Once more into the breach Dear Friends, once more into the breach

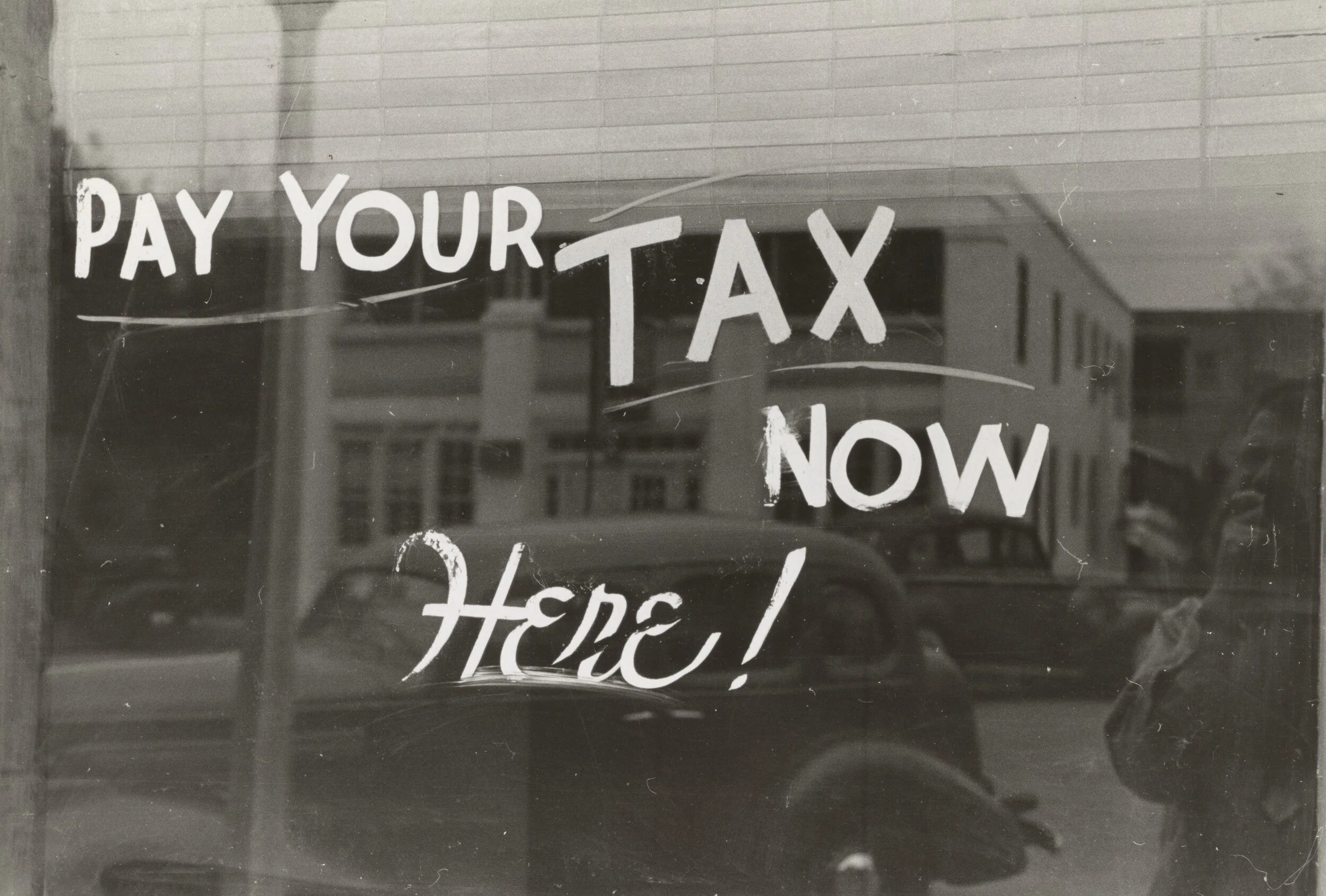

Some 20 years ago we started making fun of the Living Wage people like the JRF. Every time they came out with an insistence that, you know and actually, the minimum wage needed to be higher we did the sums. Having done the sums we then gleefully pointed out that the difference between that living wage and the minimum was the amount that low income people had to pay in income tax and NI.

