The government's sugar strategy is having problems

The National Audit Office has had a look at that plan by Public Health England that we should all be eating less sugar. Given PHE’s ability to concentrate upon the day job, pandemics and infectious diseases, this was unlikely to be laudatory:

Despite pledges to cut sugar consumption by 20 per cent between 2015 and 2020, a review by Public Health England found that in fact it had dropped by just 2.9 per cent..

Well, yes.

A starting observation would be that humans seem to have a taste for sugar. Few reports about hunter gatherer lifestyles are free of the wonder at how many stings will be accepted just to gain a few pounds of that sweet, sweet honey. Many languages use both sweetness and honey as synonyms for everything from a pleasant person to a complaisant lover. The history of our own society shows that we enslaved some three, three and a half million, went to war several times to conquer the islands upon which to do so, just to grow sugar for the palates of our forbears. Human beings really, really, like their sugar and we’re unconvinced that a few prodnoses, from their comfy offices, yelling at us to stop doing so is going to have much effect.

But there is more here from the report. Their major observations:

In 2018/19, nearly one tenth of 4 to 5 year olds and more than one fifth of 10 to 11 year olds were obese.

This is not true, not in the slightest. As Chris Snowdon has been pointing out for years it isn’t even vaguely true. Further:

The government estimates that treatment of obesity-related conditions in England costs the NHS £6.1 billion each year.

This is also not true in any useful sense. As we have been pointing out for years obesity saves the NHS money. Yes, there are costs to treating obesity related diseases but in a lifetime health care service it also matters how many years of life health care needs to be offered over. And since the - truly, and morbidly - obese die younger there’s a saving there. The net position being that obesity, as with smoking and booze, saves, not costs, the NHS money. This before any issues over taxation and the like.

We regard the aim itself as being one of those near impossible things to do and both reject and refute the evidence on offer as justifications for even trying. Fortunately, this does mean that we agree with the first recommendation from this NAO report:

Recommendations

a The Department should establish a robust evidence base

Yes, that probably would be a good idea, wouldn’t it?

A morally suspect view of corporate taxation

We’re told that organisations - the statement is companies but organisations is meant - that add value to lives in Britain should be taxed for doing so. This strikes us as a morally suspect justification of taxation:

“Any business that takes money from British customers should contribute to the schools, hospitals, roads and services those customers need, by paying their share of taxes. Far too many are not,” he said.

A business makes a profit by adding value - that’s what profit is, the value added. It is also true that what we all consume is value added - that’s the definition of consumption in the GDP calculation, the total value added in the economy. It is also true that people only purchase something if they believe that the value on offer is greater than the price they must pay - the consumer surplus.

So, a profit making business is, by definition, adding value. Any consumer is also gaining further value they don’t have to pay for. For this temerity all such companies must pay more tax? This makes neither moral nor logical sense.

That those who then draw incomes be taxed, why not? The broader shoulders pay more than in proportion perhaps. Vast dividend or interest streams, CEO salaries, pay a higher rate of tax, this could be fair even as we might argue that current rates are more than what might be fair.

But why would we insist upon taxing the organisations that make us rich for being the organisations that make us rich?

‘A Level’ Lessons for the Cabinet

The Cabinet did not deserve a long summer holiday, after flunking ‘A levels’, it should have been back in the classroom. “The Need for Independence” was the main failure followed by “How not to Lose to Judges” but we can consider the second another time. Part 1 of the former paper dealt with civil servants, part 2 with what the Cabinet Office is pleased to call “arm’s length bodies”.

We all know that civil servants are part of government but should be independent of political party. Policy intentions of ministers should be challenged, the classic introduction being “yes minister, but…”. Of course, once the ministerial decision is made and recorded, the civil servant’s role changes from devil’s advocate to implementation but the nature, course and timetable for that implementation should have been recorded as part of the decision. If the policy turns out to be wrong, either the civil servant or the minister or both should take the blame according to whether the civil servant’s “yes but” advice was correct. If the civil servant failed to predict the adverse outcome, he or she was incompetent. If the minister failed to heed the warning, the buck should stop there. Nobody should be sacked for being right however irritating that may be.

