But what happens when you want to run the trains at night?

We’re told that solar power is now price competitive to run the train system. Which is great, obviously. A few panels is indeed a better solution that burning dead dinosaurs:

Rail line in Hampshire is world's first to be powered by solar farm

Pilot scheme on Network Rail’s Wessex route could pave way for direct powering of trains

Currently (sorry) this is to provide power to the signals and perhaps the onboard electricity requirements of the trains, not to power the transport itself. But we’re told that:

The falling cost of solar power technologies means these subsidy-free solar farms could supply electricity at a lower cost than the electricity supplied via the grid.

At which point a necessary observation. Which is that if this is true then we’ve rather licked climate change, haven’t we? Solar power is now cheaper than whatever it is we suck out of the grid. And thus we’ll all be using solar power because it’s cheaper and we’ll not be using those fossil powered stations that push the electrons into the gird.

That is, the radical transformation of society isn’t necessary as we’ve already solved the problem.

The only way it is possible to still insist that we must do more is if solar isn’t in fact cheaper than grid. Say, we’d like to be able to run the trains at night. Or there’s a cost to having the back up power when the Sun goes down - or given England, isn’t shining - that still has to be paid. Or that grid connection to provide it costs something.

That is, either solar is cheaper in which case we’re done or it isn’t cheaper in which case why are we being told it is?

Nationalisation by the Scottish Government is ferry bad news for taxpayers

It’s the end of an auld song. Not to mention the end of competition. The Scottish Government has just nationalised the last remaining shipbuilder on the lower Clyde and the only builder of merchant ships on the river. And it was all entirely avoidable!

Ferguson Marine, of Port Glasgow, was saved from collapse by tycoon Jim McColl in 2014 and landed the £97million contract to build the new Glen Class Ferries for Caledonian MacBrayne. CalMac, as it is known, is the major operator of passenger and vehicle ferries, and ferry services, between the mainland of Scotland and the 22 major islands on Scotland's west coast. And it is wholly owned by—who else?—the Scottish Government. Meanwhile, its sister company CMAL, which owns the ships, ports, harbours and other ferry infrastructure, is wholly owned by—yes, the Scottish Government.

To add to the completeness of state control, the Scottish Government has also decided that geography does not exist. The idea is that, if the sea did not exist, there would be roads instead, so getting to Brodick, Rothesay, Stornoway, Lerwick or Portree would be cheap. So ferry fares are made cheap too—cut to a ‘road equivalent tariff’. The result of these artificially cheap fares is that island parking spaces and narrow roads are now clogged with large camper vans, full of provisions bought on the mainland. Add to that the fact that islanders themselves now find it cheap to go to the mainland and stock up with provisions, clothes and household items, and you can see why island village shops are closing by the day.

Everyone who uses the ferries knows they are notoriously unreliable. It is not just the weather: true to a nationalised industry’s form, the service is starved of capital, the ships are superannuated and clapped out, and the port infrastructure just isn’t up to the job—never mind up to modern standards. Ferries plough on with crippling faults, and are shuffled about between different routes to plug gaps because there is simply no spare capacity available in case of problems. And yet CalMac and CMAL have vigorously fought off any attempt to introduce competition on their routes. And now they have managed to kill off competition even in building their ships.

When Ferguson Marine was given the contract for the Glen Class ships, it was effectively a start-up. Its predecessor, Ferguson Shipbuilders, had been broken financially by a Scottish Government contract to build the world’s first sea going Roll On Roll Off vehicle/passenger diesel electric hybrid ferries. But then politicians are more interested in green virtue signalling than they are in taxpayers’ money.

In 2015, CMAL announced that Ferguson Marine would build two even more novel ferries, operating on either marine diesel or liquefied natural gas—not that any of the 22 islands served by CalMac have anywhere to store liquified natural gas. Nor are there yet any such ferries in service anywhere in the world.

Less than three years later, Fergusons were complaining of design creep, CMAL’s poor understanding of the complexities, bad customer project control and inadequate funding for the extra expenditure—the same problems inflicted on its predecessor. Matters came to a head in 2019 when the Scottish Government refused to stump up £61 million to cover the spiralling costs caused by the same inadequate controls and lack of understanding. So the planned ferry for the Arran route—the busiest, by far—which should have been in service last year, will is not likely to sail before 2020. But Arranachs are not placing optimistic bets on that.

