The Australian trade deal won't affect British production standards in the slightest

Minette Batters is entirely and wholly wrong here:

Minette Batters, president of the National Farmers’ Union – which bitterly opposed lifting levies on meat imports from Australia – said it would await further details, but was concerned Tuesday’s announcement “made no mention of animal welfare and environmental standards”.

She said: “We will need to know more about any provisions on animal welfare and the environment to ensure our high standards of production are not undermined by the terms of this deal."

The Australian trade deal will make no difference whatsoever to British production standards - whether they’re high or not. Beef - for this is the beef at issue - will be produced in Britain to British standards as previously.

What Ms. Batters is actually complaining about is that British consumers will now have the choice of beef produced to British standards or to Australian ones. This is, of course, an advance in freedom and liberty and so to be welcomed merely on those grounds. What Ms. Batters is worried about is that some to many will choose those Australian standards. Which is, as we say, an advance in liberty and freedom. For those who still prefer the British standards will be able to have them, those who don’t will not be required to.

Which does bring us to a point we’ve made before. The only possible logical reason for denying people such a choice is the fear that they might make the one the proposer of the ban would prefer they didn’t. After all, if everyone continued to prefer British standards then there would be no need at all for restrictions upon Australian beef. The call for the restrictions is this not just an admission it’s a positive insistence that some to many would prefer the Australian option.

And, when put like that, why in heck shouldn’t people have that choice? Why should production standards they don’t desire be imposed upon them?

That is, Ms. Batters, the very fact that you oppose the freedoms is why we should have them. Because you are agreeing that people desire the freedoms by your very opposition to them.

If only Polly Toynbee actually understood

But then if she understood then she’d not be Polly Toynbee of course. For Polly tells us of a new tax explainer from the IFS and insists that it will be a glorious addition to the progressive’s armoury:

Thatcher said you will always spend the pound in your pocket better than the state will. This remains the key political divide: the left believes our taxes buy everything we value beyond price – health, security, education, beautiful parks and public spaces, fine stadiums and leisure centres, museums and galleries. In a country to be proud of, burdens are fairly shared and no one falls below civilised living standards: that requires fair taxes, fairly raised. The right relies on fiscal ignorance. The IFS is impeccably neutral, but its TaxLab will be a great asset for progressives.

Up to a point Lord Copper, up to a point. Take this about corporation tax:

However, economic theory and evidence strongly suggest that the incidence of corporation tax is not exclusively on shareholders. In some cases, companies will set higher prices, or pay lower wages, than they would in the absence of corporation tax, such that part of the burden of the tax will be felt by customers or workers respectively. Evidence shows that corporation tax affects how much companies invest and where they locate their real activities. To the extent that companies respond to corporation tax by doing less investment in the UK, a lower capital stock and associated lower productivity will leave UK employees with lower average wages.

Quite so, entirely reasonable estimates for the US have shareholders and workers carrying 30/70% of that corporation tax burden, others equally reasonable 70/30. One UK estimate is 50/50. Further, we know what determines the split and it was Joe Stiglitz along with Tony Atkinson who pointed out that for a small economy reliant upon foreign investment - so, a developing country - it could be the workers hauling more than 100% of the costs of corporate taxation.

Don’t tax profits because you’ll lower the workers wages isn’t, quite, what the progressives want to hear.

But there’s another point here as well.