The head boy of this Cabinet may be giving too much credence to the head boy of the junior school, “Dom Major”. According to The Times, the junior school, meeting in “mission control” i.e. Room 38, 70 Whitehall, will determine all policies and prepare the announcements, leaving departments to catch up as best they can. “Also in the room is the prime minister’s implementation unit and the No 10 legislation team.” If this report is correct, the junior school would make all decisions without independent challenge or advice from those expected to implement the policies. This would be folie de grandeur.

Moving to part 2, arm’s length bodies can be divided into three categories: executive agencies, which are part of government, public corporations and regulators which are supposedly independent of government and non departmental public bodies (quangos) which are both independent of government, and not independent, at the same time. Executive agencies, such as the Rural Payments Agency, were invented by Sir Robin Ibbs, in 1988, to handle the implementation of departmental policies. [1] Public corporations, such as the BBC, are owned by the state, financed by government authority but operationally independent, as should be the case with regulators, such as Ofcom, which is answerable to parliament, not government.

The ambiguous status of quangos has long been criticised, notably by the House of Commons Public Administration Select Committee “There is insufficient understanding across Government about how arms-length Government should work” and the National Audit Office: “the arm’s-length bodies sector remains confused and incoherent.” Cabinet needs to determine, for each one, whether its main role is to implement policy, and should be an executive agency, or its independence is more important, in which case it should not be part of government.

The ‘A level’ fiasco this summer illustrates the confusion. Ofqual, according to its website, is “independent of government and report[s] directly to Parliament”. As the regulator, it should not have been offering advice to the minister; that is the role of his civil servants. Ofqual should either have made the decision, as the independent body it is supposed to be, or concluded that the matter was not within its competence and stepped away. We now know that Ofqual’s preference was for 2020 ‘A level’ exams to go ahead. To prevent cheating, exam desks are well distanced, masks would have been easy and there was plenty of empty local spaces, churches in particular. That was the right decision and administrative confusion blocked it.

One question remains open. In all, there are about 85 public corporations, i.e. arm’s length bodies, which are not governing us, and not regulators, ombudsmen or part of the judiciary. They are owned by, and part of, the state but operationally independent of government which is itself only one branch of the state. Most of these bodies are museums, libraries, property and parks which pretty much take care of themselves apart from finance and the appointment of top directors. If they are not part of government, to whom should they be answerable?

We need to remember that we, the people, are the state and the fulcrum of our democracy is parliament, not the government. The Queen only appoints the prime minister if he or she can form a government supported by the House of Commons. Some public bodies, such as the National Audit Office and the regulators, are answerable to parliament, not government, and are no less democratic for that – probably more. Regulators and ombudsmen should be answerable to the relevant select committees, if they are not already, but they might not welcome having the 85+ public corporations dumped in their laps as well.

That is the conundrum: government needs to be streamlined in order to focus on governing, especially this government. So who will supervise the public corporations that are supposed to be independent and not part of government? One possibility is to create a supervisory group within parliament itself, replacing the supervision now provided by the executive. It would simply be the shareholders, i.e. very little supervision, beyond inspecting their annual reports, would be required. And most of these bodies’ annual reports already go to parliament. However the legislature is no more suited to safeguarding these public assets than the executive. The alternative is to have another branch of state, accountable to parliament as is government, with each focused on its own role.

The performance of all human activity benefits from clear boundaries. Be it neuroscience, banking or tennis, professionalism requires the participants to know whether the ball, so to speak, is in or out. So it is with governing: the Cabinet should be crystal clear about what should fall within its remit and what should be independent.

[1] Sir Robin Ibbs, (1988) Improving Management in Government. The Next Steps. February, HMSO.

In which we find out that the TUC doesn't do economics

There are times when the Trades Union Congress spiffs up a lovely report to claim that higher wages will make the world a richer place. There are also times when the TUC just demands higher wages. Even when it is quite obvious that such a demand will not make the world a richer place. At which point we should really stop worrying about whatever economics the TUC uses to spiff up their reports and simply peg them for what they are, a special interest group not interested in what is good for us all in general:

The head of the Trades Union Congress (TUC) has denounced a possible freezing of the national living wage as “totally wrong”, as the Treasury reportedly considers backtracking on a planned pay rise for the lowest paid.