And the answer to all this incompetence by the Scottish Government and its ferry subsidiaries? Buy ferries that actually work from proven ferry shipbuilders in England, Germany or even China, Korea or Japan? No: the politicians’ answer is that Ferguson Marine is being nationalised, so it can be run by the people who have failed so spectacularly in the first place.

What the Nazi-Soviet Pact entailed

Eighty years ago, on August 23rd, 1939, Vyacheslav Molotov and Joachim von Ribbentrop signed the Treaty of Non-Aggression between Nazi Germany and the USSR, the treaty known to the world as the Nazi-Soviet Pact. The signing in Moscow stunned the world. Communist parties all over the world had opposed Nazism, but now they were ordered by Moscow to swing behind the deal.

The pact left Hitler free to make war in the West, and World War II started only 8 days later when his troops invaded Poland. It looked to the world like a cynical move on Stalin’s part, to make peace with his sworn enemy in order to unloose Germany’s military machine on other countries. What the world did not know at the time was that there were secret protocols to the treaty that carved up neutral countries between Germany and Soviet Russia. Lines were drawn up on a map delineating the spheres of influence of the two powers. It carved up Poland, Latvia, Lithuania, Estonia and Finland. The secret protocols were only revealed at the Nuremberg Trials after the war.

When World War II began, Communist parties in Europe were ordered to oppose the war in order to respect the Soviet neutrality. The Pact lasted 22 months, ended unilaterally when Hitler launched Operation Barbarossa and invaded the Soviet Union. With hindsight’s 20-20 vision, it looks as though this had been Hitler’s intention all along, and that his conquest of Western Europe was designed to prevent it allying with the Soviets when he invaded their territory.

It seems extraordinary now that Communists, thought of as extreme Left, should have aligned themselves with fascists, regarded as extreme Right, but Stalin and Hitler were alike in many respects. Both were totalitarian despots who wielded absolute power. Both murdered without a qualm and killed millions. Both sought to grab territory from other nations and subdue their peoples. Neither had any time for liberty and democracy, and both fostered a personality cult that brainwashed their peoples into thinking of them as gods.

There were differences, though. Anyone raising the Red Flag in Trafalgar Square today could be regarded by some as campaigning for a “just” society (meaning one like Stalin had), and could perhaps hope that Jeremy Corbyn or John McDonnell might give speeches in front of it. On the other hand, anyone raising a swastika in Trafalgar Square would probably be arrested and imprisoned.

A stirring call to give us lots of money

The G7, President Macron, the usual UN suspects, tell us that gender equality is very important. They’re right, it is. Emma Watson gains a presence on stage because, well, because having Emma Watson on stage produces more PR for the claim, that’s just how things work. All of which we’re entirely fine with, of course.

We do rather want to make the point - as we have done so often in the past - that gender equality is something that comes about as a result of economic development, not something that causes it. Gender division in labour isn’t going to stop in a society that relies upon human heft as its power source. Gender division in domestic labour isn’t going to stop in a society where an adult woman spends most of her fertile life pregnant or suckling. The use of machines as the power source is economic development, the greater incomes and wealth from it leading to the fall in fertility rates.

That is, causality is an important point. Given the importance of gender equality of opportunity a very important point.

However, we can’t help but note this in the official call to arms:

Every G7 country should have a feminist foreign policy

We tend to think that depends upon the definition of feminism we’re using here.

The members of the G7 Gender Equality Advisory Council are activists and advocates from 23 countries. We are civil society and business leaders, doctors and actors, artists and lawyers, ambassadors, UN leaders and Nobel laureates. We’ve built on the efforts of our diverse networks and partnerships, and on the recommendations we and others developed for Canadian prime minister Justin Trudeau’s G7 presidency last year under the banner of Making Gender Inequality History.

OK, good for you.

Along with civil society groups, we encourage each G7 country to have a feminist foreign policy and by 2025 to significantly enhance aid to promote women’s rights and gender equality. But none of this will happen unless countries properly fund the independent women-focused and women-led organisations that hold legislators to account on their commitments.

Ah. The stirring call to action is that we must all give more money to those making the stirring call to action. It is possible to think of less mercenary demands.

