The problem with all macroeconomic policy

This claims that monetary policy comes with certain problems:

Monetary tightening is like pulling a brick across a rough table with a piece of elastic. Central banks tug and tug: nothing happens. They tug again: the brick leaps off the surface into their faces.

Or as Nobel economist Paul Kugman puts it, the task is like trying to operate complex machinery in a dark room wearing thick mittens. Lag times, blunt tools, and bad data all make it nigh impossible to execute a beautiful soft-landing.

That is all true - it’s also true of monetary loosening of course. Our recent 12% inflation rate is proof of that.

But the big bad truth about macroeconomic policy is that this also applies to fiscal policy. Which, given that there are only two macroeconomic toolsets, fiscal and monetary policy, leaves us with something of a problem concerning macroeconomic management.

Given the tools available macroeconomic management just isn’t going to be very good. Sure, if gross events occur - GDP drops 10%, inflation rises to 12% - then clearly a gross and inaccurate tool might be appropriate. But that Keynesian dream of managing, in detail, the temperature and speed of the economy centrally just doesn’t work. Not because we cannot make an intellectual case for it, but because the ability to do anything about it relies upon those gross and inaccurate tools.

The management of the economy therefore devolves down to those microeconomic matters that we both know more about and can indeed deal with. Incentives, the fine detail of market structures and so on.

This is not to say that we must have microeconomic foundations for our macroeconomic theories. Quite the opposite in fact - it’s to insist that our macroeconomic toolbox to be able to do anything about the macroeconomy isn’t very good. Therefore use must be sparing, in extremis only.

Get the structure of markets and incentives correct and she’ll be right, the economy as a whole being emergent from those.

This is, of course, very boring for those who would get all Fat Controllerish about the macroeconomy but it does have the startling merit of being both true and useful advice.

All hands on deck (chairs)

When the ship of state lacks direction, crowding the bridge with more Cabinet Officers and unfolding more deckchairs for the crew, will not avoid any icebergs.

Last week we had 30 around the Cabinet table - now there are 33. By statute there should be a maximum of “21 Cabinet Ministers excluding the Lord Chancellor.”(1) This changes the dynamic of those in the room from being decision-makers to being part of an audience.

Worse still, Commander Sunak is steering by hindsight. The policy of reducing the size of the civil service to pre-Brexit numbers has been scrapped. More deck chairs are being made available and the crew can work ashore if they like. When I grumbled about a senior Department of Health civil servant working from Gloucestershire, he told me he had just had approval to move his office to Cornwall…

A zero carbon 2050 implies that almost all energy will take the form of electricity. That rests on three legs: renewables, nuclear, and fossil fuels. Back in April, Boris Johnson recognised nuclear as the key to minimising fossil fuels emissions because renewables are unreliable. On more than 180 days in any year wind only produces 4GW (2% of electricity needs) at some stage of the day or night.

Remarkably, this fundamental issue is not even mentioned in the BEIS 2050 projections. (2) Johnson clocked it and created Great British Nuclear (GBN) to deliver it. Purser Jeremy Hunt, however, answering a question at an informal gathering of Tory MPs, replied that “Boris Johnson’s ambition to build one new plant every year for the next decade was unfeasible in the present environment."(3)

That means fossil fuels will remain the key leg. The current artificial pricing which is responsible for their record profits has little to do with Mr Putin and everything to with the government allowing them to base wholesale prices on alien products. The UK was buying very little gas from Russia: Norwegian pipelines were an issue and so was using the foreign gas market to set the prices for UK renewables. (4)

Another example of steering by hindsight is the re-merger of domestic and international trade departments. International trade used to be part of the domestic business department but its relationship with the Foreign Office did not work so UK Trade & Investment was formed in 2003 as a joint subsidiary of the two departments. That proved useless, partly because the three cultures did not mix, and in 2016 the Department for International Trade (DIT) became a stand-alone ministry in anticipation of Brexit. (5)

Now Commander Sunak is taking us back to where we started and history will repeat itself. All that said, dedicating one department solely to energy/net zero is a good idea but Lieutenant Shapps should be given his own lifeboat to row, free of constraint by the Treasury. Captain Hands, meanwhile, should be facing the titanic problem before him, and should clear his bridge of those looking back.