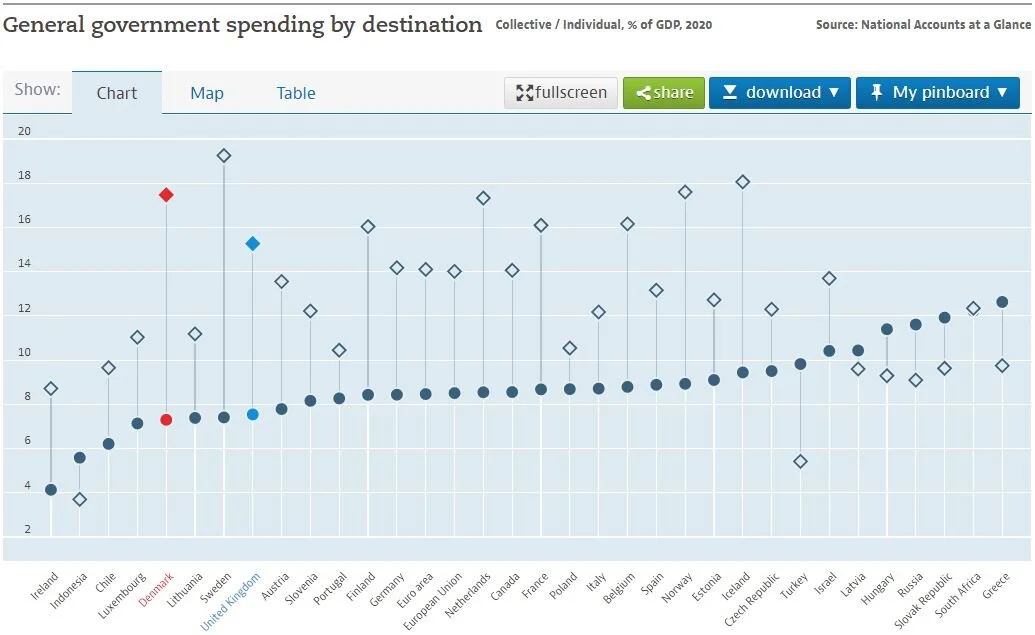

A mouse-click shows that people in Britain pay less tax (in 2019 figures), at 33% of GDP, than the EU average of 39%, while in Denmark it’s 46%.

...

Democracy depends on citizens understanding what they vote for; ignorance breeds dangerous misconceptions.

....

Voters are unreasonable, demanding Scandinavian services on US-style low tax rates.

Well, OK to each individual point there. But this is to miss that what government spends on those services is very much less than the tax revenue government collects. Denmark spends some 17.5% of everything on such things, the UK some 15.3%. We agree, that’s a difference, but it’s not anything like that of the tax collection. Near all of the rest is redistribution of incomes, not the provision of public, state or government services. That is, it’s entirely possible to have those Scandinavian levels of service without having to have their tax bills. Why, that might even be good idea:

Tax is not a “burden”, but the price we pay for civilisation.

The price we pay for something is the burden we must carry for having that thing. That’s the very definition of price. But we do come to an interesting place here, don’t we? We can have those services which Polly describes as civilisation for very much less than we currently pay for them. Gaining civilisation at less cost sounds like a good idea to us. Why don’t we try it?

All of the things we gain from government - whether they’re done well or badly, could be done better in other ways - in terms of goods and services can be had for 15 to 20% of GDP. Everything else is just shuffling bits of paper between citizens. A state limited to those necessary goods and services has its attractions. This not being something we expect progressives to be interested in hearing.

So, that's that problem solved already then

We are told that the virus lockdown and associated actions have led to something happening.

The number of homeless households rose slightly in 2020-21 compared with the previous year.

Ah, so the virus and lockdown and associated actions in fact made pretty much no difference then. That’s good. There is also this:

At least 130,000 households in England were made homeless during the first year of the pandemic

That does seem remarkable though. We rather think that it would be possible to see this. That number sleeping rough, exposed to the elements, would be easily visible, wouldn’t it?

Analysis of published government homelessness statistics and figures collected under the Freedom of Information Act from around 70% of local authorities in England show that 132,362 households were assessed by councils as being owed the “relief duty”, where a household is deemed to already be homeless.

Ah, all is explained. This is a celebration of the glorious success of the welfare system. Without it there would have been - OK, could have been - 132,362 households forced to sleep in the rain. What is being measured here is the number of households - because that is what they are measuring, the number of people kept out of the rain - who could have been but were not, in fact, made homeless. Because we have a system that deals with the risk of homelessness, those local councils having a duty to provide a solution.

So, that’s nice then, isn’t it? We need a system to protect people from sleeping in the rain, we have one, time for the Happy Dance, no?

Given that this is all sorted which is the next problem that we need to find a solution to?

Defending the Great British Sausage

70 Whitehall

“Humphrey.”

“Yes, Minister?”

“I hear our gallant friends in Ulster will not be allowed to breakfast on British sausages after 1st July.”

“That’s correct.”

“Why on earth not?”

“As I am sure you are aware, Minister, they do not comply with regulation EC 853/2004.”

“Never heard of it.”

“Inter 151 pages of alia, EC Regulation 853/2004 says about meat products, i.e. sausages: ‘Certain foodstuffs may present specific hazards to human health, requiring the setting of specific hygiene rules. This is particularly the case for food of animal origin, in which microbiological and chemical hazards have frequently been reported.’”

