What are the Weil's Disease numbers for Scotland, Wales and Northern Ireland?

Apparently there’s something wrong with the water system:

Polluted water is causing 60 per cent more hospital admissions than a decade ago, official figures show.

The number of people admitted to hospital for water-borne diseases – including dysentery and Weil’s disease – has increased from 2,085 people in 2010-11 to 3,286 in 2022-23, according to NHS statistics.

OK. Weil’s Disease has been rising in incidence for well over a decade, from 2018:

A deadly infection spread by rats has reached record levels in the number of hospital appointments taken up by people suffering from the illness.

Hospital sessions for people suffering from Weil's disease, which is spread by rats' urine, are three times the level three years ago and are now at unprecedented levels.

We’d like to know why of course. Perhaps more rats, perhaps different rats, perhaps councils aren’t controlling rats. And we are also told that dysentery cases are up - perhaps it’s just more people going to waters where Weil’s and dysentery can be caught?

We’d clearly like to know why this is happening - so we can decide what, if anything, we’re going to do about it.

From the Labour Party:

Labour pledged it would put failing water companies in special measures to force them to “clean up their toxic mess and protect people’s health”.

Ofwat, the regulator, would get powers to block the payment of any bonuses until water bosses had cleaned up the pollution, while water company bosses who oversaw repeated law-breaking would face criminal charges.

Clearly the blame is being placed upon the capitalist nature of the English water companies. For, as The Guardian of all places points out:

Waterborne diseases such as dysentery and Weil’s disease have risen by 60% since 2010 in England, new figures reveal.

OK.

We’d still like to find out what is causing this problem in England. And it’s true that England has capitalist water companies in a manner that the other Home Nations do not - Wales, Scotland and NI have variants of state owned water companies performing the job. The other home nations also have NHS organisations that are separate and thus their own statistics on this matter.

Which does mean that we can test the proposition. It’s possible that there is some, or some set of factors, increasing dysentery and Weil’s in these isles. Hand washing to more rats to greater water sports patrticipation to the capitalist nature of water provision. We’ve also the statistics to be able to at least begin to make the distinction. Compare the rise in infections across the Home Nations’ versions of the NHS to the ownership of the water companies across the Home Nations.

What has actually been done? Noting the rise in incidence in the one country, England, then blaming it upon the one difference in England, that ownership. Without, ever nor at all, actually testing the proposition. Which is, if we are to be very polite about it indeed, not a proof of anything at all other than the ability to project prejudice.

So, why do people urinate in the public information pool in this manner? Because it’s politically convenient to do so. Which is why politics is such a bad way of running anything - decisions are always based upon biased and piss poor information.

Yeah, but no, but yeah, but....

We have no inside knowledge about this claim at all. We do have more general knowledge about the idea of the claim.

Wind farm owners are being investigated by the energy watchdog for alleged market manipulation after they were accused of overcharging consumers by £100m.

Ofgem is to examine claims that renewable energy companies artificially inflated compensation payments given to them for switching off their turbines on windy days when the grid did not need extra capacity.

It has been handed a dossier gathered by analysts at the Renewable Energy Foundation (REF), which suggests wind farm companies could be boosting the price of “virtual energy” they never actually generated.

Nope, no idea as to the truth of that. But yeah, the idea that such a thing might happen?

It’s inevitable in any complex system.

Any Heath Robinson (Rube Goldberg to Americans) scheme to do anything will be gamed. Simply because that’s what humans do - look at the rules, consider the possibilities then do whatever appears to them to be beneficial to their enlightened self-interest. Man wrote a book explaining this 248 years ago, time enough for the idea to sink in.

The answer to which is to not have complex schemes. True, there really are things that need to be done. Say, internalising externalities. Therefore don’t have a complex scheme to achieve that, have a simple scheme to achieve that.

Another way to put this is that bureaucrats designing rules about other peoples’ money are not going to be as eagle-eyed on the gaps in the rules as those playing against the bureaucrats to the benefit of their own wallets. Or, again, rules will be gamed.

KISS is not just an acronym you know, it’s a rule.

Why detailed macroeconomic management doesn't work

This applies both to that archaic idea of precise Keynesian demand management and also the more recent Modern Monetary Theory. They don’t work because:

Official figures have confirmed the UK economy went into recession at the end of last year, after the latest estimate found it had contracted in the last two quarters of 2023.