(2) www.gov.uk

(5) https://www.gov.uk/government/organisations/department-for-international-trade

As we were saying, Just Say No to HS2

Madsen Pirie describes our work here as to be those howling in the woods - shouting out those truly weird ideas and concepts which a decade later become the commonplaces of the political discussion. Which brings us to HS2:

The number of trains running on HS2 will be almost halved and services will travel more slowly in a proposed shake-up of the £72bn line as ministers scramble to save money.

Whitehall officials are considering reducing the number of trains from 18 to 10 an hour, insiders said.

Meanwhile, plans to run services at up to 360 km/h (224 mph) are in jeopardy as officials weigh whether to reduce maximum speeds.

Dropping the H is indeed one way to reduce costs. But in the newspaper report there is also this:

Lord Berkeley….He said: “Why do you need to get to London 30 minutes quicker when you have Wi-Fi and your laptop on the train?

“I suggest that ministers should look at options for radically cutting the costs of what is left of HS2.”

Ah, yes, as we pointed out just over a decade ago:

The economic case for HS 2 is dead

Unlike the trains themselves - or even the project - the truth is arriving just on time.

On-train wireless internet connectivity is growing fast in Europe - but even faster in the UK, which now has more than 2,000 Wi-Fi equipped carriages.

If people are productive while in a train then the benefit of getting them there faster disappears.

That's bad news for High Speed Rail though, as the justification for HS2 (the £17bn high-speed London/Birmingham connection) assumes all travellers are entirely unproductive during transit and thus the 30 minute reduction in travelling time benefits the economy.

We did get one part terribly wrong, that £17 billion was terribly naive. But the base point, once we have WiFi on trains then the economics entirely fall apart was and is true.

Of course, having been right isn’t enough, even if unlike Cassandra some now believe. It’s still necessary for someone to act on that rightness and cancel the thing.

This seems like a sensible idea

We criticise often enough so perhaps applauding something sensible should also be done:

Train tickets in Britain could be priced like airline seats under a demand-based system being trialled by the government as part of a wider rail shake-up.

The transport secretary, Mark Harper, announced on Tuesday evening that fares on some long-distance trains run by LNER on the East Coast line will fluctuate according to availability.

He said the state-run train company would also move towards scrapping return tickets across its network, as a test for whether the idea could eventually be rolled out across the wider railway. The trial follows a successful pilot of selling only single-leg tickets on some longer intercity journeys such as London-Edinburgh since 2020.

Airlines face the same basic problem as trains. Near all of the costs (near for airlines, all for trains) are the fixed costs of running the routes. The marginal cost of the extra passenger is near (or is) nothing. Thus the game is to maximise total revenue from the seats. That does mean variable pricing. This is then compounded by the manner in which an empty seat on a train/plane 10 minutes before departure has some value or other, that same seat 15 minutes later is worth nothing.

So, given that airlines have indeed found the solution to this problem over the past 30 to 40 years why not the same solution on trains? After all, solving an economic problem is indeed solving an economic problem. This also being an interesting proof that economics - at the level of microeconomics at least - is indeed a science. Generalisable principles extracted from observation and experiment, that’s pretty scientific.

Which does leave us with just the one question really. Why has it taken 30 to 40 years for a solution already known to be applied to trains? Possibly because whatever it is we’re calling the Department for Transport these days has retained control of ticketing methods?

Less lab space keeps us off the pace

The COVID-19 pandemic helped highlight our reliance on laboratories like never before.

The labs provided vital research into vaccinations, playing a vital role in overcoming the challenges presented by the pandemic. Even before that point, life science innovation has contributed to society in immeasurable ways. Including the development of antibiotics, the invention of gene editing techniques, and understanding the structure of DNA à la CRISPR.

