If wind is more expensive then we want to have less wind

Yet another example of fallacious argumentation in the energy industry:

The UK’s net zero ambitions are expected to be dealt a blow as offshore wind farm developers halt new projects because of a shortfall in government funding.

On Thursday night, no major new offshore wind projects were expected to be included in the latest annual round of renewable contracts to be announced on Friday, The Telegraph understands.

There were five major projects, with a total capacity of 5GW, that were eligible to bid for contracts to boost the country’s current 14GW of offshore wind.

But industry sources said it was “likely” that none had chosen to bid into the process, because the Government failed to offer sufficient prices for their energy.

The outcome will deal a blow to the Government’s ambitions to install 50GW of offshore capacity by 2030, and remove fossil fuels from the electricity grid by 2035.

The fallacy is that as wind has become more expensive therefore subsidies must rise so that we gain the same amount of future wind power. Which is indeed a fallacy - if wind is now more expensive then we desire to have less wind in our energy mix. As relative prices change so do the things we want to buy, of course.

And this is what is wrong with the general plan people are trying to work to. They’ve decided there should be this much production of this sort of energy, so much of that and so on. But what is the desired mix changes as prices do. And this then feeds through, up a level, to the basic idea of net zero by one or another date. How much climate change mitigation we do depends upon the prices of doing climate mitigation.

Our whole idea here is to maximise human utility over time. As the Stern Review went on (at 1200 page length) this does not mean “no climate change”. It means the right amount of climate change. Something which is determined by how expensive it is to mitigate, how expensive to adapt and the expense - all of these are the real expense, not mere money but the cost to human lifestyles - of just putting up with it.

As the various prices change therefore the right amount of mitigation, adaptation and just putting up with change. Which is the one thing that a plan for net zero by a certain date dosn’t take account of. Which is why it is a bad plan of course - because it’s violating the very aim of doing anything at all, that maximisation of human utility.

Because wind prices have changed we therefore desire a different amount of wind power. Further, because mitigation costs have changed we therefore desire a different amount of mitigation. Wind costs are up - OK, the correct answer is to have more climate change then.

The aim of all economic advance is to kill jobs

Jeremy Warner could be a little stronger here:

And we all remember the famous Robert Solow observation about the computer: “You can see the computer age everywhere, except in the productivity statistics.”

The long, but persistent, decline in Western productivity growth can be dated almost exactly to the advent of the desktop computer and accompanying surge in corporate and household IT spending. As far as living standards are concerned, the computer appears to have been ineffectual.

Four primary reasons tend to be put forward for why this might be the case.

One is that the data simply doesn’t capture the gains being made because of the plethora of free stuff that is made available over the internet, and their failure to measure intangible benefits not before encountered.

A case in point would be access to virtually the entire body of human music ever recorded where once you would have had to go to an expensively priced live concert to hear just a tiny fraction of it.

It’s not just a possible explanation, it is that explanation. WhatsApp is where some 1 billion people get free telecoms. It appears in the GP accounts as a fall - yes, fall - in productivity and so something that makes us poorer. We have a measurement problem here.

On the other hand this is spot on:

But just because a technology becomes available, doesn’t mean it will be used.

Taking radiography by way of example, doctors first have to be convinced and apply their skills elsewhere. Resistance from vested interest among medical professionals is one thing. Introducing AI more widely into the public sector, where it is perhaps most urgently required, will encounter all kinds of Luddite-style opposition.

Quite so. It’s also fairly obvious. Few want to see their own comfortable little perch sawn off the branching tree of the economy. But that is indeed what all economic advance is about. Getting the machine to do the work and thereby destroying a human job.

No, the same technology does not then create more jobs. What actually happens is that that rare and scarce economic resource, human labour, can be applied to solving another desire or want. But first we’ve got to destroy the old jobs with the new technology so we can then experiment with what the labour then does.

All economic advance is predicated on destroying jobs.