This was, obviously, nonsense. The minimum wage is, by definition, that amount that society says someone must righteously earn for their labour. That there should be no minimum wage at all, that it’s £0, is also true. But that argument for having a minimum set by statute is “Guys, this is the just and righteous minimum!”

Therefore the government, the Chancellor, doesn’t get any of it - it’s the just and righteous value of that labour.

The reason why those on minimum wage were getting taxed was fiscal drag. Don’t increase the tax free allowance in line with inflation, don’t adjust it for rising real wages. Over a generation the threshold for paying income tax migrates from it being something that only hits the middle class and above to being something that someone working part time on minimum wage has to pay. Which is an absurdity.

Which we kept pointing out. Along with the demand that the personal allowance for both income tax and national insurance be raised to the full year, full time, minimum wage. This also actually worked. The CPS had worked on George Osborne, we (and we know this to be so) convinced Nick Clegg and the LibDems, come the Coalition it became so.

Yes, it took time to be brought in but that’s why the personal allowance is now £12,500 a year. Because that’s what the full time, full year, minimum wage was back when the Coalition signed onto the idea.

At which point:

Should income tax thresholds be raised?

Millions more households will be pushed into higher tax brackets by 2028. We ask two experts if they think this sneaky way of raising tax is fair

We have views on those higher brackets. But we are adamant about that initial threshold. The personal allowance should be, must be, at the minimum wage at minimum. Not to do this is not only sneaky it’s vile.

Consider, for a moment. The current minimum wage is £10.42 an hour. The average (full time) work year is 1,866 hours. The personal allowance is £12,570. Gross annual income is £19,443. Minus the allowance, that’s £6,873. Which is then taxed at 12% NI and 20% income tax. £2,200 a year.

The working poor, those making only that legislated minimum wage, should be taxed £2,200 a year on their incomes? No, monstrous.

So, we’re going to have to do it all over again, aren’t we? The personal allowance for income tax and NI must be the full year, full time, minimum wage. And that needs to be set into stone as policy. Change one change the other, no ifs or buts or this is just a temporary measure for hard times.

Of course, this will produce a revenue problem. Some 30 million working in the UK, if all of them pay £2,000 a year less in tax then that’s £60 billion in revenue foregone. Which is, given the (2021/2) total spend of some £1,180 billion, about 5%.

But we’d remind of O’Rourke’s Principle of Circumcision. You can take 10% off the top of absolutely anything.

People shouldn’t be paying income tax on the minimum wage. So we’re going to have to do this all over again, aren’t we? Gird the loins and once more into the breach - lower taxes for poor people!

Now they're just being ridiculous

It’s becoming just one of those statements:

That free-market capitalism is almost certainly not environmentally sustainable, as well, is a realisation that many rightwingers, including Sunak, are avoiding for as long as they can.

We know that many simply don’t like free market capitalism and wish to see it end. But this idea that it should go because it’s inefficient is simply ludicrous. One obvious reason for that statement is that it is based upon the economic analysis of George Monbiot. Hmm, yes, well…..

There’s nothing at all in either capitalism or free markets that insists upon economic growth. They’re both good ways of getting it, certainly, but the growth is not a necessary precondition for either of the systems or their blend.

However, what each are separately and both are together is efficient. Efficient in the use of resources to gain a certain output that is. For the obvious reasons that inputs are a cost to capitalists therefore capitalists economise upon inputs. This is not complex logic.

We’ve also tested this in that grand experiment we call the 20th century. The capitalist and free market (agreed, many to greater and lesser degrees capitalist and free market) economies gained total factor productivity in a way the planned and socialist economies did not. Paul Krugman’s on record musing that perhaps the Soviet Union managed no increase in economic efficiency at all in 70 years. All growth came from greater resource use, none from better resource use.

We’ve also another test of this in the emissions scenarios that underpin climate change worries. The capitalist and market (ie, A1) outcomes are considerably better than the non-market ones (ie, B2). Yes, in everything.

Economic efficiency means lower resource use for any given standard of living - equally, a higher standard of living for any given resource use. That’s just definitional. Given that free market capitalism is more efficient with resource use than other economic systems therefore - for any given standard of living - free market capitalism is the most environmentally friendly.

But here we’ve got the intelligentsia speaking unto the nation and claiming entirely the opposite.

