Happy Tax Freedom Day!

As of June 2024, this is out of date. Please refer to Tax Freedom Day 2024 for the updated statistics.

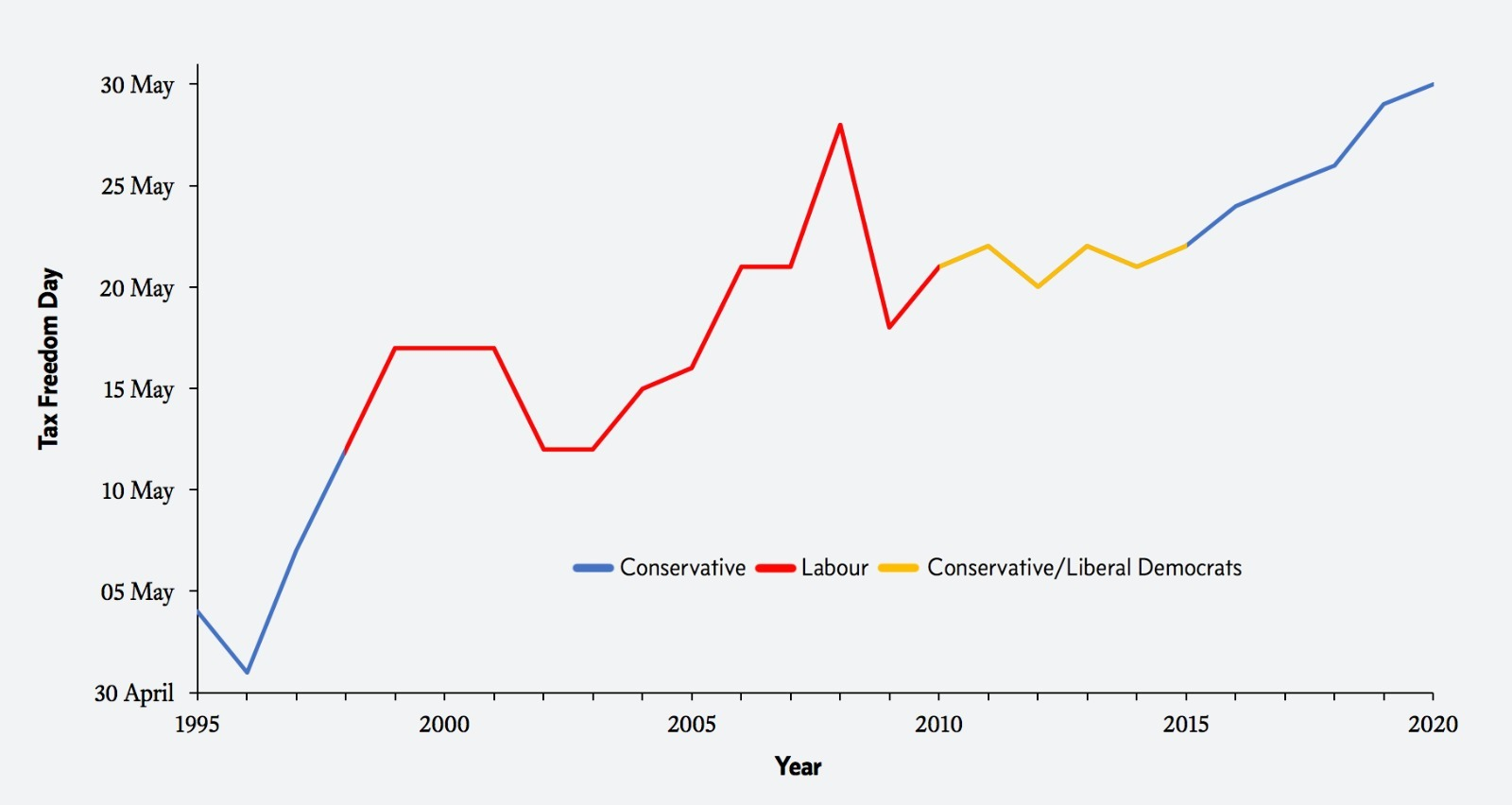

EVEN PRE-COVID TAX BURDEN HIGHER THAN AT ANY TIME SINCE 1995

Taxpayers worked 149 days for the Chancellor this year, today is the first day they start working for themselves

Tax Freedom Day falls on May 30th the latest it's been since 1995

Brits work 149 days of the year solely to pay taxes, 1 day more than last year, but as of today workers are earning for themselves

UK Taxpayers will fork out over £773 billion to the Treasury this year, 41.17% of net national income

But Tax Freedom Day is based on figures from before the economic and fiscal effects of COVID19 and the lockdown came into play

Cost of Government Day, which factors in borrowing as well taxes is the earliest it has been since 2008. The UK is successfully bringing down the deficit, but spending is still too high.