We’ve just had a serious recession. Wages have fallen, unemployment is rising. This might not be the time for a pay rise:

Frances O’Grady, the general secretary of the TUC, said: “Many key workers who have got us through this crisis – including care workers and supermarket staff – are on the minimum wage. It would be totally wrong to freeze their pay.

“The government must not renege upon its commitment to raise the minimum wage. Millions of low-paid workers are struggling to make ends meet. That’s not right during a pandemic – or at any time.”

One of the grand mistakes that Roosevelt made during the Depression was his insistence upon raising wages in the teeth of it. It’s one of the reasons that the disaster over there lasted a decade while the one here was over within 18 months.

The general thinking is that it is the low end of the service sector which is getting it in the neck in this post-covid employment market. Increasing the cost of employing people in such jobs just as we’re worrying about the disappearance of a million or two of those jobs just ain’t the way to do it. Well, not unless we want to wait for a war, as FDR had to, to overcome that mistake.

Learning from the free press why we should free commerce

On Saturday, many of you were left without a newspaper because of a small group of smelly hippies clogging up the roads outside of the country’s printworks. They have decided that the media is full of lies and that you must have ‘free speech’ given to you by their beneficence in the form of you not getting your crossword puzzles.

No, I don’t follow their logic either.

Fortunately, neither did anyone else sensible. Beyond a single deleted tweet by Labour MP Dawn Butler in favour of the group’s actions, and Diane Abbott’s botched comparison between them and the Suffragettes, there was widespread condemnation by politicians across the spectrum for a group who wanted to censor newspapers that they dislike.

Of course, if you actually wanted the news on Saturday, while the papers were full of good stuff, in this modern age it was far more likely that you jumped onto BBC News’ website or one of the papers’ own, or switched on the radio, or went on Twitter, or an app. As my boss Eamonn Butler explained, this was an attack as much on the press as it was on the customer of the physical newspaper.

A number of observations sprang to my mind too.

Firstly, Extinction Rebellion are a right noisy nuisance of the worst sorts of ninnies that most people try to spend their lives avoiding. The biggest threat to their aims is how lame they are. Protests of uncoordinated dances, rhythmic drumming, pants that should have been left in goa when they finished their gap decade. It’s all just, well a bit naff. It turns normal people off the topic of climate change and it hardens attitudes against their proposed measures. As the ex Liberal Democrats leader Tim Farron posted: “Feeling righteous and doing good are not always the same thing.”

Secondly, if they actually cared about the environment they might take care to look at some of the amazing advances being made by those getting stuck into inventions and enterprise. From lab grown meat, indoor fish farms, vertical ocean farming, and how urban density and reduced sprawl can reduce a city's environmental impact, to carbon taxes and road pricing. Free markets and neoliberal policies that build on property rights and monetary incentives are the best hope we have of ensuring our planet is one we are all able to live on and one on which we all do want to live — something my colleague Matthew Lesh recently wrote about in his chapter for Green Market Revolution. If you, or any young relatives you have, are concerned about environmental matters, I’d urge a read of that book.

A third observation came to mind that was somewhat left of field. The newspaper is a little wonder. It arrives at addresses across the country 364 days a year bringing news (Christmas is off, even for Scrooge’s staff), fact, opinion from across the globe condensed into a readable and digestible form and plops onto the doormat simply and easily. It is one of the original right-to-your-door deliveries. The word of man, for you to read and argue over and build new ideas and do it all over again the next day.

Just like Amazon, straight to your doorstep, usually using a local newsagent or network to deliver it to you. And yet, I don’t recall any politician saying that your perusal of a national broadsheet undermined the high street pamphlet printer, or that there should be a delivery tax because you didn’t go and pick it up yourself.

Nor do we condemn papers for taking customers out of high street shops when they deliver direct, preferring to use low cost out-of-town printworks and then lorries and vans and bypasses.

Nor do we slam them for using modern efficient methods of production. They’re not condemned for moving from quill to printing press, or even for using adobe indesign over physical type-setting. The days of the ‘Stop press!’ command are over and online headlines can be changed at the quite literal touch of a button.

And, while there were worries about radio, and then tv, and then websites, podcasts, social media, and apps challenging the traditional print media and its product — there has never been a good justification.

