If we could just suggest something to Mr. Peston?

If you are going to start complaining about the tax paid by some corporation do, please, try to have at your side someone who has a clue about corporate taxation:

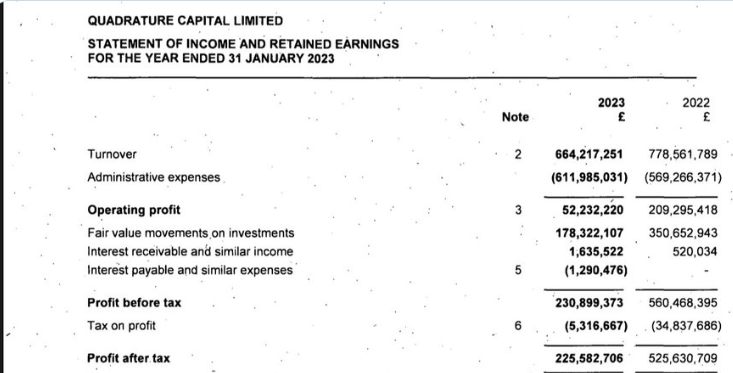

Quadrature Capital Ltd made a £4m donation to Labour on 28 May 2024. It was reported to the Electoral Commission on 30 July 2024. It has only just been revealed by Open Democracy. I have just looked up Quadrature’s UK accounts. The firm says it’s receives remuneration for “investment management services” and that profits are driven by “the performance and assets of the funds under management”. According to its most recent filings (see attached) it paid tax of a paltry £5.3m in 2022/3 on profits of £231m and just £35m of tax on profits made in the previous year of £560m. In other words it has been paying a fraction of what was the UK corporation tax rate of 19% - which at the time was low by UK standards. There will be Labour members and supporters who will be surprised and disappointed that the party is funded by a business that pays considerably less in tax than the official rate.

They’re an investment management firm, as you say. Which means that they manage investments for people. Those investments will change in value over the course of a year - this is rather the point of hiring the company to do the managing of investments. Which is the bit that’s been missed in the analysis.

The “fair value movements on investments” is not taxable. Because it’s not a realised gain. In exactly the same way that you are not charged capital gains tax if your shares go up - but are charged CGT if you sell shares that have gone up and thereby take a profit. You are not charged tax every time your house changes in value. You might well be when it is sold and you book the profit (second homes etc). Profits that stem from marking to market are not taxed. Profits that are realised are.

This is different from what you get to say to shareholders and potential customers - there, of course, you do want to say “Look, number go up!” and good luck to you as you do so.

We do know that this is quaint, even old fashioned. But we do still run with the idea that the purpose of journalism is to inform.

Tim Worstall

Introducing Greenpeace to the concept of sums

There are many ideas out there about how to make the world a better place. Some of them might work, most won’t - just one of those little tragedies. We need - and have - methods of trying to work out which is which. One method is our own favourite, simply use the market. The interactions of 8 billion people will pretty quickly come to a conclusion. But if our guess at making better is an intervention into markets then we do need to at least try to do some sums.

Renationalising the railways does not go far enough – Labour should spur a rail renaissance by allowing people around the UK unlimited train travel for a flat fee, campaigners have said.

Under a “climate card” system, passengers could pay a simple subscription to gain access to train travel across all services. This could be effective if set at £49 a month, according to research published on Thursday, though travellers on fast long-distance trains and those on routes in and through London would need to pay a top-up to reflect the greater demand on those services.

If such a system were implemented across the UK, it would be likely to result in a loss of revenues to the railways of between £45m and £637m, depending on the uptake, the report found. This would have to be subsidised by the government, but transport is already subsidised in various less effective forms, and the report found the climate card would generate economic growth and improvements to health from lower air pollution.

Well, OK, it’s an idea. The report is here. No, we’ve not checked, but we’d suspect that the numbers are done on one person in a car and everyone in a full train - rather than a full car and a half empty train. That’s just our prejudice there because that’s how these numbers are normally done.

But OK, let’s assume they’ve not done that. So, the benefit is:

This mode switching would result in a reduction of 378.7 thousand tonnes of carbon emissions (CO2e).

OK. We know what the value of a tonne less of CO2-e is - $80 because the Stern Review told us so (we think it’s true that this is actually higher than the number the govt currently uses as a shadow price - think, note). The value of the emissions reductions is £30 million therefore. The cost is £45 to 637 million. Or, if we run this back the other way, the cost of the CO2 reduction is $120 to $1,700 a tonne.

The value of the reduction is $80, the cost is up to $1,700. No, this is an idiot thing to do. Therefore don’t do it - doing things where the cost is greater than the value is known as making us all poorer.