And to think, there are those who deny the validity of public choice economics.

Deng Xiaoping, saviour of China

One of the most remarkable figures of the 20th Century was born on August 22nd, 1904. This was Deng Xiaoping, China’s “Paramount Leader,” the one who changed the course of China’s economic development and its position in the world. His rise was not predictable.

A peasant upbringing was followed by study in Paris, conversion to Communism, then the Red Army and the Long March. He was purged twice by Mao in the Cultural Revolution, and his son was crippled for life when he was thrown from an upstairs window by Red Guard zealots. When Mao died in 1976, his chosen successor, Hua Gofeng, put on trial and imprisoned the Gang of Four fanatics, and Deng manoeuvred his way into power. He never held any of the key high offices, so they called him the “Paramount Leader.”

He was called "General Architect of the Reforms,” as he abandoned collectivism and Socialism (though he kept the words), and opened China to market capitalism and international trade. China stepped onto the world stage and became one of the fastest-growing economies. Deng famously didn’t care if the cat was black or white, as long as it caught mice; and capitalism caught mice. He called it “Socialism written in Chinese characteristics,” but to those unable to read Chinese characters, it looked like capitalism.

When the village of Xiaogang illegally abandoned collective farming, and apportioned the land to family farms, its first harvest outdid the combined totals of the previous five years. Under Mao they would have been executed, but Deng, pragmatic as ever, looked at the results and decided to do the same across China. From mass starvation and food imports, China became a net exporter of food.

Deng lifted about a million people out of subsistence poverty and above the UN-set level of non-poverty standard of living. China boomed at nearly 10 percent growth per year for two decades. His legacy is the modern prosperous China of today.

Jeremy Corbyn has praised China’s economic achievements “since 1949,” the year it went Communist. This conveniently ignores the 60 million killed by famines and purges. Its economic achievements date not from 1949, but from 1978, when Deng abandoned Socialism. Corbyn credits to Socialism the achievements that resulted from its rejection.

In science, when the evidence goes against a theory, you reject or modify the theory. Under Socialism, when that happens, you reject or modify the evidence. Deng Xiaoping changed the world immeasurably for the better. Jeremy Corbyn will not.

Employers seem happy with the wages they're paying employees

It’s possible to hear a certain whine as the outrage generators spin up:

Shareholder revolts at annual meetings have “little impact” on restraining runaway pay across FTSE 100 companies, despite a fall in the average salary paid to chief executives last year, according to the CIPD and the High Pay Centre.

Between 2014 and 2018 shareholders approved all FTSE 100 company pay policies presented at an AGM, with most votes sailing through, a report by the association for human resource professionals and the think tank found.

“Despite the rhetoric about shareholder dissent, most remuneration packages in 2018 were voted through with levels of support of 90pc or more,” it said.

We, being reasonable and rational people, take a 90% vote in favour of current arrangements to mean that 90% of the people voting - or of the votes cast - are happy with the current arrangements. That is, the shareholders who determine the pay of their employees, those managers, are happy with the amount they pay those employees, the managers.

The outrage here coming from the manner in which the High Pay Centre thinks they shouldn’t be. And the whine is that of the prodnose finding that reality doesn’t agree with their prejudices.

That is, there’s no problem with shareholder dissent here because the shareholders aren’t dissenting. Despite the HPC’s insistence that they should be. This is therefore all a problem that we’ve solved. Those footing the bill are happy with the cost they’ve got to pay, what else is there we should think about in a market economy?

Voluntary exchange of money and or resources for services performed being rather the point of that market economy….

