This is entirely vile

Government as mafiosi - nice business you’ve got here, be a shame if anything happened to it:

Donald Trump has demanded that the US government receive a “substantial” cut of the proposed takeover deal between Microsoft and TikTok owner ByteDance.

The president said that he had given Satya Nadella, Microsoft's chief executive, a blessing to buy the controversial video app from its Chinese owner during a conversation on Sunday. However, he insisted that the US Treasury would receive a payment for green-lighting the purchase.

"I did say that 'If you buy it…a very substantial portion of that price is going to have to come into the Treasury of the United States, because we’re making it possible for this deal to happen", Mr Trump told reporters on Monday. "Right now they don’t have any rights unless we give it to them."

This is not misreporting, sadly. The video clip is here.

It was Mancur Olson who told us that government was simply banditry. Better to have stationary bandits who will farm the economy rather than roving ones who will plunder it but it’s all still shades of banditry. While we all know this intellectually it’s still a shock to have it flaunted in our faces quite so obviously.

Pulling some form of comfort from this mess perhaps this will now make more obvious the benefits of investor state dispute systems, ISDS, as is encapsulated in near every trade and investment treaty:

U.S. BITs require that investors and their "covered investments" (that is, investments of a national or company of one BIT party in the territory of the other party) be treated as favorably as the host party treats its own investors and their investments or investors and investments from any third country. The BIT generally affords the better of national treatment or most-favored-nation treatment for the full life-cycle of investment -- from establishment or acquisition, through management, operation, and expansion, to disposition.

....

BITs give investors from each party the right to submit an investment dispute with the government of the other party to international arbitration. There is no requirement to use that country's domestic courts.

We can hope at least.

Ombudsmen yes, regulators no

“Regulator genes” suppress the structural genes that create our growth. Regulators have much the same effect on our economy. In 2017, the National Audit Office counted 90 UK regulators, costing us £4bn. p.a. According to the NAO, “Government’s target [is £10bn.] for the reduction in regulatory costs to business over the period 2015–2020, from an estimated total of around £100 billion each year.” If anyone has seen any sign of that £10bn. do let me know. Add the barriers to entry created by the regulators and UK competitiveness is seriously undermined. The 2019 Nanny State Index showed the UK to be the fourth most regulated country in the EU, after three Baltic countries. Germany, perhaps surprisingly, is the least. Maybe that explains our relative economic performance.

All competitive markets need regulation but they do not need regulators. Consumers are protected by competition, legislation, the media and specialist reviewers such as the Consumers Association. Also by ombudsmen but we return to that later. The UK led the way with Margaret Thatcher’s privatisations starting with British Telecom in 1984. Regulators made sense at the time: a state monopoly could not be expected to transition to a competitive market in a single bound. Regulators were created to drive each private monopoly toward a competitive market, providing consumer safeguards, primarily on pricing. When competition was achieved, regulators were supposed to emulate Cheshire cats. Instead, they created all kinds of things to enforce and, like any organisation spending other people’s money, expand their payrolls.

The dozen largest regulators have, since 2014, formed a trade union, UKRN, that looks for ways to justify their existence. For example, in January 2020 they trumpeted their invention of “performance scorecards”, a supreme example of teaching grandmother to suck eggs. Businesses have known all about such matters for over 20 years and do not need regulators telling them now. What was conspicuously absent from UKRN’s annual report was any performance scorecards for itself or its members. It did, however, note the 25% increase in fees for 2019/20 with a further 15% for the following year. Fat cats yes, Cheshire cats no.

It is a quis custodiet Ipsos custodes problem: no one is ensuring the regulators do what they were supposed to do, namely take their sectors toward fair competition and measurably improve value for consumers meanwhile. Instead they are loading them up with wasteful compliance and bureaucracy. Regulators are supposed to be independent of both government and the sectors they deal with. The Cabinet Office, contrariwise, lists key regulators as being part of government: Ofgem, Ofqual, Ofsted and Ofwat are shown as non-ministerial departments whereas Ofcom and the Financial Reporting Council are “other” bodies. The Financial Conduct Authority (FCA) is not shown at all even though it has a close relationship with HM Treasury.