In a blow to the government’s economic standing, the Office for National Statistics (ONS) said the economy, measured by gross domestic product (GDP) shrank by 0.3% in the last three months of the year, unrevised from an earlier estimate.

That archaic Keynesianism would suggest that back this time last year - about - the government should have increased the deficit. Spent more - easy enough - or reduced taxation - Hah! - in order to use fiscal policy to boost the economy. MMT has a slightly different prescription, keep printing money until the economy runs hot then tax back the excess money creation causing any inflation.

We’ve now the reliable figures giving us the policy we should have followed a year after whatever it is we should have done. That means that the GDP figures cannot be used as a guide to policy, obviously - we’ve not a time machine to go back and change policy now that we know, do we?

Hayek wins again that is. We simply do not gather information in time and in detail sufficient to be able to manage the economy in any detail.

Yes, obviously, 10% changes in GDP - in either direction - mean action should be taken and we’d have other guides to that happening other than these GDP figures too. But given that Hayek does win again we’ve simply not the information flow to be able to follow that dream of that detailed macroeconomic management.

This leaves us with getting the microeconomics right - incentives and so on - and then seeing what happens. Which is, as we’ve long said, about the only form of economic planning we can do that actually works.

If people lose their jobs to AI they'll do.....something else

A certain error of logic here. We’re being told that we’ll not get richer from AI because AI will destroy jobs. But that’s the wrong way around. We’ll get richer from AI according to how many jobs AI destroys - the more destroyed the richer we shall collectively be.

The aim and purpose of all technological advance is to destroy jobs, after all.

Almost 8 million UK jobs could be lost to artificial intelligence in a “jobs apocalypse”, according to a report warning that women, younger workers and those on lower wages are at most risk from automation.

How excellent is the correct reaction.

In the worst-case scenario for the second wave of AI, 7.9m jobs could be displaced, the report said, with any gains for the economy from productivity improvements cancelled out with zero growth in GDP within three to five years.

They’re just not getting it in the slightest. Sure, we agree, transitions can be difficult. But the end state of AI destroying 7.9 million jobs will be that we’re all richer by 7.9 million jobs.

A very basic observation about humans is that desires are unlimited. So, if we have more human labour available to tackle more human desires then that’s good - more human desires can be sated by that more human labour.

This is how we got the NHS, universities, ballet and professional sports after all. Back three centuries 90% of us had to spend all of life standing around in muddy fields growing the crops that kept 100% of the population alive. Then someone invented the tractor (as a shorthand for the mechanisation of farming) and we ended up needing only 2% of the population on the land. 88% were then free to go work in the NHS, universities, ballet and professional sports. We are now richer - because of the tractor - by whatever value we put upon the NHS, universities, ballet and professional sports.

We can say the same thing about the Spinning Jenny - the great wealth was that abolition of hundreds and hundreds of hours a year per person of entirely female labour in handspinning - and the washing machine (again, a shorthand for the mechanisation of much domestic labour). Formerly exclusively female and household labour disappeared into the maw of the machines leading to the economic emancipation of women - a very grand increase in human wealth.

AI destroys jobs that are currently done by human labour. That frees up human labour to do other things, sate other human desires for things that can be solved by human labour. Who knows, we might eventually be able to get the NHS to work properly, universities to educate and British sports teams that win something now and again. Ballet, well….

Of course, it’s possible to postulate that human desires are not unlimited. In which case there are no more things to be done with excess human labour - therefore leisure will rise. Given the number of people telling us that working hours should fall - all that 4 day week stuff - this is also an increase in human wealth. On the useful grounds that an increase in leisure with a maintained consumption level is an increase in human wealth.

There is no possible outcome of all that work disappearing into the machines that makes humans worse off. No, really. As Bill Nordhaus has shown. Imagine that all the money from the AI goes to capital, that the tech bros gain all the gains. We end up with:

If capital productivity is rapidly rising (which is the same statement as the robots are eating all our jobs) then yes, it's true, the plutocrats who own the machines end up getting (or, more accurately, asymptotically approach getting) 100% of the output of the economy. But at the same time, and because of this process, wages go up in real terms at 200% a year.

Transitions, ah, yes, transitions. But the end state simply cannot be a bad one. So, let’s do it, right?