In the UK, this innovation is largely concentrated in the Oxford-Cambridge arc, an area in which there is a distinct focus on academic research. Biotechnology companies buzz around this golden part of the South like bees to (profitable) honey, hoping to set up research laboratories across these cities due to their close proximity to highly intelligent science graduates who may go into research.

However, there is a colossal problem standing in the way of the continued development of vital research innovation. A problem so big that it could hinder the very safety of the British people come the next pandemic - a lack of lab space which handicaps the very research keeping us safe.

As shown on the graph below from the Financial Times, demand for lab space far exceeds available supply.

Sue Foxley, research director at Bidwells property consultants, explained in 2022 that,

“In June this year, Oxford had 18,000ft(sq) of lab space available for research-intensive SMEs, but the demand was vastly higher at 860,000ft(sq); Demand in Cambridge totalled nearly 1.2 million square feet, but the availability there was zero.”

With the UK unable to keep up with growing demand for lab spaces, we are at threat of losing potential innovation opportunities in the life sciences sector to cities such as Boston, where more lab space is available. We’re also at risk of a brain drain, forcing graduates from these research specialist universities to move further afield. Perhaps to another more attractive country.

You may hear people argue that we are fixing this problem by growing lab spaces in other parts of the UK, and indeed we have. In South Manchester for example, a £2.1 million deal has been passed, completing the sale of 10,000 sq ft of office space to convert into lab space. Similarly, in Edinburgh, 20,000 sq ft of space is currently being turned into lab space.

This is a step in the right direction but it doesn’t fix the problem in Oxford and Cambridge: the areas where clusters of innovative firms already exist. These innovation clusters, like the ones we see in Oxford and Cambridge, take years to develop. By building a series of lab spaces dispersed throughout the UK we would be missing out on agglomeration effects and thus losing out on the positive innovation opportunities that we see in Oxford and Cambridge.

How do we go about resolving this? We could repurpose existing spaces in Oxbridge into lab space. One way this could be done is by relaxing restrictions on Grade II buildings which take up a large percentage of all listed buildings in both Oxford and Cambridge (in Oxford and Cambridge there are 77 and 47 Grade II buildings respectively). While there is a reluctance to suggest this due to the ‘special interest’ these buildings have, due to the dysfunctional nature of the planning system, this seems like a necessary approach to ensuring an increase in lab space.

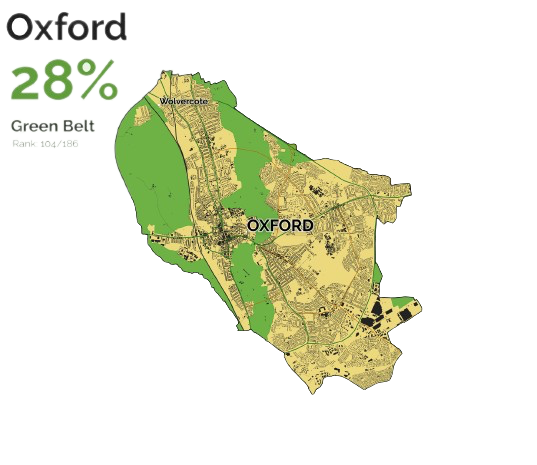

Another solution, as with the housing market in general, is to open up areas of the green belt for construction. Admittedly, Oxford and Cambridge are places with lower green belt areas in contrast to others in the UK, however there is still around a quarter of green space in both, as shown on the graphs above.

By extending construction into these areas, the supply of space available for labs would become much more readily available. Despite concerns that this ruins ‘picturesque’ landscapes, this largely isn't the case with more than a third of the green belt dedicated to intensive farming, an environmentally damaging process which leaves landscapes far from scenic.

We're mildly unconvinced by this medical records contract

This strikes us - from an admittedly sketchy knowledge of IT - as being not the right solution:

Silicon Valley billionaires are lining up to bid for a £480m NHS contract to transform the health service’s creaking IT systems into a high tech database.

The so-called NHS Federated Data Platform has attracted a bid from US artificial intelligence company C3.AI, founded by billionaire Thomas Siebel, The Telegraph can reveal.