Don’t forget the other thing the Stern Review told us. We must be efficient in our reaction to climate change. We must find the lowest cost methods of reducing emissions. Because - we’re all just odd this way - humans do more of cheaper things, less of more expensive. Using expensive methods to beat climate change will lead to less beating climate change - using less expensive methods more. Exactly and precisely because climate change is so important means we’ve got to concentrate, real hard now, on beating it efficiently.

So, no, idiot idea. But then Greenpeace and sums, eh?

Tim Worstall

Of course we should stop subsidising bad things

We’re a great deal more sympathetic to this argument than most will think we are:

The world is spending at least $2.6tn (£2tn) a year on subsidies that drive global heating and destroy nature, according to new analysis.

Governments continue to provide billions of dollars in tax breaks, subsidies and other spending that directly work against the goals of the 2015 Paris climate agreement and the 2022 Kunming-Montreal agreement to halt biodiversity loss, the research from the organisation Earth Track found, with countries providing direct support for deforestation, water pollution and fossil fuel consumption.

Yes, obviously, we should not subsidise bad things.

Now we’re a lot more sceptical about those international agreements than many. That all the meetings are held during Northern Hemisphere winters in nice low latitudes seems something of a hint to us - it can’t always be the existence of significant air traffic connections, can it? But leave our general scepticism of the process out of it.

We don’t want to be doing bad things let alone subsidising them. So, if the thing is a bad thing then we should obviously not be increasing usage through subsidy. We’ve no problem at all with that chain of logic.

The report itself is also pretty good on what is a bad thing and what is a subsidy to it. We’d not do so far as to say completely right, but rightish at least. The biggie - getting on for half the total - is subsidies to fossil fuels. And yes, obviously, these should stop.

But the thing they’ve got right is the identification of what is a subsidy. We’ll all recall that $7 trillion number The Guardian shrieks about but that’s not what is used in this report. Instead of a subsidy being “not paying a carbon tax and also full consumption taxation” which the IMF uses as their definition here a subsidy is an actual, direct, cash out the door, subsidy to the use or production of fossil fuels.

As it happens we here in the UK doesn’t have those by the IMF definition subsidies on petrol and diesel so we’ve nothing to do here. Well, now we’ve stopped subsidising domestic energy bills at least. It’s also true that we - again pretty much and near totally - don’t have any subsidies to fossil fuels by this narrower definition. OK, we here in the UK are being good chappies and we’re done then.

It’s the others, out there, that need to up their game on these subsidies. We’re already done.

Which leads to just one of those niggling little thoughts. The argument in favour of us spending £ trillions on birdchoppers and a zero carbon grid is that Johnny Foreigner will, staggered by the immensity of our moral leadership, then do the same. Yet we’ve already stopped subsidising fossil fuels and they aitn’t. So there could be a hole in the logic here. Anyone got a contact number for the planet the Sec of State is currently residing upon?

Tim Worstall

Markets unadorned don’t always work, no

We all know very well that - well, we all should know very well that - a pure free market in pharmaceutical drugs simply will not work. It costs $2 billion to do the research and gain authorisation to sell such a drug. It costs perhaps $5 to make a dose of said drug - often enough 50 cents. So, if anyone and everyone could simply make the drug once approved then no one would spend the $2 billion. Therefore patents on drugs.

Yep, quite right, those who - or their health care systems - need the drugs right now are held to ransom to pay that $2 billion. The saving grace of the system being that the patent protections mean we do get new drugs. The patent lasts 20 years, it takes 10 years to get to authorisation, so after 10 years of being in use that patent lapses and everyone can make the drug for that 50 cents.

It’s possible that this is not the very best system possible. But the point to be made is that this clearly and obviously a constructed market. We have invented, out of whole cloth, that idea of ownership of the proof of authorisation in that patent. This isn’t a right that exists in nature, it’s something we’ve invented to try to make the system as a whole work better.

That is, people can be entirely right in claiming that good government can make markets better. Indeed this is true.

Almost a century on from the groundbreaking discovery of penicillin by Alexander Fleming, his scientific successors are racing to save modern medicine.

Infections that were once easy to cure with antibiotics are becoming untreatable, and a novel treatment for bacterial infection is the holy grail for teams of researchers around the world.

However, severe financial challenges have left the pipeline of new antibiotics thin and fragile – and treatments are unavailable in many of the places they are most needed. Big pharmaceutical companies have left the field in search of greater profits elsewhere, and talented researchers have opted for new jobs in more stable sectors.