“Frequently been reported? Has any continental ever reported a single hazard?”

“That might be because continentals don’t eat our sausages and Her Britannic Majesty’s subjects have, over the centuries, acquired immunity. Of course, that might not apply to the Duchess of Sussex but she may not have lived long enough in the UK to acquire immunity and has now put herself at a safe distance.”

“You are wandering, Humphrey. The fact is these sausages were considered perfectly complicit with EU regulations when we were in the EU, the regulations haven’t changed and nor have the sausages, so why should they be banned now?”

“They are not banned from consumption, Minister, just for import from third countries, which did not include us then, but does now.”

“So it’s another EU non-tariff barrier like VI-1 forms to deter the imports of third country wines.”

“Indeed, Minister, but in this case it was unintended.”

“So the Ulstermen could produce exactly the same sausages in Belfast and send them all round the EU?”

“It would seem so, Minister. Maybe the Protocol does open trade opportunities for Northern Ireland after all. Although I doubt it. Pork sausages made in the Republic of Ireland are much the same as British ones, apart from their shape, and the continentals do not go for those either.”

“Well, that’s really what is daft. The EU insists this ban is necessary to prevent the British sausage undermining the sanctity of the single market by flooding into the Republic and all other parts of the EU thereafter. The reality is that the Republic is awash with its own sausages and none of the continentals want to go near them.”

“The EU is not interested in reality; it cares about rules and the logic thereof. It is an ideal; a fictional aspiration designed to stop the tribes of Europe squabbling but ultimately ensuring they will do exactly that – or that’s what recent polls indicate.”

“You may be right, but that’s too clever for me. The issue today, Humphrey, is that Ulstermen must have their British sausage and if that is something we overlooked in the Brexit talks, you can’t expect us to have thought of everything. It was all very complicated.”

“No one admires more than I do, the ability of our ministers, advised by their civil servants of course, to cover every detail across an enormous range, but I must mention un petit oubli, if I can put it that way. On the 17th December, your colleague Michael Gove agreed a grace period until 1st July.[2] Far be it from me to be critical, but he simply kicked the can six months down the road, when he should have pointed to paragraph 27 of the introduction to the regulation which says ‘Scientific advice should underpin Community legislation on food hygiene.‘? As we have 40-something years of harmless EU enjoyment of the British sausage, there is no scientific evidence to support banning its import.”

“Well spotted, Humphrey, even Brussels would have to recognise that as the reality of that. Unfortunately we can’t blame Mr Gove now. He is one of our star players. We simply have to blame the French.”

“I quite understand, Minister. M. Macron has given us an opening when he said the Protocol cannot be amended. He clearly has not read it. The Protocol is designed as a working document: intended to be amended.”

“Jolly good. Nothing like biffing the Frogs.”

“There is one other small ray of sunshine. Mrs May, as you will recall, imported all the EU regulations into UK law, en bloc, to make transition easier. So now under UK law, the French cannot make British bangers and export them to us at prices lower than ours. As a third country, their sausages would be deemed hazardous.”

“Do they show the slightest desire to do that?”

“Well, I did say it was a ‘small ray’.”

Dom Cummings is a decade late in noting HS2's worthlessness

Dominic Cummings tells all that Boris Johnson signed off on HS2’s £100 billion costs on the basis of inaccurate - fanciful to laughable in fact - projections of future passenger traffic. This being obviously true, it’s just that all of this was known a decade back, as we’ve repeatedly pointed out.

Boris Johnson signed off on the £100 billion High Speed 2 rail line based on "garbage" data predicting an exponential increase in demand for the service, Dominic Cummings has claimed.

In a posting on the Substack website, the Prime Minister's former chief adviser, said that he and other officials had highlighted "absurdities" in the evidence presented to Mr Johnson to justify pressing ahead with the construction of the line last year.

But Mr Johnson "blew" the decision on whether to go ahead with the scheme having been presented with a "garbage model/graph", Mr Cummings wrote.

This is not something new. As we have indeed been pointing out for a decade now.

For HS2 has never actually passed a properly done cost benefit analysis. The underlying assumption is that business, or working, time spent in a train carriage is unused, worthless, time. So, if those business, working, people get to their destination faster they have more working time available and this is, really, the major benefit on offer from HS2. It’s by far the largest amount of money on that benefit side.