Of course, some of this is simply delusion and that’s not a rarity on newspaper opinion pages. But we do have a distinct impression that for at least some this is driven not by matters environmental but by that desire to do down free market capitalism. We can definitely think of a few who, if convinced that free markets and capitalism were environmentally optimal, would prefer to damn the environment rather than support liberal economics.

Well, there's your problem then

News from the US:

The world’s biggest offshore wind developer has taken a £4.6 billion hit after scrapping two projects in the United States in a significant setback for America’s renewable energy industry.

The decision led to billions of pounds being wiped off the market value of Orsted, the Danish energy group that also operates much of the North Sea’s wind industry.

It blamed rising costs…

Wind power is grossly more expensive than everyone thought it was and was planning for. As a result, obviously, we both should and will have less wind power.

From the London Stock Market:

Shell has announced a bigger-than-expected $3.5 billion share buyback even as the oil and gas giant’s quarterly profits fell by a third to $6.2 billion on lower prices.

The FTSE 100 energy group’s adjusted earnings were down from the $9.5 billion it made in the same period last year but were in line with analysts’ expectations.

Fossil fuels are vastly profitable and wildly value additive. Therefore we should have more of them.

Except, of course, those pesky externalities of climate change. If only someone had written a report - 1200 pages would be a nice length - explaining how to deal with this dichotomy. Or had been granted the Nobel for explaining it. Or even explained the basic mechanism well over a century back.

Work out what the cost of the externality is - roughly is good enough - and stick that on the whatever it is that causes it. Then it’s included in all the prices everyone uses to make a decision. We then get not just less of the externality but the right amount of it. For only those things that still add value despite that cost still get done, those that don’t, don’t.

Or, given that people did do all of those things if only we had a polity that would enact that solution - or, given the current polity, was capable of understanding it.

The answer to climate change is the carbon tax.

One result of having had it would be that a Danish company wouldn’t lose £4.6 billion trying to build something clearly and obviously economically unviable in the US. For given that all of the costs of the varied technologies would already be in the decision making prices the economic unviability would have been obvious on the first Excel spreadsheet. And so remain in that model rather than become the £4.6 billion reduction in aggregate human wealth it just has become.

The carbon tax is not, in fact, a tax. It’s a decision making guide so that we don’t do blubberingly stupid things. Given what people have been doing about climate change we therefore recommend it as a policy. For we really do think that climate change would be better addressed by not doing blubberingly stupid things.

Maybe that’s just us, but, well, you know…..maybe?

White hydrogen may or may not be a solution

The Daily Telegraph tells us that white hydrogen (geologic H2, that may be archaic or other theories suggest constantly generated) may or may not be the solution to some or all of our climate change woes.

Estimates of the flow of hydrogen from these process are imprecise, varying from very little to all of the current global annual consumption of hydrogen. In addition there might be potentially vast quantities of primordial hydrogen. And the great thing about all this white hydrogen is that we do not need to use large quantities of electricity or fossil fuel to produce it: this is not an energy store like all the other colours of hydrogen, it is a dispatchable primary energy source like nuclear or fossil fuels.

They’re right too - too much is unknown to be able to decide on whether this is some mildly interesting but marginal issue or of some great import.

The bit that amuses us is the sheer serendipity of this other announcement made on the same day:

Significant concentrations of hydrogen and helium have been encountered in sections of the Ramsay 1 well, confirming historic measurement and demonstrating an active hydrogen system in the Ramsay Project area. Testing and laboratory results measured air-corrected hydrogen at 73.3% at 240m below ground level, consistent with the 76% air-corrected concentration of hydrogen reported in the Ramsay Oil Bore 1 in 1931.

This is not investment advice about Gold Hydrogen and it’s most certainly not a recommendation. We just do think that it’s fun.

From that fun we also derive two little lessons. The first is something about mineral resources in general. There never has been a proper survey of the planet and what it holds. The only statistics we’ve got (all those mineral reserves, resources) are listings of what currently active companies claim to have marked out as economic to recover deposits. Anyone claiming that mineral reserves (or that wider definition, resources) is “what we’ve got” is wholly and entirely wrong. Systematically wrong in that they don’t know what they’re talking about, have failed to grasp the basic definition. For example, this find of H2 in Oz - we know it’s there, from that announcement. But it’s not a mineral resource even yet, let alone a reserve. This is also true of all the other places we’ve not gone looking as yet.

