELN is a Marxist organisation that was founded in 1964 by Colombian rebels trained in Cuba. Today, the ELN leadership is based partly in Cuba, partly in Venezuela. According to Colombian General Luis Fernando Navarro, 45% of the ELN (over 1,000 of the 2,300 ELN guerrillas) is based on Venezuelan soil with the active support and encouragement of the Maduro regime. The Colombian authorities also allege that on Maduro’s orders Venezuelan soldiers have trained the ELN in the use of heat-seeking anti-aircraft missiles, specifically the Russian-manufactured IGLA surface-to-air missile system. Such weapons are extremely dangerous in the hands of terrorists, because they are most effective against soft targets like commercial airliners.

Maduro’s support for the rebels goes beyond simply providing haven and training for terrorist activities. The ELN has a strong presence in 12 of Venezuela’s 24 states, and it uses Venezuela as a base for wider criminal operations, including drug smuggling, illegal mining, kidnapping, extortion and petrol smuggling. The ELN actually exercises social control in some parts of Apure State, acting as a de facto state power that maintains some kind of order and charges ‘taxes’. The Maduro regime has even entrusted it with the task of distributing subsidised food boxes. Maduro and his cronies personally benefit from the ELN’s criminality, primarily through co-operation in drug smuggling and illegal mining.

However, outspoken Chavista support for Colombian terrorists is nothing new. It was Hugo Chavez himself who allowed the FARC, then Colombia’s biggest terrorist group, to operate inside Venezuela with impunity. Chavez backed FARC to the hilt: when Venezuelan Lieutenant Colonel José Humberto Quintero captured FARC leader Ricardo González; it was the Lieutenant Colonel whom Chavez jailed. The full details were discovered when Colombian forces raided a FARC safehouse in Ecuador in 2008 and captured the laptop of FARC Deputy Leader Raul Reyes. The laptop contained 37,000 files detailing Chavez’s support, which included a gift of $250m to purchase weapons. Reyes’s emails described secret meetings with Chavez as early as 2000, in which Chavez offered FARC financial support and access to weapons. Moreover, Chavez started the process of Colombian terrorists using Venezuela to smuggle cocaine to the US and Europe. In 2008 the International Crisis Group estimated that between a third to a half of Colombia’s drug production passed through Venezuela.

Chavista sponsorship of terrorist groups has not been limited to Latin America. Chavez’s close partnership with Iran led to support of Middle Eastern terrorists. Already sheltering Hezbollah terrorists, on the 22nd of August 2010 Chavez gathered senior leaders of Hamas, Hezbollah and Palestinian Islamic Jihad (PIJ) at a secret conference in his military intelligence headquarters at Fuerte Tiuna. Attendees included Islamic Jihad Secretary General Ramadan Abdullah Mohammad Shallah, (on the FBI’s list of most-wanted terrorists); Hamas’s “supreme leader”, Khaled Meshal; and Hezbollah’s “chief of operations”.

A variety of activities followed, including the establishment of terrorist training camps on Venezuela’s Margarita Island, where Iranians trained operatives from a variety of groups. Under Maduro this cooperation has expanded further. In particular, Minister for Industries Tareck El-Aissami has become deeply involved with Hezbollah, according to secret files recently leaked to the New York Times. “Hezbollah maintains facilitation networks throughout the region that cache weapons and raise funds, often via drug trafficking and money laundering", according to the U.S. Southern Command's Admiral Craig Faller.

The Chavista regime’s prolonged support for state-sponsored terrorism undermines the idea on the left that Venezuela is a state is being bullied by outsiders. Instead it suggests it is actively siding with groups which spread misery and strife around the world. The Chavista regime hides behind a shroud of legitimacy, but it is being pulled back and what we find is all too revealing.

Liberalise High Street planning, yes - but why not actually liberalise it?

A plan here to liberalise High Street planning:

The government is working on a shake-up of planning laws to help to revive struggling high streets.

James Brokenshire, the communities secretary, is working on draft legislation, seen by The Times, that will scrap the need for landlords and retailers to seek consent to change the use of empty or poorly performing shops, bank branches or estate agents to other services, such as cafés and hairdressers.

We don’t need as much retail space as we did, the internet is taking care of that. To the tune of near 20% of consumer spending, explaining why near 20% of retail space is empty. So, yes, good idea:

In town centres, planning rules mean that properties designated “A1” can be used for shops and retail outlets; “A2” properties are for financial and professional services, such as bank branches and estate agents; and “A3” properties can be used as restaurants and cafés.

Changing the use requires planning permission, which can take months, so Mr Brokenshire is planning to introduce a “high street use class” that would incorporate those under A1, A2 and the café element of A3, so that no planning permission would be needed for any changes.