Finally, even though they’re one of the chief beneficiaries of generalised education and literacy we don’t demand they and other publishers pay a targeted ‘education tax’ to get them to pay for the spillover benefit that they receive.

Instead we reap the benefit of a free press unencumbered by restrictions or taxes or coercion. What a wonder it might be if we took the same attitude to commerce of all types.

Really rather missing the point

A survey in India showing that many workers suffered complete loss of income during the covid related lockdown.

Examining the impact of lockdown imposed in late March on more than 8,500 urban workers aged 18 to 40 ofIndia’s 1.3 billion population, it reminds us that under half of those surveyed were salaried employees.

A staggering 52% of urban workers went without work or pay during lockdown, while less than a quarter had access to government or employer financial assistance.

Indeed so and as the paper itself says but doesn’t emphasise, the reason is that most Indian workers are not part of the formal economy. Of course, more in urban areas are than up country, but even so, most are not. At which point a certain amount of missing that point.

For they call for new national policies and government to be involved and…..but why are these people not in the formal economy in the first place? Because the costs of employing them formally are more than the gain from the employment of their labour. The bureaucracy, the taxation, the licences required, the risks to be taken - it being near impossible to fire a formal worker, or even close down a loss making operation or company - plus the wages mean both that few are willing to hire formally and also few get hired formally.

Adding to those costs by introducing another right or tax is not going to aid matters.

As Torsten Bell says, we should note what is happening elsewhere as well as gaze at our own coronavirus scarred navels. We might learn something even - like, perhaps our own explosion of gig workers, those without those employment rights, is a function of the cost of formally employing people? A problem that might be solved by lowering said formal employment costs?

To argue with a Guardian headline

This is of course an isometric exercise, lots of effort to get nowhere. But when such an excessively silly claim is made needs must:

Sunak's reforms are long overdue – income shouldn't be taxed more than wealth

Carsten Jung

Yes, yes it should Carsten. Currently the top rate of income tax in the UK is 45%. We think that’s a bit high. We also think that taxing wealth at 45% would be insane - and so do you. Having disposed of what is being said let us now turn to what is meant.

Which is that income from wealth should be taxed at the same rate as income from labour. This is also incorrect.

A slight detour, in that there is much confusion - some deliberately planted - in this field. We must look at the total tax rate upon a flow of income. Not just whatever portion is charged to a specific person in the flow. So, the taxation of dividends, for example, must include both the income tax charged to the recipient and also the corporation tax charged at the level of the company. We should also adjust with capital gains and so on, for inflation over the period of the gain. Once we do that the gap between those capital and labour income taxation rates narrows. In fact pretty much disappears for dividends, never was there for interest and significantly narrows for capital gains.

The actual science of the subject is over in optimal taxation theory. Mirrlees being a part of it, his Review another. The really big result though being Atkinson and Stiglitz which says that the optimal taxation rate for capital income might well be zero. Most of the more modern scholarship on the point, since 1976, is a bit of smoke blowing attempting to obscure this inconvenient result.

It is certainly economically efficient that the taxation of incomes derived from capital should be lower than those from labour. Dependent upon the definition of fairness being used it can also be argued that it is fair.

Standard economics states that capital incomes definitely should be taxed less than labour incomes. Not that we expect The Guardian to accept that but all those seriously discussing the shape of the tax system should grasp the point, no?

The grand plan from Mr. Varoufakis

Yanis Varoufakis has taken the time out from his busy schedule to produce a plan for the management of the world. It suffers from the occasional problem we are sad to have to say:

But to be crisis-proof, there is one market that market socialism cannot afford to feature: the labour market. Why? Because, once labour time has a rental price, the market mechanism inexorably pushes it down while commodifying every aspect of work (and, in the age of Facebook, our leisure too).

This is not true. It is not even remotely true. Here is the time series (OK, a time series) of real wages in England. The acceleration of wages starts around when capitalist labour markets, unconstrained by the Corn Laws, really start to operate, subsequent to the 1840s. After that well known Engels Pause. Thus the theory behind this new form of socialism fails to have even that nodding acquaintance with reality so necessary for success in the real world.