The second is that we need some way of working out which of all these possibilities is going to be important and which aren’t. The answer is not to use planning. For obviously planners didn’t know about this white hydrogen find. Nor, really, does anyone’s current plans include any white hydrogen at all. So, what we need is a system that continuously alters course given the new information that flows into it.

You know, markets? Not government plans written into the Climate Change Act 2008 and “legally enforceable” as a result. But prices, markets, the efficient manner of incorporating new knowledge into the body politic. That’s the one way we’ve got of trying everything and so seeing what works.

Sure, perfectly happy to help markets along by incorporating externalities into prices - we’ve been arguing for that for two decades now. We’ve also no complaint at all about the idea of dealing with climate change. It’s the process we use to do this - markets adjusted for externalities rather than the plans of whichever babykisser last got elected - which we insist upon.

Yesterday we didn’t know that white hydrogen existed in Australia. Today we do - great, so, how do we incorporate that into our plans? By not having societal plans other than using prices to inform activity…..

Are we being cynical enough?

It’s possible that TikTok is terrible. As with Twitter, Facebook, MySpace and Bebo (yes, it exists again). They are all just ways for humans to communicate and humans in groups can be pretty terrible at times.

But it’s always useful to think a little cynically. After all, the correct question for all adults, when viewing the world around them, is “Am I being cynical enough?”

At which point:

This trend is fuelling concerns that content on apps such as TikTok could drive anti-Semitism and radicalise young users, particularly as conflict in the Middle East drags on.

Some experts believe this could mean countries rue the decision not to shut out TikTok once and for all.

Sam Lessin, a former Facebook executive, says “far too many smart people” ignored the issue of misinformation on TikTok: “And now, a few years later, we are paying for this major misstep.”

TikTok competes with Facebook - or with one or other of their versions like Instagram or something, we can’t recall which. At which point a gentleman with at least an emotional investment in Facebook tells us that TikTok is the very devil which we should have banned.

Oh, right.

Or is that too cynical?

Now that is something that any sentient being can spot, what is being done there. But it’s necessary to go that one step further. As soon as we have a system of governance which takes upon itself the power to ban this or that player in any market then the attentions of every other player will be laser focussed on influencing that government power. As such lobbying (to use a polite word, rapine of the body politic we’d prefer to call it) is by definition zero sum then the activity is societally impoverishing. Effort expended which produces nothing nett just is such, again by definition.

In economic terms at least the problem with such government powers is simply that the effort to influence said powers reduces the common wealth. This is true either of subsidy of certain selected or of the banning of certain selected businesses. The effort that goes into capturing that government influence is a gross loss to us all.

So, don’t have a government with such powers and we shall all be richer. We might even get to the stage where it would be possible to believe the surface message in a news report, that would be nice, wouldn’t it?

Santa Claus takes over our Energy Supplies

“The biggest piece of energy legislation in the UK’s history has become law today… laying the foundations for an energy system fit for the future.” That will surprise anyone involved in the gas and electricity privatisations between 1986 and 1990. The truth of the matter is that the government will now be messing about with our energy supplies more now than they were before, increasing regulation and reversing the tide of privatisation. The six claimed benefits are:

The introduction of new business models for Carbon Capture and Hydrogen (CCH), which would create 50,000 jobs in Carbon Capture and 12,000 in Hydrogen.

We would become world-leaders in nuclear fusion regulation.

Energy network competition would be enabled through the introduction of competition to onshore electricity networks. This is predicted to save consumers up to £1 billion off their energy bills by 2050.

The expansion of heat networks through Ofgem, creating better pricing for consumers and businesses.

Better regulation of energy smart appliances.

The extension of smart metre rollout to 2028, saving consumers £5.6 billion.

There is no doubt that fossil fuel electricity will still be needed for a considerable period- in essence because the wind does not always blow nor sun shine. Current policy expectations for Net Zero means CCS (Carbon Capture and Storage) must be upscaled and extended until fossil fuels are mitigated by a sufficient baseload of alternatives. The fossil fuel providers should be expected to take care of this problem with its costs, and supply, in effect, green electricity to the national networks.

What is puzzling, and, frankly, nonsense is the idea that the Department for Energy Security and Net Zero (DESNZ) has to discover how that should be done and show helpless private companies how to do it. Of course, the fossil fuel generators are happy enough for DESNZ, and therefore the taxpayer, to take charge and pick up the tab.

