How glorious that Britain's green economy is shrinking

We can always trust The Guardian to get the wrong end of any economic stick:

Britain’s green economy has shrunk since 2014, heightening concerns that the government will miss targets to cut greenhouse gas emissions by the middle of the decade.

The number of people employed in the “low carbon and renewable energy economy” declined by more than 11,000 to 235,900 between 2014 and 2018, according to the Office for National Statistics (ONS). Green businesses fared little better, seeing their numbers drop from an estimated 93,500 to 88,500 over the same four-year period.

This is something to glory in, not complain about.

All are agreed, even The Guardian, that UK emissions have fallen and are falling - yea whether we include emissions embedded in imports or not. Excellent, that’s the desired target. Well, as always when discussing this subject that’s what we’re told our desired target is.

The complaint here is that we’re reaching that target while using less human labour to do so. That not being something to complain about, that being something to marvel at, glory in the existence of.

For, as we keep having to remind people, jobs are a cost, not a benefit. Human labour is an input into the process, we like using fewer inputs to reach our goal than more - it means we’re being more productive, that ultimate underpinning of our standard of living.

After all, if one bloke with a magic machine could solve climate change just by flipping the switch then we’d all be delighted. Two blokes means a second person has to stop working in the NHS, providing us with ballet, producing vital grievance studies output, therefore the extra job means we’re poorer by some amount of health care, dance and or grievance. 11,000 people not providing us with green stuff is 11,000 more grievance lecturers and aren’t we the lucky ones?

Gaining our goal by using less human labour is something to be celebrated, not worried about. For the advance of civilisation comes from the process of killing jobs.

How nice of the NHS to prove the Laffer Curve

Out there further to our left we often enough see the insistence that the Laffer Curve simply does not exist. That there is no tax rate which causes people to reduce their supply of labour to the market, therefore there is no tax rate above which revenue collected actually falls.

So we should be grateful to the National Health Service for disabusing everyone of this notion:

Changes to pension rules mean that once workers earn more than £110,000 they face more stringent taxes on their contributions. Under the NHS scheme, in which contributions are calculated automatically and are outside the control of beneficiaries, senior consultants have been landed with unexpected tax bills of tens of thousands of pounds.

As doctors turned down extra shifts to avoid breaching the limit, the problem was said to have led to cancelled operations and lengthening NHS waits. A&E performance hit a record low last month, with one in five patients waiting more than four hours.

Excellent, we have now proved - as in shown to be true, not just tested - the contention that tax rates can be high enough that they lead to the withdrawal of labour.

True, we now need rather more work on exactly where that peak of the curve is (our best evidence, from varied independent empirical and theoretical sources is in the 50 to 55% of income range - note, not income tax, but taxes upon income so income tax plus national insurance or social security taxation and yes, all, nominally paid by employee or employer) but we can now relax on having to prove the base contention itself.

After all, the NHS is the Very Wonder of the World, all looking to it as that shining beacon on the hill. We should all be lauding the manner in which that Jerusalem we’ve built illuminates this slough of despond, no?

So that's another third off corporation tax then

Our reaction to this news is how excellent. For this means we can cut another one third off corporation tax:

Taxpayers plough £17bn a year into business support schemes which are often poorly designed, badly monitored and barely coordinated, the National Audit Office (NAO) has found.

The Government runs more than 100 programmes to help companies to grow, at a total cost of more than £17bn. These include targeted tax reliefs, advice services and grants to boost productivity.

But the money is at risk of being badly spent as results are not watched closely, the watchdog said, while poor coordination and marketing means the companies most in need of the aid may not know it exists or struggle to find it.

£17 billion a year is being micturated away simply because government is a bad manner of doing these things. Excellent, so, let’s stop government doing these things.

If we’re not to waste £17 billion a year on business then we can stop raising £17 billion a year from business too. Corporation tax raises some £51 billion a year at present.

Thus, stop wasting £17 billion a year, don’t raise £17 billion a year and cut the corporation tax rate by one third. Sometimes economics really is just this simple.