With tax demands at record highs, the way forward for growth at the end of lockdown cannot be to increase the burden on businesses but to reduce tax on the revenue generating private sector

Recent polling showed 72% think that the Government should reduce taxes after the lockdown to try to increase economic growth and jobs, with fewer than one-in-ten (8%) disagreeing with reduced taxes.

Tax Freedom Day is a measure of when Britons stop paying tax and start putting their earnings into their own pocket. For 2020 the Adam Smith Institute has estimated that every penny the average person earned for working up to and including May 29th went to the taxman—from May 30th onwards they are finally earning for themselves.

British taxpayers have worked a gruelling 149 days for the taxpayers this year. More than in any year under New Labour, and one day longer than last year. Britain’s tax burden is moving in the wrong direction.

Government tax choices fall on UK Taxpayers, this year they will fork out £773bn—representing 41.17% of net national income.

Unfortunately for Britons, this Tax Freedom Day cannot yet take into account the tax costs of measures taken to tackle COVID19. All borrowing is a form of taxation deferred and the hundreds of billions of pounds borrowed to tackle this viral threat will only begin to be borne in future years and as the government begins to unlock economic activity.

Tax Freedom Day remains over a month later than in the USA, and the UK has fallen behind Canada where their Tax Freedom day was on May 19 this year.

In April 2020 the Adam Smith Institute commissioned Survation between 15th - 16th April 2020 to undertake a nationally representative online poll of 1,001 UK adults (margin of error +-3.1%) to investigate the financial impact of the lockdown, views on developing an economic recovery and lockdown exit plan, and tax policy after the lockdown.

There is popular support for reducing taxes after the lockdown to help boost the economy and jobs. Younger cohorts are the most supportive of tax cuts after the lockdown. Almost three-quarters of respondents (72%) think that the Government should reduce taxes after the lockdown to try to increase economic growth and jobs, while fewer than one-in-ten (8%) disagree with reducing taxes.

Of those aged 18-34, two-in-five (44%) “strongly support” lower taxes after the lockdown, compared to just one-third (33%) of those over the age of 65.

The Adam Smith Institute singled out tax and regulatory changes in a recent report, Winning the Peace, that would boost growth post-lockdown and the pay packets of Britons right across the country:

The UK Government should respond to dire warnings on unemployment by immediately raising the threshold for employer’s National Insurance to £12,500.

Abolish the Factory Tax, by allowing for the immediate full write off on capital investments, to encourage business investment. ASI estimates show abolishing the factory tax would boost investment by 8.1 percent, and labour productivity by 3.54 percent (£2,214 per worker) in the long-run.

Governments across the UK should abolish stamp duty (in Scotland the Land and Buildings Transaction Tax). Britain’s most damaging tax, Stamp Duty destroys 75p of wealth for every pound raised.

Dr Eamonn Butler, Founder and Director of the Adam Smith Institute, said:

“Borrowing in a crisis is easy, making sure we balance the books and stop passing the buck to the next generation will be the hard bit. An economic recession and even the possibility of a depression cannot be ruled out. There will be calls for grand plans and spending like the clappers, but what we’ll actually need is the economic freedom to make choices for ourselves. We’ve all seen the damage in recent weeks of Whitehall deciding what’s good on our behalf.

“As we remove short-term restrictions we also need to remove the long-run burdens of government on transactions, investment, employment and our access to goods and services. We should not risk turning the last few months we’ve lost into a whole lost decade.”

Notes to editors:

For further comments or to arrange an interview, contact Matt Kilcoyne, Head of Communications, matt@adamsmith.org | 07904099599

The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.