Hydrogen is a more subtle issue. Contrary to popular belief it will not be efficient for heating homes (ever) or blending with natural gas for electricity generation (sometimes) except when it is virtually free because wind farms and / or solar are producing more than consumer / business demand needs. It also has uses for heavy goods vehicles but, because hydrogen’s storage space to power ratio is poor, not for aircraft- except the smallest. In short, the DESNZ claims for hydrogen are wildly exaggerated.

And so are its claims for fusion. Nuclear fusion, as distinct from fission, was discovered in 1922 and its use for commercial electricity generation has been receding ever since. There is no harm in government investing in scientific research, but the May 2022 Science Select Committee agreed there would be no commercial use by 2050. It might be commercialised in the next century, so why is it in the Act now?

DESNZ is correct in outlining that previous attempts towards energy market privatisation were only skin-deep. As energy analyst Ronan Bolton outlines: “The eventual market model and regulatory framework introduced in 1990 was a compromise. This was dictated by concerns about the risks that competition would pose to the coal and nuclear industries, along with concerns about the share price of the privatised companies if they were exposed to too strong a competitive threat.”

Yes, consumers had a choice of retailers but Ofgem and the National Grid, which bought the electricity and resold it to retailers at standard (wholesale) price, pretty much continued what the Central Electricity Generating Board had long done. Where DESNZ is wholly incorrect, is in moving the electricity market back to central control and regulation, rather than towards the full competition it claims.

The ways of achieving that include those suggested to the 2023 Energy Select Committee. One of them recommended that genuine competition nationwide (including Scotland) be introduced by distribution system operators (upgraded from today’s local “retailers”) whilst Ofgem and the National Grid retreated to simply balancing the books. In other words, DESNZ, having correctly identified the problem, recommends precisely the opposite of what is needed.

Domestic energy is about 40% of energy consumption and home heating (neighbourhood hot water – popular in Iceland) is 2% of that. 0.8% is not a large enough part of the UK’s energy problem to justify 17% of DESNZ targeting, though it clearly has room to grow, notably from local small modular reactors. In the five years to 2022, the number of people in government interested in home heating has doubled which may explain its appearance in the Act.

Finally, the Act addresses smart metres. In 2019, it became clear that only half of domestic energy metres were “smart” and the target to make 100% smart should be shifted from 2020 to 2024. By the end of March 2021, things were not going much better: a 1% drop since the previous quarter and 44% overall. Smart metres were turning dumb, installation costs were rising and being passed on to consumers. The 100% target date is now 2028. Thus claimed £5.6 billion saving per annum does not follow reasonable assumptions.

The Energy Act does, and does not, apply to Scotland and Northern Ireland which have their own legislation. The extent to which devolution applies is unfathomable. English and Welsh (presumably) consumers and businesses may save up to £16.6 billion but, as DESNZ has provided neither arithmetic nor rationales, their figures have the credibility of jingle bills. Absolutely no attention seems to have been given to dividing issues between what the free market can, and should, do for itself and where it is only the government that can bring some necessary public benefit.

Instead, the Energy Secretary, a.k.a. Santa Claus, claimed: “The Act also supports our new approach to make sure that families don’t feel a disproportionate financial burden as we transition to net zero, and forms a central part of our efforts to keep people’s bills affordable in the long-term.” In fact, as can be seen above, it does nothing for those objectives at all. And where are Chris Skidmore’s recommendations?

Why not waste another £400 million on AI then?

Image Credit: https://claudeai.uk/

It’s entirely true that we have government because sometimes it is useful that we have government. There are things that can only be done collectively and with that element of compulsion that government power provides.

We are not, after all, anarcho-capitalists.

It is also true that there are things that government can do which we do not wish government to do. Like do those things that can - and will be - done better, faster, bigger, by other mechanisms than government. At which point let’s save the oppressed taxpayers of the nation £400 million, shall we?

Rishi Sunak is poised to increase taxpayer spending on artificial intelligence chips and supercomputers to £400m as he strives to boost Britain’s technology credentials.

The Government is quadrupling a planned investment package to secure equipment for a national “AI Research Resource”, The Telegraph understands, which will also be used to launch a new facility in Cambridge and improve a site in Bristol.