Instead, the Cabinet Office should remind the regulators of their independence and their original purpose. This means they should be funded by and report at least annually to parliament – presumably the relevant select committees of the House of Commons who might be equally surprised by the news. The precedent is the National Audit Office which reports to the Public Accounts Commission which in practice means the Public Accounts Committee. As the piper tends to call the tune, it is important that funding and reporting follow the same. The boards of all regulators except the wholly trade and professional ones. such as the General Medical Council, are appointed by ministers. That cannot do much for their independence and should cease.

Ombudsmen are similarly supposed to be independent of both government and the sectors they mediate. The above Cabinet Office listing includes seven, two as tribunals, one as an executive non-departmental public body and four as “other” government bodies. According to the Ombudsman Association, there are more than 20. Where a sector has both, financial services for example, their roles overlap. In that case, the Financial Ombudsman reports to the FCA. There are two key differences: regulators are funded by levies on the businesses in the sector and/or the taxpayer whereas ombudsmen are funded by the fees charged to the companies about whom complaints are being made, assuming the complaints have enough prima facie justification to merit investigation. That puts pressure on businesses to resolve their own complaints and does not cost the taxpayer a penny. The other difference is that a competitive market needs an ombudsman whereas it should not need a regulator.

The most expensive, and the most unnecessary, regulator is the FCA, né 2013, which cost £589M in 2018/19. It prides itself on resolving PPI complaints but the Financial Ombudsman dealt with most of those. The body cost another £270M for the year. The FCA had 3.951 staff members, 35% being supervisory, yet most of the major work was contracted out to consultants.

With the benefit of hindsight, it was always unrealistic to expect regulators to plan for, and commit, hara-kiri. A better solution would be to convert all regulators to ombudsmen or merge the former into the latter where both exist, as in finance, for the same sector. In some sectors, being part of an ombudsman scheme is voluntary. Where such a scheme exists, it should be compulsory. To remove gender bias and make them more consumer friendly, maybe they should be retitled “ombuddies”. The new or merged bodies should then report progress toward competitive markets in their sectors and future strategy to the relevant Select Committee which would arrange funding and appoint board members.

We hatched regulators 25 or so years ago; now we should despatch them.