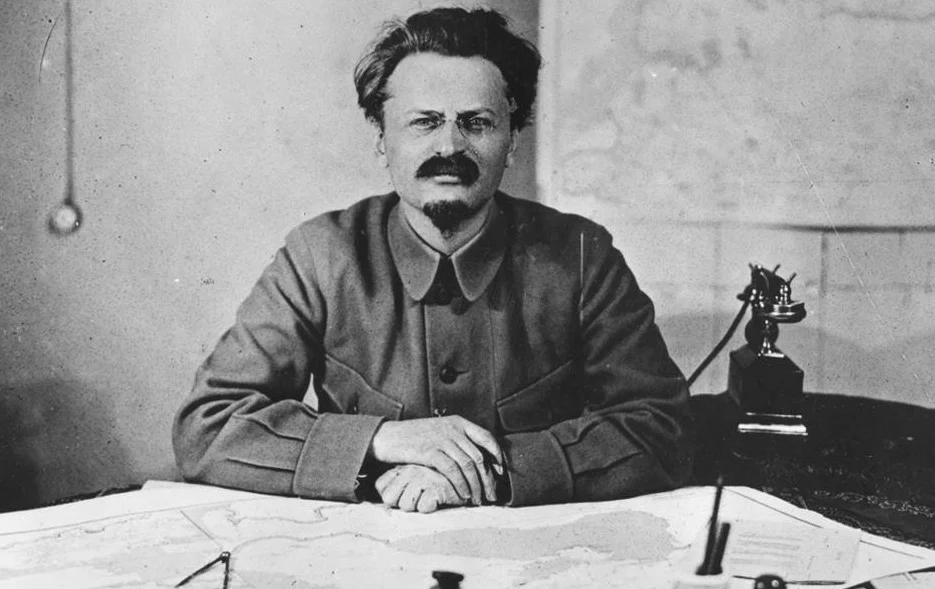

What Leon Trotsky achieved

Leon Trotsky died on August 21st, 1940, murdered in his Mexican retreat by an agent sent by Stalin to kill him. He was one of the leaders of Russia's Bolshevik October Revolution, which he saw as a permanent proletarian revolution, as opposed to the democratic "bourgeois" Menshevik revolution that had seized power in February.

Initially a Menshevik himself, Trotsky had joined Lenin in the Bolsheviks just before the October Revolution, and played a major role in establishing the totalitarian Communist state that followed. First as foreign commissar, he negotiated peace with Germany, then as Commissar for Naval and Military Affairs, he built up the Red Army into an efficient war machine that defeated the "White" forces who opposed the revolution.

He was totally ruthless, setting up the Red Terror to eliminate "ideologically impure elements," and initiated concentration camps and the practice of summary executions. He thought that soft-heartedness would destroy the revolution, and that the propertied classes had to be totally eliminated. He initiated the state takeover of the unions, and party control of any independent organizations. Control had to be total, which means a totalitarian state. And he wanted international revolution, not merely "socialism in one country."

When Lenin suffered a series of strokes and died, many had expected Trotsky would succeed him, including Trotsky himself, but he was outmanouevred by Stalin, now general secretary of the Central Committee. Trotsky's arrogance won him few friends, and he was thrown out of the party in 1927, then exiled in 1929 first to Kazakhstan, then to Turkey. All his supporters who remained within the Soviet Union's borders were executed in the Great Purges of 1936–1938.

Trotsky himself continued to write against Stalin, and worked to co-ordinate a movement of international Communism to oppose and denounce Stalin, whose rule he described as an "undemocratic bureaucracy" and a "degenerated workers' state." His 11 years of exile saw him living first in Turkey, then France, then Norway. In all three he was declared persona non grata and had to leave, finally settling in Mexico. He was finishing his biography of Stalin when he was attacked in his study by a blow to the head with an ice pick, and died next day.

Subsequent supporters of Trotsky have claimed that he would have implemented a genuine Socialist revolution, with workers' rule and a classless society. The reality is, though, that he would in all likelihood have been just as murderous as Stalin, and would have succumbed to the same megalomania that characterized the Soviet leader. He had already shown signs of this, and had practised an even more cold-blooded and fanatical zeal than Stalin.

Trotsky’s death at the hands of one of Stalin’s killers, reminds us that ruthless Russian leaders, then and now, have shown the same readiness to murder opponents living abroad, as recent events in the UK have confirmed.

The argument in favour of independent central banks

Donald Trump has tweeted:

Our Economy is very strong, despite the horrendous lack of vision by Jay Powell and the Fed, but the Democrats are trying to “will” the Economy to be bad for purposes of the 2020 Election. Very Selfish! Our dollar is so strong that it is sadly hurting other parts of the world........The Fed Rate, over a fairly short period of time, should be reduced by at least 100 basis points, with perhaps some quantitative easing as well. If that happened, our Economy would be even better, and the World Economy would be greatly and quickly enhanced-good for everyone!