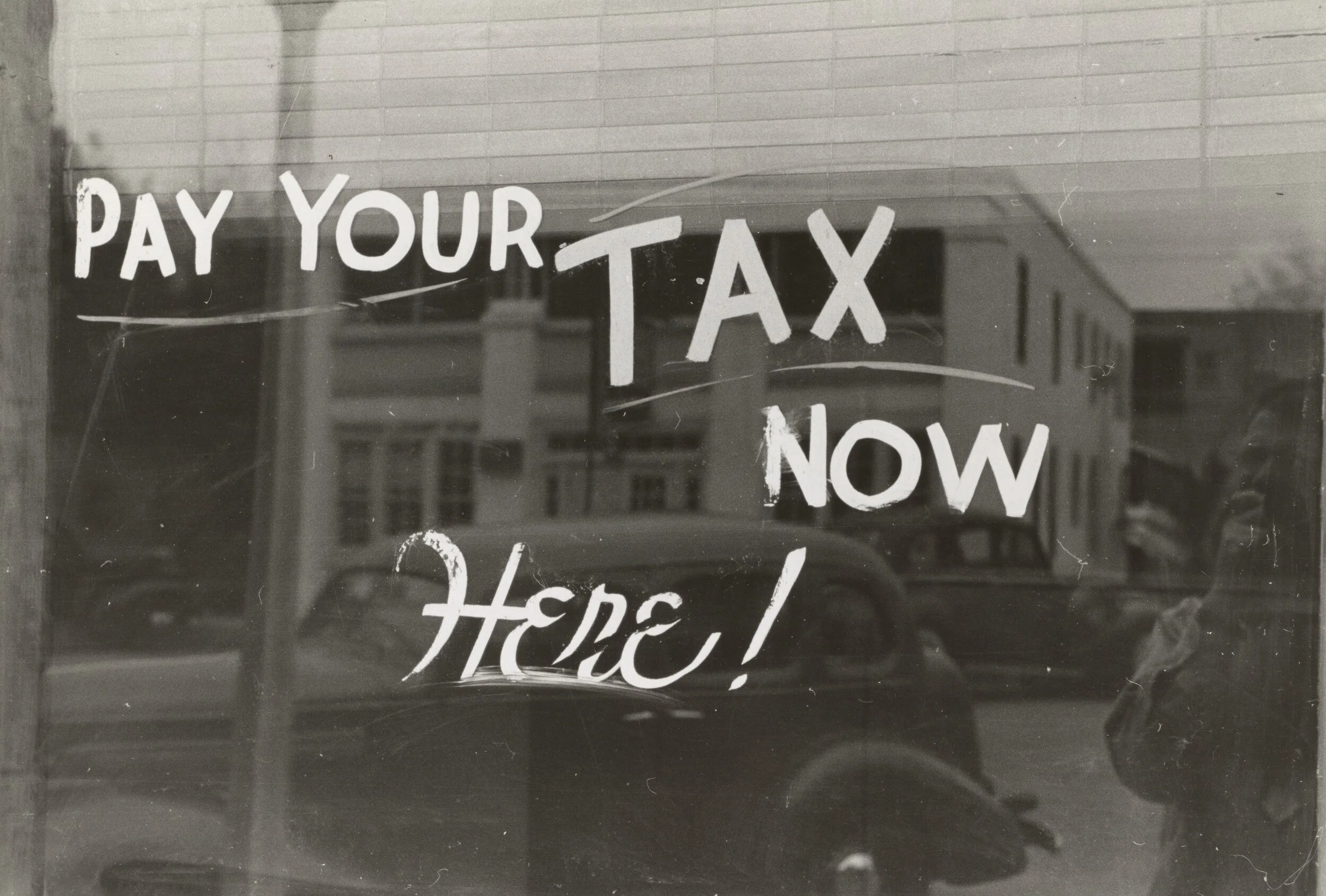

Plans of mice and men - taxing inflation edition

One of those ideas. We should tax inflation.