This is a problem. The really big one here being that the financial incentives of that patent conflict, mightily, with the medical incentives. As and when someone has spent that $2 billion to get a new antibiotic to market we don’t want them selling the heck out of it for 10 years to make that money back. Instead, we want this new drug to be used as sparingly as possible - preferably never in fact - so that we don’t promote the evolution of the bugs to be resistant to it. We want that new and fully effective antibiotic to remain fully effective by not using it, or only using it when all else has failed.

Our constructed market doesn’t work for new antibiotics. OK then:

The issue needs incentives that push innovation, De Felice says, such as grants to support early-stage research from governments and the third sector.

It also needs incentives that pull drugs through to market and guarantee companies a return on their investment, even if the antibiotics are not used but held in reserve as a last resort for particularly severe infections.

Some of those programmes exist already. In the UK, drug companies can receive a fixed annual fee for new antibiotics regardless of how much they are used. The subscription model bases payments on how valuable the drugs are to the health system.

So, a new market is being constructed. This looks like it will cure that specific problem but of course it may not. So, continual innovation in the market itself is something we should at least hope to aim for.

The larger point here being that it is not true that the market fails. Rather, specific markets, given their structure and incentives, can fail. If that’s so then the correct answer is to construct another market with different incentives.

For example, we all know that Nick Stern comment upon climate change - the biggest market failure ever. At which point the Stern Review doesn’t say abandon markets, it recommends constructing a new market, with the correct incentives, by having a carbon tax.

Markets fail so use markets.

Of course, there are even some things that markets cannot handle. Say, keeping the French at bay so government should indeed run the Royal Navy. But these things are few and far between - unlike the beliefs of those who twitter on about strategic plans with strict conditionality.

Tim Worstall

This week’s prize for obdurate stupidity goes to….

And it’s only Monday as we write:

Campaigners have urged the chancellor to start taxing jet fuel – with a report showing that charging duty at the same rate paid by motorists would raise up to £6bn a year for the public finances.

An analysis by the thinktank Transport & Environment (T&E) UK said introducing a “fair” equivalent to the fuel duty paid in other sectors could raise between £400m and £5.9bn a year, based on the 11m tonnes of kerosene consumed by planes taking off from the UK in 2023.

It’s entirely true that jet fuel is not directly taxed. But we do have Air Passenger Duty:

Air Passenger Duty, a duty unique to the UK, was introduced in 1994 by the then chancellor of the Exchequer, Kenneth Clarke. Clarke regarded it as anomalous that fuel duty was not levied on air transport, but international agreements prevented his levying a duty on aircraft kerosene. As an alternative, Clarke introduced Air Passenger Duty, a levy collected by airlines on passengers who start their journeys at UK airports.

As with skinning cats in the Mid West there are many ways to tax something. APD is the method we use to tax jet fuel. Annual collection is heading toward £4 billion.

In the paper from the not thinking very much tank, Transport and Environment (UK), there is no mention of Air Passenger Duty. Not one.

Yes, today’s only Tuesday, we’ve only had Monday’s examples to consider for nominations for this week’s prize so far but we are going to have to award that prize for obdurate stupidity to T&E (UK) we’re afraid. For we really do think it most unlikely that anyone’s going to beat this in only 6 days.

No, please, do not take this as the start of an hold my beer challenge. We are indeed pretty robust but there is still only so much we can take.

Tim Worstall

Live by the meme, die by the meme

We do think this is a bit rich from The Observer:

Trump’s fantasy that migrants are eating cats proves the meme has prevailed over real politics

Signs and symbols are increasingly being wielded by politicians around the world in place of reasoned debate about serious issues

Politics isn’t about reasoned debate over serious issues, it’s about memes. At least one of us has done this for a real political party in an election cycle. Politics isn’t about reality, it’s about what people believe.

Memes about those foreigns barbecuing cats are something we’re not going to comment upon - only to say that if that’s what people believe is happening then that’s what people believe. Politics is about those beliefs.

We have our own more recent example domestically. Until just a few weeks back it was an absolute truth of British politics that there had been “austerity”. The Tory B’stards had deliberately and with malice aforethought slashed away at government. Those of us who pointed out that, acshully, real spending, nominal spending, spending as a proportion of GDP, had - absent the fall back from the pandemic and financial crisis highs - risen over the years were pooh-poohed as spouting nonsense. Yet we were right. As the current mumblings from the current government are showing. There are “black holes” in the government accounts, too much has been spent and not enough taxed. Despite taxation being the highest, as a proportion of everything, since the War. Thus these “difficult decisions” that must be taken.