The increased investment comes as the Prime Minister seeks to present Britain as a global hub for AI safety to world leaders at a summit at Bletchley Park on Wednesday and Thursday.

This is not investment this is wasting money.

From another source:

Google, Amazon, and Microsoft funnel billions into rival AI companies. There is just so much money flying in this colossal AI arms race.

• Microsoft has poured as much as $13 billion into OpenAI.

• Amazon recently reported a potentially $4 billion investment in the Google-backed Anthropic.

• Now The Wall Street Journal reports that Google will slide Anthropic a cool $2 billion over time on top of its previous investments in the company.

The government money - our money, that lifted from our wallets - will arrive in two to three years’ time, be miniscule in market size, shrunk by the inevitable multi-layers of bureaucracy and, in all probability, be spent upon the wrong things. Late, trivial and worthless.

There is indeed an argument - Professor Mazzucato does at least start from a logically firm position - that government should spend on useful things that market participants do not. Those public goods which are undersupplied by private economic actors. If we’ve $21 billion in just this week’s news story about AI then adding £400 million of our capital just isn’t relevant now, is it? It’s just an imposition on our wallets.

But more than this. AI is an investment frenzy right now. It’s possible to float a company - we really do see this all the time - where the addition of the word “AI” to the prospectus gains access to market capital. The AI company of great profit but no one to know what it is would raise money right now. Actually, someone’s already done that and raised $600 million.

Let’s not use government to do what the market is already doing bigger, better and faster. Horses for courses and all that, reserve governmental powers of compulsion and inefficiency for when there’s no other viable option.

Truly lousy analysis of profits in children's homes

Another year and another repeat:

The biggest private providers of children’s homes in England made profits of more than £300m last year, as concern mounts over the conditions some children are being placed in and the spiralling costs for councils.

Gosh, what horrors, the capitalists are making out like bandits. And now to make the same criticism the last time they told us this. This is not just to pick nits, this is a lousy analysis, entirely scabrous even.

For the report manages the remarkable feat of detailing the vast profits being made and also worries about the financial condition of the companies, whether they make enough to keep going as a valid concern. Which is, we admit, really a very wild piece of contortionism.

As we’ve said before:

It’s a report from Revolution Consulting which looks at the operating profits, not net profits, of the care home providers. That is, it looks at the excess of revenue over cost before accounting for mortgages, interest upon them, depreciation or maintenance of buildings and so on. You know, things that are a considerable portion of costs concerning anything with the word “home” in it. By using Ebitda as the measure it, in effect, looks only at the current account, not the capital. Which is, as a measure of profitability, absurd.

As this year’s version of the report says:

Some financial analyses go further in also looking to eliminate rental costs of property, but this study has not taken that further step. Several providers report sizeable operating lease costs, often in relation to rental of property used by the provider. These costs raise the possibility that and profit or loss on renting property to the operating business is not included in the reporting we have accessed.

They’re not including property costs.

Or even, they’re not including the costs of buying property via debt (ie, a mortgage or the like) when estimating profitability but are looking at debt levels when measuring going concern basis. Which is, as we say, a contortion too far.

The aims here are, obviously enough, to a) complain about the capitalists and b) insist that the bureaucracy should have more power over the sector. Which is why such effort has to be made to scratch that itch.

But then this is how government is done these days, isn’t it? A rickety construction of figures in order to sway opinion and logic and reality be damned.

There are things we’d like to know about the private, capitalist provision of children’s homes. Is this method better, cheaper or more responsive than council provision of the same thing? If it is then we should use it, if it isn’t then we should not. But note what this current reports says about such matters - nothing. It’s performative number crunching intended to persuade, nothing else.

But as we say, that’s how government is done these days.

But why wouldn't we cut the cost of bananas?

A very strange insistence here:

UK accused of plan to further cut cost of bananas at expense of poorest African producers

UK refusing to commit to EU pledge to stop cutting tariffs on big producers despite bananas being as cheap today as three decades ago

Are we sending gunboats to take the bananas cheaply or something? Not that we have any gunboats and we’d not do so if we did. But what’s the complaint here?

The government has now been accused of pursuing an irresponsible post-Brexit policy that could reduce the price of bananas further in the shops – but at the cost of the livelihoods of thousands of workers on small plantations in some of Africa’s poorest countries.