Moving back one step to what the Federated thing is:

A flagship programme intended to bring down NHS waiting backlogs is to be delayed after becoming mired in bureaucracy.

The £360 million federated data platform is seen as critical to reducing waiting lists, with a record 7.1 million people now waiting for treatment.

When the plans were announced in the spring, health chiefs said that the system would be an “essential enabler to transformational improvements” across the NHS.

Experts have warned that progress in clearing the lists has been set back by chaotic recording systems.

We would not argue that NHS IT is all Ticketty Boo, we are after all rational beings. Greater centralisation would not be our base plan for sorting it out, however. We do recall what happened last time a central solution was tried, £11.5 billion was spent to produce not one, single, usable line of code.

This is also one of those areas where even we agree there’s a role for government. As with the internet itself. But to remind what the government involvement in the internet was - it wasn’t to plan how cat pictures get to you, not how advertising should work, nor even what people should use it for. It was to develop and define the interface.

If the output of some process, machine, effort, whatever, can pass through that TCP/IP interface then it can go on the internet. Any process, machine, effort, whatever that can absorb information through TCP/IP can read the internet and all that’s on it.

Yes, yes, that’s gross simplification to an absurd level. Yet it is also true.

Which is what the reform of NHS IT should be. Define the interface. Information that is in a format that can be read in “this manner” is an acceptable output of any process, machine or effort. Any information that cannot be read in that manner is not allowed. So too with any demand from any machine or process for information as an input. It must be able to accept that in this one specified format. Proprietary methods are allowed, of course they are. But only if any system can both emit and collect all information in the one standardised form as well.

Government’s role is to define and then insist - very forcefully - on that one interface.

We’d go further too, in not allowing anyone in British Government to alter, upgrade, improve or anything else that interface. Pick one - say OpenEMR - and that’s it.

We then gain the best of both worlds. We retain - or even get for the first time - all the glories of markets and competition in how information is to be processed, increasing productivity, lowering costs and all that. We entirely avoid technological lockin by having that open and fixed standard. We also gain an integrated health care IT system - the interface, the portability of the only important thing, the information.

Works for us, now tell us why it doesn’t work in reality?

Lifting the next 800 million out of poverty

How do we go about lifting more people out of poverty?

‘Over the past 40 years, the number of people in China with incomes below US$1.90 per day—the international poverty line as defined by the World Bank to track global extreme poverty—has fallen by close to 800 million. With this, China has accounted for almost 75 percent of the global reduction in the number of people living in extreme poverty.’ (World Bank, 2022)

How do we lift the next 800 million out of poverty? It’ll be tough. But here in the UK there are some simple, effective, and proven policies that I’d like to share with you. Poverty is by no means a solved problem in the West - and I think you’ll be surprised to see the state of it in the UK.

As per the brilliant Our World in Data graph above, the yellow section of the graph indicates a colossal move out of extreme poverty for a huge amount of East Asians - half of which is attributable to China. A colossal move away from absolute destitution never before seen in the history of the World. How the hell did this happen?

I think the single most effective measure at lifting people out of poverty - which has been tried and tested - seems to be a focus on growing the economy; on increasing the amount of products and services we produce. Baking a bigger pie so all can have a bigger slice… supposedly.

So what pro-growth policies did China pursue in order to bring nearly a billion of its people out of poverty? The World Bank tells us that:

‘China’s poverty reduction story since the late 1970s is fundamentally a growth story, complemented, particularly in more recent years, by targeted poverty reduction policies and programs.’ (2022, pg.5)

China opened themselves up to world markets by lessening economic protectionism and mercantilism, developed the necessary infrastructure to compete on the world stage, increased their agricultural productivity, managed urbanisation from rural to urban economic hubs, all of which constituted the free-market led growth side of this achievement. And targeted ‘in-house’ poverty reduction policies constituted the second part, namely investment in education and productivity-increasing skills development.