Which is the argument for central bank independence.

You or we might think that Donald Trump should be re-elected - or not. But that boom or bust for the economy should be determined by his re-election prospects is that argument in favour of central bank independence. As far as interest rates should be centrally determined their being so by politics is a seriously bad idea. Because, obviously enough, the motivation of a politician is to get re-elected, not to do what is independently best for the economy nor the people.

True, there are certain elections where one side winning rather than the other will clearly be better for said economy and said people. Thus we might even think that a bit of manipulation will be of benefit. It’s just that for incumbent politicians “certain” always means “this one with me in it” which isn’t the way to decent monetary policy.

The teenage minimum wage debate

Recent months have seen further calls for raising the minimum wage rate for teenagers to the same rate as adults. For instance, Labour has promised to include under 18s in its plans for a £10 an hour minimum wage. However, this debate is not a new one, with the Green Party proposing an equalised £10 minimum wage system five years ago.

Supporters argue that age should not be a defining feature in determining the minimum wages of workers. In the words of SNP MP David Linden, “How, therefore, can we be in this ludicrous position in which people under 25 are paid less simply for being a particular age?” To illustrate this point, the National Living Wage for those aged 25 and over is £8.21 an hour, whilst those under 18 can be paid £4.35 an hour.

On the other hand, there is another aspect of this debate that must be considered: employability. There are concerns that equalising the minimum wage rate for all ages could end up reducing youth employment rates, because employers may choose to hire more experienced, older workers over teenagers. Indeed, scrapping age differentials would generally reduce the incentive for employers to hire younger workers with less experience in the job market.

The potential risks of a large increase in the youth wage rate has been noted by the independent Low Pay Commission (LPC), which advises the government on the national minimum wage policy. Its 2015 report cited the 3 to 6 per cent fall in the employment rate of 16 to 17 year olds after New Zealand raised its under 18 minimum wage by 41%. The LPC generally tends to suggest smaller, consistent increases in the minimum wage. It has also been argued that for youths with few qualifications, greater difficulty in acquiring jobs can negatively impact their CVs and resultantly their long-term employability. To put this into perspective, raising the UK’s under 18 rate to equal the over 25 rate overnight would amount to an almost 90 per cent increase.

It is due to these potential unintended consequences that this issue has been a cause for debate. Whilst proponents of Labour’s position note the benefits of higher wages for younger people, there have been concerns raised over possible side-effects.

Arguments on both sides of this debate are by-and-large genuine in attempting to promote the interests of younger workers. Ultimately however, moves to change the status quo require an assessment of the costs and benefits. This debate will certainly persist in the coming years, but if politicians are serious about promoting the interests of young people, then potential impacts on teenage employability should not be disregarded.

Kaamil Kaba is a research intern at the Adam Smith Institute.

Carbon taxes in practice

The idea of a carbon tax has been previously addressed on this blog by Tim Worstall [here, here, here, here, and here]. He’s already covered the economic arguments behind why the carbon tax would correct the market failure of negative externalities from pollution, incentivise innovative solutions to climate change, and reduce the environmental damage of an atmospheric buildup of CO2.

But it’s not like taxing carbon is a brand new idea. Plenty of countries have instituted forms of carbon tax, including Australia, British Columbia, Canada, and the UK itself. So just how successful have these initiatives been?

Let’s start with Australia, which passed a carbon tax scheme on 1 July, 2012 despite heavy public and partisan opposition, with the intention of moving to a more market-based emissions trading scheme in 2015. It set a price at AUS $23 (£14.8) per tonne, not applicable to road transport or agriculture. The then-Labour government reduced income tax, increased welfare payments, and introduced forms of compensation for heavily-hit industries and households to offset higher costs for consumers, all powered by the revenue gathered from the new tax. It had an extremely short lifespan, however, being repealed in July of 2014 after the opposing Liberal Party won on promises to ‘axe the tax!’. The scheme has been replaced with a much less encompassing ‘Safeguard Mechanism’ in which a voluntary scheme of emissions reduction credits and observation aim to reduce emissions through a much more subtle approach.

