Yes, of course, this is purely electioneering, but still

Holding politicians to whatever they declaim at election time is an isometric exercise - a great effort and you get nowhere. After all, politicians don’t hold themselves to what they promise at election time and seem mystified that anyone else would take such declarations seriously.

Even given that this from Lisa Nandy appears somewhat confused:

This would mean that most people have some money in the bank in case something goes wrong, instead of corporations sitting on huge piles of cash.

What corporate cash piles? The more normal criticism is that companies take on debt in order to pay out dividends. That is, the corporate sector has net debt not net cash.

This means taxing wealth at the same rates as income and making sure gains from land, shares and property are properly and fairly taxed.

Wealth is to be taxed at 40 and 45%. Per year? That’s certainly a cat please meet pigeons sort of proposal.

And that so much of the wealth held in this country today is not earned, but gifted, whether through inheritance, house price rises or playing the market.

Playing the market is gifted, is it? Given that no one consistently outperforms that market this is a difficult contention to prove.

At which point there are really only two options. One is that Ms. Nandy just needs a better ghostwriter. The other that she actually believes these things. Neither are great advertisements for her competence.

Factory Tax number one issue holding back UK manufacturing: survey

The Factory Tax is the number one issue holding back industry in the UK according to a new survey of the country’s manufacturers.

The Factory Tax is the inability to fully expense investments in machinery and buildings. It holds back growth in parts of the country that are relatively more dependent on manufacturing, such as the North and Midlands.

Under the UK’s current tax arrangements, businesses can immediately deduct expenditures on the likes of salaries and stationary. But most investment in fixed capital can only be written off over time, which fails to account for inflation and a real return on capital. This means, in real terms, firms pay a tax — a Factory Tax — on investment in buildings and machinery.

The Adam Smith Institute's latest paper, Abolishing the Factory Tax: How to Boost Investment and Level Up Britain, argues that this is contributing to Britain’s woeful productivity. Over the last decade, productivity has grown by just 0.3% and the U.K. has had the lowest level of private investment in fixed capital as a share of GDP in the G7 for over two decades. This means lower incomes and lower quality of life for Brits.

The Factory Tax is the key issue raised by British manufactures. As it stands, they can only immediately write-off a small amount of investment under the ‘Annual Investment Allowance’. A survey commissioned by industry body Make UK found that 71% of companies want an increase in investment allowances. It was the number one issue cited, followed by energy costs and R&D tax credits. But as it stands the AIA, which is £1 million this year, will automatically decrease to £200,000 at the end of the year unless corrective action is taken.

Make UK has specifically referenced the Adam Smith Institute’s Factory Tax paper in their release about the survey.

“Low levels of private sector investment and poor productivity have been the achilles heel of the UK economy for decades,” Stephen Phipson, chief executive of Make UK has said. “One reason for this is the poor level of capital allowances compared to other countries, coupled with the inclusion of capital investment in the calculation of business rates.”

The ASI has called on the government to Abolish the Factory Tax by making the Annual Investment Allowance unlimited. This could have a huge economic impact: increasing investment by 8.1%, boosting labour productivity £2,214 per worker and moving the UK from 15th to 6th on the Tax Foundation’s International Tax Competitiveness Index. It would also help ‘level up’ the UK economy by removing the bias against industry that tends to be located in the North and Midlands — areas that the Conservatives have just won in large numbers for the first time in generations and will need to see growth in if they want to win the next General Election.

Abolishing the Factory Tax is a no-brainer for a Government that wants level up Britain and boost productivity and living standards.

Rates and land taxes - seriously folks, this is getting pathetic now

A land value tax would be better than the business rates system, yes. Simply because we would be taxing what we want to be taxing, rather than a proxy for it. However, the two are pretty good proxies for each other. There are, as we’ve been explaining, problems with the factory tax but this isn’t anything more than entirely marginal when considering retail property.

One thing to note about either system is that the tax is, in the end, incident upon the landlords, not the retail tenants. That final burden just does not depend upon who writes the cheque. Thus these complaints about changing from business rates to land value tax don’t work:

Retailers have blamed the tax for the growing number of high street closures as they struggle to see off online competition. The present system is based on shop rental values and is calculated every five years. The levy is paid by tenants, rather than landowners.

Who pays doesn’t matter, who suffers does - landlords.