The proof that there was no austerity being that we’re now told there is no unspent pot of money, no austerity that can be reversed.

But the meme won. That’s the way politics works. It is not about reality, it’s about what people believe.

Say, you know, that underfunding of the NHS. We’ve seen people insisting that NHS got under inflation funding over the years of the Tory B’Stards. There’s not a year since the early 1950s when the NHS has had a less than inflation funding round. It’s beliefs, not facts, that matter. True, there are those who insist the NHS just always requires more than mere general inflation - but that’s proof of a problem with the NHS, nothing else.

Of course, memes do end up, eventually, being confronted with reality. Which is what makes those incorrect beliefs so dangerous. We end up committed to a plan based upon beliefs and then those ugly facts rear their heads.

As long as everyone grasps this politics will carry on as it has for centuries. An inefficient and largely useless way of running things but with that saving grace of allowing a change of power at the top without a bloody revolution. The true danger is those politicians who believe their own memes. Like this idea that the British grid and energy production system is going to be net zero in only 4.25 years. Two decades back that was a useful enough meme to get loins girded for the task*. Here’s reality knocking on the door now and it’s simply not going to work. Having a politician in charge who actually believes the meme, now that’s dangerous.

Politics concerns beliefs about reality, not reality itself. Which is why memes work and also why they’re dangerous.

Tim Worstall

*Note we don’t say correct, or righteous, but as a piece of propaganda it works

It’s successful! Quick, regulate it!

It is entirely true that certain forms of economic power do need to be regulated. It’s also true that there are those who would insist that anything, everything, must be regulated. This is one of those second:

But regulators do too, because they know from experience how monopolies engage in illegal anti-competitive behavior that squashes competitors and manipulates the market to expand their dominance. The US Department of Justice (as well as other competition authorities and tech observers) suspects Nvidia has used such tactics to entrench its chips monopoly, and last month it was reported that the Department of Justice was opening an antitrust investigation. It’s high time.

No one has the slightest idea how this is all going to work out. Let alone the regulators - so what are they going to do in their regulation then? Other than piddle about, waste everyones’ time and collect fat cheques for doing so?

And there’s another reason to be wary of a hyper-concentrated chip market: AI regulation, be it the EU’s AI Act or the White House executive order on AI, is emerging slowly, putting Nvidia – which gets to decide who gets chips for what – in a quasi-regulatory role. That’s not the way things should work; regulatory policy is a public function, and a for-profit company should not be allowed, through its sheer size, to fill the vacuum. But Nvidia likes it this way, and has stepped up lobbying to try to maintain its de facto control of global AI.

Tsk, cannot have that at all. Industry participants taking the place of bureaucrats? Heavens to Betsy isn’t that a violation of all that is Good and Holy?

It is possible to give a little pencil sketch of how this is going to work out. The whole point of GPUs is that they do graphics - that’s what the G is, graphics - better than general purpose CPUs. The hint is in the name. However, the how they do it is by being better at floating point operations. OK. Which means that we can look at another area of the chip industry for a guide.

Crypto mining depencds upon those floating point operations as well. Which is why mining crypto quickly moved off general purpose CPUs and into graphics chips. That was the first boom that Nvidia enjoyed in fact. But that boom ended. Because specialisation is good. So therefore people designed chips that specialised in the specific processes that mined crypto, not chips that were just good at floating point. What are known as ASICs. Which now have the crypto market and Nvidia pretty much doesn’t get a look in these days.

As sure as eggs is eggs this will happen again. Because specialisation is good. The why should be obvious enough - currently Nvidia gets to charge truly massive prices for what is essentially processed sand. Every capitalist - and VC more importantly - worth their greed is thus throwing money at those who think they might have an idea about ASICs for AI. Design some of those, send the designs to TSMC and the job’s a good ‘un.

The cure, you see, for high prices being high prices.

The most important part here being that this is going to happen faster than any bureaucracy can swing into action. Or even, faster than any bureaucracy can expensively swing into action.

It is entirely true that certain monopolies need to be regulated. Sure it is. It’s even true that certain technical monopolies do. But one that is under attack from the world’s largest concentration of bright people - Silicon Valley - and faces the world’s largest concentration of risk loving capital - Silicon Valley - through a specialisation cycle well understood by Silicon Valley probably isn’t one of those technical monopolies that requires regulation.

Well, not unless you belong to the regulatory school of if it moves regulate it.

Tim Worstall

Hayek warned us that we’d all end up serfs to the NHS

The warning, in Road to Serfdom, was not that the existence of a health care service would turn us all into slaves. Nor that a government, or tax, financed health care service would revive serfdom. Rather, that direct government provision of health care would lead to us, the populace, being managed to benefit the health care service. Rather than the NHS taking care of us we would be managed so as to take care of the NHS.