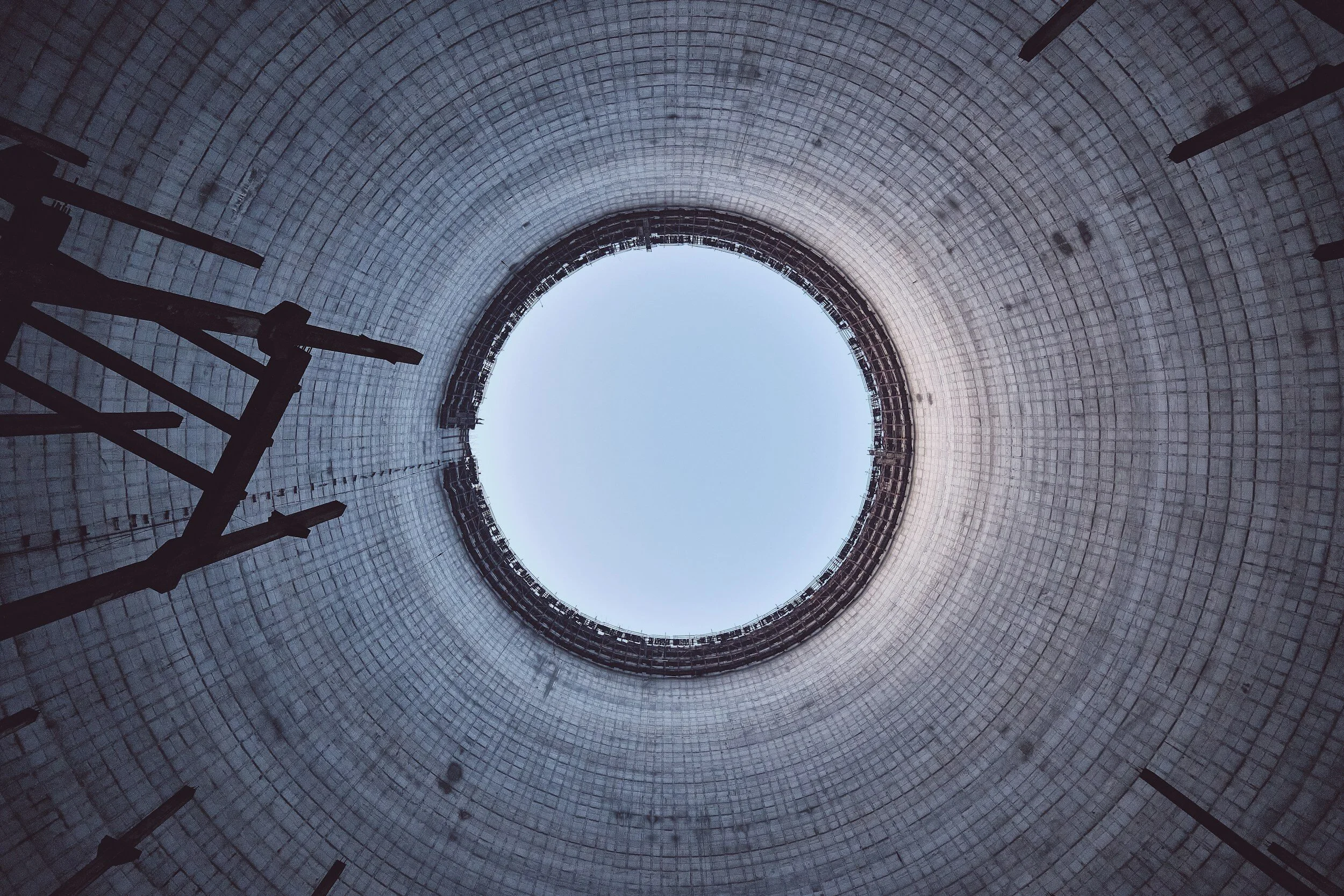

Generic Design Assessments

The UK nuclear strategy today is a muddle. After a brief description, this blog suggests what it should be.