We did in fact do that. Through the 70s, companies were taxed on nominal profits not real ones adjusted for inflation. The return to capital fell to near 10% of GDP, not even covering depreciation and the entire productive base of the country was going bust. So, let’s not try that one again perhaps.

The specific proposal here is that government should set a wage rise it thinks is consistent with its desired inflation rate. Say, 3%. Anyone who then increases wages by 5% would have to pay a tax. The 2% that is over the target would be that level of that tax. So, a 5% pay raise would cost the employer 7% in the 5% wage rise and the 2% tax. A 6% raise would cost 9% - 6% wages, 3% tax and so on.

Sigh.

Firstly this is gargantuanly stupid because we are not in an economy static in form. Things change all the time. The demand for buggy whip makers falls, that for AI engineers rises. We therefore not just desire, hope for, but need wages to be flexible. It has to be possible to raise AI engineer wages to tempt them away from the joys of buggy whip making.

That is, the idea of government control of wages - even if indirectly through taxes - kills off the very point of having a market economy in employment in the first place.

It’s also ludicrous in that we all know how to get around such a limitation. We change the name of the job (AI engineer to AI senior engineer) and thus rerate the payscale. The NHS has been doing this with nurses’ pay for decades now. There’s the basic pay rise, yes, but then on top there’s the rise coming from years in post and then there’s the progression in posts and…..you get the idea.

But this is the bit that made us shriek with laughter:

Of course, one would need to deal with the administrative difficulties that come with any new tax and the inevitable problems of implementing such a scheme. But a government that delivered the much more complex furlough scheme during a lockdown should not allow itself to be deterred by teething difficulties.

The Morris Marina minds - OK, we’ll accept that some of them manage to rise to Austin Allegro - of the British civil service are to administer a complex scheme like this?

‘Ee’s ‘avin’ a giraffe.

We hire our senior civil servants from those who do classics, history and English. You know, the people who cannot count?

Just to remind everyone. Plans for running the country have to be simple because the people who run the country are simple. Nothing complicated like numbers or discretion can be allowed.

Here's an idea - why not just not do so?

The FT makes a statement and then asks a question:

Big government is back. How will we pay for it?

How about we don’t? Pay for it that is?

No, not an argument for just printing the money, we’ve been through that one just recently, thank you. How about let’s not have Big Government so that it’s not necessary to pay for it?

We would refer, in more normal times, to O’Rourke’s Principle of Circumcision, you can take 10% off the top of anything. Times now are different, we need to take 20% off the British state by our more fervid dreams. Actually, likely more than that. A perfectly good nightwatchman state - yes, including a social safety net - can be run on 20% or so of GDP. We’re well over double that as the government’s portion these days. Rasetsu of the state appeals that is.

But we can retreat from such joys and be a little more reasonable. We all know that the British people do not actually want this big government. Because absolutely no one at all is suggesting that the British people be asked to pay for it. No one is saying that income tax, NI, VAT (the three big revenue raisers) be increased to pay for more bureaucrats in comfy offices. The reason this isn’t being suggested is because everyone knows the answer will be no. All the suggestions are that them, over there, they, should be made to pay. Wealth taxes are a current favourite. But that’s them, they.

We, Brits, aren’t prepared to pay for the Man in Whitehall to know best. Therefore we don’t believe it. So, let’s not have it then. The answer to how we pay for Big Government is not to have Big Government.

Some things are just easy with a little logic.

If only Will Hutton used even a smidge of logic and knowledge

We think this is both true and absolutely fascinating:

Between 1949 and 1978, according to an important paper by Jagjit Chadha and Issam Samiri for the Productivity Institute, net public sector investment averaged 4.5% of GDP. It then fell precipitately in the Thatcher years to zero, before climbing under New Labour from those depths to nearly 3% of GDP in 2010. Austerity prompted another steep fall, since when it has bumped along at about 2% of GDP. Overall, the rate of public sector investment from 1979 to 2021 has run at less than half the rate of the previous 30 postwar years. Cumulatively (even allowing for privatisation), that means the evisceration of our public services – from schools that are unusable to weak backup systems at Nats.