So did it work? Well, kind of. Overall, emissions dropped by 0.8% in the first year and 1.4% in the second year, the latter being the largest emissions decrease experienced in a decade. Just in 2013, emissions from companies reduced by 7%. However, energy increased, the government that scrapped the tax argued any reductions were attributable to declining industry, as emissions were decreasing before the tax began, and public concern for the environment was at an all-time low of 36%. The Energy Users Association of Australia maintains that “it cannot be said that pricing emissions...reduced emissions in stationary energy to any meaningful extent". So it’s a bit of a toss-up.

Canada, meanwhile, was lauded by environmentalists as visionary, when Prime Minister Justin Trudeau passed legislation in December 2018 that imposed a federal carbon tax across four provinces which had thus-far failed to create sufficient environmental plans. However, such new legislation has had little time to take effect, so let’s look at a province which took this path years ago. British Columbia instituted a carbon tax scheme in 2008, headed by the BC Liberal Party. Beginning at CAD $10 (£5.43) in 2008 and increasing to CAD $40 (£24.91) this past April, it “applies to the purchase and use of fossil fuels and covers approximately 70% of provincial greenhouse gas emissions”. A decade on, per capita emissions have decreased 14%. While it did increase energy prices, with gas rising by up to $0.19 per gallon (approx. £0.3 per liter) the first year, it worked exactly as carbon tax advocates said it would. People drove less, businesses invested in renewable energies and energy-efficiency. By 2015, only 32% of citizens opposed it, and the business community largely held a favourable opinion. Significantly, the province actually returns more money to taxpayers in the form of corporate and personal income tax cuts and tax credits distributed to low-income families ($1.7 billion) than is actually generated in revenue ($1.2 billion) from the tax. In terms of tax schemes, a success.

And so, back home. The UK has a form of carbon tax, and has done for a while. The Fuel Duty Escalator (FDE) was in place from 1993 to 2000, then in 2005 the UK signed on to the EU’s Emissions Trading Scheme (ETS). However, the ETS was not seen as placing big enough prices on carbon, with permits for additional carbon being as cheap as 2.81 euros per tonne. On 1st April, 2013, the Carbon Price Floor was introduced “to underpin the price of carbon at a level that drives [the] low carbon investment” that the ETS had so far failed to do. The Carbon Support Price (CSP) was added on top of the ETS allowance prices to reach CPR levels. The current CPF is £18 per tonne of CO2 is frozen until 2021. Recently, it was announced that the UK would continue with carbon taxes even in the case of a no-deal exit from the EU on 31 October.

So, has it worked? Well, the UK’s use of renewable energy has increased, with 11.5% of energy in 2016 coming from wind, compared with only 9.2% from coal, which is the first time coal has been so eclipsed as an energy source since 1935. In March of that year, “coal generation fell to zero for the first time since public electricity supply started in 1882”, and in 2017, total carbon emissions in the UK fell to levels last seen in 1890. The fact that the CPF doubled in 2015 may have had something to do with this.

There seem to be three key features of successful carbon tax schemes. The first is that, in the initial stage of planning and initiating, there must be bipartisan support. Australia’s tax was pushed through by the Labour government, leaving it all too easy for the consecutive government to win on an ‘axe the tax’ platform that highlighted any price increases or additional difficulties imposed on businesses. However, in the UK, when a tax scheme was spearheaded by a right-leaning leader, bipartisan support ensured more public acceptance of the scheme and a longer life span.

Secondly, the price of the tax must be set high enough to make an impact and accurately reflect the social cost of carbon emissions. The UK specifically chose to add a tax in addition to the ETS scheme, and it was only after that increase that businesses started evolving and investing in energy efficiency and renewables and emissions declined significantly.

Lastly, a ‘revenue neutral’ approach is necessary, meaning revenue gathered by the tax is used to offset any negative impacts: especially those imposed on the lowest-income households and carbon-intensive businesses. The global financial crash hit a mere 2 months after B.C. first instituted its carbon tax, yet the tax survived and even the poorest households received cuts and repayments to make up for increased energy prices.

However, there are questions regarding how far a tax can feasibly be taken without losing public or business support, and how much of a substantial impact it can actually make. Some researchers estimate a tax of even $73 per tonne would be insufficient to make a substantial climatic impact, and while $100+ per tonne just might do it, the likelihood of this happening in real life is very low.