The Government claims that it ensures “that any new nuclear power station built in Great Britain meets high standards for:

safety

security

environmental protection

waste management”

The process is called the Generic Design Assessment (GDA) which is claimed to take four years, though insiders say the average is nearer six. But that is less than half the time taken to approve the National Grid Electricity System Operator (ESO) plans to connect up to 86 gigawatts (GW) of offshore wind by 2035. If one is building just one nuclear power plant every 20 years, these bureaucratic delays may not matter much, but the new small modular reactor (SMR) technology means, if we are to achieve net zero by 2050, building five a year over the next 20 years. No chance of that unless the bureaucrats mend their ways.

The three stages of the GDA are: “Step 1 (initiation) which can take around 12 months. At its conclusion, ONR will publish a GDA Step 1 Statement setting out its regulatory position at this point. Step 2 (fundamental assessment) can take around 12 months, after which a GDA Step 2 Statement sets out ONR’s regulatory position at this point. Step 3 (detailed assessment) can take around 24 months. ONR will then publish one or both GDA Step 3 Statement and Decision Document.”

If a developer requires a GDA for the building of an SMR at one site only in the UK then the process can be halted after the successful conclusion of Step 2 followed by a Site Licence application. If the deployment of a particular SMR design is envisaged for multiple sites in the UK then Step 3 needs to be successfully concluded.

Although the four issues are supposed to be considered as an integrated whole, they can really be considered as two: safety determined by the Office for Nuclear Regulation and site approval determined by the Environment Agency. Good progress was made on the former issue by the nuclear regulators in the US, Canada and UK agreeing that safety clearance in any one of the three would be regarded as approval by all three.

The two-way (and hopefully now three-way) transatlantic agreement to harmonise the licensing process has thus far only tackled the administrative landscape work that occupies much of the first 2 years. There are few safety aspects to Stage 1 which could be reduced to 4 months in all 3 countries if a standardised and transportable approach is agreed. Note that activities covered by the various steps and/or stages of the UK, US and Canadian systems do not match precisely at this stage, and some harmonisation is still required.

Stage 3 is where the actual design is critically scrutinised and an iterative dialogue with design teams is established. This work can take around 12-18 months depending upon the lineage and degree of novelty in the reactor design. If the applicant has a well-resourced design team that can respond quickly to regulator questions and design modifications, it can proceed quickly. In the case of the AP1000, there were still almost 1,000 issues raised by the ONR that remained (and still remain) unresolved. This is where delays can become significant and where developers may be to blame. Trying to design and license a new reactor on a shoestring budget can result in developers complaining to their shareholders that the regulator is being unreasonable. Institutional shareholders then lobby politicians to influence regulators to be more accommodating of the newcomers.

Terrapower has realised the importance of having an FOAK (First Of A Kind) site under development and adequate financial resources to quickly design, build and commission their first reactor. They are now putting pressure on the US NRC to bring the same urgency to their licensing application.

There is one other point worth noting. The history of nuclear safety thus far, together with the accidents that have happened, have largely surrounded the use of water/steam as a coolant and transporter of heat energy from the reactor to where it is converted into mechanical and electrical energy. But when it comes to HTGRs and MSRs there is no high temperature and pressurised water in or around the reactor. These advanced SMRs have much simpler and safer systems and this needs to be reflected in their design processing time.

How should it work? We need to distinguish, as the current system does not, between the traditional gigawatt reactors such as proposed for Sizewell C and small or advanced modular reactors (SMRs) which are rapidly coming onto the market. But more importantly we need to distinguish between an FOAK reactor that has never been licensed before and an NOAK (Nth Of A Kind) reactor for which design approval has already been awarded in either the US or Canada, or indeed another country that meets the UK’s exacting standards for nuclear licensing. With more than 20 SMR designs likely to make it to the licensing and construction stages in the next decade, the US, Canada and the UK can ill-afford to repeat the administrative and technical procedures given the time, staffing and financial constraints that each regulator is experiencing or is likely to experience once these designs are submitted. The US and Canadian regulators are already facing political pressure to speed up SMR design assessments and to be proportional given the size of these reactors when compared to giga scale reactors. The UK is limiting SMRs to a small number deemed most useful for the UK situation. However, adopting this line risks excluding exciting new technologies and applications from both the UK nuclear industry and the nation’s effort to decarbonise industry and power generation.

Of the possible new nuclear plants going through the mill in 2010, it was deemed necessary for their sile locations to be approved by 51 separate quangos. It was all a complete waste of time as in March 2011, Energy Secretary Huhne says Britain may back away from the use of nuclear energy because of safety fears and a potential rise in costs after the Fukushima disaster. No new nuclear plants were approved after Sizewell B and Hinkley Point B in 1967. In other words, the process had become disapproval, not approval.