So, umm, what actually is public sector investment? Well, if the national grid and the power stations and the drains and the reservoirs and the gas pipes and so on are all government owned then it’s the government spending upon the building and maintenance of the national grid, power stations, drains, reservoirs and gas pipes then, isn’t it?

If all of those things are in the private sector then that same investment is no longer part of public sector investment it’s private sector. And as those with decent memories will recall part of the privatisation process was to liberate the private sector to invest in these very areas. Government always had some union or other to pay off rather than fixing the drains. Yes, we know Will Hutton says “even allowing for privatisation” but we’ve read his own source paper and it doesn’t do so. Not as an error, it’s simply not the thing being analysed therefore isn’t worried about.

Government gets out of the investment business, government investment falls. Will Hutton thinks this is terrible, a disaster, we think it’s obvious. We really do think that both logic and knowledge are on our side here - not unusual in a battle of wits with Willy.

Nonsensical Nuclear

The new Energy Secretary has only had a few days in the job but long enough to discover that her department’s nuclear strategy, if it has one at all, makes no sense. This critique has three parts: what we know, rumours, and why we are in this situation.

We know that, in a net zero carbon 2050, Great Britain’s energy needs will be at least as high as now and they will almost all have to be met by electricity. Based on average demand, electricity capacity will have to increase by 6 times to 226GW. Total energy demand in 2022 was the equivalent of 1,968 TWh of electricity, and electricity only supplied 320.7 TWh, i.e. 16.3%. However capacity will have to be even higher than this to deal with periods of peak demands which can be 50% above average demand.

Renewables are all very well but the wind does not always blow nor does the sun always shine. Existing nuclear supplies about 6.5GW, but that will shrink to 3.26GW as Hinkley Point C comes on stream and all other reactors close. The Department for Energy Security and Net Zero(DESNZ) thinks 25% of electricity needs for nuclear would be 24GW, which is clearly too low. 25% of 226GW would be 56.5GW, a more reasonable 2050 target for nuclear, or 53.2GW of new nuclear excluding Hinkley Point C.

DESNZ now recognise that small nuclear reactors (SMRs) are cheaper and better value for money than the traditional big Giga-reactors and they refer to the former as “low cost nuclear”. With a capacity of about 300MW each, we would need about 177 SMRs to be operating by 2050, an average addition of 6.8 per year.

Contrarily, the DESNZ approach is “too little, too late.” A competition to select SMRs has been set up with a view to deciding on which two SMRs (one of each of two types) should be ordered over the next six years, specifically expressed as “the government’s commitment to take 2 Final Investment Decisions next parliament”. The two needs to be 41.

Contributing to the confusion is the DESNZ’s “hire a dog and bark yourself” policy. “Great British Nuclear” (GBN) was announced three Prime Ministers ago, and confirmed by successors. GBN has a chairman and CEO, autonomy and “is responsible for driving delivery of new nuclear projects.” Meanwhile DESNZ, no doubt playing games with HM Treasury, appointed “a Senior Responsible Owner (SRO) of Phase 2 of the Low-Cost Nuclear Programme with effect from 8th February 2021 (the “Effective Date)”, directly accountable to Jeremy Pocklington under the oversight of the relevant Minister of State.” Whilst Pocklington has doubtless told his new Energy Secretary that this is merely oversight or liaison, the memo makes it very clear that the SRO is in charge, i.e. it duplicates the GBN Chairman’s.

What is probably correct but not independently verifiable must be described as “rumours”, One is that while GBN is doing its best to run the run competition fairly, DESNZ has rigged it so that Rolls Royce, as the only British SMR manufacturer, is bound to win. The SRO appointment letter only mentions Rolls Royce. As some degree of apparent competition must emerge, General-Electric-Hitachi will also win. This decision is remarkable as the latest date for entering the competition was 23rd August. Several leading SMR developers are believed not to have bothered because certain failure is not good for business.

