What? Really? People change their behaviour because of taxes? Sirsly?

No, no, there must be some mistake here. We all know that people called upon to proffer up their mere fair share to the common weal don’t change their behaviour in order to dodge that righteous gifting. After all, if they did then the Laffer Curve would be true and there’d be a limit to how much can be shaken out of the pockets of the rich. They’d not stay around to be turned upside down, or not work so hard, or loaf, so as to not have to pay the higher taxes.

Clearly, that cannot be true.

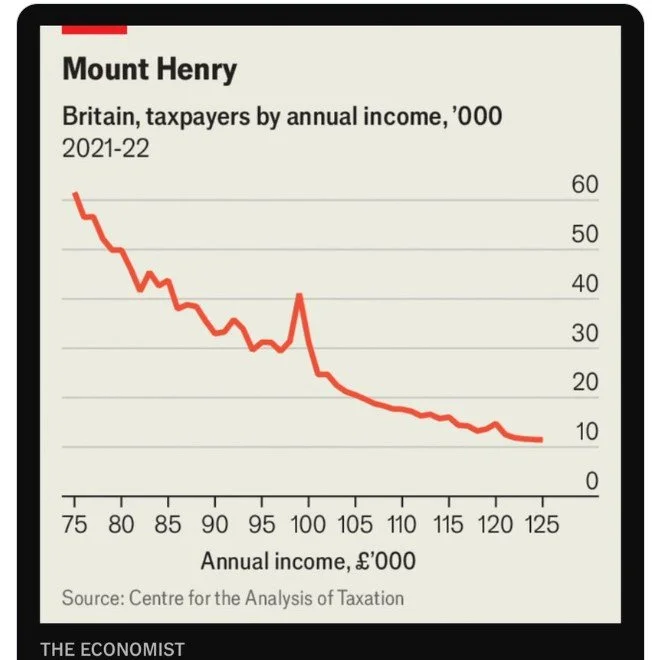

Ah:

Apparently this is not so. £100k is where the personal allowance starts to be withdrawn, pushing marginal rates up above 60%. In households containing children the withdrawal of varied kiddie related things pushes it over 100%. People really do change their behaviour in the face of marginal tax rates. Even, we have at least some direct evidence of, that happens at rates in the 50 to 60% range. As the Diamond and Saez paper suggests, the US peak of the Laffer is 54% on incomes (note, not income tax, tax upon incomes).

Aren’t we learning things today?

But there’s more! The Centre of the Analysis of Taxation is one of the nom de plumes of Arun Advani and Andy Summers. Who are the people who’ve suggested that 5% “one off” tax on wealth. The one that one of us, in evidence to a committee of the HoC, called “tantamount to theft”. You know, that proposal that is remarkably free of calculations of who would not stick around, not work so hard or loaf more as a result of such a penal level of taxation.

Which is, we think an amusement. Yes, an amusement, for no one could possibly take such an idea seriously now, could they? Not given the evidence presented by the same people.

Tim Worstall