There are also concerns that a land value tax would be passed immediately from landlords to retail tenants through higher rents. Ed Cooke, chief executive of Revo, which represents hundreds of retailers, high street landlords and consultants, said that the proposal “misses the point entirely that rates and rent are related and therefore the incidence of the tax is shared between owner and occupier”.

No, it isn’t. The rates bill, an LVT bill, will fall on the shoulders of the landlord. That claim that rents will rise is proof of that. Currently the tenant “pays” rates and then rent to the landlord. So, we go with an LVT and it’s the landlord paying the tax. At which point rents rise to be the same as what the rent and the rates bill were before. That is the claim, isn’t it?

That is, to the tenant the rent and rates bill is exactly the same as the rent bill in an LVT system. Thus it must be the landlord paying the tax both times, a change in the tax bill doesn’t change occupation costs, only the amount the landlord receives.

Rates, as with LVT, are therefore incident upon the landlord.

Or, as we should put it, business rates aren’t paid by tenants therefore alleviating business rates won’t help retail. The savings will just flow to landlords. And why would we want to alter the tax system to aid landlords?

It's not what you spend that matters, rather what you achieve

Leave aside whether the whole enterprise is worth undertaking for a moment and consider this complaint about climate change in isolation:

British companies are lagging far behind their European neighbours in low-carbon investment after contributing only 3% of the continent’s €124bn (£104.2bn) green spending last year.

A report has revealed that German-listed companies invested 11 times more in low-carbon investments such as electric vehicles, renewable energy and smart energy grids than UK firms.

London-listed companies spent €4bn on green research and technologies compared with €44.4bn from German groups, including the carmaker Volkswagen, which invested more than a third of Europe’s total low-carbon spending in 2019.

There’s the obvious point that a maker of cars shifting to making battery powered cars is going to invest quite a lot in the process. And also that the major manufacturers of cars in the UK (say, Nissan and Jaguar Land Rover) aren’t actually listed in London which is going to rather skew those figures.

Instead concentrate upon the complaint there. Those people over there are spending more than these here, isn’t that terrible? The answer being no, not at all. What is wanted is a reduction in emissions, not lots spent on attempting to reduce emissions. We’re interested in the effectiveness, the end result, not the effort put in.

And the thing is, the UK has reduced and is reducing emissions rather more than Germany. That it’s doing so at lower cost shows that it is reducing emissions rather better than Germany.

Thus neatly proving one of the points made in the Stern Review. Planning is less efficient than market processes suitably prompted. Therefore we should use market processes suitably adjusted to deal with this problem, as with near all others, rather than planning. Because less efficient means more expensive and humans tend to do less of more expensive things, more of cheaper. Using the more efficient market processes - suitably adjusted - means that more climate change mitigation will take place. Use the system that reduces emissions more cheaply and more emissions reduction will take place.

That the UK reduces emissions more at lower cost than Germany means that Germany should be adopting our methods, not we Germany’s spending.

But then logic is in short supply in this discussion, isn’t it?

How glorious is that lust for gelt and pilf

As and when the attributes of a population change it’s easy enough to see that the things desired by that population might change. Say, longer lifespans moving the seaside holiday market from something like Club 18-30 to Saga. Or, possibly, immigration over the decades changing the average melanin enhancement of said population.

The question then being, well, how is that change in desires to be assuaged?

The UK’s largest retailer Tesco is introducing a range of plasters to match different skin colours and better reflect racial and ethnic diversity.

In a supermarket first, its new own-brand fabric plasters, available in light, medium and dark shades, go on sale in all 741 Tesco stores nationwide and online from Monday.

Tesco developed the plasters after a member of staff spotted a now-viral tweet last year, when a black American man described his emotional response when he first used a plaster on his cut finger that matched his skin tone.

Tesco has done this because they expect to make money from it. If they don’t, ah well, no great harm done, plasters are going to be dyed one colour or another after all. The experiment will have been carried out. If it does make money then all other retailers will follow because capitalists are not only greedy but observant.

The same is - has been as well - true of hair care products, make up colours and so on. People have noted that they can make money out of catering to these previously non-extant desires among the British population. Thereby those desires get assuaged. Pretty neat system, eh? Something only comes into existence when people want it and does so when they do.

We might note that the NHS, that glorious and wholly planned system, is not providing such plasters - and, we’d assume, won’t be for some time.

Vespasian pointed out that pecunia non olet and it’s that same idea applying here. Money has no colour which is why capitalist and market systems cater so well - better than any other system - to the variability of the population and the variances in their desires.