The UK seems to be breaking ranks with the US and Canada on SMR support and licensing. The North Americans are adopting a non-prescriptive, all ideas welcome, approach. They provide licensed land for prototype development and encourage utilities to build FOAKs (first of a kinds). They are doing this in the full knowledge that some technologies will fail and that those investors will lose money. But at the end of the day they will have a smaller number of the best value SMRs. We could learn from SMR developers setting up in Britain and we should. Chasing away nuclear investment at this stage is daft

The last question, “why?”, is simply baffling. We need all the help we can get and not artificial barriers created by Whitehall civil servants keeping out the best and the best value SMRs. Doing so is bad for Britain and will prove expensive for energy users if the government is serious about a net carbon zero 2050.

No plan strikes us as being eminently sensible here

This is intended as a criticism:

As for Britain, Rishi Sunak will arrive at the G20 a puzzling figure: the prime minister of a nation without an industrial policy in a global industrial policy race, with no diplomatic focus on minerals when the rest of those assembled are competing ferociously over this.

This is all this “critical minerals” stuff. Essentially, lithium, cobalt and rare earths. Lithium is half the price it was a year back. Given that we know of - and that’s just us knowing of - some 200 prospective lithium miners out there we expect that price to fall again. Rare earths, again, prices are half what they were a year ago. We know of a round dozen (that’s not around, that a round) finds of ionic clays reported to the Australian stock exchange in the last 6 months alone. Three years ago we didn’t even know that ionic clays existed outside China. We expect that price to decline further as well. Finally, the cobalt price is around, or a little under, the production price. That’s not a signal that something’s in short supply.

As we’ve said before, sure we need a system to change, increase, the supply of minerals when demand changes. We’ve got one - free market capitalism. Varied corners of the world’s stock markets are simply packed with exploration miners, even people bringing projects to fruition. We’ve simply no need of anything else.

We would even go so far as to insist on the following. This is not investment advice, of course it isn’t, but we are putting it out there as a general prediction. The prices of lithium and rare earths will be, within the decade, back where they were three and five years ago. Absent any significant scarcity value and around and about what makes normal - not excessive - profits for the miners. It also requires no further intervention for this to happen - capitalist greed will achieve this all on its lonesome.

The British policy of doing nothing therefore seems eminently sensible to us. So, why this insistence in the Sunday Times that there must be a plan?

Working on a think tank report for the Atlantic Council on the new green geopolitics over the past year, I’ve seen expectations move wildly.

Well, yes, we see and appreciate the problem. There’s not a year’s work in “S’all solved already” is there?

Our Word, so Hayek was right then

The Office for National Statistics has found 1.7% of GDP down the back of the sofa. Isn’t that a lovely proof of Hayek’s contention? The centre never will have the data - let alone the information - to be able to plan the economy in detail. Therefore government should not try to plan the economy in detail because it doesn’t, and never will have, the information necessary to be able to do so.

In more detail:

The UK economy shrank less and bounced back faster during the pandemic, official figures show, after the Office for National Statistics (ONS) admitted its previous assumptions were too gloomy.

The revised figures add nearly 2pc to the size of the economy as of the end of 2021, meaning Britain recovered to its pre-pandemic size almost two years ago.

We’ve had several years now of shrieking - sorry, politics - insisting that there’s something fundamentally wrong with the British economy because look, look, slower recovery. This has allowed every gimcrack and shyster to promote their plans to fix what ails. More tax, wealth taxes, harder and faster on renewables, no doubt there’s someone out there who’s used this to argue for more childcare. In fact we’re pretty sure we have seen that one.

All of these using as their supporting crutch the untruth that there has been a relative underperformance by the UK economy. Which, to repeat, has not in fact happened.

This, of course, kills off that idea of Keynesian demand management of the macroeconomy. Which does try to insist that government should be able to fine tune by percentage points and fractions of GDP. If we can find 1.7% in the crevices of a chaise-longue then we really do need to kill off that idea.