These growth-led policies helped China to lift 800 million out of poverty. But how do we start to lift the next 800 million people out? The low-hanging fruit (to use a weird but apt phrase) has been picked and it is now tougher to take the next person on the margin out of extreme poverty. And we still have a lot of work to do, globally. Although only 9% of the world now live on the UN’s definition of ‘extreme poverty’ - less than $1.90 - another 53% of the world lives on less than $10 a day. This is far too high a number., as per the OurWorldInData graph below.

But how do the numbers look in the UK? Not great. As of 2017, over 200,000 still live in extreme poverty, defined as living below the International Poverty Line; less than £1.79 ($2.15) a day. Just above the amount of people who live in York are this impoverished in the UK, a high-income G7 country. This is obviously not acceptable - and I thought we’d got rid of extreme poverty in the UK?

200,000 people is around 0.3 per cent of the UK population, which is obviously a very low percentage. But statistics get in the way of reality: these are still people who are struggling and who can ill afford to feed themselves or their families. Some may have mental health problems that make this tougher, etc, but we should look at these cases as challenges to be solved rather than a reason to say: “ah, poverty is pretty low, so we should just be happy with that.”

Unaffordable housing, extortionate childcare costs, high-tax for substandard public services, an increasingly less competitive private sector, and other ailments, seem to have *at the least* worked against further poverty alleviation in the UK.

It seems that there isn’t one single silver bullet here when it comes to growth. But I’ll try and single out some of the more focussed options from here on out. I’m sorry that this first policy on the list could effectively be hundreds of separate ones. I promise the rest of the list isn’t like this…

2) Take the Poorest out of Tax

The UK’s ‘Personal Allowance’ means you can earn up to £12,570 before you are subject to any tax. But I think this personal allowance amount should be higher. As does the Adam Smith Institute, who thinks the specific amount should be pegged to the National Minimum Wage rate, at least. If this was the case,

‘the personal allowance should now be £17,374.50 a year, the equivalent of 37.5 hours a week on the minimum wage of £8.91. Instead, it has remained frozen for the last 10 years. For the average 18-29 year old, we calculate an annual saving of £250 if both income and NI thresholds were indexed by inflation.’ (2022, pg.15)

This would mean those earning the least would have more money in their pocket. I also err on the side of not wanting taxation falling on the poorest in society.

3) Trillion-Dollar Bills on the Sidewalks

We should liberalise immigration. If I’m right, the gains would create so much value that American Economist, Michael Clemens, imagines that it would be like having trillion dollar bills on the sidewalks… sound appealing?

‘The gains to eliminating migration barriers amount to large fractions of world GDP—one or two orders of magnitude larger than the gains from dropping all remaining restrictions on international flows of goods and capital.’ (2011, pg. 83/84)

But won’t this just mean the poorest in our society will face fiercer competition for lower paying jobs? Clemens thinks not:

‘If [...] human capital externalities are real and large [...] it is possible that the depletion of human capital stock via emigration inflicts negative externalities on nonmigrants. However, these externalities have proven difficult to observe [...] and their use to justify policy remains shaky.’ (2011, pg. 90)

Some useful reforms here:

Implement Flexible Right to Buy à la my last blog.

Let residents in each street vote to allow existing houses to be extended upwards or outwards.

Allow development on small areas of the green belt within walking distance of train stations, whilst preserving areas of exceptional beauty.

Liberalise a range of design regulations.

Legalise subletting for social tenants to make better use of existing social housing stock.

The Housing Crisis might just be the single most damaging and far-reaching ailment the UK is suffering with. But how does this help those in poverty?

First-order effects include: an inability to even *think* about getting on the housing ladder as someone in poverty; means those in poverty who might be more economically productive elsewhere cannot live there due to high housing costs.

Second-order effects include: less affordable housing means social housing is more likely to be at capacity usage, meaning those in poverty will wait longer for better housing arrangements; a stronger housing sector means a stronger economy which in turn could increase the opportunities available to those in poverty.

5) Phase in a Negative Income Tax or Basic Income

There is a sizeable literature which believes that just *giving* money to people in poverty might be the most helpful solution to their situation. Those in poverty are so because they lack cash. Yes, other factors are at play, such as mental health and familial wealth. But the primary issue here is that they don’t have enough cash.