Sure, it’s possible to complain that it should have happened already, these differently hued plasters, but do note that no planned or any other system did it before markets, fueled by the desire for other peoples’ cash, did so.

Action on NHS consultants’ and GPs’ Pension Tax Rules

Complying with today's pension tax rules is akin to playing rugby with only the referee being allowed to know where the ball is. HM Treasury provides pensions to attract and retain senior NHS medics and other public servants. They reduced the Annual (AA) and Lifetime (LTA) Allowances for personal pension savings from £255,000 and £1.8M in 2010 (thereafter to rise with inflation) to £40,000 AA (with no inflationary rises) and £1.055M LTA (inflation linked) today. Worse still, the “Tapered AA” shrinks the £40,000 to £10,000 for “adjusted income” over £150,000. [1] Exceeding the Allowances triggers unexpected tax demands, removes the incentive for senior medics to give their time and skills precisely when they are most needed and promotes early retirement. All disastrous for the NHS. The allowances are for the annual increase in pension values based on defined benefit (CARE [2] and final salary) pensions, not the amounts put into pension pots by NHS employers and employees.

Those increases in pension are obscure but HMRC have a formula. The Pension Administrators will provide a statement for the previous tax year if one does not mind waiting at least three months. The nub is that higher earners have no means of knowing when the ceilings are breached. Government has talked about the issue since April 2019, and even encouraged the NHS to break the law to get around it, but the policy error has yet to be corrected. The “sticking plaster” current fix and all the briefings the NHS has to provide its staff are costing millions of pounds. The January House of Commons Briefing Paper (HoCBP) sets out the problems, and in October last year the Office of Tax Simplification also made suggestions. This note suggests solutions, or at least ameliorations. The present system is too complex so the ideas of introducing more pension flexibility or different tax systems do not merit further consideration (7 February HoCBP).

Abolishing AAs and LTAs altogether would be the simplest solution but HMT would need to find the income elsewhere. The changes were aimed at the private sector with the argument that it was “unfair” to allow the well-off to make so much pension provision free of tax. This is nonsense because deducting pension contributions only defers tax; the pensions themselves are taxable in due course, albeit, perhaps, at lower rates. It would be complicated, but possible, to tax the future pensions at the levels at which the contributions were deducted, i.e. 45% for top earners. I doubt if HMRC could cope with that. Exceeding the Allowances is unfair in that those savings are taxed twice: on original earnings and then on the pensions themselves.

Alternatively, the AA and LTA should be returned to their 2010 levels. Failing that, raising them to £100,000 and £1.5M, say, would ameliorate the immediate problem. But the employee would still need to know when those ceilings are being reached. At present they are completely in the dark. The PAYE change proposed in paragraphs 4 and 6 below would apply irrespective of the levels of AA and LTA.

The Tapered AA should be abolished forthwith.

The levels at which AAs and LTAs are set pose less of a problem than the complexity and lack of understanding by pension savers, leading to large unexpected and incomprehensible tax bills. The main employer PAYE should track the individual’s annual pension gains against AAs and LTAs on monthly payslips and P60. Those for the month that either or both ceilings are breached should warn the employee that pensions tax deductions will cease for the rest of the year. Remaining in the scheme even without the tax benefit would usually be beneficial; it would not be practical to drop out of a scheme when the levels are breached and rejoin at the start of the next tax year. The net monthly payment for the rest of the tax year would be the usual PAYE amount less the tax on the employee pension contribution. The first month of breach should be called the “grace month” and HMRC should not recover the relatively trivial excess.

Legislation would also be required to allow the main taxpayer’s payroll department full transparency, with the employee’s consent, on his or her pension entitlements, e.g. from prior employment. At present this information is limited to the Pensions Administrator, e.g. NHS Pensions.

Paragraph 4 above does not deal with pension savings funded by income other than from the main employer. Tax relief on these only represent 1.3% of the total. Consultants, for example, often have private practice alongside the NHS. The simplest procedure here is not to allow any deduction for tax purposes during the year but for HMRC to refund the tax on any pensions savings where the total gain would be below the AA (if also within the LTA and given proof that the non-main employer pension savings at least cover that amount), as part of the annual tax calculation. Thus some taxpayers would receive welcome refunds rather than unexpected bills and HMRC cash flow would benefit.

Whenever these changes are introduced, a year should be allowed for programming changes to PAYE and payroll systems. This year, called perhaps the “grace year”, should be free of all forms of AA and LTA or, failing that, return to 2010 levels plus inflation since as originally envisaged.