OK. But we are reminded of what happened with the abortion law change. This isn’t a point about abortion, rather about how law changes. The time limit was 28 weeks, this was lowered to 24 weeks. A tightening of the abortion law? Not so fast - at the same time abortion for deformity was no longer limited by the 24 week restriction, nor even the old 28 week one. Is that a tightening of the law or a loosening?

Which brings us to this:

A list of “unacceptable” uses would be drawn up, including betting and pay-day loan shops, amusement arcades, shisha bars, tattoo parlours and casinos. Planning permission would still be needed to change use to and from restaurants, bars and hot food takeaways.

They’re not loosening the law, are they? They’re tightening it. Before, space could be filled by what gained an audience at the cost of some paperwork. Now space can only be filled by those approved of - with less paperwork.

At which point, why not actually loosen the planning laws which rule our High Streets? Simply state that if a business is legal in itself then it may operate out of any building? Yes, obviously, necessary to insist that a restaurant have taps and water supply, everyone has a fire exit and so on. But this insistence that the rulers know which sort of shop should go where is just the planning delusion. Of the same type even if at a lower level of idiocy as that which made the Soviet Union such a consumer paradise.

The people who know what sort of shop they want are consumers, they show this by their patronage. Those who chase that, the shop providers, the retailers. We’ve a method we can use to try and match that desire with supply, a sorting mechanism to search for the optimal solution - the market. Why not just get out of the way and allow the most efficient method yet devised, that market, to get on with it?

General Motors’ bankruptcy heralded change

On June 1st, 2009, America’s largest vehicle-manufacturer, General Motors, filed for bankruptcy. The US Treasury then invested $49.5bn in the company through its Troubled Assets Relief Program, and recovered $39bn of that when it sold its shares in 2013 - a loss of $10.3bn.

The bankruptcy of such a major player in the US and, indeed, the world economy was a portent of changing times. The heyday of General Motors was the era of the big gas-guzzlers, but the oil shock of the early 1970s led to a drive for fuel efficiency, only achieved then through small cars. The Japanese seemed to make better ones, and theirs were reliable, unlike the GM ones.

Most major manufacturers have suffered quality problems and recalls, and GM has been no exception. In 2014 it was fined the maximum $35m for knowingly continuing with faulty ignition switches linked to 124 deaths. The recall cost it $1.5bn, and it now faces lawsuits over the issue that could cost it $10bn.

Concerns over the pollution emitted by petrol and diesel cars is speeding a trend to electric vehicles that GM has followed somewhat half-heartedly. The EV1 it launched in 1996 was available only for lease, not purchase, and three years later it stopped renewing the leases and destroyed the returned vehicles. Both its Volt plug-in hybrid, and its Spark EV were only released in selected areas, and were criticized for their poor range.

I joined the trend to electric vehicles four-and-a-half years ago by acquiring a Tesla. I have found it reliable, fast, clean and quiet, and it is the safest car ever tested. The other trend in America is that young people are driving less. Only a quarter of 16-year-olds are qualified drivers, compared with nearly half just a generation ago. More young people are choosing to live in city centres rather than suburbs; this makes car ownership more awkward and less necessary.

The spread of gig economy transport by firms such as Uber and Lyft contributes to making personal ownership less necessary, as does the prevalence of urban electric scooters. And two developments coming along are likely to accelerate it further. One is the advent of driverless taxis, and the other is the emergence of pilotless people-carrying drones. All of this contributes to a changing world of personal transport, one in which big, slow corporations will find it more difficult to adapt to than smaller, fast-moving upstarts which enter the field. This is Schumpeter’s “creative destruction” in action. It is how neoliberal capitalism renews itself by allowing the new to edge aside the old.

Instead of trying to protect the established industries with regulations designed to thwart and deter newcomers, and to hold on to the status quo, the strategy should be the reverse: to make it easier for the innovators to enter existing markets or to generate new ones. This can converge on offering more consumer satisfaction and on offering more consumer choices. And it can do so more rapidly.

Now they're designing a tax system to cure a problem that doesn't exist

One of the criticisms of the banking system post-crash was that it was too homogenous. So many people - males mostly - all from the same sorts of backgrounds, believing the same sorts of things led to significant groupthink and thus an inability to recognise reality outside the window.

Harriet Harman’s famous statement that if it had been Lehman Sisters then all would have been different. She’s got a point too even if not the one she thinks. All female organisations are, as with women generally, less risk loving than male and men. But mixed gender organisations and groupings are more risk loving than either single sex one.

But Robert Shiller’s share of the Nobel, the story of Galton’s Ox, that Wisdom of the Crowds - all underlying the same point, that everyone’s views must be taken into account, not just the ingroup. For such ingroups are all too prone to that groupthink and thus error, that not looking out the window at reality.