Except that 21st century technologies, the laptop, mobile phone and internet - OK, possibly 20th century technologies - make that assumption about the 19th century technology of the railways untrue. People do work while travelling these days therefore the reduction in travel time isn’t worth what is being assumed.

This is such an obvious point that it even made George Monbiot choke on his cornflakes when he was told it. And if you’re making an economic error that even Monbiot can see through then you are, obviously, making a real doozy.

The question then becomes well, why in heck is it being built? The answer being concentrated benefits and diffuse costs. That £100 billion becomes, for us out here, £1,500 each in costs. Or, perhaps more accurately for how we care about it, £75 a year per man woman and child in the nation for a couple of decades.

Yes, this is real money, it’s a cost for us to bear, but it’s not an amount we’re about to storm the barricades over. On the other hand those who are to receive the £100 billion are a small group who are really very, very indeed, interested in their receiving this bounty from the rest of us. Therefore we have a concentrated political interest fighting a diffuse not very interested at all. Guess who wins in politics?

Which brings us to our actually lesson from all of this about HS2. Politics - therefore government - is a lousy way of not just getting infrastructure built it’s a terrible way of deciding which and what infrastructure to build. HS2 being our perfect exemplar - it wasn’t worth it back when it was only going to cost £17 billion but it now continues at £100 billion.

The solution is equally obvious. Insist that those who wish to build infrastructure do so with their own money, not our.

Once more into the breach on the gravity model of trade

As seems to be turning out Brexit has not had some disastrous effect upon British trade. There’s some rebalancing between trade with the remnant European Union and the rest of the world and that’s about it. Which leads The Telegraph to tell us that:

First, the single market is wildly over-sold, and so is the textbook "gravity model" of trade, on which the Treasury and most trade experts relied to forecast catastrophe once we left the bloc. In truth, even though its cheerleaders like to sell it as the EU’s crowning achievement, and a jewel that must be protected at all cost, it does not make much difference one way or the other, and certainly not between major developed countries.

It is tariffs and quotas that count, not regulatory alignment, and those are dealt with under World Trade Organization rules, and were set aside by the trade agreement. Beyond that, it is an irrelevance.

Well, yes, and also no, not quite. The thing being that all too few understand the gravity model.

Large economies trade more with each other than do small - obvious enough, a large economy has more economic activity. Economies close to each other trade more with each other. Thus the analogy to gravity, large close economies have more influence upon each other than do small and far apart. The Earth and Moon have more gravitational impact upon each other than do Ceres and Europa, The Sun is very large and has impacts on all of them.

However, the distance that is talked of is not geographical distance, it’s economic. “Economic” here being that mixture of simple geography, transport links, artificial barriers like borders, more artificial barriers like customs declarations, tariffs, quotas and so on. At which point it should be obvious that the single market was tipping the scales in the measurement of that distance. The absence of that free movement, the reversion to all trading with the UK on the same terms - to the extent this has actually happened - means that all are now competing on the same economic distance. The same economic distance as measured by those artificial barriers such as tariffs, quotas and so on.

Lower economic distance is a good thing, of course it is, more trade makes us richer and all that. But the changes in trade barriers are allowing the gravity model to play out on that level playing field as EU membership did not. Thus the reallocation of trade relationships to non-EU members:

The UK is returning to a historic trading relationship with the rest of the world, which means trade with the EU will fall a lot more over the next few years.

That’s not a violation of the gravity model of trade it’s a proof of it.

Of course, what we should really do is abolish all those artificial additions to economic distance by simply moving to unilateral free trade. But then as we know such obviously sensible actions have no chance in politics, do they?

The absurdities we're told about taxation

That some desire to have more taxation and more government is true. And, if we’re honest about it, that’s an opinion that people may have, are entirely entitled to hold, even as we vehemently disagree with it. We’re against the idea that more of life be decided by those who can kiss enough babies to get elected, even as we agree that some modicum of government is necessary to enable the babies to grow up to vote.

That doesn’t excuse gross misinformation being used to make the case:

The G7 helped to build this low-tax world. Are they really ready to change it?

Mark Blyth

We’re not in a low tax world. As Parliament has been told tax is some 35% of GDP. This is higher than the usual since the war - before which the burden was much lower - and has only been exceeded during one of the regular economic crises which shrink the GDP part of the calculation. We’re simply not in a low tax world.