Looks like Bjorn Lomborg was right that 22 years ago

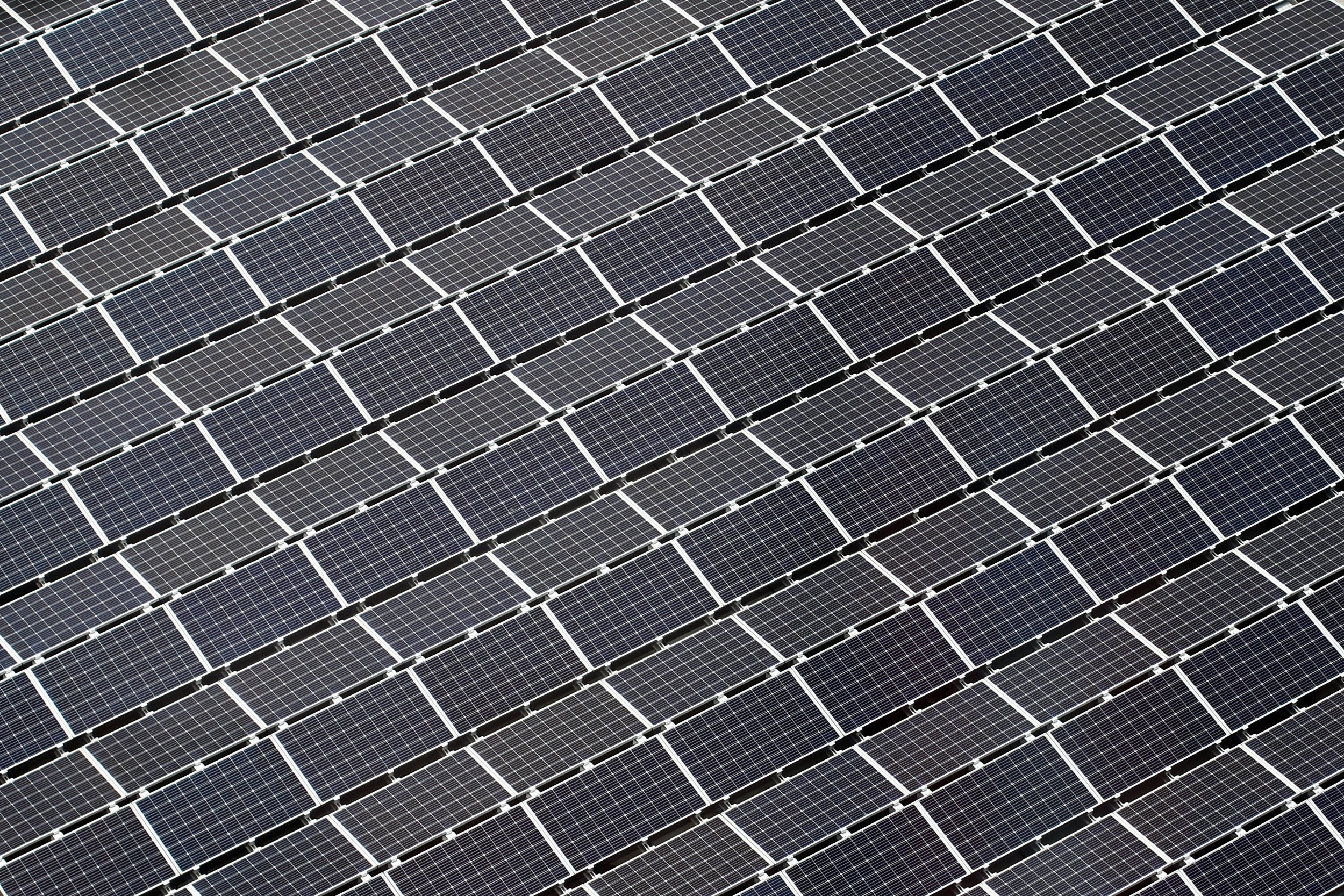

Lomborg’s Skeptical Environmentalist was first published (in Danish) 22 years ago. In which he said - and we paraphrase wildly - that climate change wasn’t that much of a problem. For solar power was going down in cost by some 20% a year. Had been for decades and there was nothing very much that said this wouldn’t continue.

Yes, entirely true, it’s not simple to run an industrial civilisation this way but insolation is such that if we can make it cheap enough then it’s entirely possible. That price drop meaning that we didn’t have to do much more than keep feeding the researchers and wait.

Just a few years ago, low cost natural gas was the main force pushing coal out of the power generation market, and now low cost solar power is sneaking up on low cost natural gas. So far the competition is a trickle, not a flood. However, natural gas stakeholders don’t have much breathing room left, as indicated by the latest perovskite solar cell research.

It appears that he was right. This being what is driving the apoplexy of certain parts of the climate change movement:

Whence the warning about 3 degrees C? The standard argument from the international advocates of climate policy for years was a need to limit anthropogenic warming to 2 degrees C by 2100, officially reduced by the Intergovernmental Panel on Climate Change (IPCC) in 2018 to 1.5 degrees C, for the obvious reason that given ongoing and likely trends, the 2 degree C limit is going to be achieved without any climate policies at all.11 Thus has the climate left moved the policy goalposts, a dynamic that has received vastly less critical attention than it deserves.

It’s not necessary to overturn industrial civilisation nor smash capitalism. Some are going to be so disappointed about this. But no worries, no doubt they’ll find a new excuse soon enough.

All of this is entirely independent of whether we should, or should not, worry about climate change itself. The fact is that the standard processes of markets and technological development are dealing with it. As they’ve dealt rather well with other human problems this past few centuries. Meaning that perhaps it’s a system that we don’t want to smash or overturn then?

The lower paid work shorter, not longer, hours

Another one of those Mark Twain things, beliefs that just ain’t so. The argument is that the poor eat horribly junky food because they’ve not got the time to prepare anything else. To busy slaving away at low wages to be able to do anything else, d’ye see?

The problem being that it ain’t true:

The latest campaign against obesity feeds into this history, too. Obesity is a significant health issue and an important factor in Covid-19 deaths. But the reason poor people eat junk food is not because they are ignorant or lack middle-class virtues. It’s because of the circumstances of their lives. Britons work the longest hours in Europe. Many are forced into two or more jobs. Few have the time or the resources to cook like Jamie Oliver.

There are, obviously, those who are both poor and working long hours. Just as there are those swanning around on a high income and doing very little for it. That’s not the way it works out in general though. As the Resolution Foundation reported only this past week:

As we have shown previously, both men and women in lower-paid jobs work fewer hours than those in higher-wage roles

The correlation works the other way. The lower the income the greater the non-working time. Thus the more that can be devoted to that unpaid household labour of cooking a decent meal.