At which point we get the Chief Medical Officer trying to design a tax system to reduce childhood obesity:

The Chief medical officer is considering a tax on all unhealthy foods in a bid to reduce the levels of childhood obesity and persuade parents to buy fresh fruit and vegetables.

A review by Prof Dame Sally Davies will examine these ideas as well as further measures in order to halve the levels of childhood obesity by 2030 after more than 20,000 of primary school children were classed as obsese when they left primary school last year.

One problem with this being that there simply isn’t an epidemic of childhood obesity that needs to be reduced.

And yet, one in ten kids are classified as obese when they start primary school and one in five are 'obese' by the time they start secondary school. According to the latest figures, 23 per cent of 11-15 year olds are obese. And that’s before we add those who are merely overweight.

These are shocking statistics and we are reminded about them at every opportunity. Organisations like Public Health England repeat the claim that ‘more than a third of children [are] leaving primary school overweight or obese’ like a mantra whenever they have a new anti-obesity wheeze to push. So where are they all?

You can’t see them because most of them do not exist. They are a statistical invention. The childhood obesity figures in Britain are simply not worth the paper they are printed on. The childhood obesity rate is much lower than 23 per cent.

The public health authorities are in the grip of that groupthink. They’re simply not looking out the window at reality. Which is why the’re trying to cook up a taxation system to solve a problem that simply doesn’t exist.

Francis Bacon imprisoned

On May 31st, 1621, Sir Francis Bacon was imprisoned in the Tower of London, some say for one night, some for a few. His enemy, Sir Edward Coke, had instigated proceedings for taking bribes. It was common practice in those days, and was not regarded as corrupt if it didn’t influence judgement. Sir Francis had even given verdicts against some who paid him, but Sir Edward was determined to punish one of King James’ favourites. His fine was £40,000, which was remitted by the king, and he was released.

None of this has diminished his reputation as a strikingly original thinker. He was a philosopher and statesman, who managed to combine his scholarly publications with a political career that included his becoming the first Queen's Counsel designate when Queen Elizabeth appointed him her legal counsel. He went on to become Solicitor General, Attorney General, and Lord Chancellor of England. He was elevated to the peerage as Viscount St Alban.

The skeptical methodology developed through his writings makes Bacon “the father of the scientific method,” and his works remained influential through the ongoing scientific revolution. His book, Novum Organum, set out the basis of scientific method as a process of observation and induction. Long after his death in 1626, Bacon was commonly invoked during the Restoration as a guiding spirit of the Royal Society, founded under Charles II in 1660.

Bacon pioneered the Renaissance trend of turning away from the reasoning of the Scholastics and the writings of Aristotle, and into open-minded observation, and speculation based upon it, about the nature of the universe and observed reality. He said, “If a man will begin with certainties, he shall end in doubts, but if he will content to begin with doubts, he shall end in certainties.”

Many of his other sayings still remain pertinent. He recognized the power of questioning, saying that “A prudent question is one half of wisdom.” More famously, he remarked that “Knowledge is power.”

His enquiring mind proved to be his undoing, for while investigating if snow could keep a chicken fresh by freezing it, he contracted pneumonia, and died of it a few days later at the age of 65. Amongst innumerable other honours, he was featured on a 1910 Newfoundland postage stamp in recognition of the major role he played in the establishment of the first colony there.

It is important to remember Bacon when people come forward with glib theories about how society should be organized and how people should live. His skeptical approach and insistence on actual observation could have saved the world from many follies had people heeded it, and could save us from many more in future.

Encryption ghosting - the spies suggest breaching civil liberties for a solution that doesn't work anyway

That there are times when civil liberties take a back seat to other issues more pressing is obviously true. Sad, but true. In time of war, however distressing this might be, we don’t have a jury trial before shooting at the enemy soldier. Nor do we do so in some time of civil mayhem, the Riot Act exists for a reason and so on.

However, before we permit the erosion of those rights we do want to know that the solution is both necessary and also works. It’s that second that GCHQ’s latest idea fails. The thought is that we can all still use end to end encryption. But that such a system must create a “ghost” message. GCHQ must be cc’d with a copy of what we’re saying to each other. So that they can, if they wish, then try to break that encryption.

Obviously, of course, they’d only do so when pursuing really bad guys. Oh yes. As to why this rather than a back door which simply allowed them to decrypt such a backdoor is exploitable by every bad guy out there so that’s not a good solution.

And yet, quite clearly, this won’t work. The code - source code - for end to end encryption is easily available, undoubtedly there are versions on GitHub and the like. Therefore, what will happen? The commercial forms of such messaging systems would - if such a law were passed - contain such ghosting. Our civil liberties would have been reduced. But to no good end. For what are the bad guys we’re trying to catch going to do? Go get the source code and create their own end to end encryption networks which don’t contain the ghosting.

There’s really no point to such a diminution of our freedoms if it simply won’t solve the problem to hand, is there?