The pencil sketch on offer of the system as a whole is:

People receive two types of income: the dividends credited into their central bank account and earnings from working in a corpo-syndicalist company. Neither are taxed, as there are no income or sales taxes. Instead, two types of taxes fund the government: a 5% tax on the raw revenues of the corpo-syndicalist firms; and proceeds from leasing land (which belongs in its entirety to the community) for private, time-limited, use.

Essentially the Social Credit of Major Douglas plus the land value taxation of Henry George. We like half of that - and it’s not the Maj. Douglas bit - but it’s difficult to say that the combination is really anything new or radical.

There is also this crippling problem:

But it is the granting of a single non-tradeable share to each employee-partner that holds the key to this economy. By granting employee-partners the right to vote in the corporation’s general assemblies, an idea proposed by the early anarcho-syndicalists, the distinction between wages and profits is terminated and democracy, at last, enters the workplace.

The identifying feature of capitalism is that it is possible to gather capital from outside the labour force of the organisation. The same statement from the other direction, it is possible to invest in adventures that one does not work in. In this system this is not possible. Therefore outside capital is not available to an enterprise. It thus becomes impossible to have any large scale economic organisations - or at least to start any. Well, unless government is going to be doing all the capital allocation and the 20th century tried that idea to destruction.

Sure, there will be those who enjoy this idea. But note what it actually means. The 5,000 or so workers in a modern steel plant will not have the several billions necessary to build a modern steel plant. Therefore we will not have modern steel plants. Nor any of the things that come with such big ticket capital needs. A chip fab these days costs upwards of $6 or $7 billion. It isn’t possible to replace one with some hundreds of smaller scale operations that could be financed by their future workforces.

And of course the inability to tap into outside capital makes starting anything new pretty much impossible.