This being more than just a gotcha on an Observer columnist - that’s far too easy a sport. It is actually an important point. Assume that the diet of the poor is indeed a problem. If this is so it is necessary to work out why it is so that something can be done about it. Identifying the wrong cause - a poverty of time to ally with the agreed paucity of income - will mean the crafting of an incorrect plan for dealing with the problem.

As Twain pointed out it’s the things you believe are so that ain’t which are dangerous.

The more we think things must change the more this is a good idea

A suggestion to revive an old policy:

The EAS was launched in 1981. At the time unemployment was hurtling towards three million, and a shocking 30pc of young people had no jobs. The Specials’ Ghost Town was a great song but it also topped the charts that summer because it reflected the bleak prospects most of its audience faced.

The EAS paid anyone who signed up £40 a week, about £160 in today’s money, for a year. They had to be unemployed, and they needed £1,000 in savings or loans. But that was about it. True, you had to submit a business plan, but didn’t need to get your idea approved. There were no committees monitoring your performance. There was nothing to repay, and the support wasn’t scaled back if the business made money. You could just go off and try something out, with some free money to help you along the way.

There is Richard Layard’s great point to consider:

If you pay people to be inactive, there will be more inactivity. So you should pay them instead for being active – for either working or training to improve their employability.

If unemployment is going to be high you might indeed usefully pay people to go and do something rather than the unemployment restriction of you must do nothing in order to gain your dole.

As to the what is being usefully done it’s to explore the universe of things that can possibly be done and see how they match up with what people want to have done. The last time around, that EAS, led to the establishment of Viz. Who knew that what the country really needed was a scabrously foul-mouthed comic? But it did.

The truly important part of the scheme being that no one did pick between ideas before they were funded. It was a true exploration of that envelope of possibilities, not solely of the much smaller set of those approved of - or even understood - by the bureaucracy.

One more point to make. The worse we think the situation is then the more this makes sense. Say that you are insistent that coronavirus changes everything - as the opinion pages of many newspapers are indeed insisting. Or that inequality does, or resource exhaustion, or climate change or whatever is leading to that same conclusion, all must change. So, all must change then. And if all must change then we need to explore all of the universe of possibilities available to us before the selection of those that do take over.

This being exactly the thing that entrepreneurs within a market economy do better than any other system.

If we’ve got to subsidise those unemployed we might as well get them doing something useful for the society as a whole. The more the insistence that change must happen then the more insistent we should be that the subsidy is to explore the changes available.

The worse you think the situation is therefore the more you should be supporting the idea of paying people a couple of hundred pounds a week to go off and have a go. Undirected by the bureaucracy, of course.

What drivel is this?

Everyone loves to hate on the tech giants these days. The unthinking establishment view is that they’re ripping us all off. Thus we have Oliver Kamm, the epitome of that unthinking and establishment view telling us that:

They do not work in consumers’ interests. They give capitalism a bad name.

Let us take just the one example, that of Facebook. Which, through various services like Messenger, WhatsApp and so on allows people to make voice and often enough video calls at no direct cost. Lots of people use these services.

Now perhaps it might be simply our advanced maturity in years but we do actually recall when long distance phone calls were something thought seriously about. They were expensive. International calls doubly so, one did not call up another country simply for a chat. We are also aware that it was only a couple of decades back that it was physically impossible to call much of the world as they simply didn’t have the lines, phones nor connectivity for us to do so.

Now some two to two and a half billion people gain some to all of their telecoms needs, through Facebook, for free.

OK, yes, there are those phone calls which it is not in the caller’s interest to make, often involving late nights and substantial beer, but as a general rule something that used to be too expensive to do casually, that often wasn’t even physically possible, is now to cheap to meter and offered to the consumer for free this is in said consumers’ interests.

It is simply drivel to even wave around the idea that the tech giants are not operating in consumers’ interests. What the heck would be doing that, only if the free telecoms came with a back rub?

We do agree that the world is, as yet, imperfect, even that sometimes government action can and should be taken to getting it closer to the desired state. But we do have to at least start from a valid analysis of the current reality. Something not greatly in evidence in this case of the tech giants,

Social care needs a framework for innovation

From Spain to Canada, and everywhere in between, we have seen the devastation Covid-19 has brought to congregated care settings like nursing homes. Part of the issue is the nature of these settings; with so many vulnerable people in a confined space, it is fertile ground for infectious disease to spread.