We all do recall being told to stay at home to save the NHS, yes?

Sir Keir Starmer is preparing a raft of “nanny state” interventions on public health as he scrambles to save the NHS from collapse.

The Government promised a “prevention revolution” on Thursday – saying measures would be bold, controversial and not universally popular.

Ministers announced plans to introduce a 9pm watershed on junk food advertising – and a total ban on paid-for online ads – by October next year. Sir Keir has also promised a string of further measures as part of efforts to move “from sickness to prevention” of ill-health.

A ban on energy drinks for children under 16 is expected to be introduced to Parliament next month, with supervised tooth-brushing rolled out for pre-school children later this year.

We are indeed being Nanny-stated for the benefit of that direct government provision of healthcare, the National Health Service.

This is getting pretty extreme too:

Honesty about death is long overdue, as are frank conversations about the tendency to keep very infirm people alive a bit longer with more interventions, instead of allowing them to die more comfortably at home.

One, possibly harsh, way to read that is that Polly thinks Granny should die earlier to save the NHS.

As Chris Snowdon has pointed out:

Starmer is not going to reform the NHS. He is going to try to reform the public.

Well, yes. The Road to Serfdom came out in 1944. A prescient warning, obviously. We would though remind of something about Brecht’s of 9 years later:

Would it not in that case

Be simpler for the government

To dissolve the people

And elect another?

That was satire, criticism, not a plan for action.

We can’t help feeling that paying attention to the warning rather than enacting the satire would be a better government plan.

Tim Worstall

If we desire investment then why does everyone want to tax pensions?

A fairly standard analysis of the UK economy at present is that we don’t have enough investment going on. Therefore we desire to have more investment, an obvious outcome from that analysis. The usual claim is also that we desire patient, long term, investment.

Private pensions are a £7, perhas £8 trillion, pot of such long term investment. That’s a very large pot of such investment too - getting on for three times the size of GDP, the annual economic output of the country as a whole.

Well, OK. But everyone seems to be competing to see how much more pensions can be taxed. It’s becoming a general sport. But taxing something simply always does lead to less of it. So, we tax pensions more heavily than we do now and people will save less into their pensions - so there will be less long term and patient capital around that can be invested into solving the base British economic problem.

This strikes us as being illogical. So, why then? What is the logic behind this seeming illogic?

It’s because they’ve already run out of everyone elses’ money, isn’t it.

That is, we didn’t in fact get rid of the socialists but perhaps we ought to?

Tim Worstall

An entire country making the Naomi Klein mistake. Sigh.

We’ve been making fun of Naomi Klein’s ignorance of trade for well over a decade now. For she claimed, in one of her books, that banning cheap solar panels from a country aids the fight against climate change by making solar panels more expensive.

Yes, aids.

But how we’ve an entire country going down that path to madness:

The Biden administration touts solar energy as one of its big success stories, a booming new industry that is curbing the effects of the climate crisis and creating high-paying jobs across the country. But the more complicated truth is that the United States is mired in a long-running trade war with China, which is flooding the market with artificially cheap solar panels that carry an uncomfortably large carbon footprint and threaten to obliterate the domestic industry.

At which point they’re adding tariffs to stop those dastardly Chinese sending cheap solar kit which will aid in the fight against climate change. Abject nonsense, obviously. Either we want cheap solar so as to beat climate change or we don’t. If we don’t then no subsidies, no push, no regulations are required. If we do then getting them from anyone sellin’ ‘em cheap is a great idea. And that’s all there is.

As to why there’s this problem it’s because people simply don’t understand trade. Yes, it’s true, comparative advantage is indeed the only theory in the social sciences that is not trivial or obvious. But even then we’d hope for a better understanding of it than this:

“Chinese companies don’t have any comparative advantage, only artificial advantages. They rely on government subsidies, and on lack of enforcement of labor and environmental laws.”

That’s not comparative advantage in the slightest. That’s absolute advantage. Comparative means what is, given those advantages, China least bad at doing? Absolute is that those advantages mean that China is better than US companies at solar panels.

Sigh.

Either climate change is some vast problem that we need to subsidise our way out of - in which cheap solar from anyone at all is just what we want - or it isn’t and therefore no subsidy from anyone is desirable. Insisting it’s a very big problem that needs hundreds of billions in subsidy but that we must reject the cheap kit someone’s knocking on the door with is to be, well, it’s to be Naomi Klein. That way madness lies.

Tim Worstall