The assistance of Mark Belchamber, Income for the Third Age Ltd, is gratefully acknowledged.

[1] Adjusted income is total gross earnings, plus employer contributions, dividends, property income, and interest on capital. The AA tapers by reducing by £1 for every £2 of Adjusted Income over £150,000 and reaches £10,000 after Adjusted Income exceeds £210,000.

[2] Career Average Revalued Earnings

But why is this a better world?

Apparently having more women in power making decisions leads to more decisions being taken which make the world a better place. We’re not so sure.

In fact, we’ve been stuck with at best 30% of the cabinet being women since that threshold was first reached in 2007. Does this matter? Yes, finds recent research into the effects of female representation on policymaking.

With some impressive data collection from that most glamorous of political arenas, Bavarian councils, the study examines the impact of female councillors on what decisions get taken. The results are… striking. One additional woman on a local council resulted in a 40% expansion of public childcare in their district. You can see the same dynamic in the UK. The British state basically ignored childcare before the 1990s, when a larger cohort of female MPs such as Harriet Harman helped put it on the agenda. Childcare spending even went up during the last decade of austerity.

Our point is not about whether paid childcare is a good idea or not. We can see value in moving something from the unpaid, household, labour section of the economy into the paid, market sector of it. It allows greater division and specialisation of labour for example, thus greater efficiency. We can also see that this effect might not be all that great - depends on how many children any one employed person is allowed to look after. There’s also that small point that kids might like being looked after by their Mums. Possibly, even, that mothers like being Mums - we do find a decent portion of the population deciding to just that, after all.

Rather, our point is the assumption there. It is simply assumed that more paid childcare is good. Thus anything that provides more of it is good, like female political management. The argument in favour of equal political rights is not, to our minds, a consequential one. That is, it’s not dependent upon, nor even supported by, the decisions that result.

After all, we don’t use whatever Caroline Lucas is getting wrong this week to argue against female MPs, despite the temptation.

That JPMorgan climatechangeisgonnakillusall report

Much fuss as it appears that JP Morgan has a report stating that climate change is going to wipe out human life upon this lovely planet:

The human race could cease to exist without massive worldwide action to tackle global warming, economists at JP Morgan have warned in a hard-hitting report on the "catastrophic" potential of climate change.

And:

The world’s largest financier of fossil fuels has warned clients that the climate crisis threatens the survival of humanity and that the planet is on an unsustainable trajectory, according to a leaked document.

The actual report is here.

Much of it is entirely reasonable. Discount rates are discussed, it is pointed out that any economic losses are counterfactual:

And fourth, these are counterfactual losses rather than actual losses. Nobody would have an income in 2100 lower than today in absolute terms, but rather lower than it would have been in the absence of climate change.

Sadly, they don’t go on to point out that if policies are adopted which reduce emissions by reducing economic growth then the losses will be larger - something many of the IPCC’s own models make clear.

They also point out, as with Stern, Nordhaus, the IMF etc, that if all of the predictions about emissions, their effect, temperature change are correct then the solution is a carbon tax. Anyone insisting that all the predictions are all correct and not agitating for a carbon tax is not taking the matter seriously - although that’s us, not the report.

However, there’s a gross mistake in the report. The assumption is:

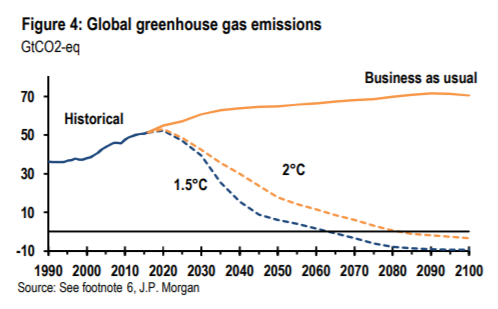

Using their model and the IPCC Representative Concentration Pathway (RCP) scenario 8.5―broadly a business-as-usual emissions outlook …

Everything they say is based upon the idea that we’re following that RCP 8.5 path. Which we’re not. We’re not in current emissions and we’re not in future either. For to do so requires the use of coal in ever greater quantities, something that isn’t being done and isn’t going to be either - technologies that don’t use that ever more coal have already been developed and are being deployed.

In fact, the one thing we are absolutely certain about over climate change is that this emissions pathway isn’t going to be one that happens, it’s a gross over-estimate of the future. Thus any predictions based upon it are false.