This should act as a massive wake-up call for all of us. I hope it will have as far-reaching an effect on our care models as the 2008 financial crash had on banking practices. According to Irish figures, Home and Community Care Ireland (HCCI) recorded a peak Covid-19 infection rate of 0.45% (91 cases) among our members’ 20,000 clients.

Home care should be at the heart of our thinking as we redefine our thinking on how to deliver social care to vulnerable people.

The ASI’s report, Fixing Social Care, is a useful contribution to the debate and helps us to break down the problem. Making insurance costs more viable is important if we are to drive both value and innovation in the sector. Currently, technological advancement in healthcare is focused on either consumer facing wearables or high-tech equipment for hospitals. While there are some companies working on how to incorporate new technologies into social care, these efforts are relatively disparate.

If we are to change the game in social care – and this pandemic should leave us under no illusions that the status quo ante is acceptable – we need to create an innovation framework for the sector. We could start by looking at places like Germany. They take a broad approach, funding a €300 million annual Health Innovation Fund that encourages new models of care and more effective ways to deliver care across a range of healthcare settings, with the private sector closely involved. Although not every country can replicate the size of this funding, they should be able to design a national framework for healthcare innovation that carries with it an annual budget.

Looking to America, MobiHealthNews reported 82 health related funding deals worth $2.9 billion in Q1 2020. However, as you look through them, only one is focused on home care. They are almost all directed towards consumers or the acute hospital system. Talking to one home care entrepreneur in New York earlier this year, he was very discouraged about innovation in social care. His view was that American insurance companies are not yet serious about keeping people at home for longer – the money is in things like surgeries. It will take a considered investor, matched with some entrepreneurs with real vision, to turn the game on its head in the USA.

Another option for all countries to think about is for healthcare and hospital groups themselves to lead out on providing more care in the home, either themselves or with other provider organisations. For example, the Danes have trialled giving chemotherapy treatments in the home. If this sort of initiative is underpinned by the sort of innovation framework Germany has, we could see a much more integrated acute and community care system that provides continuity of care and the care where it is best for the patient to receive it.

Social care is the beginning and the end for so many people. Whether a sniffle treated by a relative, a healthcare assistant helping with the routines of daily living, to palliative care at the end of life – so much begins and ends at home. If we grasp the opportunity Covid-19 has given us to rethink healthcare delivery, and if we design a framework for innovation that seeks to integrate our care models, we have the chance to build a brighter future for millions of vulnerable people.

Joseph Musgrave is the CEO of Home and Community Care Ireland, the representative organisation for 80 companies that provides home care to 20,000 older and vulnerable people in Ireland. HCCI advocates for the highest standard of regulated home care services to be made available to all on a statutory basis, enabling as many people as possible to remain independent within their homes and community.

Happy Birthday Milton Friedman

On this day in 1912, Milton Friedman was born.

It is hard to imagine today the incredulity with which Milton Friedman’s most well-known views were met when he first expounded them. Ideas which are by many regarded as self-evidently correct were then considered heretical to the Keynesian orthodoxy, rendering Friedman a sort of flat-earther amongst the academic community. More than any other economist, Friedman was at the vanguard of the discreditation of the hegemonic post-war consensus of demand management, with its highly discretionary countercyclical actions and interventions aimed at mitigating recessions or speeding up recoveries.

You wouldn’t intuitively think that such a well-known defender of market economics would have come from such a poor background. The son of Hungarian immigrants, growing up, his father took work wherever he could, and his mother worked as a low-level seamstress. His preciousness was evident from a young age, beginning a degree in mathematics at Rutgers University at the ripe age of seventeen. From there, his academic rise was meteoric, and he found himself doing postgraduate work at the University of Chicago with such scholarly titans as Frank Knight, Jacob Viner and Henry Simons, eventually becoming one of the pillars of the Chicago School of economics.

Friedman’s star as a radical economic thinker began to shine with the publication with George Stigler of Roofs or Ceilings? in which he demolished the idea that rent controls were anything but extremely damaging. There is now widespread agreement amongst economists on this. Assar Lindbeck puts it extremely well when he says that “Next to bombing, rent controls seem in many cases to be the most efficient technique for destroying cities”. But widespread agreement on this most topical issue did not exist at the time of writing (1945).

The monograph was derided as an attack on the ability and authority of politicians and economists to shape the economy according to their benevolently motivated and rationally preconceived ends. Of course, as with much of what Friedman advocated, in the long run, he was right.