Taxing business to subsidise business is always a slightly odd proposition. Taxing business in order to waste the money is just silly.

Sure we should have four day working weeks - the US already does

One of those little ideas peering over the lip of the political punchbowl these days is that we should all be working 4 day weeks. After all, Keynes said we would by now so why not?

It being entirely true that as a society becomes richer we expect more of that greater wealth to be taken as leisure rather than as simply more stuff. The interesting question here being, well, how to bring it about? The answer being do and plan nothing.

Don’t have government tell everyone to do so, instead, this is an area where laissez faire really does work. For as we keep being told the US has very little regulation of working hours, employers are allowed to crack the whip in a manner just not possible in Europe. The next effect of this?

The average workweek for all employees on private nonfarm payrolls was unchanged at 34.3

hours in December. In manufacturing, the average workweek and overtime remained at 40.5

hours and 3.2 hours, respectively. The average workweek of private-sector production and

nonsupervisory employees held at 33.5 hours.

33.5 hours isn’t quite a 4 day work week but it’s a lot closer to it than a 40 hour one would be given an 8 hour working day. This isn’t because there are vast hordes stuck on undesired part time hours either:

The number of persons employed part time for economic reasons, at 4.1 million, changed

little in December but was down by 507,000 over the year. These individuals, who would

have preferred full-time employment, were working part time because their hours had been

reduced or they were unable to find full-time jobs.

Given the 160 million or so in the US labour force that’s an entirely trivial number with no great impact upon that average work week.

Leave people alone - both employers and employees - to decide the hours of paid labour and as a society gets richer people work less. This is therefore a problem that is solved, nothing more need be done. As is so often true of leaving people alone to work out how to live their own lives of course.

Or as we could put it, proper liberalism works.

We can see why they're doing the wrong thing

The European Union is to insist that every country sets the minimum wage at 60% of the median wage. This is the wrong thing to be doing:

The commission’s aim is to ensure member states set a minimum wage equivalent to 60% of the median salary in that country.

The why is obvious. Poverty is currently defined as - even though this is inequality, not poverty - less than 60% of median income. So, if the minimum wage is 60% of median income there will be no in work poverty. Huzzah!

The problem being that the ill effects of a minimum wage being “too high” don’t magically appear when it is set at 60% of median income. A more realistic estimate of when jobs and hours noticeably start disappearing is 45 to 50% of that median income. Thus the adoption of the target will lead to significant such effects.

We’re also absolutely certain that the EU will adopt the full year, full time, median income as its target. And as even the very pro-minimum wage Arindrajit Dube has pointed out - he being the American scholar of the minimum wage the UK government is using as an advisor - it is the blended part and full time, temporary and all year minimum wage that needs to be used. This being notably lower.

It’s a bad aim, the wrong target and it’ll not be helpful in the slightest.

There is also that other problem:

Of the 28 member states, only Denmark, Italy, Cyprus, Austria, Finland and Sweden do not have a statutory minimum wage.

Different places have different solutions to this same problem or point. This difference being an anathema to those who would rule a continent, for if places can sort things out without that centre being involved what’s the point of that centre?

Well, quite, what is the point of the EU insisting upon a particular approach to the minimum wage? How does this, in the words of Sr. Barroso, stop Germany invading France? Again?