The British market is already dominated by the so-called “dollar banana” producers of Latin America who are able to sell cheaply having benefited from rolled-over EU-negotiated free trade deals that have cut the import taxes, or tariffs, on the fruit.

The EU, however, promised in 2019 not to cut tariffs imposed on the big producers any further in recognition of the impact on the smaller African competitors. The UK’s exit has freed it from that pledge to the world’s poorest.

According to Afruibana, the Pan-African association of banana producers and exporters, all the indications are that the result will be betrayal, with the UK government ditching the EU promise to protect them.

So, we have tariffs against banana imports. Presumably preferential ones too. Such tariffs make bananas more expensive in Britain - that’s what tariffs do. That’s what tariffs are, they’re a tax upon consumers. Logic would suggest that a British government, with the interests of Britons at heart, would not have a tax upon bananas. So, cutting those tariffs seems like an excellent idea. Britons will be better off.

The complaint then is that those African producers will be worse off. To which one response is and? Whose government is this after all?

Another, and a more subtle one, is that if people in Africa are growing high cost bananas then they’re trapped in a low value occupation. What is actually desired is that they move into a high value occupation. Maybe growing date palms, or oil palm, or maize. Or possibly flooding into the factories which is what made this country rich. Or, well, something, anything, else than adding very little value by growing high cost and thus low value added bananas.

But the insistence here is that by deliberately fiddling the terms of trade we should continue to trap those Africans in their poverty. Keep them on those high cost banana plantations where they earn little - because the value add is low.

So, actually, the policy being demanded here is that we trap Africans in poverty by making bananas more expensive for Britons. We tend to think that fails on both counts.

It’s also possible to be very much more basic about this. Don’t have a trade policy, don’t have tariffs. Simply leave free trade be in its totality. If we then also want to help poor Black Africans then let us then go and help poor Black Africans.

And finally, who really benefits from the preferential tariffs? Well, it’s the capitalists in Africa who own the banana plantations, isn’t it? And why do we want to benefit them at the cost of cheap fruit (yes, we know, it’s an herb) for Britons?

DESNZ Con-fusion

The Department for Energy Security and Net Zero (DESNZ) is enthusiastic about wasting taxpayers’ money. It allowed, and arguably caused, consumer energy prices to fly out of control by tying the wholesale price of windfarm electricity to Russian gas with which it should have had no connection. It failed to supervise the National Grid infrastructure so we may have blackouts this winter. So much for “security”. No decision has been made on any nuclear electricity generator since Hinkley Point C nine years ago which is now running three years late (operational 2026 maybe) and 50% over budget (so far). Not being in the business of learning from experience, DESNZ is keen to build its twin at Sizewell.

Britain needs over 20 times The Sizewell capacity that if it is to reach net zero by 2050 and its costs will be about 5 times higher than the small modular reactors (SMRs) now available.

If that catalogue of failure is not bad enough, DESNZ is hastening slowly down the SMR path, whereas it is now about to spend £650M on fusion reactors. That was announced a year after telling us that there was no guarantee fusion would work – not on a commercial scale that is. Con-Fusion will cost taxpayers £650M, two thirds the cost of one of the SMRs we badly need.

“Nuclear fusion was ‘discovered’ in the 1920s and the subsequent years of research focused on developing fusion for nuclear weapons. In 1958, when the United States’s war research on fusion was declassified, it sent Russia, UK, Europe, Japan and the US on a race to develop fusion reactions for energy provision.”

One of the questions is the availability of fuel. On 16th October 2023, DESNZ said “Fuel abundance: the fuels used in fusion reactions are effectively inexhaustible. Deuterium is readily extracted from seawater, and tritium is produced using lithium.” Just over a year earlier, Science magazine claimed “A shortage of tritium fuel may leave fusion energy with an empty tank.”

No one thinks fusion can make any contribution to net zero 2050. When Graham Springer MP asked, at the May 2023 Science and Technology Select Committee, “would it not make sense to put some of the money going towards fusion into more small modular nuclear reactors?” Dame Sue Ion agreed 3 or 4 SMRs should come first (they aren’t) and argued fusion was a relatively small amount for the basic science by comparison. That is what fusion enthusiasts have been saying for 100 years.

The truth of the matter is that they want to keep up with their opposite numbers in other countries which is the exact opposite of DESNZ policy on SMRs. Con-Fusion?