A Basic Income (BI) is a payment sent to every citizen (above a certain age, as usually construed) unconditionally - regardless of their wealth. Usually (except for some tougher cases) people in poverty are there because they lack the cash needed to live comfortably and buy their essentials. A BI would seemingly remedy this. Although of course there are questions of how you give those in extreme poverty the cash when most don’t have their own bank accounts.

A Negative Income Tax is, as per Nikhil Woodruff of the PolicyEngine who wrote for us on the topic last week,

‘[…] a very broadly-defined concept with a simple proposition: income tax should start below zero, representing a transfer from the government to the taxpayer.’

‘'When it comes to work incentives, the negative income tax diverges from a policy often described in the same breath: a universal basic income, which provides an unconditional equal cash payment to every person. While a NIT and UBI might sound like the same thing, a UBI doesn’t include any kind of clawback […]'.’

‘This kind of radical egalitarianism necessitates equal treatment of an entire population [combined with] the values of equality and fairness with its most practical implementation: if we share those values, so should we.’

Final thoughts:

Poverty reduction across the World and in the UK has come far and market reforms have lifted hundreds of millions out of poverty.

There is still more for the UK and other countries in the World to do to lift those last people out of poverty-stricken misery.

Effective policy can prove a potent weapon in this task.

We do wonder about The Observer and economics

This particular claim rather causes splutters:

But land is expensive because the property that can be built on it is so expensive.

No, really, just no. The property, as a property, costs about its replacement cost. £100k to perhaps £200k. Have a look at what the insurance company will pay out if it suffers a sudden dematerialisation event. Property, houses, that’s not where the expense is.

That’s over in the price of a building permit. That planning permission to be able to build a property on that specific piece of land. Again, easy to prove, take the market value of the house as is, deduct what the insurance company will pay in the event of an SDE and that’s the value of the permission. Actual land is £10,000 a hectare which isn’t a number that really matters in this calculation - yes, Mayfair more than that, Cumberland less, but it is the system, the licences and permissions, that costs the money.

Again this can be shown. There was a slice of park in South London which had planning permission as a result of post-WWI decision - anything that had been bombed out had permission. As part of the park it was worth £15,000 according to the local council, the compensation they wished to pay for having incorporated it into said park. With that planning permission it was worth £1,5 million as the courts decided.

All of which makes this useful as an analysis:

“Housing policy is killing British civilisation,” said my interlocutor. “Right to buy has been a social catastrophe, making today’s generation pay for the earlier generation’s bonanza of buying their council house on the cheap – the stock has collapsed because the homes were not replaced. There is too little or no affordable housing or rents in great parts of the country where young people can start or bring up a family.

“It is already hitting the birthrate. Forget building a quarter of a million houses a year rising to 300,000: it is not going to happen with the new planning rules that enthrone the nimbys. This country so safeguards the interests of the old and the equity in their houses, it is literally killing off its future.”

Well, yes. But the solution is to deal with the actual problem - the short supply of those permissions which lead to the high price of them. We can call opposition to it Nimby if we like. The answer is - as it always is with a shortage of supply - to flood the zone with supply. As we’ve been saying in fact.

Issue more planning permissions. Or kill off the need for them even. And watch as the problem of excessive bureaucracy and planning is solved by having less bureaucracy and planning.

Simples.

We do love the smell of a good trade war in the morning

Trade wars underpin, underline, our more general view that political management of the economy - of life itself - is something to be avoided.

The base logic is terribly, terribly, simple. Imports are the benefit of trade, exports the costs. Imports are the labour of Johnny Foreigner that we are able to consume, to our benefit. Exports are our sweat of hand and brow that we send off for some other chappy to consume and benefit from. Exports are costs, imports benefits.

At which point, this:

Rishi Sunak’s plan to scrap thousands of EU laws by the end of this year risks triggering a full-scale trade war between the UK and Brussels, senior figures in the European Union have warned.