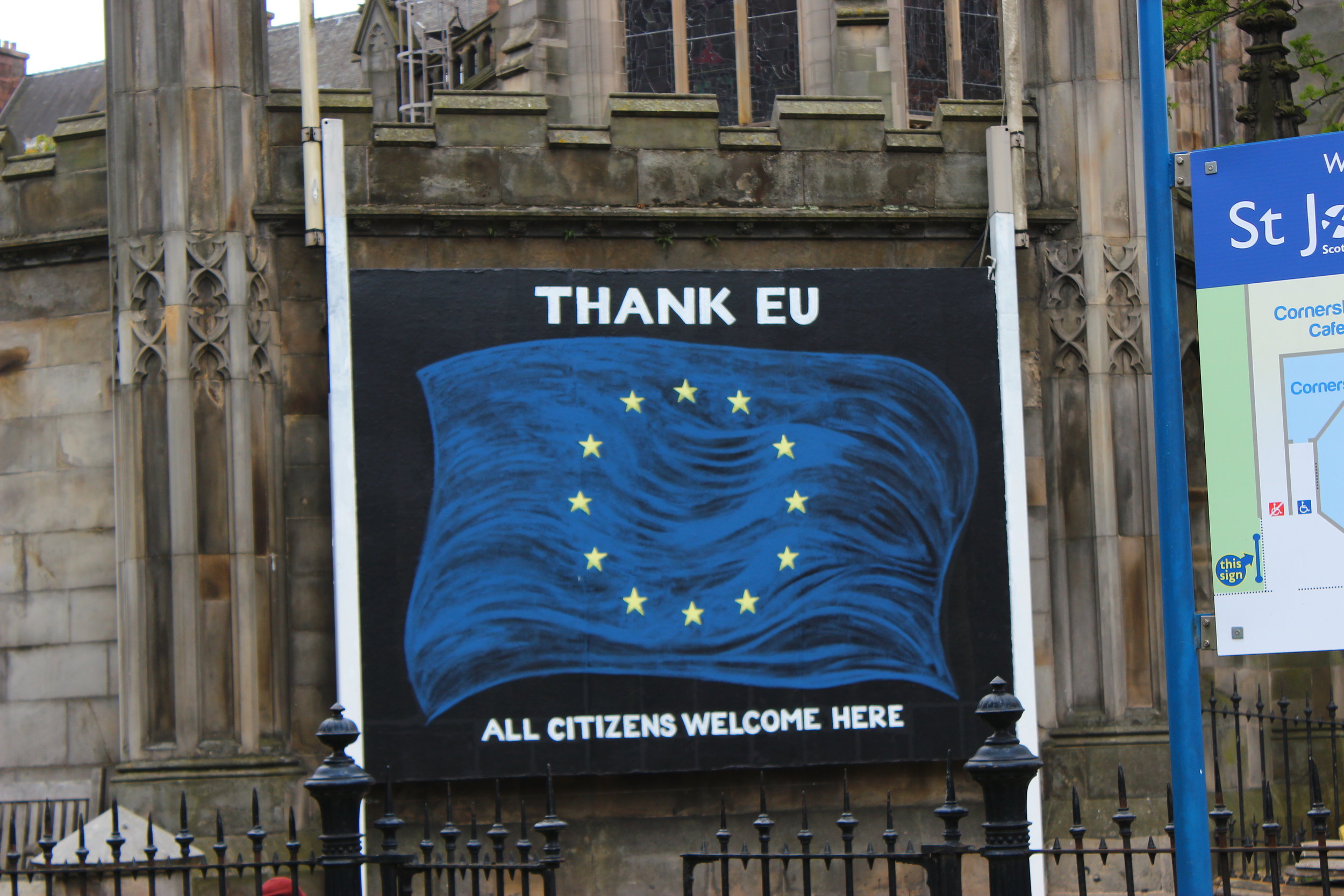

This being the basic problem with international negotiations

Asked whether the EU would use its power to switch off the City’s ability to serve European clients to gain leverage in the coming negotiations with Britain, Plenković said: “I wouldn’t go into the vocabulary of weapons but what I have learned in international and European negotiations [is] that all arguments and considerations are treated as political.”

The aim here is to try and come to the correct economic decision. Yet the criteria to be used are the political ones.

We’re most unlikely to get to the right answer therefore.

This always being the problem with all of these international negotiations. It’s the politicians sitting around the tables discussing what would be good for politicians. With trade this problem is especially stark as the correct answer is that politics should play no part in why may trade what with whom.

But that’s the way it’s done and is the reason why international trade doesn’t boost our lifestyle as much as it should - political interference in who may trade what with whom.

Our perverted measures of affordable housing

A useful example of how polluted, perverted even, political language can become. We’ve a claim here that creating more housing reduces the amount of affordable housing there is. This is also being said with an entirely straight face, despite the obvious point that increasing the supply of housing by just the one unit makes every single unit of housing in the country that infinitesimal fraction of a percent more affordable:

Office buildings being converted into flats is driving the shortage of affordable homes, local government officials have warned.