Future strategy: NOAK for Nuclear

The UK would be much better off if we abandoned trying to be first of a kind (FOAK) but aimed for Nth (NOAK). The advantages would be:

The GDA process could be immensely streamlined as the environmental issues could mostly be taken from predecessor countries and, if Canada and/or the US had already given approval, the safety aspects could be eliminated altogether. Instead of starting from scratch, new GDAs should only have to look at environmental issues that differ from GDAs already approved. For example, if the radioactive elements of SMRs were sited underground, approval of one should automatically apply to another similarly sited.

Hinkley Point C is a glaring example of the risks and costs of trying to be first. The French utility EDF, which is developing Hinkley Point C, has reported a cost increase to £33 billion (30% higher than initial estimates) and potential delays in its start date.

Construction and operating skills would have been developed elsewhere first. A Science Direct paper took NOAK build time to be 6 years versus 10 for FOAK.

The market would have had time to grow, be competitive and both capital and running costs reduce.

From these comparisons, we should conclude that both for large Giga Watt reactors and SMRs, the UK should abandon its enthusiasm for being the world leader. NOAK is quicker, cheaper and more reliable. Nuclear skills can be the better learned from other countries as well as developing our own. The car industry has proved not just to be a UK success story, but a NOAK success story too. Nuclear should learn from that.

That targetted planning with strict conditionality

As we all know there’s a move to demand a new industrial policy. Government - those Rolls Royce minds - should determine what is done in our economy, by whom, how, and thereby gain such glorious results to the benefit of the nation.

Hmm, well, it’s an idea. Is there, though, some method by which we can test this? Before we gain that benefit to the nation or not? As it happens, yes. For the use of land has been nationalised since 1947. That’s when the Town and Country Planning Act did exactly that - centralised and nationalised who may use which piece of land for what to gain such glorious results to the benefit of the nation.

The Resolution Foundation has just told us how that has worked out over the 75 odd years:

If all households in the UK were fully exposed to our housing market, they would have to devote 22 per cent of their spending to housing services, far higher than the OECD average (17 per cent), and the highest level across the developed economies with the solitary exception of Finland.

We pay more than everyone else (except those Finns).

In 2018, for example, the floorspace per person in England was 38m2, compared to 43m2 in France (in 2020) and 46m2 in Germany (in 2017). We have been overtaken by Japan, at 40m2, and have less space per person than households in Taiwan, at 49m2. It is unsurprising that our homes are far smaller than in the US overall given its land mass but, strikingly, English floorspace per person is no bigger than that of residents of the central city district of the New York metropolitan area, who on average enjoy 43m2 of room.

We get less than everyone else, (even than those Finns).

Nationalisation of who may build houses where and in what form has led to more expensive housing of worse quality than places which do not have Rolls Royce minds doing that targetted planning with strict conditionality.

There we are, we’ve had a test of the contention and it’s a monstrously bad one. This is not, of course, a good thing to have happened. But it does have that silver lining of telling us what to do next.

First, and clearly, blow up the Town and Country Planning Act 1947 and successors. Blow it up properly, kablooie. Secondly, and even more obviously, tell those with arguing for targetted planning with strict conditionality where they can stick that idea.

Doing both of those will allow us to gain such glorious results to the benefit of the nation. Or, at least, do no worse than anyone else free of such impositions.

A trade deficit doesn't create debt Mr. Timothy

If we are to have a national conversation about trade, manufacturing, debts, foreigners buying up the country and so on then it would be a good and reasonable idea to get the underlying right first:

Economic theory, and generations of politicians, told us not to worry about leaving manufacturing behind.

We’ve not left manufacturing behind. Manufacturing output is still within a few percent of all time highs. It’s double what it was when St Maggie came to power.

Since we moved to a floating exchange rate, economists and politicians have claimed this does not matter. But the trade deficit is both a product of our problems and a cause. It is a product because we do not make, do or sell enough to the rest of the world. It is a cause because the arising current account deficit leads us to sell assets to foreign investors and build up external debt, which leaves us with less control over our economy, and more exposed to investors’ interests and increases in international interest rates.

Economists are right here. Which, given that we are talking about economics seems appropriate.