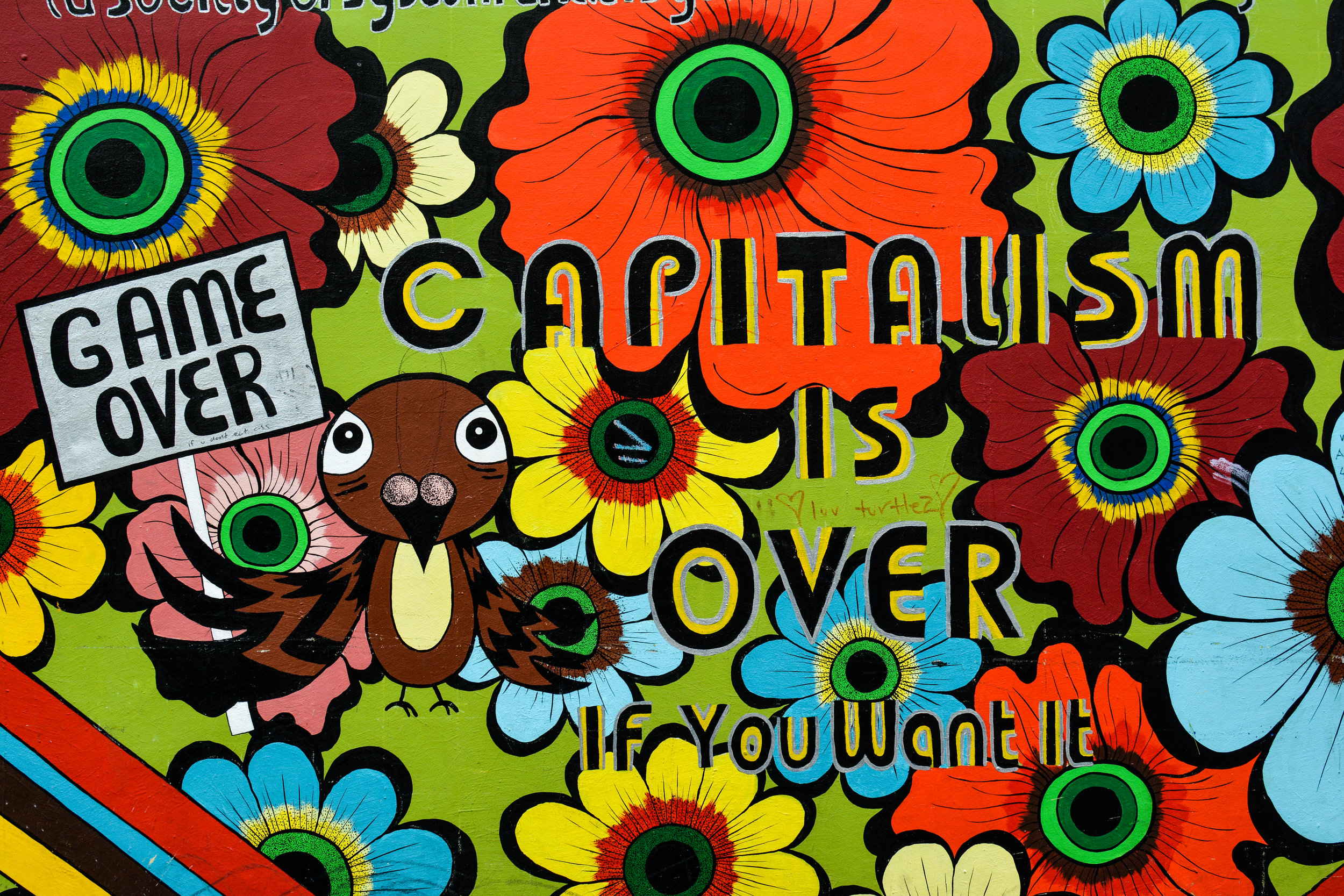

There is actually a reason why no one has - OK, we’ll admit, as yet - successfully sketched out a workable alternative to roughly capitalist roughly free marketry. Yes, there are flavours within that spectrum, from Hong Kong’s laissez faire to Sweden’s social democracy. But the reason that designs outside that spectrum don’t work is because the two - together, both capitalism and also markets - solve the basic economic problems we face. How to make the people richer through the efficient allocation of scarce resources.

Nowhere has got rich without that capitalism and markets, those who did not get rich but recently adopted the twin system are getting rich and those places which have abandoned them have become poorer again.

Which does lead to an important question - why mess with what works?

The glorious 1000% rise in the number of food banks

This calls for a celebration we think. It’s also a useful example of what happens when we have both technological development and also a rise in the general wealth of the society - we get to do new things, solve old problems:

As the economists Mark Blyth and Eric Lonergan observe, from 1980 to 2017 the UK’s GDP rose 100%. Over the same period the number of food banks in the UK leapt 1,000%.

The rise was rather more compressed than that, the Trussell Trust itself points out that food banks pretty much didn’t exist in the UK when they started in 2000. The technology - a manner of organisation is indeed a technology - hadn’t been imported from the United States at that point. Then it was. Much hunger has been eliminated as a result of the adoption of that technology, we regard this as a good thing.

It is also true that a richer society is able to divert more to solving such problems than a poorer one and as we can see that is exactly what has been happening.

We are, of course, supposed to think the other way around, that’s the point of the statistic being presented to us. That society has become worse therefore the need for such food banks. Reality works the other way around. State inefficiency in distributing welfare did not start in 2000 - we ourselves have direct experience of that not being true. Nor were those 20th century days free of pockets of hunger. What changed was both the wealth to do something about it and also the technology to do so efficiently. At which point we say Huzzah! For the pangs of poverty are being alleviated better than they were before and isn’t that a good thing?

That claim that the increase in food banks is a bad thing is, when thought about properly, an absurdity. For it is to say that solving a problem is proof of the problem getting worse. Instead of what has actually been happening, the world becoming a better place as a problem is solved. We’re all in favour of food banks, who wouldn’t be happy at fewer people being hungry?

Adult Social Care: Broken Promises

The other day I asked a well-informed Tory peer when we should expect the long-delayed adult social care Green Paper. “Not in my lifetime” came the response. Recent history begins with the 2011 Dilnot Report which was accepted by the coalition government, welcomed by the Labour party and then rightly over-ruled by HM Treasury as being impractical and too expensive. It was, or should have been, a start.

There was much talk of achieving cross-party consensus, but no action, and it was left to Select Committees to fill the gap. The government response to the Health Committee’s 2012/3 report included “The Government will work with stakeholders and the Opposition to consider the various options for what shape a reformed system could take, based on the principles of the [Dilnot] Commission’s model, in more detail before coming to a final view on reforming the system in the next Spending Review.”