Town hall leaders claim that more than 13,500 affordable homes have potentially been lost across England over the past four years due to rules allowing offices to be converted into housing without needing planning permission.

The Local Government Association (LGA) looked at the number of office conversions carried out under the permitted development right, which allows homes to be created without going through the planning system.

If you go through the planning system then in return for being granted the permission you must build - or reserve from those built - some units of affordable housing. The definition here being below market price. So, if people are allowed to just build housing without going through the planning system then there’s that shortfall of below market price housing being produced.

Which is, of course, the real complaint here. That bureaucracy isn’t gaining those new assets to have control over, that “affordable” housing to be allocated by the bureaucracy.

The solution also becomes obvious. Bin the entire system of “affordable” housing and get on with building more so that all housing becomes more affordable.

Which is where that perversion lies. We don’t want to build below market price housing in the slightest. We want to lower the market price of housing. Which building more does and building more without paying a tithe to the local housing department still does. The only reason this isn’t starkly clear being the manner in which political language has perverted this obvious truth.

As Kingsley Amis did point out, more means less. Greater supply means a lower price.

Quite so, this is rather the point of doing Brexit in the first place

The UK’s regulation of The City should be whatever is best for the UK:

City heavyweights rowed in behind Bank of England Governor Mark Carney and former Chancellor George Osborne by calling on the UK to distance itself from Brussels after Brexit.

The UK should “move as far away as we can” from EU rules without losing access to European markets, said Nigel Wilson, chief executive of FTSE 100 insurer Legal & General.

This being rather the point of it being our government, it rules us and it should do so in whatever manner is best for us.

The benefit of access to The City’s financial markets is something that accrues to the Europeans who gain that access of course - it is the consumer who gains from trade. But even if we’re to think about the value to the producer we still want to think about this properly. Following EU rules and regulations would harm our own domestic economy by how much? And limit our exports to other non-EU jurisdictions by how much?

The entire point of Brexit itself being that we can, once again, make such calculations and take such decisions. Diverging from EU regulation is not some problem with the process, our very ability to do so is the point of it.

Whatever decision is taken may or may not be a good idea but that we can is the benefit of leaving.

The Case for Legal Organ Sales

The shortage of organs poses the great threat of preventable deaths. This is not just an issue in the UK but worldwide. An immediate solution? Legalise the sale of organs.

Legalising the sale of organs will increase the supply of organs. This means shorter waiting lists for those waiting for donations. It means that more people will be able to receive life saving transplants. If you allow a private organs market to coexist with a system of donations, it also means that those least able to afford it will have greater access to organ donations, as the more wealthy pay for the luxury of a not having to wait for a state sourced organ. A private market will mean new sources of supply as those who do not currently donate for altruistic reasons are encouraged by the profit motive. The majority of those who have currently opted to donate their organs will likely continue to do so regardless of the possibility of financial rewards. This will result in organs donated in an altruistic manner reaching more of the most vulnerable in society.

A private market for organ sale may even lead to a decrease in organ trafficking. As with any market, an increase in supply (caused by the legalisation of organ sales) will force the market price down. This phenomenon has been seen in perhaps the most unlikely of places: Iran. Not a country with many policies we ought to adopt, Iran takes a surprisingly liberal stance on the sale of kidneys. Iran’s higher supply of kidney has kept prices relatively low. The increased supply of organs in Iran meant that by 1999 there was no one left on the waiting list for kidney transplants. The high supply and fall in demand led to a fall in the incentive to traffic organs into Iran and would have the same effect if introduced internationally. The UN estimates that currently 5 to 10 percent of all kidney and liver donations worldwide are derived from trafficking. Victims of organ trafficking will also be able to seek help from the police without fear of arrest. The increased threat of investigation will also discourage organ traffickers due to the likelihood of getting caught and prosecuted.