Letters from leading EU politicians, seen by the Observer, reveal deep concern that the UK is about to lower standards in areas such as environmental protection and workers’ rights – breaching “level playing field” provisions that were at the heart of the post-Brexit trade and cooperation agreement (TCA).

In retaliation, EU leaders in the European Commission, the European parliament and the council of ministers are preparing what they call their own “unilateral rebalancing measures” in secret meetings in Brussels. Sources say these are certain to include the option of imposing tariffs on UK goods entering the EU single market.

The British Government is considering doing some things which might be of benefit to British citizens, to inhabitants of Britain. Whether they will be or not we’ll leave to one side, it’s not relevant to our point here. The reaction from J. Foreign is that in the face of such absurd provocation they will make their own citizens, their own inhabitants, worse off.

For that is what the imposition of tariffs is. EU folk will no longer be able to - or must pay a higher price to - enjoy the work and labour of Britons. This makes those EU folk worse off. But this is the very threat which is supposed to make us quail in our boots? Europeans will be made worse off so we Britons must not do that?

The reason for this absurdity - and it’s not just the EU subject to this mal-thinking - is that politics views trade through a mercantilist lens. Exports are the aim, piling up the gold bars achieved from them the benefit. This view is 247 years out of date (since the publication of Adam Smith’s Wealth of Nations) at the least. Yet it is still how politics and trade policy interact.

Given that politics and politicians have had that near quarter millennium to get this point right and have, gloriously and completely, failed to do so, we end up with the insistence that politics and politicians are not the way to decide trade policy. For after all those years if they’ve not managed to note it yet we can safely assume they never will.

A politics and politician free trade policy is one of free trade. Actual, real, whole and total, free trade. So, if politics and politicians are going to be - as they are - really, wholly and totally wrong about trade then we must have free trade, mustn’t we?

Once again the steel industry is missing the point

We can all argue over whether we should have a policy about climate change emissions but start from the point that we do. That policy being that Britian should stop doing things which have lots of climate change emissions:

“Some of the reduction in steel production is in response to reduced demand, but the exorbitant energy prices faced by industry have clearly taken their toll on industry in the UK.”

Soaring energy costs, typically at least 50 per cent more than continental competitors, and environmental penalties levied on high carbon-emitting plants are behind a decision by British Steel, the operator of blast furnaces at Scunthorpe owned by Jingye, of China, to cut 800 jobs, a quarter of its workforce.

As with Tata at Port Talbot, that’s working then.

No, really. The aim, the point of the policy, is that we stop doing things highly emittive like use blast furnaces to make iron and steel. We’ve made using blast furnaces to make iron and steel uneconomic. Excellent, job done.

The industry complaints are that the policy is working in achieving its express aim.

This is then followed up with the begging bowl:

It applied for £300 million of state aid to save the plant…(…)…“This is a critical point in time when the sector needs to decarbonise and transform, something that can only be done in partnership with government,”

….and so on and etc. Having been deliberately driven out of business in this old tech we now want subsidy to build the new tech - DRI steel making for example.

But that’s incorrect. If it makes economic sense to build a DRI plant in Britain then one will be built. It’s not difficult to find the capital for things that make economic sense. If no one is willing to put the capital into a project then we’ve that very good indication that it doesn’t make economic sense. At which point of course government shouldn’t be throwing the populace’s cash at something that doesn’t make economic sense - that just a way of making the populace poorer.

Either making virgin steel in Britain using non-emittive techs makes sense or it does not. That it doesn’t make sense but we must dun taxpayers to do it anyway is not a good idea.

We do not, for a moment, think that the steel industry nor its fund raisers are ignorant of all of the above. We do think that politics might be stupid enough to swallow the glaring inconsistencies in the logic behind that begging bowl. We mean we hope they won’t be that silly but worry that they will.

The entire aim of climate policy is to close down industries like this archaic method of making virgin steel. If the new method doesn’t make sense to do in Britain then it doesn’t make sense to do it in Britain.

There is nothing else anyone needs to know here - nor anything else anyone should fall for either.