The Health and Social Care and Housing, Communities and Local Government Committees published a joint report in June 2018. Their four main principles were:

Ensuring fairness on the ‘who and how’ we pay for social care, including between the generations

Aspiring over time towards universal access to personal care free at the point of delivery

Risk pooling—protecting people from catastrophic costs, and protecting a greater portion of their savings and assets

‘Earmarking’ of contributions to maintain public support”

The Care Minister could not comment as the Green Paper would follow “this autumn”. Her letter was undated, so the autumn to which she referred is still unclear.

A Commons Library briefing note has a timeline of Green Paper postponements up to September 2019. Amongst them are: “January 2019 – Mr Hancock told the House that he ‘intends’ for a social care Green Paper to be published ‘by April’”. When there was no sign of it by the end of April, he “attributed the ongoing delays to a lack of cross-party consensus”. As the Opposition pointed out, there was nothing to be consensual about.

In a speech to the Local Government Association (LGA) in July 2019, Matt Hancock said “Infamously, during the 2017 election campaign. But more recently too – when my colleague Damian Green recently proposed a scheme very similar to a plan supported by not one but 2 cross-party Commons select committees, by 10:42am on the day of the launch, the Shadow Chancellor had condemned it as a ‘tax on getting old’. It’s not the first time narrow partisan politics has got in the way of a solution, but let us hope it’s the last.”

It was naïve of the Tories to assume that Select Committee agreement equalled cross-party consensus and still more to rush out such a controversial plan mid-campaign. Labour also called it a “dementia tax” and it nearly cost Mrs May the 2017 election.

Significantly, when the senior civil servant, Jon Rouse, Director General for adult social care, left in 2016, he was not replaced until this year. The 2012 Health Act was supposed to leave NHS matters to NHS England, with the Department of Health and Social Care (DHSC) attending more to the last part of its title. That has not happened: the vast majority of DHSC announcements have referred not to social care, still less working age social care, but to the NHS – ignoring Sir Simon Stevens, its CEO of NHS England, who is more than capable in speaking for his own organisation. In July he tried to balance the picture by demanding an adult social care Green Paper within the year.

Hancock’s LGA speech referenced above gave an indication of his Green Paper thinking, in brief: “integrated care systems (ICS), bringing together the NHS with local authorities”, “health and wellbeing boards”, “specialist training”, “better leadership”, “increasing the Carers Innovations Fund”, “more control for care users” and “tech”.

Some of this is sensible enough, some just adds bureaucracy and some are junk-filled platitudes. Care users cannot get what they want if it is not available. We were 122,000 carers short the last time I looked. We know the DHSC’s record with new IT, test and trace apps being the most recent example, so do not hold your breath for “Social prescribing apps are being integrated with GP systems to give people greater access to social activities in their communities that can help improve physical and mental health.” The idea one needs an app to get the GP to prescribe riding a bicycle is ludicrous.

What these seven components of the Hancock vision fail to include are the three essentials: more money for carers, greater professional status akin to nurses to build pride in the profession, and less bureaucracy giving them more time and freedom to do what they believe to be best.

Nor is there any discussion of finance. HM Treasury has probably been blocking any social care Green Paper and are likely to continue to do so. That ignores individuals’ increasing willingness to contribute towards their own old age costs. French and German insurance companies offer cover and most of those who can afford it take it up. There’s only a 40 percent chance one will have to spend one’s final months in a care home. The government has made no effort to encourage British insurers to follow suit.

The broken promises did not stop there. During the last election Boris Johnson claimed a Green Paper consensus would be developed within 100 days of being elected. At nearly the end of that, nothing had happened and Hancock wrote to all peers and MPs saying, in effect, that as he had no clue, please would they send in any ideas about reforming social care. And although care for the elderly gets all the headlines, about half of adult social care costs are for those of working age.

The current excuses for the broken promises, namely Covid and the upcoming financial crisis, do not hold water. Thousands of DHSC civil servants have been sitting at home on full pay with little to do but write the Green Paper. We need an adult social care strategy that will do the job, as the NHS has, for decades. This demands some degree of political party consensus. Any party that fails to respond constructively to a sensible Green Paper will pay the price at the polls. And the strategy does not have to begin tomorrow; it should start as soon as we can afford it. The failure to deliver rests squarely with this government.