Some object to organ sales believing it will oblige the poorest in society into selling their body to exploitative third parties. While this is horrific, some people facing extreme poverty already resort to selling their organs on the black market despite the illegality. When doing so, they risk unsanitary procedures performed by potential unlicensed surgeons and the possibility of not even being paid. Indeed some groups steal organs. At least with a legal market, these groups could be held accountable. In Iran, the Iranian Patients’ Kidney Foundation arranges kidney transplants, removing the role for an intermediary broker. The Iranian Ministry of Health prevents the sale of kidneys to foreigners, in turn preventing organ trafficking, in order to sell kidneys to foreign demand. Combined, these two factors have led to the eradication of organ trafficking in Iran.

The legal sale of organs will also lead to a decreased strain on the NHS. While awaiting kidney transplants, patients require dialysis, an expensive daily treatment costing the NHS. It has been calculated that each kidney transplant saves the NHS over £200,000. The greater the number of kidney recipients, the fewer dialysis treatments need to be performed. Individuals will also be motivated to keep themselves healthy in order to secure a higher price for their organs. Not only does this benefit the individual (in the form of both health and financial benefits), it also benefits the country as a whole as fewer preventable illnesses will need to be treated on the NHS such as obesity or illness related to smoking.

Not all organs are vital for a good quality of life. Many people do not object to a legal market for blood, eggs, or sperm, but there are other organs which the body can live without. Humans can survive with one lung, part of your liver or part of your kidney. The sale of organs need not be seen as an exploitative practice that will ruin the donor’s life. Although it may not be desirable, organ sales do offer a source of money for those battling extreme poverty. While some view the introduction of a opt out donation system (similar to that which we will have in Britain in spring of this year) as a more pleasant answer to the shortage of supply, it is not. It depends on donors of very specific physical traits having died. If you take organs from living people there is not such a long wait.

A legal market for organs is the way to go. It is an effective solution to the shortage of organs needed for transplants and will help deal the with the issue of human trafficking. By legalising organ sales, you can help to protect the most vulnerable who pursue the sale of their organs (legally or illegally). Governments can protect potential donors with bodies performing the same functions that the current organ registry does, bar the procurement of organs. There is a cost to inaction. For far too many on a waiting list that cost is pain and suffering — or the loss of a loved one. There’s a solution out there ready to be tried. We need to jettison the ideologues that reject organ sales because they come with a price tag, and realise it’s worth potential backlash in order to save a life.

Retail landlords should be paying much of the business rates bill

A complaint here which really doesn’t stand, is rather missing the point of the system:

BRC chief executive Helen Dickinson said retailers had been scarred by the shift of sales online, prompting a wave of restructuring, as well as increasing caution among shoppers amid the uncertainty of a potential no-deal Brexit and a general election. Firms are also battling with high rent and business rates.

Ms Dickinson called on the Conservatives to fulfil a pledge to cut rates, adding: “It is essential the new Government makes good on its promise to review, and then reform the broken business rates system."

She said that 25pc of all rates are paid by retailers, even though they make up just 5pc of the economy.

Tenants- and thus retailers - hand over the cash for business rates to be sure. But the economic incidence is upon landlords. This is not well known but is well proven. Thus rates are a tax on landlords.

Which is what rates are supposed to be as well. Some people own land - and the tax feeds through to land itself - in locations where it has a lot of value. As the location of a piece of land is rather happenstance, so too is its value. This is thus a good thing for us to be taxing.

Retail is both the reason for those high values and also the major user of that high value land. So, landlords of retail properties is where a tax on high land values is going to fall. That such landlords pay that large portion of business rates is not a failing of the system it’s the point of it.

It is, obviously, possible to make the system better. Which we should do in fact given the confusion that the current system produces. Move the responsibility for handing over the cash from the tenant to the landlord. That’s where the economic incidence is anyway and thus nothing else will change. The total occupancy cost of any site will be just what it is today.

The advantage would be that no one would be able to obfuscate, as above, about the system. We’re trying to tax high land values, we are, and under such a system still would be. All we’d be getting rid of is the ability of retailers to bleat about it all.