Then there is the budget deficit and stock of debt…..In 2024-25 Britain plans to issue a record £271 billion in new gilts, and the strangers upon whom we depend will demand higher yields. They will wonder about inflation – higher in services than goods – and the value of Sterling, and price British debt accordingly.

And here’s it’s necessary to become detailed - in order to show why the economists are right.

There is no connection - none - between the size of the national debt and anything to do with trade. We have a national debt because generations of politicians micturate the wealth of the country up the wall. They continually spend more than we the people are willing to pay in taxes - or more than the politicians are willing to try extracting from us. That’s the cause, the only cause, of the national debt.

The trade defict is indeed balanced - exactly, precisely - by a surplus on the capital account. That’s definitional. But while capital might flow in from foreigners into debt instruments - like gilts - it doesn’t have to. It can purchase assets outright. This then leads to the old Warren Buffett argument about Squanderville. What happens when Johnny Foreigner owns all the capital assets in the country?

The UK trade deficit is - of the order of - £80 billion a year, meaning we need to have that same amount coming in on the capital account. In one recent year the UK produced £1 trillion in new wealth. That’s a 9% rise in total wealth - and we sold 8% of that new wealth to foreigners. Thus at the end of the year foreigners owned less of the national wealth than at the beginning of it.

This does not strike us as being a problem.

Painful things to political arguments, facts are. But we do think that facts are where the arguments should start so let’s try doing that, eh?

Our real contempt is reserved for this argument:

Classical economic theory holds that it does not matter who owns what, nor what is made where. Comparative advantage means countries do what they are good at, and buy what other countries provide. Thus, trade makes us all richer.

But this is not the case. First, governments get in the way.

So the solution to governments getting in the way is that we should have more government getting in the way in order to solve the problem of government getting in the way. We all should be contemptuous of that silliness.

Oooh, what a fun argument this is, how very, very, fun

We seem to be watching a new elite consensus view being formed. As ever, it’s wrong, wholly wrong, but it is, we think, very fun indeed. In that forehead slapping, “No, really, they’re not trying this are they?“ definition of fun.

So, Ireland:

At the core of it were a number of key propositions. Ireland would have to embrace the idea of free trade, which meant encouraging competition and ending the protectionism that had been the hallmark of Irish economic policy under Lemass’s predecessor Éamon de Valera (whose economic philosophy had once been satirised as: “Burn everything English except their coal”). Most importantly, though, the strategy required that, henceforth, Ireland would have to be welcoming to foreign capital, which essentially meant being nice to multinationals – giving them generous tax breaks, assistance in finding locations for building and generally bending over backwards to attend to their needs.

Whitaker’s was a bold strategy, but it worked.

Ireland got rich by being standardly classical liberal sensible. OK.

There’s a massive shortage of affordable housing and an associated homelessness crisis: nearly 12,000 people in emergency accommodation and average monthly rents of €1,468;

But there’s a problem associated with those riches. Hmm. The source for this is:

The national budget surplus – essentially the difference between the amount of money coming in and going out in day-to-day expenditure – is forecast to add up to €65.2bn (£56.3bn) over the next four years.

Loadsamoney - Ireland is rich.

This has made Ireland an “outlier”, according to Prof Barrett, who pointed out more than 25% of tax revenue in the Republic of Ireland comes from corporation tax – compared an average figure of less than 10% across Europe.

The money’s made by stinging the capitalists. Rather a Laffer Curve there in fact - low rates means lots of capitalists and so beaucoup de revenue. Could be a plan for more countries really.

Nationwide, the touchstone social and political issue is housing.

Homelessness in Ireland is at a record high – with the most recent figures showing 12,600 people were in emergency accommodation in June.

But the housing shortage is having wider effects.

Ah, housing.

So, The Observer and the BBC agree here, and that is one of those elite consensi forming. Obviously. Ireland’s got rich because low taxes on corporations but this cannot be allowed - we can’t have an example of actual classical liberalism working now, can we - because housing.

And where the argument becomes, in the local argot, a bit of a cute hoor:

Rent controls are a fiscal policy that governments around the globe incorporate to control and regulate the amount that a landlord can charge for a lease of a property. The challenge lies in finding a balance between the rights of sitting tenants, new tenants and landlords. Rent regulation that is too strict can have a negative impact on the market, but complete deregulation can also have negative effects as it will push people into home ownership even where it is not feasible.