Income from Independent and Professional Practise was published shortly after. This was a book length piece of research which drew on extensive statistical analysis to reveal that those who benefited the most from occupational licencing were not in fact the consumers of the services which those professions provided, but rather the professionals themselves (such as lawyers and dentists). By restricting competition by throwing up costly entry barriers, Friedman showed that the general public were merely paying more for worse services. The results of his study reflect a recurring theme in Friedman’s work, which is exemplified by the pithy and humorous quote of Ronald Regan’s:

“Government is not the solution to our problems. Government is the problem”.

Indeed, what Friedman emphasized was that in matters of policy, intentions ought to matter little. Even the best-meaning government programme is useless if its effects are bad in the jurisdiction to which it would have effect. This evidence based, empirical approach to policy making is reflected in his Methodology of Positive Economics, an excellent and very accessible essay (despite its rather wonkish title) in which it is asserted that economics as a science should be concerned with facts, rather than normative judgements. His insights were the apparently obvious contentions that positive economics should produce the facts which inform normative economics, and that the assumptions behind any model of the world matter little, as long as it is capable of accurate prediction. The value of any theory in the social and physical sciences depends on the success of the predictions which can be made with it, and not on the descriptive realism of the assumptions behind it.

Given the last sentence, it will probably not shock you that Friedman was not as preoccupied with touching up complex and highly abstracted mathematical models as he was with testing theories against the facts time after time so to discover the answers to the big questions in economics, which have a very tangible impact on our day to day lives. This led him to study the issue of his day, inflation, and in 1956, he wrote The Quantity Theory of Money, which along with his later book A Monetary History of the United States (co-authored by Anna Schwartz), revealed how, as he was later to say in a quote which has become synonymous with his name, “Inflation is always and everywhere a monetary phenomenon” – that is to say, too much money, chasing too few goods. He went on to demolish the Keynesian critique of this in his Theory of the Consumption Function in 1957.

By the 1960s, he was able to predict the forthcoming combination of persistent high inflation combined with high unemployment and stagnant demand, catchily labelled by Paul Samuelson as ‘stagflation’. Friedman’s monetarism could account for the economic malaise of the 1970s in a way that the Keynesian consensus could not.

Outside of the academy, his work as a public intellectual was whopping not just in its amount, but also in its scope. He wrote hundreds of newspaper columns, and featured frequently on national television and radio. This is not even mentioning the pop-economics books Capitalism and Freedom and Free to Choose, which together sold hundreds of thousands of copies.

Probably more than any other public thinker, Friedman helped to turn the tide of mainstream thought in economics. Interestingly however, he was not the first person to express many of the aforementioned ideas. His legacy is largely the result of his masterful command of the art of communication. He was able to spin and thread an easy to understand narrative out of complex and deeply thought-through economics, enabling him to communicate with the public in a way which the present Conservative party would do well to remember.

Of course, the man is hardly without controversy. He is often tainted (wrongly, but that is another article in itself) by association with the Chicago University trained Chilean economists who went on to serve under the brutal military dictatorship of Augusto Pinochet. The ‘Chicago Boys’, as they were known, composed a document following the 1973 Chilean coup d’état which was named El Ladrillo, (The Brick) for its sheer size, which served as the template for Chile’s subsequent economic reforms. These reforms, which included the pioneering privatisation of swathes of state-run industries and reforms to the pension system, saw Chile go on to become one of the most prosperous states in South America (the second richest to this day).

Similar programmes of deregulation, privatisation and liberalisation have since had the same effect elsewhere, most notably today in China and India. Because of this, more people have escaped grinding poverty in the last 25 years, than have in the last 25,000 years of human existence. The Nobel Prize winning economist Gary Becker rightly stated that “The person they are most indebted to for the improvement of their situation is Milton Friedman”.

No posthumous birthday hagiography would be complete without a character assessment, and in this area too, Friedman shines. He was known for his warm temperament, his infectious smile and the kindness he showed to all he met.

Both the President and Director of the Adam Smith Institute can attest to this, having had the privilege of knowing the man personally. The economic historian Diedre McCloskey recalls how when she transitioned from male to female, Friedman was particularly understanding at a time when changing gender was less accepted than it is now. Indeed, in McCloskey’s own words “Milton cares for freedom because he puts tremendous weight on the dignity of his fellow humans. Over and over he says: Laissez faire, let the person herself decide for herself”.