There is also a more subtle point:

If no new policies are enacted relative to what was legislated as of the end of 2017, emissions would rise to 60GtCO2eq by 2030 and 70GtCO2eq by the end of the century (Figure 4, Business-as-usual (BAU) scenario).

No. This is to assume that technological changes - and thus variances in emissions - only come from legislative fiat. Yet this is not so. The most obvious example being fracking, which has distinctly reduced emissions by making natural gas significantly cheaper than coal for electricity generation in the places that it has been done at scale. You can add whatever effects you wish from those claims that wind, or solar, are price competitive as well.

The actual claim in the report is that something which isn’t going to happen would be dangerous. Which might even be true but it’s not a hugely useful addition to the debate for it’s not going to happen.

But Polly, we were warned this would happen

Polly Toynbee wants us all to know that Brexit is going to mean higher wages for the low paid in our society. Polly thinks this is a bad idea and we’re not quite so sure.

The argument in favour of free migration is that those migrating benefit - they, as we, are God’s special snowflakes and why should they be denied the wealth and glory of our society based upon nothing but accident of birth? Whatever your answer to that it is clear that restricting the free movement of labour will raise local wages.

If there is to be no more cheap foreign labour, he will need to raise pay steeply to attract enough British staff.

Yes, quite so, and the problem with this is? As we pointed out elsewhere last year:

Brexit is about to give us a problem with this, though. Karl Marx was right: wages won’t rise when there’s spare labour available, his “reserve army” of the unemployed. The capitalist doesn’t have to increase pay to gain more workers if there’s a squad of the starving eager to labour for a crust. But if there are no unemployed, labour must be tempted away from other employers, and one’s own workers have to be pampered so they do not leave. When capitalists compete for the labour they profit from, wages rise.

Britain’s reserve army of workers now resides in Wroclaw, Vilnius, Brno, the cities of eastern Europe. The Polish plumbers of lore did flood in and when the work dried up they ebbed away again. The net effect of Brexit will be that British wages rise as the labour force shrinks and employers have to compete for the sweat of hand and brow.

As we were in fact warned before the referendum in 2016:

The wages of low-paid workers would rise if Britain left the EU, the chairman of the campaign to remain in Europe admitted yesterday.

Lord Rose, the former boss of Marks & Spencer, told MPs that ending free movement would mean less competition for Labour, so pay would go up.

British wages for workers in Britain rise. Especially at the low end. Isn’t this what Polly has been campaigning for over the past 5 decades?

Certainly, we can see the downside of it - we are cutting off considerable numbers from the glories of working in Britain. But the actual thing being complained about, that wages will rise. Someone is going to have to tell us what’s so horrible about that.

There's really no excuse for it these days

There is controversy at the World Bank over a paper published by a research team there. When aid to certain countries rises so too do the Swiss bank accounts of those who rule there. “Swiss” here just standing in for private and secret and not in the country being ruled. The controversy being that all know this to be true but such things are not to be said. Rather like commenting upon the gastrointestinal interestingness of the elderly aunt at the tea table - obvious but not mentioned.

To us quite the most interesting part is this:

For countries receiving more than 2 per cent of GDP in aid “the implied average leakage rate is approximately 7.5 per cent”, the report, by three economists, states. “On the other hand, raising the threshold to 3 per cent of GDP (sample of seven countries), we find a higher leakage rate of around 15 per cent. This is consistent with existing findings that the countries attracting the most aid are not only among the least developed but also among the worst governed and that very high levels of aid might foster corruption.”

Poor places are badly governed. We would go further and insist that there’s no excuse left either. Places are poor because they are and have been badly governed. For what the past few decades have shown is that a modicum of capitalism and markets - Adam Smith’s peace, easy taxes and the tolerable administration of justice being much the same thing - can make anyplace rich. Places that were colonies have done it, places that were not. Places with natural resource endowments, places without. Places of every religion and none. There is simply nothing left to blame but that bad governance - something we could and would define as not allowing that modicum of capitalism and free markets.

Another way around to put much the same point. Assume that those who would plan an economy are correct - they’re not, but assume. That does require that those governing are competent and at least vaguely honest. If that government doing said planning and economic direction is a nest of thieves then it’s all most unlikely to work. In fact, the place would do better with the thieves having nothing whatever to do with the economy. That is, if poverty is caused by bad government then riches will be achieved with less of it.