In the early 90s, governments started buying into an argument about capital mobility, taxes and welfare states: in a world of global capital, investors will seek the best returns they can get globally. If those returns are reduced by “distortions” such as taxes, investment will flow to countries that tax less. Consequently, those expensive and expansive welfare states that neoliberal economists had always targeted had to go. Funding them through taxing the wealthy and corporations would lower investment and employment, so the story went.

This is not an argument, it’s a truth - derived as it is from Adam Smith and one of his only three mentions of the invisible hand. We can also derive it from very simple observations of tax incidence, taxes will always fall on the less mobile factors of production. Further, it says nothing about whether to have an expensive or expansive welfare state - it just says that it will be counterproductive to try to finance it from the more mobile factors of production. Which is why those Nordics don’t try to finance their expansive and expensive welfare states by the taxation of corporates and capital.

That is, it isn’t a normative argument about what sort of polity to have. It’s a positive one about if you wish to have a certain polity then it is necessary to finance it in this particular manner.

There’s even a neat proof of the fact that the taxation of mobile capital does work this way. For what is the solution being suggested? The global taxation of that capital - or at least of tax rates - meaning that capital mobility doesn’t change the tax rate faced. One would only propose this as a solution if it were true that capital mobility were not just an argument about taxation but a truth concerning it.

But then there’s this which steps well over the line of acceptable propaganda:

Governments across the Organisation for Economic Co-ordination and Development (OECD) used this argument to cut taxes on both individuals and corporations. The UK’s corporate tax rate fell from 34% to 19% between 1990 and 2019, while the US’s rates fell from 35% to 21% over the same period. But rather than those reductions leading to an explosion of investment in both countries, investment levels actually fell, as the tax-savings made were taken as profit and pushed into asset markets. In the UK, gross fixed-capital investment fell from 23.5% of GDP in 1990 to 17% in 2019. In the US, it fell from 23.5% to 19%.

Definitions matter. Gross fixed-capital investment being:

Fixed assets are produced assets that are used repeatedly or continuously in production processes for more than one year. The stock of produced fixed assets consists of tangible assets (e.g. residential and non-residential building, roads, bridges, airports, railway, machinery, transport equipment, office equipment, vineyards and orchards, breeding livestock, dairy livestock, draught animals, sheep and other animals reared for their wool). The European System of Accounts (ESA95) explicitly includes produced intangible assets (e.g. mineral exploration, computer software, copyright protected entertainment, literary and artistics originals) within the definition of fixed assets.

Value creation, in this modern world, depends ever more on those intangibles. The measure being used, of fixed-capital, assumes that ARM Holdings wasn’t investment, Windows, Amazon’s website, e-Bay, and on and on aren’t investment. Amazon’s warehouses are but not the rest of it. An absurdity of course.

Mark Blyth is a political economist at Brown University.

By the argument Blyth is using building a new gym at Brown is investment, everything that happens in the classroom, being an intangible, is not. But then at Brown, with Blyth, that might actually be true.

We entirely agree that there are different visions of the future we should be striving for. But we would like to at least try and insist that the evidence presented to argue for one or the other be evidence, be observations about the real world. For without that stricture we end up somewhere on the spectrum from being misleading through propaganda to casuistry which really, we do insist, isn’t the way to run the world.

Josh MacAlister needs to base public policy concerning children's homes on better evidence than this

If there’s a problem out there with the way government gets something done then appointing someone to have a look into the problem seems rational enough. But it does, obviously enough, depend upon who is appointed. Someone who believes mutually contradictory things before breakfast might not be the best choice. As with Josh MacAlister and this investigation into the provision of children’s home places:

Josh MacAlister, the head of the government’s review of children’s social care, will warn children’s homes bosses they must cut “indefensible” profits and improve the experience of young people in care or run the risk of intervention.

Rising levels of wealth are being made off the back of soaring children’s home fees and people are rightly concerned that private homes are making an estimated £250m a year in profits from the care of vulnerable children, MacAlister will say in a speech to the Independent Children’s Home Association on Thursday morning.

That is possible, we agree. Whether it’s true or not is another thing but it’s certainly possible.

MacAlister, who has welcomed the Competition and Markets Authority’s investigation into the children’s care market announced in March, is concerned that some heavily debt-laden private children’s care companies are at risk of collapse, with dire consequences for children in care and the local authorities that fund them.

That is also possible, that the providers of these homes are so laden with debt they’re about to go bust. Again, whether it’s true or not is another matter but it’s possible.