And:

Government measures to control rents have backfired and in many cases have led to an increase in rents, a new report has claimed.

The study by economist Jim Power suggests that rent pressure zones (RPZs), introduced in 2016 to limit rent price increases, have resulted in significant "rent rigidities" and an inefficient two-tier system where the proper maintenance of rental properties is no longer economically viable.

Rent controls are not a classical liberal policy. Rent controls are what are screwing the Irish rental property market.

Which is where that argument becomes so fun, isn’t it?

Classical liberalism makes a place rich. Not classical liberalism on rents makes housing expensive. But as the argument - that elite consensus view - is becoming it’s the bit that works, the stinging the capitalists for the costs of running the state that must go and it’s the idiocy of rent controls which is unquestioned and so presumably should stay.

Well, it would be a fun argument if it wasn’t palpably so damn stupid an argument.

The Annals of State Efficiency - Only 75 years late

We note this from the National Audit Office:

In June 2023, NHS England (NHSE) published its Long Term Workforce Plan (LTWP). Based on an extensive modelling exercise, the LTWP estimated a starting shortfall between workforce supply and demand of approximately 150,000 full-time equivalent (FTE) NHS workers.

The important part of which is here:

For the first time @NHSEngland has produced modelling that combines planning its future services and planning its long-term workforce needs.

Now, government long term planning, we’re really pretty sure that’s going to be done badly. On the useful grounds that we know of absolutely no example at all when it has been done well.

But the British government has been in charge of the planning of the medical workforce since around the time of WWII. For it is government that decides how many doctors and nurses will be trained - they’ve long controlled the budgets for that education. This is, of course, why we’ve so many of both imported as domestic supply has fallen so woefully behind demand.

But put aside our prejudices about such planning. Put aside even the good or bad sense of it. Just relish the efficiency of this particular example.

The government, in that form of the NHS, is only 75 years late in having a plan for that thing that they’ve been in charge of all these decades.

And there are people who disagree with us when we mutter that perhaps government planning isn’t the way to do things, eh?

Absolute poverty numbers prove a couple of things

Much whingeing about the absolute poverty numbers. The Joseph Rowntree folk seem to be taking over the The Guardian about it - situation normal in fact.

Absolute poverty, in this sense, is who is below the relative poverty level of 2010/11. The relative poverty level, as we know, is less than 60% of median household income adjusted for household size (and etc, etc). Absolute poverty, in this sense, is using the 2010/11 measure of relative poverty and comparing to that. There’s a trick used here. We’re old enough to recall when it was relative poverty in 2000/01 that was used. Given that poverty by that measure seemed to be disappearing real fast the rebasing was done. After all, calls for ever more stringent taxation to beat poverty cannot be maintained if poverty is disappearing before our very eyes now, can they? As Chris Snowdon points out, properly measured absolute poverty has fallen from 85% of the population in 1961 to the 14 to 18% of today.

From which we can gain one useful lesson. Economic growth is important - it kills poverty. This means that we can reject all that degrowth nonsense because as we keep being told beating poverty is our prime economic directive.

Cool.

But there’s also one more thing here. This rise in absolute poverty is more an artefact than a reality. Because this:

Inflation-linked benefits and tax credits will rise by 6.7% from April 2024, in line with the Consumer Prices Index (CPI) rate of inflation in September 2023. For example, in 2024/25 Universal Credit standard allowances will increase: From £292.11 to £311.68 per month for single people aged under 25.

Significant portions of - if not all - income of those in absolute poverty will be coming from the benefits system. Benefits are uprated for inflation after the inflation has happened. The measures of absolute poverty are before those benefits upratings. The problem will be - largely - solved when the benefits are uprated. We’re just in that interregnum before they are.

But we can also take another lesson from this. Which is that Modern Monetary Theory does not work. The inflation was indeed caused by that vast money print and spending into the real economy. Which is MMT of course. But if MMT increases poverty in this manner - which it does, the inflation is compensated for later - then we cannot achieve our prime directive of reducing poverty if we use MMT.

So, two useful lessons from these absolute poverty numbers. Both degrowth and MMT are bad ideas not to be used. Well, sure, we know that anyway but nice to have another string to the bow - they increase poverty, see?