But this is also of wider applicability. Because if numbers are this bad and misleading then all finer plans are going to be in error as well. The number of people in the country is not known to any useful - for planning purposes - level of accuracy, the number of women working, the gender pay gap if indeed we even have one and on and on and on. Government simply doesn’t have the data, - again, let alone the information - to be able to plan these things in detail. So, it shouldn’t.

The best we can do is set general rules on incentives, fairness, equity and so on. The structure of the legal system, some interventions on the pricing of pollution and so on. But they do have to be general, given the lack of that data. Then leave be and see what happens.

That this accords with our own desires for how the country is run might seem convenient. We would say that, wouldn’t we? Which is to misundertand. We hold the views we do because we’ve read Hayek’s Nobel speech, grasp the implications of The Pretence of Knowledge.

This finding by ONS is not just a convenient crutch for our views, it’s the reason for our views. Government doesn’t know enough to plan - therefore government should not plan. QED.

Political planning should not apply to stock markets

A litte story from the frontlines of day to day capitalism. Back a couple of years a Chinese lithium processing company, Ganfeng, decided to take over a London listed lithium miner, Bacanora Lithium. There was much huffing and puffing about the Heathen Chinee taking over a good and stoutly British company and so on, echoes of Yellow Peril and all that. We noted it at the time and insisted that it should be left be.

The thing is the potential mine that Bacanora owned was in Mexico, the Sonora deposit.

Ganfeng was left be, did take over Bacanora. Now the Mexican Government has cancelled all the mining licences at Sonora. Other than the most wonderful shrieking argument to come there’s little to no value there, therefore.

British shareholders, who were left be, therefore are now cashed out and paid, their money fructifying in their pockets. The Chinese have that argument to come. From the point of view of the British Government, of British politics, this is about as a good a result as it is possible to gain. This being the result of exactly the opposite of what the government was urged to do of course.

The correct policy to have over stock markets is, once we’ve ensured the basic rule of law, leave it be. Things will sort themselves out. For markets in the ownership of assets really do work.

If intervention had happened then it would be assets owned by Britons made valueless. The policy of benign intervention means it’s foreigners losing their money in foreign. And really, isn’t that the best possible outcome?

Revisions

Following the Office for National Statistics’ revision of GDP figures by 1.7% today, we thought it would be important to illustrate this precedent through satirical historical examples and the damage such sloppiness could cause.

1. Edward Gibbon revised his figures to find that the Roman Empire did not in fact collapse, but instead expanded its border size by 2%, in the year that it was alleged to have fallen.

2. It has been found that Vladimir Lenin celebrated prematurely at the fall of the Tzar and the rise of the Soviet Union by around 2 years, according to new revisions by historians.

3. The great Khan, Genghis, has been found to have saved 100,000,000 lives, rather than prematurely ending them, as statisticians had confused the + and - signs in their calculations.

4. New research by Historic England has found that Henry VIII had more wives than previously thought, which could result in a serious change in the way the Church of England functions.

5. Abraham Wald’s Bullet Hole Problem, according to new estimates, has been found to be misplaced. Armour was incorrectly applied to airplanes, leading an increase of 2% of casualties.

6. The number of Popes has been revised by the Vatican. The Great Western Schism has been corrected to the Somewhat Discord, reducing the number of overall number of pontiffs.

7. Protestants are in shock, as Martin Luther’s 99 Theses has been revised to 97, fundamentally shaking the Western Order and theology as clerics and theologians know it. Indulgences are back on the table for the Church of England, plugging their fiscal gaps.

8. Famous rapper Jay-Z has miscalculated how many problems he has, sending shockwaves through the charts.

9. After new documents came to light, the 1922 Committee has discovered that it was founded in 1925, undermining a great deal of its power.

10. The number of Disciples has reduced by 1, following a late night meeting of the ONS (the Office of Nazarene Studies).

The revisions by the (actual) ONS are, of course, welcome news for all of us. However, this is a severe blow in confidence in the machinery of government - hopefully the ONS can take more accountability for its statistics, given how much they influence day-to-day government decision making.