What’s not possible is to believe both things. It is not possible that the operators are making super, lovely, excessive, profits and also that they’re about to go bust. Someone needs to have a word in Mr. MacAlister’s shell-like to point this out. At least try to be internally consistent in your analysis perhaps?

As to where this idiocy comes from that’s simple enough, as one of us has pointed out before. It’s a report from Revolution Consulting which looks at the operating profits, not net profits, of the care home providers. That is, it looks at the excess of revenue over cost before accounting for mortgages, interest upon them, depreciation or maintenance of buildings and so on. You know, things that are a considerable portion of costs concerning anything with the word “home” in it. By using Ebitda as the measure it, in effect, looks only at the current account, not the capital. Which is, as a measure of profitability, absurd.

We’re fine with reports looking into problems with the way government does things. We do think it would help if those appointed were competent.

We struggle with The Economist's definition of a city's liveability

According to the Economist Intelligence Unit it is Auckland, in New Zealand, that is the world’s most liveable city:

The Covid-19 pandemic has shaken up the Economist Intelligence Unit’s annual ranking of most liveable cities, propelling Auckland to top spot in place of Vienna, which crashed out of the top 10 altogether as the island nations of New Zealand, Australia and Japan fared best.

We rather struggle with this as we’re entirely certain that we’ve seen piece after piece detailing Auckland’s terrible problem with anyone finding housing in it:

The Demographia International Housing Affordability Survey rates housing affordability using the "median multiple", a measure of median house price divided by median household income.

Authors Wendell Cox and Hugh Pavletich ranks as affordable cities where the median price is up to three times the median wage. Areas are classed as moderately unaffordable when the ratio is up to four, seriously unaffordable between four and five and severely unaffordable when the ratio is more than five times income.

....

Auckland, at nine times income, was severely unaffordable, and up from 5.9 in 2004. The country as a whole also ranks in this range, with a ratio of 6.5. Auckland is the seventh-least affordable city of the 91 major housing markets surveyed.

Perhaps liveable city is meant to be defined as one people can’t afford to live in. Or possibly that which makes it liveable by the EIU’s criteria is what makes it so ghastly expensive to be there. Or even, it is necessary to have an entirely absurd planning system in order to meet the EIU’s definition of liveability.

Our struggle is really that we just find it difficult to think of a place where median housing is near ten times median income as being liveable. Certainly, we’d not suggest it as somewhere to emulate.

This is how technologies end, with a whimper

The Guardian carries a story about one of the last typewriter repair shops in Goa, India:

It started as a sideline to the main business of the store, but now it is the main earner for Luis Francisco Miguel de Abreu as he struggles to maintain one of the last typewriter repair shops in this Indian state.

Inside the shop, several typewriters sit in various states of repair, looking much like museum pieces. There is a Hermes, a Remington and a Godrej Prima, from the Indian manufacturer that was the last company in the world to make typewriters.

One of the things that caught our eye was that manufacturer, Godrej and Boyce, for one of us worked with them - tangentially - back in the early 1990s on the leap to an entirely new chip architecture for computer workstations. That form of chip didn’t work out but we do think it fun that G&B was still making typewriters up to 2011, as The Guardian tells us. There’s a lot of overlap as technologies replace each other that is.

Further, old technologies never truly die. They might become insignificant in the general scheme of things but true death never does quite happen. It might end up being only the period movie business that will still use typewriters but it’s never actually going to end. As with Prince Phillip being a continued user of the services of buggy whip manufacturers.

It’s also true that the old technologies can sometimes still be the appropriate ones. We’ve been assured that this story is true, perhaps the most effective and efficient piece of foreign aid ever - a batch of manual typewriters. Madagascar had, as is obvious in an ex-French colony, a rigorous and complex paper based bureaucracy tracking land ownership. Typewriters are language based, different keys and keyboards are used for different vernaculars. These do also wear out, they’re mechanical devices after all.

At one point is was noted that no one could transfer land in Madagascar, for the typewriters were so worn that they could not imprint through the necessary carbon paper. Not having a market in land was of course hugely detrimental to the growth, even functioning, of the economy. A batch of Malagasy typewriters were made up on a special order and delivered. For the sake of those few thousands of dollars that entire portion of the economy was able to work again.

There’s no grand point here, it’s just an observation. Technologies don’t so much die as just become smaller, never quite shrinking away to nothing.