Friedman’s ideological foil John Maynard Keynes wrote in his General Theory that ‘The ideas of political philosophers and economists, both when they are right and when they are wrong, are more powerful than is commonly understood. Practical men, who believe themselves to be exempt from any intellectual interest, are usually the slaves of some defunct economist.’

Whether you love him or loathe him, it is undeniable that Friedman’s influence and legacy are astoundingly significant. His views have shaped the world in remarkable ways. The former Chairman of the U.S. Federal Reserve Alan Greenspan once remarked about Friedman, that:

“His impact is not only on the 20th century, but on the 21st, and I suspect ongoing”.

Another former Fed Chairman, Ben Bernanke, said of Friedman that:

“The direct and indirect influences of his thinking on contemporary monetary economics would be difficult to overstate”.

As you may have noticed by now (and as former Executive Director of the ASI Sam Bowman has previously stated), in many ways, the work of the ASI is a continuation of Friedman’s. Long may that tradition of freedom continue!

Why appoint a Minister to mess with what works?

A call for there to be a Minister for food security:

Ministers should consider enshrining in law a right to food and must appoint a new minister for food security, according to an influential committee of MPs, after the coronavirus pandemic exposed serious problems with the government’s handling of the food system in a crisis.

Well, largely speaking the government didn’t handle the food system in this recent crisis. Could be why it all worked.

Panic buying – which was often just consumers responding to the need to eat all meals at home – and shortages of some staples in the shops, characterised the start of the Covid-19 crisis after the government failed to communicate properly with the public and the food industry, the MPs on the environment, food and rural affairs committee found in a new report.

The government “appeared unprepared” for the impact of the closure of restaurants and cafes, they said, and was too slow to provide guidance for workers in the food supply sector.

The current, largely free market, food supply system worked fantastically in the recent crisis. Sure, there were empty shelves at times but that was more about time to deliver from warehouses than anything else. There was no significant shortage for any significant period of time of anything. Which shows a certain robustness in that system really. For the system did go through an enormous shock. That switch of tens of percents of the nation’s calories being provided by commercial (restaurants, take aways, sandwich shops, works canteens and so on) to running through the retail and then domestic channels was an immense change.

The system worked though. The only major problem noted was the government’s own rules. Products packaged for that commercial system couldn’t be simply re-routed into the retail because labelling requirements are different. Government thereby reducing the flexibility of the system in that emergency.

A cynic would describe this call for a Minister, for more regulation, as being a cry in the wilderness. If people can indeed through voluntary cooperation sort out major problems for themselves then what purpose government? What need of politicians and their interventions? As it would be most uncomfortable for those questions to be generally asked better get politics involved so as to obviate the query.

A realist would be less harsh. If the food system does actually work that would damage the battle against obesity. So, we need a politician in charge so that we all can become thin.

Isn't this glorious?

Susie Orbach tells us of what ails modern society:

In the 1980s, when low-fat products and desserts flavoured with sugar and artificial sweeteners first entered the market, they were deemed healthier than their full-fat alternatives. But what first appeared helpful caused confusion: evidence showed that the body didn’t metabolise these products in the same way as full-fat alternatives, and people who consumed low-fat foods were likely to replace the lost fat with calories from carbohydrates.

So why did low-fat products storm the marketplace? Because government’s food strategy told us all to eat less fat. Now Ms. Orbach is calling for a food strategy from government which we do think is rather glorious. More policy to correct the errors of earlier policy might not be quite the way to do it though. Bug out and leave us all alone could be closer to a sensible, erm, policy.

Henry Dimbleby also tells us today that:

The poorest people suffer most from this diet, the report says. It notes that 36% of the most deprived people are obese.

The basic human problem, certainly from the beginning of agriculture some 8,000 years ago and near certainly before that - otherwise why would agriculture have arisen? - was gaining enough calories not to die from not enough calories. The entire Malthusian construct - which, recall, was correct right up to the date the Reverend sat down to write - doesn’t work if this were not so. It is only in this past few decades that we have solved that problem down there at the bottom of the income distribution.

We do regard this as glorious. We’re even willing to mull over the idea that there are a few wrinkles that still need ironing out but that basic problem across the aeons has been solved. There’s enough food for all. As to how to do that ironing, see above - those who have been telling us the wrong things for decades might like to bug out. Well, OK, they wouldn’t like to but perhaps we should insist they do.